Securities Market & Investment Banking Operations (SMIBO)

Get 100% Job Assurance! | “Acquire expertise in both front-office and back-office functions.“

IMS Proschool’s Securities Market & Investment Banking Operations Program is a robust 11-month program offering Relevant Skills & Job Assurance. It comes with 5 months of training and 6 months of paid internship

Earn more than 7 certificates including NISM series 12, 7 & 8

Duration – 5 Months of training

Get 100% Job Assurance (0-3 years of work exp)

Avg Package – 3 to 9 LPA

Pathway to MBA & CFA

Securities Market & Investment Banking Operations Program Syllabus

Here’s Why Students Love Proschool’s Securities Market & Investment Banking Operations Program!

Assured Placements

Students enrolling for SMIBO course are offered top tier placements with an average package of 3-9 LPA

Learn From Finance Gurus

Our faculty members are masters in the domain with a combined industry experience of 30+ years.

Placement Oriented Case Studies

Students get to solve case studies from multiple industries helping them prepare for their interviews

Upgrade To CFA

Investment banks need CFA qualified individuals for Front Office roles. The SMIBO course clears your basics & gives you a strong foundation in finance domain making it easier for you to clear CFA.

Upgrade To AICTE Approved PG

Post Completion of the course, you get an option to appear for AIMA’s AICTE Approved PG exams & get a PGCM in Investment Banking. Taking this option will then open the doors to a 1 Year MBA Program.

Comprehensive Skill Training

The SMIBOP teaches you excel, financial markets, forex, derivatives, OTC etc. making you a champion for SMIBOP roles. That too in just 180 hours.

What Students Have To Say About Our Securities Market & Investment Banking Operations Program

Meet Your Course Faculty

Our faculty are all professionally qualified and have rich industry experience, essential for giving a practical context to concepts

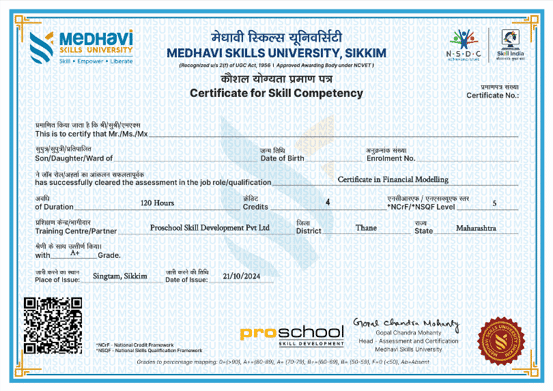

SMIBO Certifications

Certificate from IMS Proschool

Certification in SMIBO from IMS Proschool indicates that you have undergone an extensive course focused on the integral skills associated with securities market & investment banking. This course usually encompasses topics like financial analysis, equity derivatives, clearing & settlement, risk management and mergers & acquisitions.

Having this certification on your resume can considerably enhance your career prospects if you’re aiming to enter or progress in the investment banking sector or a similar field. This certificate not only showcases your dedication to growing professionally, but it also proves that you’ve been trained by esteemed institutions that tailor their curriculum according to industry requirements.

Certificate from Government (NCVET)

The Securities Market & Investment Banking Operations certification from IMS preschool indicates that you have undergone an extensive course focused on the integral skills associated with securities markets & investment banking operations.

NCVET-accredited programs offer many benefits to students, including industry recognition, flexibility, and skill development. It ensures that vocational training programs equip students with the skills that employers need.

It helps students gain industry recognition and enables them to complete their higher education in less time

Companies Where We Have Placed Students

Our Alumni are all placed in reputed firms in high positions due to the knowledge and skills gained from this course.

Course Fees

FAQ’s

Need More Info? Read Our Latest Blogs

Explore, Share And Enjoy Our Curated Content

Investment banking is historically an interesting and lucrative profession. It is a critical part of the economy that allows companies to raise money, manage investments, [...]

Investment banking is one of the most important areas of finance. It helps businesses raise capital, make big financial decisions, and navigate complicated transactions. Investment [...]

Giving customers advice and analysis on stocks, bonds, and other financial instruments is how investment banking and equity research contribute significantly to the capital markets. [...]