Essential skills for a successful Career In Investment Banking

Here's What We've Covered!

Hollywood has created a certain stereotype for investment bankers. It’s not unusual to see fast-talking, shrewd executives with gelled hair and a flair for drama on the big screen. They also tend to be quite reckless with money and diabolical with their investment plans.

That’s the fantasy. The reality is very different. It takes a set of skills to have a successful career in investment banking. None of these are shown in the movies.

The truth is the average investment banker is a highly educated professional with a sharp analytical mind and strong reasoning skills. They are not fast talkers but rather deep thinkers. They pay close attention to detail and spend a lot of time number-crunching.

The investment market is over-glamourised because massive sums of money and high stakes are involved. In the real world, investment banking is less ‘Wolf Of Wall Street’ and more about skills, proficiency and ethical decisions.

So what do you need to become the next titan of the investment industry? You need a good mix of technical and soft skills to make your mark in this exciting yet competitive field. It will take time, effort and commitment to achieve these abilities. If you do it right, you’ll be ready to get a job in investment banking and work your way to the corner office life.

Why is it so prestigious to have a Career In Investment Banking?

The movie industry certainly seems to think so. Who can blame them? Investment bankers are considered to be kings of the finance world.

- They work with some of the biggest companies in the world.

- They have a deep understanding of the stock markets and global economies.

- They can use their skills to significantly increase the wealth and valuation of their clients.

- Investment bankers can also make predictions, shape the financial future and affect economies around the globe.

It’s a powerful position to be in. Highly rewarding too. Did you know that investment bankers are some of the most highly paid and influential people in the corporate world?

(That’s the part Hollywood did correctly.) However, because of all these massive advantages, it’s not easy to get a successful career in investment banking. You need to be competent, hardworking and skilful to be taken seriously by your managers and peers. So without wasting any more time, let’s find out how to get a job in investment banking.

Read – What do you need to become an Investment Banker?

Essential skills to get a job in investment banking

Technical skills

There is a reason top financial firms and banks only take highly qualified candidates to work for them. A high-calibre certification ensures you have the training and education to jump into the deep end of financial investment services. You don’t need hand-holding or on-the-job training. You are ready to start your job in investment banking. Here are some of the qualities many employers expect all new hires to have.

-

A deep understanding of the stock market, economics and finance

Pilots can’t navigate a plane without a licence that proves their training. Investment bankers can’t work the stock market without a certification that ensures they have the knowledge. In such a complex, unpredictable and volatile industry, you need a thorough understanding of the markets and the economy. A trained professional will rely on their education and research before making an informed decision. Your qualification is the foundation on which you can build your career in investment banking.

-

Financial modelling

Candidates with a financial modelling certification are more likely to get a job in investment banking. It’s a vital tool used by many experts across the field. Financial models help investment professionals with several tasks. You can create M&A models, financial statements, company valuations, profit and loss statements and other relevant reports. It helps to make data more accessible and coherent. Financial modelling can also help with making predictions and identifying risks.

-

Technical concepts

If you are going to be a part of this industry, you must know and understand all the industry terms. Your familiarity with finance concepts must be on point. In a fast-paced workday, words and terms are thrown around at a rapid speed. You need to know what each one means and how they can be utilised to your advantage. Bonds, call options, M&A, derivatives, bear and bull markets, leverage, IPO, and futures… are just some of the many concepts you must be familiar with if you want a career in investment banking.

-

Proficiency in software

Like everything else, investments have gone digital as well. More and more investment banking professionals are moving online for trading purposes. There are several software platforms, such as MS Office, Bloomberg Terminal and Stock Market Eye, that are used extensively. If you want to know how to get a job in investment banking, it is essential to learn new software systems to keep up with the latest trends in the market.

-

Financial literacy

Investment banking doesn’t occur in a vacuum. The stock market is dependent on several financial conditions. You have to be aware of what is happening across the finance industry. You need to know how businesses function, what causes recessions and how conflicts and disasters can affect the economy. A high level of knowledge and understanding can help you go very far in your career in investment banking.

Learn all these technical skills with Proschool’s Investment Banking Course

Soft skills

-

Good communication

You may know the inside out of the investment arena like the back of your hand. Complex terms, industry concepts and statistics may seem coherent to you, but they won’t be to your client. You need to be fluent and articulate when conveying your ideas and insights to people who don’t understand technical language. You also need to persuade them to use your recommendations. A strong set of communication skills will help you win over clients and your superiors as well. It’s a big part of your job in investment banking. So ensure you work on your communication abilities.

-

Negotiation skills

How to get a job in investment banking? You negotiate well. When dealing with mergers and acquisitions, you need to bring your A game. You need to be able to efficiently ensure your terms are met, and your clients see a good profit. By using your awareness of the industry and communication skills together, you can negotiate your way into a successful career in investment banking.

-

Analytical thinking

Financial experts need to carefully analyze the market situation before taking a call. Most decisions are made after scrutinising the data, forecasting future requirements and checking for risk factors. A sharp, critical eye is needed when working at a job in investment banking. It is crucial as a lot is riding on you. So you have to ensure you have looked at every angle, number and statistic before you make a decision.

-

Research skills

Here’s something the movies don’t tell you. A large part of your job in investment banking involves researching financial data. Professionals are required to stay updated on all the latest news and developments in the markets. They have to intensely study every investment opportunity thoroughly to ensure it is feasible in the future. Good research skills can also help you avoid setbacks or losses.

-

Problem-solving abilities

The life of an investment banker is not without its fair share of challenges. Stock markets crash, economies collapse, and companies go bankrupt. On a smaller scale, sometimes small shifts in share prices can greatly affect investment portfolios. Either way, you should be able to come up with suitable solutions. Your problem-solving abilities are dependent on your research and analytical thinking skills. They work together to ensure you do a competent job in investment banking.

Did you know, you could easily complete the Investment Banking Course in 7 Months?

The Mysterious World of Investment Banking

Investment banking is like that chaat you love – it’s got a little bit of everything. From mergers and acquisitions to trading and research, there’s never a dull moment. Here are some job roles that investment bankers take up:

- The Merger Moguls: These bankers are the Cupids of the corporate world. They help businesses find their perfect match and merge to create something even more powerful.

- The IPO Gurus: They take companies public, just like celebrities hitting the red carpet for the first time.

- The Trading Titans: These guys are like the sabziwala at your local market, but for stocks. They buy low and sell high to make profits for their clients.

- The Research Rockstars: They’re like the nerds of the investment banking world. They crunch numbers, analyze data, and give their expert opinions on the stock market.

Show Me the Money!

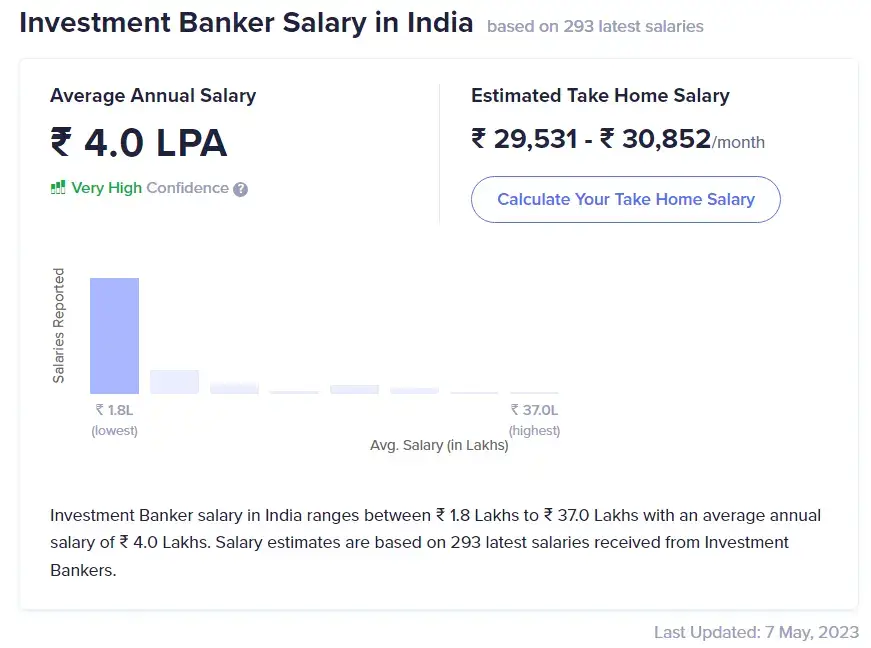

So, let’s get to the juicy part: how much do these investment bankers make? Well, as the saying goes, “With great power comes great responsibility… and great salaries!” Here’s a breakdown of average salaries in investment banking, with a little help from some famous Indian personalities:

- Analysts (1-3 years of experience): These are the freshers who have just entered the exciting world of investment banking. They make about INR 3-6 lakhs per year. In other words, they’re like the Vicky Kaushals of the banking world – just getting started but already making a mark.

- Associates (3-5 years of experience): Associates make between INR 7-10 lakhs per year. They’re the Ranveer Singhs of the industry – established, eccentric, and well-paid.

- Vice Presidents (5-10 years of experience): VPs make INR 12-20 lakhs annually, and they’re like the Shah Rukh Khans of investment banking – highly experienced, influential, and rolling in the dough.

- Directors (10-15 years of experience): Directors make around INR 22-35 lakhs a year. They’re the Amitabh Bachchans of the industry – veterans who have seen it all and continue to rule the roost.

- Managing Directors (15+ years of experience): Managing Directors are the crème de la crème, making INR 2.5 crore or more annually. They’re like the Sachin Tendulkars of investment banking – legends who have reached the pinnacle of success.

Perks & Challenges Of Becoming An Investment Banker

There’s no denying that investment banking offers some pretty amazing perks, such as:

- Fat paychecks: Need I say more?

- Global exposure: You’ll have the opportunity to work with international clients and even go on fancy business trips.

- Networking opportunities: Rub shoulders with the who’s who of the business world and create lasting professional connections.

But it’s not all sunshine and roses. Here are some challenges investment bankers face:

- Long hours: Get ready to bid adieu to your social life and say hello to those late-night meetings.

- High stress: With great money comes great stress – be prepared to handle the pressure that comes with managing millions of dollars.

- Competition: It’s a dog-eat-dog world out there, so you’ll need to bring your A-game every day to stay ahead.

How Proschool can boost your career in investment banking

Want to know how to get a job in investment banking? You need a certification that can open doors and lead you to high-profile opportunities. Choose from Proschool’s Investment Banking Course or the CFA program. Both have a comprehensive, intelligent and well-designed curriculum to help students learn about investment banking. The institution uses active learning methods and innovative techniques to help students master investment banking. The faculty consists of investment experts who teach students about core subjects, real-life case studies and technical skills. By the end of the program, you will be well-equipped to apply for any job in investment banking.

Benefits of learning with Proschool:

- Both courses are focused on investment finance to get students industry-ready.

- The subjects include financial markets, quantitative methods, derivatives and financial modelling.

- The course is open to graduates or third-year students.

- Online and offline classes are available for all students.

- Students can avail of Proschool’s placement portal to apply for a job in investment banking.

- The staff also ensures all students are adequately prepared for the recruitment process.

In conclusion

A career in investment banking is much like the stock market. It has its fair share of ups and downs. However, if you have the training, skills and expertise, you are highly likely to see an upward trajectory in your professional journey. Hopefully, this post has helped you understand how to get a job in investment banking, and how to prepare and plan for a super-hit career.

Find out more about IMS Proschool’s Investment Banking Course.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!