Do you have what it takes to be an Investment Banker? – Part I

Here's What We've Covered!

All we know about an Investment Banker is that he is some bigwig, wearing a sleek professional outfit, always on his toes & working on vacations. Many of them simply know that an Investment Banking career helps you earn a lot of moolah, but are clueless about his work profile.

In short, so much ‘swag’ about being an Investment Banker, yet, no info about how to become one? Let’s clear the air about Investment Banking!

What exactly is an Investment Banker?

An Investment Banker is a primary facilitator who helps businesses raise funds for their projects. In short, an I. Banker is a mediator between the investor and fund seeker. He offers other services such as underwriting, facilitating merger & acquisition, etc.

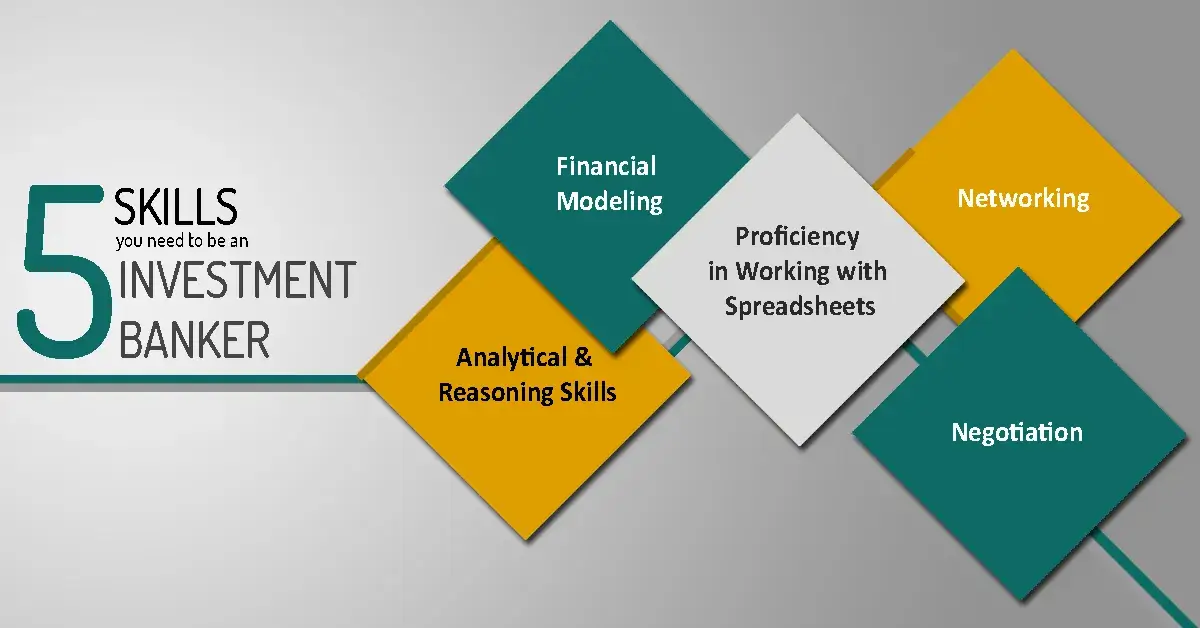

To be an Investment Banker, what are the skill sets he must typically have?

Strong Analytical and Reasoning skills: Analytical skill sets are the ability to visualize and conceptualize data set, analyze data set, derive conclusions and make decisions. These skill sets exhibit how you perform beyond ‘paper-defined’ qualifications and judge your problem-solving ability.

Let’s take an example of a chess player. What does the game involve? Making the right moves on the chessboard, to win over the opponent. At every step, he has to visualize how his next move will be responded by the opponent, and accordingly develop strategies using veto power of each piece. In short, he has to analyze various permutations & combinations possible to plan the right move.

Proficiency in Excel & Financial Modeling skills for quick analysis: Financial Modeling is the study of valuation of project, stock or an equity. Building a financial model involves studying historical information on the basis of financial statements & forecasting performance on the basis of cost drivers and other influencing factors. This requires him to be quite adept at spreadsheet skills.

Negotiation Skills: An I Banker has to liaison between two parties and to come at a golden median which can work best for both the parties. This is where his negotiation skills have a vital role to play.

Networking: Networking is an key essential for an I.Banker who wants to build relationships and build his brand in the market. To break in the field and liaison between the investor and fund seeker, he needs to have an extensive contact list. In short, to be a nexus point, I.Bankers have to network aggressively.

How to break in into Investment Banking field? What qualifications he needs? Let’s explore it in the next article.

Related Articles:

DO YOU HAVE WHAT IT TAKES TO BE AN INVESTMENT BANKER? – PART II

DO YOU HAVE WHAT IT TAKES TO BE AN INVESTMENT BANKER? – PART III

Resent Post

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

>

Financial Modelling Classes in Hyderabad: Your Guide to the Best Institutes

Follow Us For All Updates!