What Salaries Do Investment Bankers Earn Throughout Their Careers?

Here's What We've Covered!

India’s investment banking industry has seen a remarkable expansion in recent times, drawing considerable interest from individuals pursuing careers in finance.

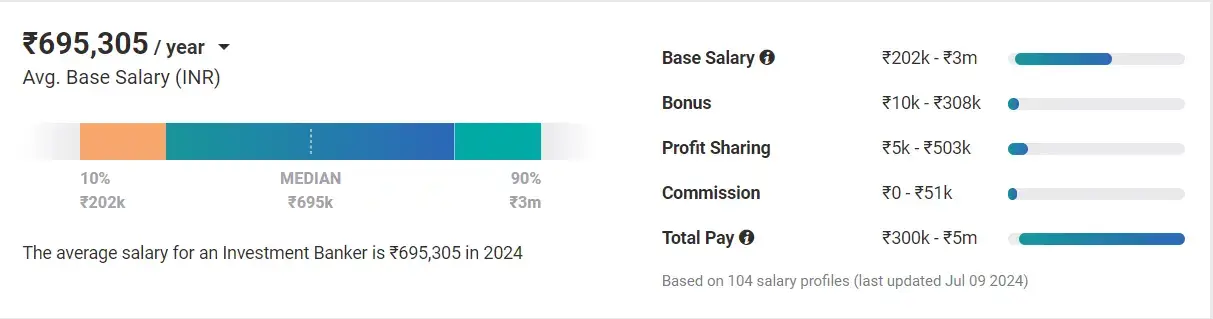

Reports suggest that investment bankers here earn an average annual salary between ₹8 lakhs to ₹15 lakhs. This amount can vary based on factors like how much experience someone has, their qualifications, where they work, and who their employer is. Understanding these factors is important for knowing how much you might earn in this field.

Investment Banker’s Salary Based on Key Factors

Exploring a career in investment banking has become increasingly popular due to its lucrative compensation, dynamic work environment, and opportunities for personal growth. In this guide, we’ll delve into the factors influencing an investment banker’s salary, including their educational qualifications, level of experience, position within the hierarchy, types of companies they work for, and geographical location. Understanding these elements is crucial for individuals aspiring to pursue a career in investment banking and wanting to gauge their potential earnings in this field.

Key factors impacting investment bankers salaries

-

Salary Based on Hierarchy

In investment banking, there are three main job levels: analyst, associate, and managing director. We’ll look at how much money people at each level usually earn and what affects their pay.

-

-

Analyst:

-

As the starting position in investment banking, analysts typically earn between ₹8-₹12 lakhs per year. The exact salary can vary based on factors like the bank’s size, location, and the analyst’s qualifications. For example, larger banks and those in big cities might offer higher salaries compared to smaller banks or those in less urban areas.

-

-

Associate:

-

After gaining more experience, associates usually earn between ₹15 and ₹25 lakhs annually. The salary depends on factors like the associate’s qualifications, years of experience, and the bank’s reputation. Associates specializing in areas like mergers and acquisitions or private equity might earn even more due to the specialized skills needed for these roles.

-

-

Managing Director:

-

As the top tier of investment banking, managing directors typically earn ₹1-2 crores or more per year. The exact salary depends on factors like the bank’s size, location, and the managing director’s performance. Managing directors often have a strong track record of successful deals, a wide network of clients, and the ability to generate revenue for the bank, which can influence their salary.

Apart from the base salary, investment bankers also receive bonuses and incentives based on their performance and the bank’s profitability. Bonuses can vary widely across different levels, with analysts potentially receiving bonuses between 30% and 100% of their base salary, while managing directors could receive bonuses exceeding 200% of their base salary.

Also Read – Is an MBA Required for Investment Banking? Explore Other Options

-

Impact of Qualification on Salary

In this part, we’ll explore how an investment banker’s education affects their pay. We’ll look at the significance of degrees like Bachelor’s, Master’s, or MBA in finance, along with certifications like Chartered Financial Analyst (CFA).

Furthermore, we’ll compare the potential earnings of investment bankers with various educational qualifications.

-

-

Bachelor’s Degree

-

With a Bachelor’s degree in finance, economics, or a similar field, entry-level investment bankers can anticipate an annual salary ranging from ₹8 to ₹12 lakhs. The exact figure hinges on factors like the college’s reputation, the student’s academic achievements, and the bank’s location and size.

-

-

Master’s Degree or MBA

-

A Master’s degree in finance or an MBA from a prestigious institution can significantly boost an individual’s earning potential in investment banking. Analysts with these qualifications typically start with an annual salary between ₹12 to ₹20 lakhs. Graduates from top-tier business schools may command even higher salaries.

-

-

CFA Certification

-

Earning the Chartered Financial Analyst (CFA) designation is highly esteemed in the investment banking field. Combined with a Bachelor’s or Master’s degree, CFA-certified professionals can expect a starting salary ranging from ₹14 to ₹22 lakhs per annum. However, actual pay may vary based on factors like experience, bank size, and location. You can check our IMS Proschool’s CFA course here.

-

-

Other Qualifications

-

Obtaining other certifications like the Financial Risk Manager (FRM) or Chartered Alternative Investment Analyst (CAIA) can further boost an investment banker’s salary. Those with these qualifications might earn higher pay because of the specialized knowledge needed for certain roles within investment banking.

Start a career in Investment Banking Operations in just 4 months with Proschool. Get a starting salary of INR 3-9 LPA

-

Salary with Respect to Years of Experience

Experience is key in shaping an investment banker’s salary. As professionals progress in their careers, their compensation tends to increase. Let’s explore how years of experience impact salary and the potential for growth over time.

-

-

0-2 years (Analyst level):

-

Entry-level analysts in investment banking start with tasks like financial modeling and market research, assisting senior bankers. They earn between ₹8 to ₹12 lakhs annually, depending on qualifications, bank size, and performance.

-

-

2-5 years (Associate level):

-

Associates take on more responsibilities, including client interaction and deal structuring. With experience, they earn ₹15 to ₹25 lakhs per year, influenced by education, bank reputation, and expertise in areas like mergers and acquisitions.

-

-

5-10 years (Vice President level):

-

Vice Presidents lead deal teams, manage client relationships, and drive business development. They earn ₹40 to 70 lakhs annually, based on deal success, deal size, and revenue generation ability.

-

-

10+ years (Managing Director level):

-

Managing Directors set strategic direction, drive revenue growth, and manage key client relationships. With over 10 years of experience, they earn ₹1-2 crores or more annually, influenced by bank size, deal success, and industry connections.

-

Salary based on Companies

An investment banker’s salary can vary based on the type of company they are employed with. Let’s explore how compensation packages differ among major international banks, local banks, and specialized investment firms, and how factors like company size, location, and performance can impact an investment banker’s earnings:

-

-

Large Multinational Banks:

-

Investment bankers at renowned multinational banks like JPMorgan, Goldman Sachs, and Morgan Stanley often receive top-tier salaries in the industry. For instance, analysts starting out at these banks could earn between ₹12 and ₹20 lakhs annually, while managing directors might command salaries of ₹1-2 crores or more. Additionally, generous bonuses and incentives based on performance further enhance compensation packages at these institutions.

-

-

Domestic Investment Banks:

-

Indian investment banks such as ICICI Direct, HDFC, and Axis Capital also offer competitive salaries for investment bankers, albeit slightly lower than those at multinational banks. Analysts at domestic banks typically earn between ₹8 and ₹14 lakhs per annum, while managing directors can expect salaries of up to ₹1 crore or more, depending on the bank’s size and performance.

-

-

Boutique Investment Firms:

-

Boutique investment firms, which specialize in specific areas of investment banking, offer varied salary ranges. Analysts at boutique firms may earn anywhere from ₹6 to ₹15 lakhs annually, while managing directors could earn salaries exceeding ₹1 crore. The actual compensation depends on factors such as the firm’s size, reputation, and performance in niche markets like mergers and acquisitions or private equity.

Also Read – How to Become an Investment Banker in India?

-

Industry-based Salary & Regional-based Salary Differences

In this section, we’ll explore how compensation for investment bankers varies depending on geographical location and industry. We’ll examine the factors contributing to these differences and gain insights into the reasons behind the fluctuating remuneration across different regions and sectors.

-

-

Regional Disparities

-

The pay for investment bankers in India can vary significantly depending on where they work. Major financial hubs like Mumbai, Delhi, and Bangalore often offer higher salaries compared to smaller cities or less urban areas. This difference is mainly due to the higher cost of living in metropolitan areas, the greater number of financial firms, and the increased competition for talent.

For instance, investment bankers in Mumbai might earn 10-20% more than those in cities like Chennai or Kolkata. These variations in compensation apply across all levels of seniority, from analysts to managing directors.

-

-

Industry Discrepancies

-

Investment bankers’ salaries can also differ based on the industry they focus on. For instance:

-

- Booming Sectors: Professionals in rapidly growing industries like technology, e-commerce, or renewable energy often command higher salaries due to the high demand for their expertise and the potential for lucrative deals.

- Traditional Industries: Conversely, those specializing in conventional sectors such as manufacturing or retail may encounter lower salaries. This is because these industries typically have limited growth prospects and fewer prominent transactions.

Get Assured Placements with Proschool’s Investment Banking Operations Course with ₹3-9 LPA starting package

Investment Banking Jobs and Salary in India

Investment bankers in India command high salaries for several reasons. Firstly, they play a crucial role in facilitating company mergers and acquisitions, which often result in substantial commissions. These complex transactions require significant time and effort, justifying the generous compensation received by investment bankers.

Source: Payscale

Growth Trends in the Indian Investment Banking Sector

Despite the challenges posed by the pandemic and uncertainties surrounding deal activities, both equity and debt issuance, investment banking continues to flourish in India. It remains one of the country’s fastest-growing sectors, with a rising demand for professionals in the field. According to the Bureau of Labor Statistics, the demand for financial services sales agents, including those in investment banking, is projected to grow by 4% by 2029, leading to an increase in employment opportunities.

Moreover, professionals in investment banking are among the highest-paid individuals globally. New hires often receive six-figure salaries right after graduation, a benefit not commonly seen in other professions.

Also Read – 10 Essential skills for a successful Career In Investment Banking

Roles in Investment Banking with Salary

Job titles in this field include Finance Analyst, Business Analyst, Investment Banking Associate, Finance Director, and Finance Manager.

Entry-level positions in investment banking often begin with the title of financial analyst. These analysts are tasked with creating comprehensive pitch books for client meetings, and outlining investment strategies and concepts. Their daily responsibilities involve researching, analyzing, and presenting investment banking methodologies.

Proficiency in financial analysis, financial reporting, Excel, accounting, and data analysis is crucial for these roles.

-

Business Analyst, Finance

Business Analysts, akin to financial analysts, focus specifically on business processes. They analyze existing methods within the sector, implement profit-generating strategies, and advise on asset investment based on business type.

Core skills for Business Analysts include business strategies, project management, Excel proficiency, and SQL knowledge. On average, they earn ₹6 LPA, with some prominent companies offering up to ₹7 LPA.

-

Investment Banking Associate

Investment Banking Associates advance from financial analyst roles. They analyze investment strategies, act as intermediaries between junior analysts and senior banking officials, and may manage client portfolios and interact directly with clients. Key skills include financial modeling, risk management, and operations management. The average annual salary for associates is ₹6.9 LPA, with a maximum of ₹10 LPA.

-

Finance Manager and Finance Director

Finance Managers and Directors hold prominent positions in the banking industry. They manage client relationships, make investment decisions, and oversee proposed strategies. Core skills include accounting, budgeting, financial analysis, and strategic planning. Finance Managers earn around ₹10 LPA on average, while Finance Directors earn approximately ₹36 LPA.

| Job Role | Average Salary Offered |

| Investment Banking Analyst | ₹5 LPA |

| Business Analyst | ₹6 LPA |

| Investment Banking Associate | ₹6.9 LPA |

| Finance Manager | ₹10 LPA |

| Finance Director | ₹36 LPA |

Also Read – CFA Exam and Investment Banking. How to become an investment banker.

Required Qualifications and Skills for Investment Bankers in India

To excel as an investment banker in India, candidates need a robust educational background and a diverse skill set. Here’s what it takes to not only enter but also thrive in this field:

- Educational Qualifications: A bachelor’s degree in finance, economics, business, or a related field is typically the minimum requirement. Many also pursue advanced degrees like an MBA or a Master’s in Finance. Certifications like the Chartered Financial Analyst (CFA) or the Financial Risk Manager (FRM) can further enhance credentials.

- Analytical Skills: Strong analytical skills are a must. Investment bankers analyze financial data, create models, and evaluate investment opportunities, requiring a deep understanding of financial statements, market trends, and valuation techniques.

- Communication Skills: Exceptional written and verbal communication skills are vital. Investment bankers interact with clients, present complex financial information, and negotiate deals.

- Teamwork and Leadership: Collaboration and leadership are key. Investment bankers work in teams, collaborating effectively with colleagues and leading as they advance. Leadership skills are crucial for managing teams, guiding junior bankers, and maintaining client relationships.

- Time Management and Adaptability: Investment banking demands effective time management and adaptability. With tight deadlines and long hours, the ability to prioritize tasks and adapt to change is essential for success.

Current Job Market and Opportunities for Investment Bankers in India

As India’s economy grows, investment bankers are in high demand for facilitating various financial activities. The expanding economy is driving increased demand across all levels, from entry-level analysts to experienced managing directors. Additionally, the diversification of industries, including technology, e-commerce, and renewable energy, is creating opportunities for investment bankers with specialized expertise. Moreover, the surge in foreign investment is leading to more cross-border deals, offering professionals opportunities for international exposure. Lastly, the rise of boutique investment firms focusing on niche areas provides additional avenues for specialization and career growth.

Also Read – Top 10 Certifications for Investment Banking Success!

Excited To Pursue Investment Banking As A Career? Proschool’s Here To Help!

IMS Proschool is a premiere institution for Accounts & Finance Courses in India. We have 15+ Centres throughout India, and we’ve helped almost 35 – 40 thousand students build careers in various domains.

If you’re looking to pursue an investment banking career, then you should definitely check out our Investment Banking Operations Course & CFA Prep Course.

The Investment Banking course will get you job roles in the middle & back office while the CFA course will open doors to many front-end roles where you’ll get a chance to directly interact with many clients.

FAQs

Q: What is the average starting salary for an investment banker in India?

A: The average starting salary for an investment banker in India typically ranges from INR 8 to 12 lakhs per annum for entry-level positions such as financial analysts. However, this can vary based on factors such as the candidate’s qualifications, the size and location of the bank, and the candidate’s performance.

Q: What factors affect Investment Banker’s Salary in India?

A: Several factors can influence an investment banker’s salary in India, including their level of experience, the type and size of the employer, the location of the job, and the candidate’s educational qualifications and certifications. Additionally, performance, market conditions, and industry trends can also impact salary levels.

Q: What educational qualifications are required to become an investment banker in India?

A: While a bachelor’s degree in finance, economics, business, or a related field is typically the minimum requirement for entering investment banking in India, many professionals also pursue advanced degrees such as a Master’s in Finance or an MBA. Additionally, certifications like the Chartered Financial Analyst (CFA) designation are highly valued in the industry and can enhance career prospects.

Q: What skills are essential for a successful career in investment banking?

A: Essential skills for a successful career in investment banking include strong analytical abilities, financial modeling expertise, proficiency in Excel and other financial software, excellent communication and presentation skills, teamwork and leadership capabilities, and the ability to thrive in a fast-paced and high-pressure environment. Additionally, attention to detail, problem-solving skills, and a deep understanding of financial markets and instruments are also crucial.

Q: What are the growth prospects for investment bankers in India?

A: Investment banking in India offers promising growth prospects, driven by factors such as the expanding economy, increasing diversification of industries, and growing foreign investment. Professionals in this field can expect opportunities for career advancement and specialization, with avenues for progression to senior roles such as associate, vice president, and managing director, as well as opportunities to work on cross-border deals and gain international exposure.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!