11 Job-oriented courses that will boost your career in 2023

Here's What We've Covered!

It is 2023. While traditional roles such as accounting and finance continue to thrive, there has been a new wave of cutting-edge and innovative job profiles. We can thank the internet for that. Companies are modifying their business strategies and objectives to appeal to the digital-savvy consumer. This has led to the rise of job-oriented courses is a reflection of the job market.

Candidates are looking for careers that are challenging, lucrative and offer immense job satisfaction. Gone are the days when you need several years’ worth of a professional degree to make a mark on the corporate world. As the world moves at a rapid pace, and change is the only constant, these five job-oriented courses are perfect for the future-ready professional.

11 Job-oriented Courses That Will Boost Your Career

1. Business Analytics

It is one of the trendiest job-oriented courses today that can lead to incredible career opportunities. Companies all over the world use analytics to boost their sales performance. Here’s why:

- Business analytics converts structured, business data into strategic insights that can help companies make smart decisions.

- It can be used to evaluate different departments or areas of the company to see if there are any weak points.

- It can assess a consumer’s behaviour and preferences so that companies can refine their products and services to suit the customer

Why business analytics is a perfect job-oriented course for you:

- You have a deeply analytical mind and good critical thinking abilities.

- You have an eye for detail and enjoy research.

- You have a good knowledge of statistical methods.

- You are skilled at problem-solving.

- You have a knack for data and number crunching.

Opportunities in business analytics:

This job-oriented course is in high demand in the market. Companies are actively seeking out analysts who possess business acumen and can provide quality solutions.

- Infosys, Amazon, Oracle, Deloitte, Accenture, IBM, PayTM and Google are just a few of the many organisations that use business analytics.

- A business analytics certification can lead to high-profile positions such as data architect, chief data officer, information security analyst and project manager.

- Salaries start from Rs 3 lakhs and can go as high as 15 lakhs a year. The average salary is Rs 6 lakhs.

Ready to start your career as a Business Analyst?

2. Digital Marketing

Every time you find an online ad that caters to your needs or you get an email in your inbox that makes recommendations you like, digital marketing is behind it. Using data science and analytical techniques, you can reach your target audience, whether it is a large group of people or just one individual. Digital marketing is a job-oriented course that is gaining rapid popularity across all industries. Here’s why:

- It helps brands connect with the right customers through a mix of channels and online platforms.

- It enables consumers to have an engaging and interactive relationship with the brand.

- It is a cost-effective yet highly efficient method that is proven to boost sales.

Why digital marketing is a perfect job-oriented course for you:

- You have a good understanding of social media, email marketing and other online platforms.

- You have a good eye for internet trends and viral content.

- You are creative yet tech-savvy.

- You know how to use digital marketing tools such as SEO, SMM and SEM.

Opportunities in digital marketing:

This job-oriented course is trending very well among recent college graduates. There is a lot of scope in digital marketing as the corporate world is rapidly transitioning to cyberspace.

- The digital marketing industry is valued at Rs 367 billion in India.

- There are various careers within this field such as SEO specialist, social media manager and content marketing specialist.

- Annual salaries start at Rs 3 lakhs, and with some experience, can increase to Rs 6 to 8 lakhs. Senior experts can earn over Rs 18 lakhs a year.

Ready to start your career as a Digital Marketer?

3. Data Science

Data science is an intensive study of data using various statistical methods, programming techniques and algorithms to analyse structured as well as unstructured data. It is fast becoming the number one choice for students opting for a job-oriented course. Here’s why:

- Data science can help various organisations improve their efficiency and minimise risks or obstacles.

- It can study every trend or pattern to create a well-rounded analysis.

- It uses advanced AI technology and machine learning methods to arrive at a better understanding of the data.

Why data science is a perfect job-oriented course for you:

- You have a good mind for statistics and maths.

- You understand coding.

- You know the relevant data tools such as Python, Tableau, R and SAS.

- You enjoy research and analysis.

- You have good problem-solving skills.

Opportunities in data science:

The potential for applying data science in all fields of life is huge. Experts have only just scratched the surface. The field of data science is poised to undergo rapid growth in the coming years, making it a very lucrative job-oriented course to pursue.

- Many global corporations such as Adidas, Walmart, Barclays, LinkedIn and Deloitte are turning to data science to improve their productivity.

- Job profiles in data science include statistician, machine learning engineer, data mining engineer and data scientist.

- The average data scientist annually earns Rs 10 to Rs 15 lakhs, but freshers start around Rs 3 to Rs 4 lakhs a year.

Ready to start your career as a Data Scientist?

4. Financial modelling

Financial modelling is a spreadsheet software system that creates reports, analysis and predictions about a company’s financial performance. It is a highly valued tool in the finance industry, and used extensively by all the major companies. It is a job-oriented course that can open up many prospects for young students. Here’s why:

- Financial models are used to record company valuation, risk management reports, comparison analysis and financial statements.

- Offers transparency and clarity on the company’s inflow and outflow of cash.

- Helps management make better decisions for the business.

- Gives a clear picture of the company’s financial data to shareholders, employees, prospective buyers and investors.

Why financial modelling is a perfect job-oriented course for you:

- You have good accounting knowledge

- You are detail-oriented by nature

- Your analytical and presentational skills are excellent

- You have a knack for simplifying complex financial data

- You are proficient in MS Excel

Opportunities in financial modelling:

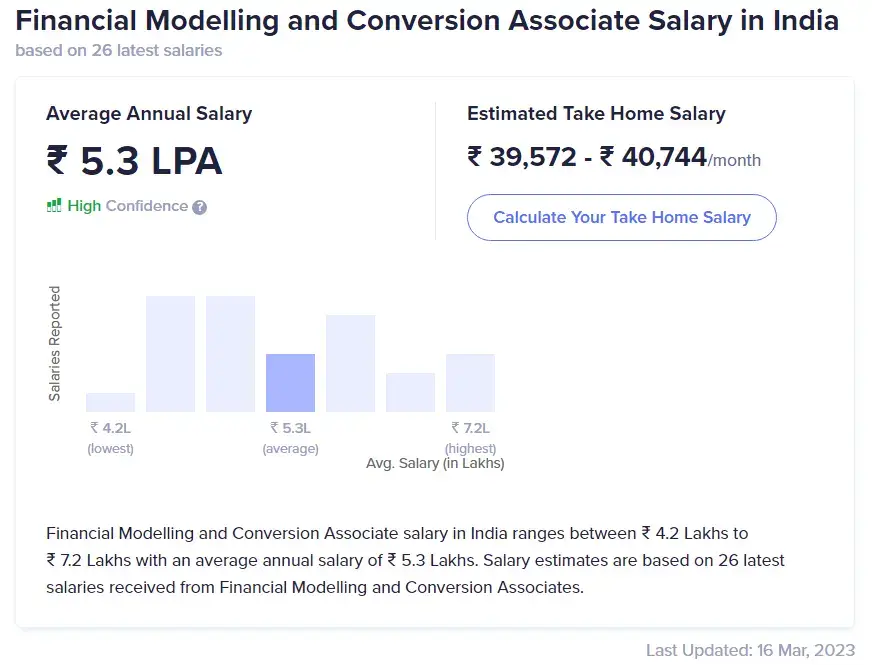

Why is financial modelling such an important job-oriented course? It is one of the more popular tools in the finance and accounting field and can give your career a much needed boost.

- Financial modelling experts can work in various fields such as investment banking, financial planning, corporate finance and equity research.

- Almost all companies use financial modelling and your certification can get you hired over your peers.

- The average salary is Rs 5 lakhs a year, but can increase to over Rs 12 lakhs with more experience.

Ready to start learning Financial Modelling?

5. Options Trading

Options trading is gaining a lot of traction in the investment industry, and is quickly becoming one of the most sought after job-oriented courses today. It enables investors to pay less for stocks while lowering the risks. Through clever and calculated thinking, you can stand to make huge gains with options trading. Here’s why:

- Allows traders to buy financial contracts that give them the right to buy stocks at a fixed price before a specific date.

- Offers investors leverage when they plan their investments.

- Enables diversified portfolio management, as investment advisors are about to buy more shares at a lesser cost.

- Gives buyers an exit strategy.

Why options trading is a perfect job-oriented course for you:

- You have a keen sense of how the stock market works

- You work well under pressure

- You have a knack for handling numbers and figures

- You have a disciplined mind and can pre-empt any risks well

Opportunities in options trading:

As the investment markets grow more complex in nature, the world will need more option trading professionals. That is one of the reasons why options trading is a job-oriented course with a lot of scope in its future.

- Options traders make between Rs 3 lakhs to Rs 8 lakhs a year.

- You can work with many NSE-listed brokerage firms, investment banks and financial institutions.

Ready to start your career as an Options Trader?

6. CFA: Chartered Financial Analyst

Yo, finance enthusiasts! If you’re eager to dive into the world of investment analysis, portfolio management, and equity research, then the CFA (Chartered Financial Analyst) is your golden ticket. It’s like the Iron Man suit of the finance world, turning you into a powerhouse of knowledge and skill. So, here’s the deal:

Why CFA is one of the power-packed job-oriented courses:

- Globally recognized certification in the finance sector

- Boosts your career opportunities and salary potential

- Solidifies your understanding of advanced investment tools and strategies

- Enhances your credibility and marketability in the industry

What makes you a perfect candidate for the CFA:

- You’re a finance aficionado

- Your analytical skills can put Sherlock Holmes to shame

- You have the patience and dedication to study for three grueling levels

- You’re ready to conquer the financial world

Opportunities in CFA:

- Investment management firms (think BlackRock, Goldman Sachs)

- Equity research (as the one who predicts future market trends)

- Corporate finance (managing the moolah for big companies)

- Financial consulting (helping businesses navigate the treacherous waters of finance)

Ready to start your career as a Financial Analyst?

7. ACCA: Association of Chartered Certified Accountants

Dear future accountants, ACCA is your calling! This globally recognized certification will have you cracking the toughest of accounting puzzles with finesse. So, if you’re ready to don the cape of a financial superhero, here’s why you should go for ACCA:

Why ACCA is considered one of the best job-oriented courses for accounting:

- Gain expertise in various domains like taxation, auditing, and financial management

- Enhance your employment prospects in finance and accounting roles

- Work in any country, thanks to its global recognition

- Be a part of a community of over 200,000 professionals

What makes you a perfect candidate for the ACCA:

- You love numbers more than Shah Rukh loves his arms-wide-open pose

- You’re passionate about accounting and finance

- You possess a sharp eye for detail

- You’re ready to commit to a challenging and rewarding journey

Opportunities in ACCA:

- Top-notch accounting firms (like KPMG, PwC, EY, Deloitte)

- Financial consulting roles (helping businesses optimize their finances)

- Multinational corporations (as a financial whiz in the management team)

- Government organizations (ensuring public funds are managed efficiently)

Ready to start your career as a Global CA?

8. Investment Banking

Move over, Karan Johar – there’s a new blockbuster career in town! Investment banking is the Shah Rukh Khan of the finance world – glamorous, high-stakes, and rewarding. If you’re ready to roll up your sleeves and dive into mergers, acquisitions, and IPOs, here’s why you should consider investment banking:

Why you should consider investment banking:

- High-paying job opportunities (think 7-figure salaries)

- Gain expertise in corporate finance, financial analysis, and deal-making

- Develop a strong professional network

- Chance to work with top-tier clients and businesses

What makes you a perfect candidate for investment banking:

- You thrive in high-pressure situations (just like Virat Kohli on the cricket field)

- You’re a natural-born negotiator (remember how you got that extra gulab jamun at the wedding?)

- You have strong analytical and financial skills

- You’re ready to put in long hours (because what’s sleep, anyway?)

Opportunities in investment banking:

- Top investment banks (like Goldman Sachs, JP Morgan, Morgan Stanley)

- Boutique investment banks (for a more specialized, niche focus)

- Corporate finance roles (managing big bucks for companies)

- Private equity and venture capital firms (as a deal-maker)

Ready to start your career as an Investment Banker?

9. CFP: Certified Financial Planner

Do you find joy in organizing your finances and helping others do the same? Well, then Certified Financial Planner (CFP) could be your true calling. It’s like being the Marie Kondo of the finance world, tidying up people’s financial lives. Here’s why you should consider CFP:

Why you should consider the CFP:

- High demand for personal financial planning services

- Establish credibility and trust among clients

- Enhance your knowledge of financial planning, insurance, and investment management

- Flexibility to work independently or with a financial services firm

What makes you a perfect candidate for the CFP:

- You have a passion for personal finance and money management

- Your empathy and communication skills are on point (like Amitabh Bachchan in “Baghban”)

- You’re a problem solver, always seeking the best solutions for your clients

- You’re willing to invest time and effort into becoming an expert in financial planning

Opportunities in CFP:

- Financial advisory firms (helping clients navigate their financial lives)

- Insurance companies (offering expert advice on insurance products)

- Wealth management firms (managing clients’ investment portfolios)

- Self-employed financial planner (starting your own consultancy)

Ready to start your career as a Financial Planner?

10. Equity Research

Are you the Nostradamus of the finance world, with a knack for predicting market trends? Then, equity research might be your playground. It’s where you’ll analyze stocks, bonds, and other financial instruments to help investors make informed decisions. So, let’s explore why equity research could be your dream career:

Why you should consider equity research:

- High demand for skilled analysts in the financial sector

- Opportunity to work with cutting-edge financial tools and technologies

- Enhance your expertise in financial modeling, investment strategies, and market trends

- Constantly learn and grow with the ever-changing financial landscape

What makes you a perfect candidate for equity research:

- You have a keen interest in the stock market and financial instruments

- Your analytical skills are sharper than a samurai sword

- You enjoy researching, crunching numbers, and making predictions

- You’re comfortable working with massive amounts of data

Opportunities in equity research:

- Investment banks (helping clients make informed investment decisions)

- Mutual fund companies (analyzing investment opportunities for fund managers)

- Financial media (providing insights and analysis for news outlets)

- Independent equity research firms (specializing in niche markets)

Ready to start your career as an Equity Research Analyst?

11. Data Analyst

In today’s data-driven world, data analysts are the superheroes who harness the power of data to solve complex business problems. It’s like becoming the Batman of the finance world, using your data-crunching abilities to save the day. So, let’s see why data analysis could be your true calling:

Why you should consider data analysis:

- High demand for data-savvy professionals across industries

- Opportunity to work with cutting-edge tools and technologies

- Enhance your skills in data visualization, statistical analysis, and predictive modeling

- Solve real-world problems and drive business growth

What makes you a perfect candidate for data analysis:

- You have a passion for numbers, patterns, and trends (Maths is your BFF)

- Your analytical skills are stronger than the Incredible Hulk

- You enjoy finding hidden insights in a sea of data

- You’re tech-savvy and always eager to learn new tools and techniques

Opportunities in data analysis:

- Financial institutions (analyzing customer data to minimize risk and maximize profits)

- E-commerce companies (optimizing pricing, inventory, and marketing strategies)

- Consulting firms (helping clients make data-driven decisions)

- Startups and tech companies (using data to fuel innovation and growth)

Ready to start your career as a Data Analyst?

Proschool offers several job-oriented courses to help your career

One of India’s finest coaching institutions, IMS Proschool has a proven track record of teaching students to become successful professionals in their chosen careers. The school is known for using active learning methods, innovative training techniques and going the extra mile in teaching its students. You can sign on to take the job-oriented course that appeals to you, such as data science, business analytics, cyber security, digital marketing and data analytics. You will be under the tutelage of industry experts and learn from their experience and wisdom. You will also receive extra attention and specialised skill development to ensure you are ready to rock your recruitment process.

Special features of studying with Proschool:

- There are coaching centres available in major cities across India.

- You can also do an online course if you prefer that.

- All job-oriented courses are planned, keeping the latest industry developments in mind.

- The institute also offers extra learning resources and certifications.

- There is a placement portal available for all students who have completed the program

- Proschool also provides assistance with interview etiquette and resume-writing methods.

In conclusion

The corporate world is opening up its doors to include several new-age, job-oriented courses that are in high demand. To be a part of the professions listed above, you need to get certified. Once you gain the skills and knowledge, you are ready to take on a number of job profiles and work your way up the corporate ladder.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!