What Is an Investment Banker? Definition, Role & Why They’re Important

Here's What We've Covered!

- What is an Investment Banker?

- 3 Types of Investment Bankers

- 3 Reasons Why Investment Bankers Are Important?

- Investment Banker Skills and Qualifications

- An Investment Banker’s Career Path and Opportunities

- Why Pursue a Career in Investment Banking in India?

- Investment Banking in Today’s World

- Why Do IMS Proschool’s Investment Banking Program?

- Conclusion

- FAQs

- What qualifications do you need to become an investment banker?

- What is the average salary of an investment banker?

- What are the most common career paths within investment banking?

- How do investment bankers help companies during mergers and acquisitions?

- What skills are most important for a successful investment banker?

Investment banking is one of the most important areas of finance. It helps businesses raise capital, make big financial decisions, and navigate complicated transactions.

Investment bankers are professionals who work in this field and play a key role in shaping the financial landscape.

They guide their clients through complex transactions, such as mergers, and acquisitions, or raising money through stocks and bonds.

Whether you’re just curious about investment banking or thinking of pursuing a career in this field, this blog will give you a solid understanding of the role of an investment banker and the importance of their work.

What is an Investment Banker?

An investment banker is someone who works in a bank or financial firm that helps businesses and governments raise money and manage financial transactions.

Investment bankers don’t usually deal with customers or everyday banking services. Instead, they work on much larger and more complex financial transactions.

Roles and Responsibilities Of An Investment Banker

Here are the main functions of an investment banker:

-

Capital Raising for Clients

One of the primary roles of Investment Bankers is in the capital raising for companies. Typically this is done by issuing stock, bonds, or other financial products. Investment banks help companies that require funds for expansion, growth, or to pay back debts by finding investors and coordinating the process. They assist businesses in going public by opening an Initial Public Offering (IPO) for the business to make Shares available to the general public.

-

Advising on Mergers and Acquisitions (M&A)

Mergers and acquisitions are complex processes where two companies come together (merge) or one buys another (acquisition). Investment bankers are the key advisors in these situations. They assist in valuing the companies at play, structuring the deal and negotiating. They are supposed to make sure that the deal is financially sensible for their client and to make the transition process run smoothly.

-

Underwriting Securities

Investment bankers often “underwrite” securities, such as stocks and bonds. This means they buy these securities from the company and then sell them to investors. By underwriting, investment bankers help companies raise capital while assuming some of the risk involved in the process.

This service is particularly helpful when a company is issuing large amounts of stock or bonds and wants to ensure they will be sold at a fair price.

-

Conducting Financial Analysis and Valuations

Investment bankers spend a lot of time analyzing financial data. This can include financial modeling, where they create detailed projections of a company’s future performance, or valuation, where they determine the worth of a company or its assets. This analysis helps businesses understand their current financial situation and make better decisions about raising capital, making acquisitions, or merging with another company.

Investment bankers are financial experts who use their knowledge and skills to make big financial decisions happen. Whether it’s raising money, acquiring a company, or helping a company grow, investment bankers are there to guide the process.

Also Read – The Role of an Investment Banker: What Do They Actually Do?

3 Types of Investment Bankers

Investment banking is a broad field, and there are several different types of investment bankers who specialise in different areas:

- Corporate Finance: These investment bankers focus on helping businesses raise money and make important financial decisions. They help companies with IPO (initial public offerings), debt financing, and equity financing. Their main job is to understand the company’s financial needs and structure deals that will help them achieve their goals.

- Sales and Trading: Investment bankers in sales and trading deal in such financial products as stocks, bonds and commodities. They facilitate the buying and selling of these products on behalf of clients, such as companies or individual investors. However, these bankers are very well-versed in financial markets and are required to stay apprised of recent market trends.

- Research: We have research analysts in investment banking who further do in-depth research on companies, industries, and financial markets. Their function is to offer valuable insights and numbers that will allow businesses to make better investment decisions. They study market trends, financial reports, and economic data — and recommend actions to clients.

Investment banking offers a variety of specializations, each of which focuses on different aspects of the financial world. Whether you’re working with clients to raise money, manage investments, or analyze the market, there’s a place for different types of expertise within investment banking.

Excited To Start Your Career As An Investment Banker? Join Proschool’s Next Batch!

3 Reasons Why Investment Bankers Are Important?

Economic Impact

Investment bankers help businesses and governments raise money and, as a result, they are critical to the economy. This capital enables companies to spend money on growth, research and development, which creates jobs and stimulates the economy.

When companies raise money by floating themselves on the stock market, issuing bonds or buying other businesses, the industries all around them are often growing in the process.

So for example, if a company needed to raise some money to build a new factory or to invest in a new product, they would turn to the investment banker to help them raise the funds. This money creates jobs, creates innovation, and benefits the economy in general.

Market Efficiency

Investment bankers also help keep the financial markets efficient. They connect buyers and sellers of financial products and ensure that market prices reflect the true value of securities.

For instance, when a corporation goes public, investment bankers gauge how much its shares should be sold at. They assist in keeping pricing accurate, so the market does not overvalue/undervalue the company and potentially harm investors and the company itself.

They also guide businesses on risk management principles and decisive measures that will govern their operations in both stable and uncertain markets.

Client Relationships

A key part of an investment banker’s job is building strong relationships with clients. The better the relationship, the better the investment banker can understand the client’s goals and provide tailored advice.

Individuals and companies find it easier to raise capital, enter into mergers, and attract customers in desirable ways when they have well-cultivated relationships.

Investment bankers establish long-term relationships with their clients, taking them through many phases of business development. That’s precisely why these relationships are so important in establishing trust which ultimately leads to more successful transactions and deals.

Investment Banker Skills and Qualifications

Educational Background Of Investment Bankers

Most investment bankers have a strong educational foundation in finance, economics, or business. Typically, investment bankers hold Bachelor’s degrees in these areas, but many also pursue Master’s degrees, like a Master of Business Administration (MBA).

The MBA especially benefits those who want to climb the ladder at an investment bank.

Although you can often find investment bankers with degrees in finance or economics you also see people with engineering, mathematics, or law degrees, since they teach problem-solving and analytical skills that are extremely helpful in finance.

Many also seek out their Chartered Financial Analyst (CFA) designation to advance within their careers as investment bankers. CFA charter holders are bankers with a deep knowledge of financial analysis and portfolio management.

Essential Skills of An Investment Banker

Becoming a successful investment banker requires a mix of technical skills and personal abilities:

- Analytical Skills: One thing that an investment banker has to master is to dig out a lot of data and give meaning to it. Figuring out budgets, and forecasting company performance all require analytical capability.

- Financial Modeling: Investment bankers often create sophisticated financial models in order to forecast a company’s earnings and valuation. The essence of the job is learning how to build these models, and how to use them to inform decisions.

- In Big Deals: CEOs — tinkering with mergers and acquisitions — drive a hard bargain with their bankers to get paid. Strong negotiation skills enable them to negotiate these deals and secure favourable terms on behalf of their clients.

- Communication: Whether it’s explaining complex financial data to a client or presenting findings to a group, “strong communication skills are a must.” Investment bankers should be able to simplify financial concepts and sell them.

- Attention to Detail: In investment banking, even small errors can have significant consequences. Investment bankers need to pay close attention to detail, ensuring all financial data is accurate and all calculations are correct.

Also Read – 18 Best Investment Banking Courses in 2025 – Free & Paid

An Investment Banker’s Career Path and Opportunities

Investment banking as a career: India is a well-defined career path with plenty of scope and lucrative chances.

Being aware of the common career trajectory, and the potential job prospects and financial benefits can aid students in deciding whether to pursue this field.

Understanding the Career Path in Investment Banking in India

The way this breaks down is typically not too complex, the investment banking path follows generally a clear structure with achievable progression.

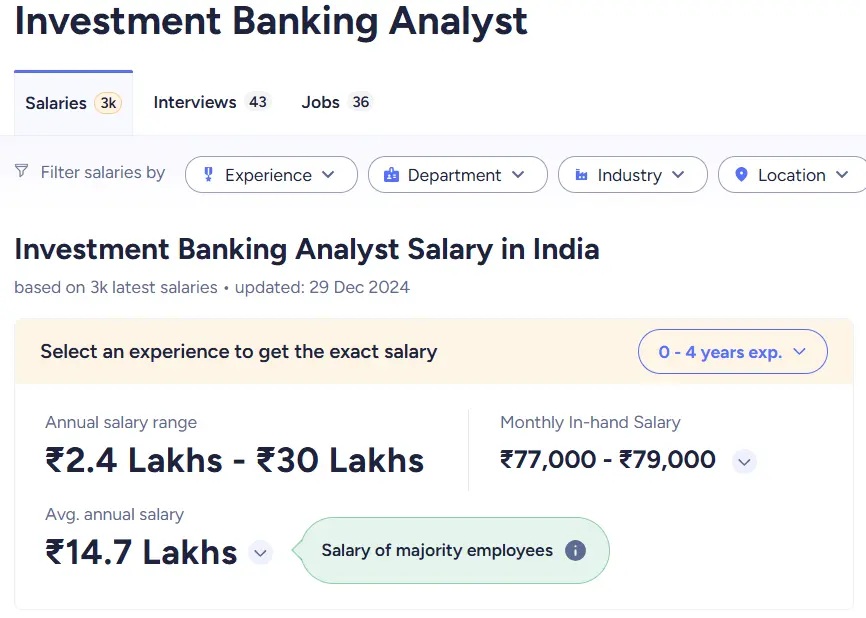

Analyst: This is the first role where people start their careers.

- What they do: Analysts mainly do research, build financial models, and help senior bankers with everything else. They are very important for data analysis and preparing presentations.

- Salary – An investment banking analyst earns an average annual salary of ₹2.4 lakhs — ₹30 lakhs, depending on the firm and location.

Source – AmbitionBox

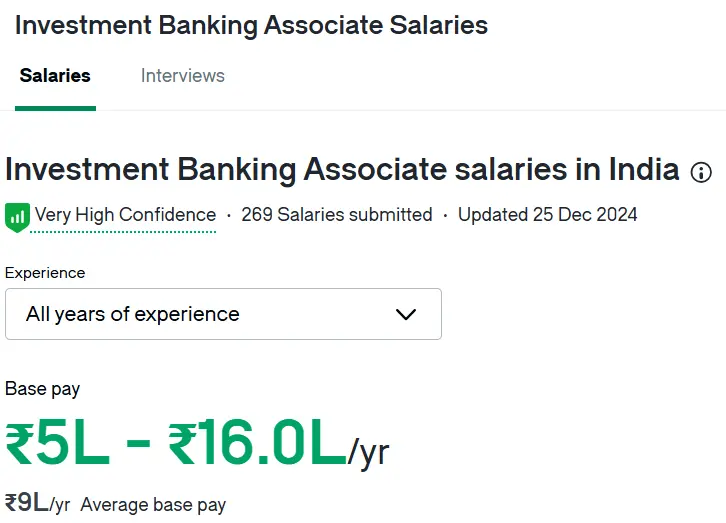

Associate: Professionals with some experience as an analyst are usually promoted to associates.

- What they do: Managing client relationships, overseeing deals, and leading teams where associates take on more significant tasks. They are misters of the financial models and reports.

- Salary: The average annual salary of an Investment Banking Associate in India is ₹5 lakhs – ₹16 lakhs per annum.

Source – Glassdoor

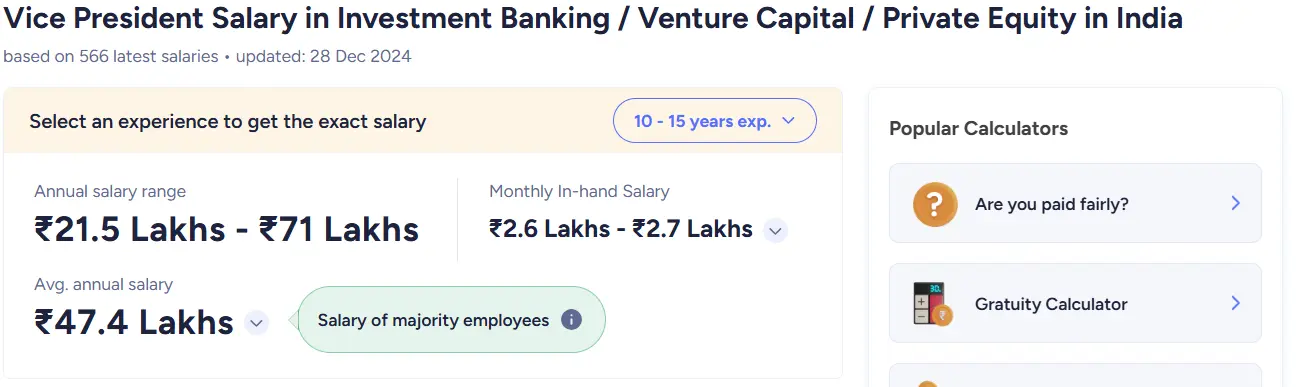

VP (Vice President): The position has more responsibility and will be strategic

- What they do: Managing bigger teams with new business focus and closing deals. VPs are critical to the firm on the client-facing side and also from an overall execution standpoint in terms of deals.

- Salary: The average salary is between ₹21 lakhs and ₹75 lakhs annually, depending on experience and the company.

Source – AmbitionBox

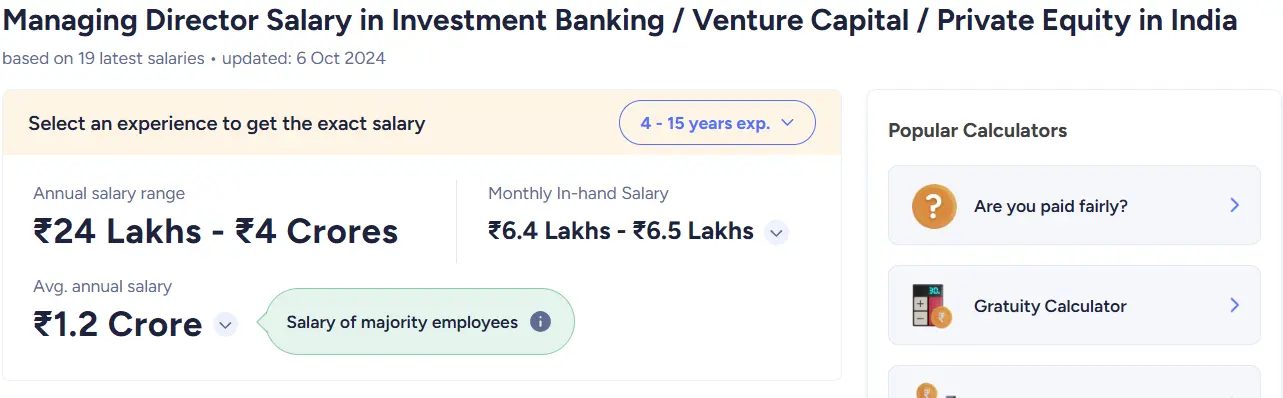

Managing Director (MD): The MD is at the top of the hierarchy, overseeing the firm’s operations and strategic direction.

- What they do: Overseeing the firm’s operations and strategic direction, maintaining relationships with major clients, and making critical decisions for the business/company.

- Salary: The average salary in India is between ₹24 lakhs and ₹4 crores annually, depending on experience and the company.

Source – AmbitionBox

Niche Career Path and Opportunities

In addition to the conventional paths, investment banking in India also provides opportunities in other niche verticals:

- Risk Management: Risk management professionals assess and mitigate financial risks for the firm.

- Compliance officers ensure that the company follows all regulations, protecting from legal issues.

- Sales and Trading: This type of person buys and sells financial instruments and brings market liquidity.

- Research: Research analysts analyze market trends and a company’s performance to advise the best investment decisions.

Also Read – What Salaries Do Investment Bankers Earn Throughout Their Careers?

Why Pursue a Career in Investment Banking in India?

- High Earning Potential: Investment banking offers competitive salaries and bonuses, making it a lucrative career choice.

- Career Growth: The structured progression allows for clear career advancement, with opportunities to take on leadership roles.

- Dynamic Work Environment: The fast-paced nature of the industry provides constant challenges and learning opportunities.

- Meaningful Work: Professionals contribute to business expansion and economic progress.

Investment banking in India is a career that offers not only attractive remuneration prospects but also excellent career growth, and he opportunity to be part of the economic development of the country.

With an inquisitive mind ready to learn about market and economic trends, finance is sure to be a rewarding career path.

Also Read – Investment Banking as a Career in India: Challenges and Rewards

Investment Banking in Today’s World

Investment banking has evolved over the years, especially with advances in technology and changes in market regulations.

Today’s investment bankers have to stay on top of the latest tools and techniques to help businesses make informed decisions.

Despite these changes, the core role of investment bankers—helping businesses raise capital, manage financial risks, and grow—remains as crucial as ever.

Why Do IMS Proschool’s Investment Banking Program?

IMS Proschool’s Investment Banking Operations (IBO) Course is the ultimate 4-month program designed to equip you with the skills and confidence needed to excel in middle and back-office roles. With a strong focus on relevant skills, assured placements, and opportunities for further growth, this program sets you on a path to a rewarding career in investment banking.

Why Choose IMS Proschool’s IBO Program?

- Certification & Exam Preparation: Prepares you for NISM Series 12, 7 & 8 certifications to boost your career prospects.

- Job Assurance: Assured placements with top-tier companies offering packages ranging from ₹3-9 LPA.

- AICTE-Approved PGCM Upgrade: Post-completion, opt for AIMA’s AICTE-approved PG exams and earn a PGCM in Investment Banking. This unlocks the opportunity to pursue a 1-Year MBA program.

- Pathway to CFA Certification: Solidify your finance foundation, making it easier to transition to front-office roles by pursuing CFA.

- Comprehensive Skill Development: Master tools and concepts like Excel, financial markets, forex, derivatives, and OTC in just 120 hours.

- Placement-Oriented Training: Solve real-world case studies from multiple industries to ace your interviews.

- Learn from Industry Veterans: Benefit from guidance by faculty with a combined 30+ years of finance experience.

Take charge of your investment banking journey with a program that guarantees skill enhancement, placement opportunities, and growth pathways.

Conclusion

Investment banking is historically an interesting and lucrative profession. It is a critical part of the economy that allows companies to raise money, manage investments, and optimize financial decisions.

Whether you advise clients on mergers and acquisitions, take a company public or present vital financial analysis, an investment banker’s work is central to finance.

If you’re interested in pursuing a career in investment banking, you’ll need a solid educational foundation, strong analytical and communication skills, and a commitment to hard work.

With the right qualifications and experience, a career in investment banking can lead to many exciting opportunities.

FAQs

What qualifications do you need to become an investment banker?

Typically, investment bankers have a degree in finance, economics, or business. Many also pursue an MBA or certifications like the CFA to boost their career prospects.

What is the average salary of an investment banker?

Salaries vary by experience and location, but entry-level investment bankers can earn around ₹ 12 – 15 Lakhs Per Annum. Managing directors can earn much more, often reaching salaries over ₹50 Lakh Per Year, plus bonuses.

What are the most common career paths within investment banking?

Most investment bankers start as analysts and progress to the associate, vice president, and eventually managing director. There are also roles in research, sales, and trading.

How do investment bankers help companies during mergers and acquisitions?

They advise on the financial aspects of the merger or acquisition, help with valuations, and structure the deal to benefit all parties involved.

What skills are most important for a successful investment banker?

Analytical skills, financial modeling, negotiation, communication, and attention to detail are all critical for success in investment banking.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!

One Comment

Excellent blog explaining the role of an investment banker! Clear insights make it perfect for anyone exploring this dynamic career path.