The Ultimate Guide to Options Trading Strategies: Tips and Techniques for Indian Investors

Here's What We've Covered!

- Understanding Options Trading

- Basic Option Strategies

- Intermediate Option Strategies – Desi Style!

- Advanced Option Strategies – The Indian Masala Mix!

- How To Read Option Chain – The Options Trading Cookbook!

- Understanding Put-Call Ratio – The Seesaw of Options Trading

- Options Trading Tips – The Gyaan You Need for Your Trading Journey

- Enroll in IMS Proschool’s Options Trading Course – Your Ticket to Options Trading Mastery

- Conclusion: The End of the Trail, but the Start of Your Options Trading Adventure!

Have you ever wondered if there’s a way to make money in the stock market that’s more exciting than just buying and holding shares? You know, something that makes you feel like a financial superhero, with the ability to predict market moves and outsmart the big guys on Wall Street. Well, my friend, I’m here to tell you that there’s an answer to your prayers, and it’s called options trading!

Options trading is a fantastic way to not only make some moolah but also have fun while doing it. In this blog, we’re going to take you through the magical world of options trading strategies, specifically designed for Indian investors like you. So, whether you’re a newbie just starting or an experienced trader looking to polish your skills, buckle up and get ready for an exciting ride!

Understanding Options Trading

Before we dive into the nitty-gritty of options strategies, let’s first understand what options trading is all about. Options trading is like playing a game of chess on the financial market, where you can make strategic moves to maximize profits and minimize losses. It’s like having superpowers, where you can buy or sell stocks at a predetermined price, all while having the power to decide when to exercise that option.

In simple terms, options are financial instruments that give you the right (but not the obligation) to buy or sell an underlying asset, such as stocks, at a specific price on or before a specific date. There are two basic types of options:

1. Call Options: These give you the right to buy an asset at a specific price. Buying a call option means you’re optimistic that the asset’s price will rise in the future.

2. Put Options: These give you the right to sell an asset at a specific price. Buying a put option means you’re pessimistic that the asset’s price will fall in the future.

Now that we have a basic understanding of options trading let’s put on our superhero capes and delve into some basic options trading strategies!

Learn all these options trading strategies, practically, in just 4 months

Basic Option Strategies

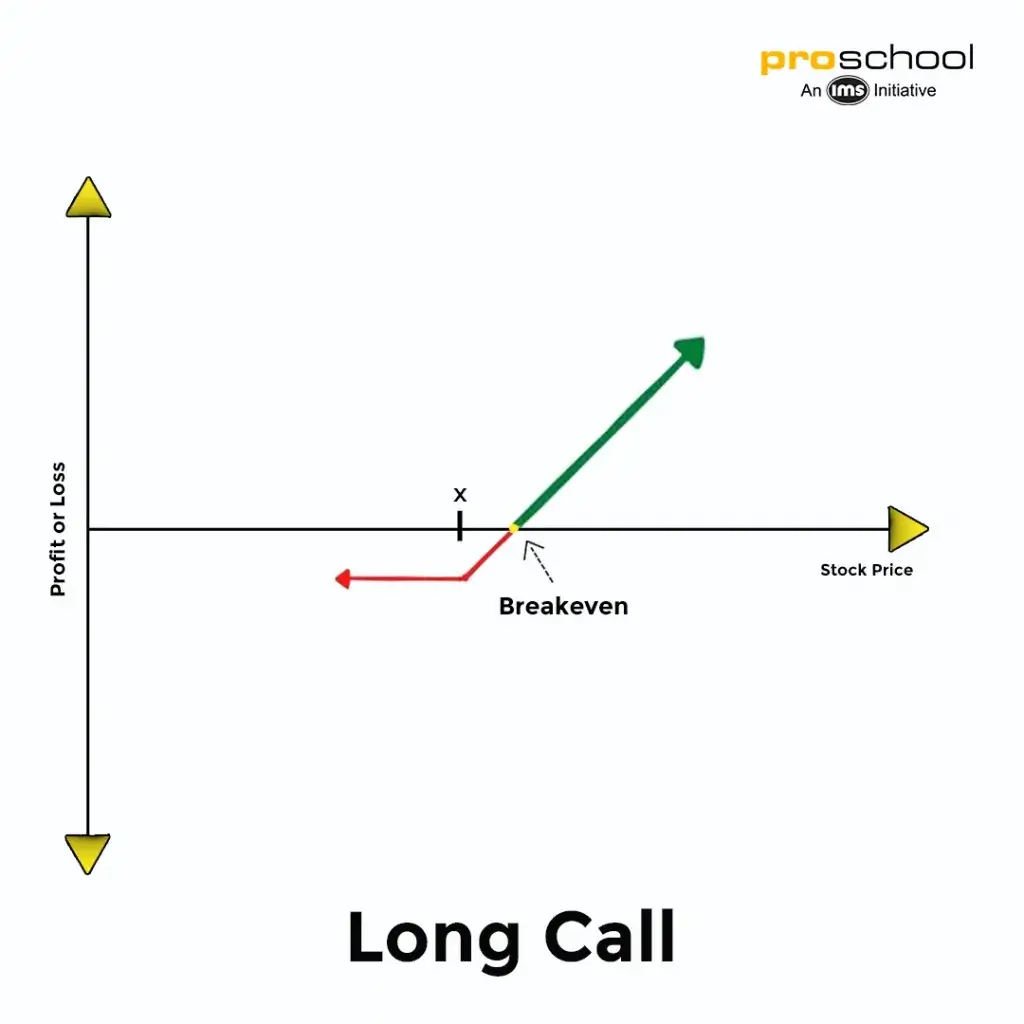

1. Long Call: This strategy involves buying a call option on a stock that you believe will rise in value. For example, if you think Reliance Industries is going to see a price increase, you can buy a call option and potentially profit from the stock’s upward movement.

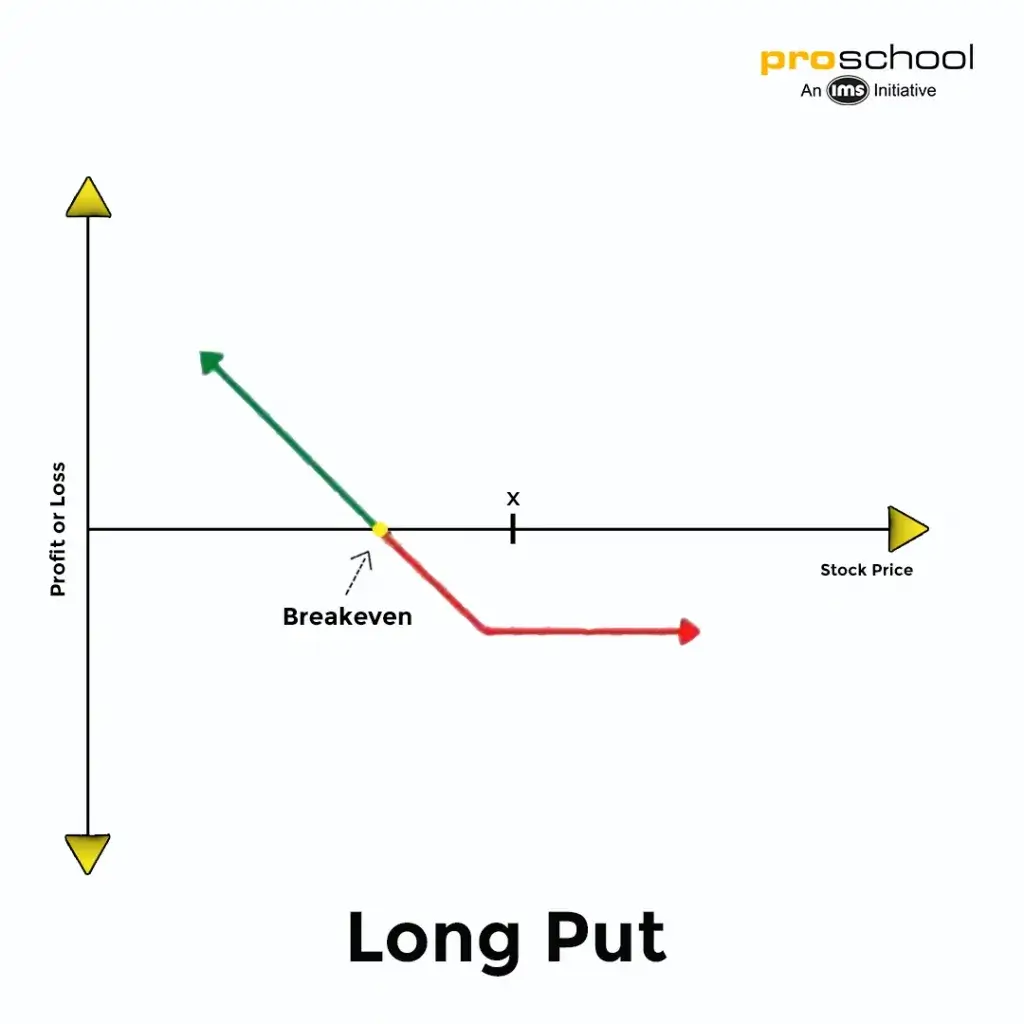

2. Long Put: This strategy is the opposite of a long call. You buy a put option on a stock that you believe will decrease in value. Let’s say you think the price of Infosys is going to drop; you can buy a put option and potentially profit from the stock’s downward movement.

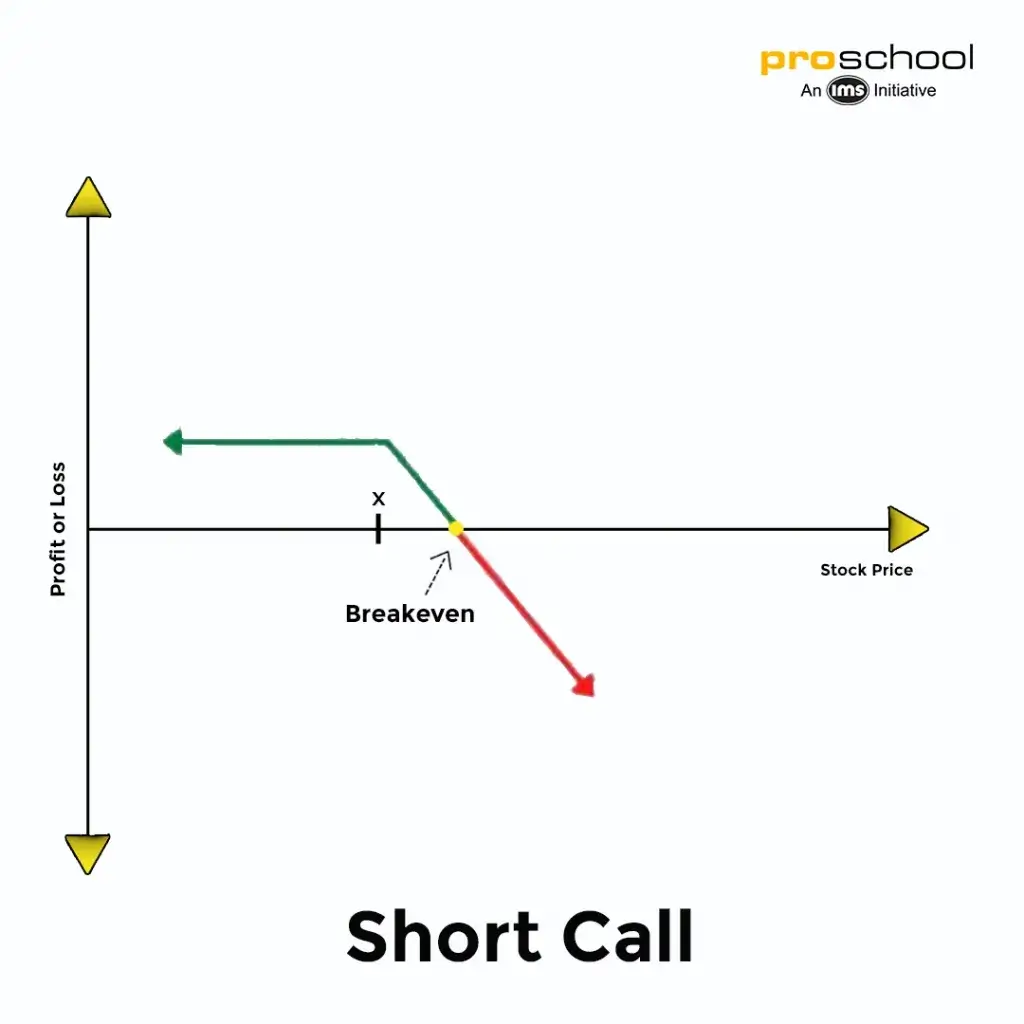

3. Short Call: In this strategy, you sell a call option that you don’t own. This is a bearish strategy, and you profit if the stock’s price doesn’t rise above the strike price. For instance, if you think Tata Motors’ stock price is going to remain stagnant or drop, you can sell a call option and potentially make a profit.

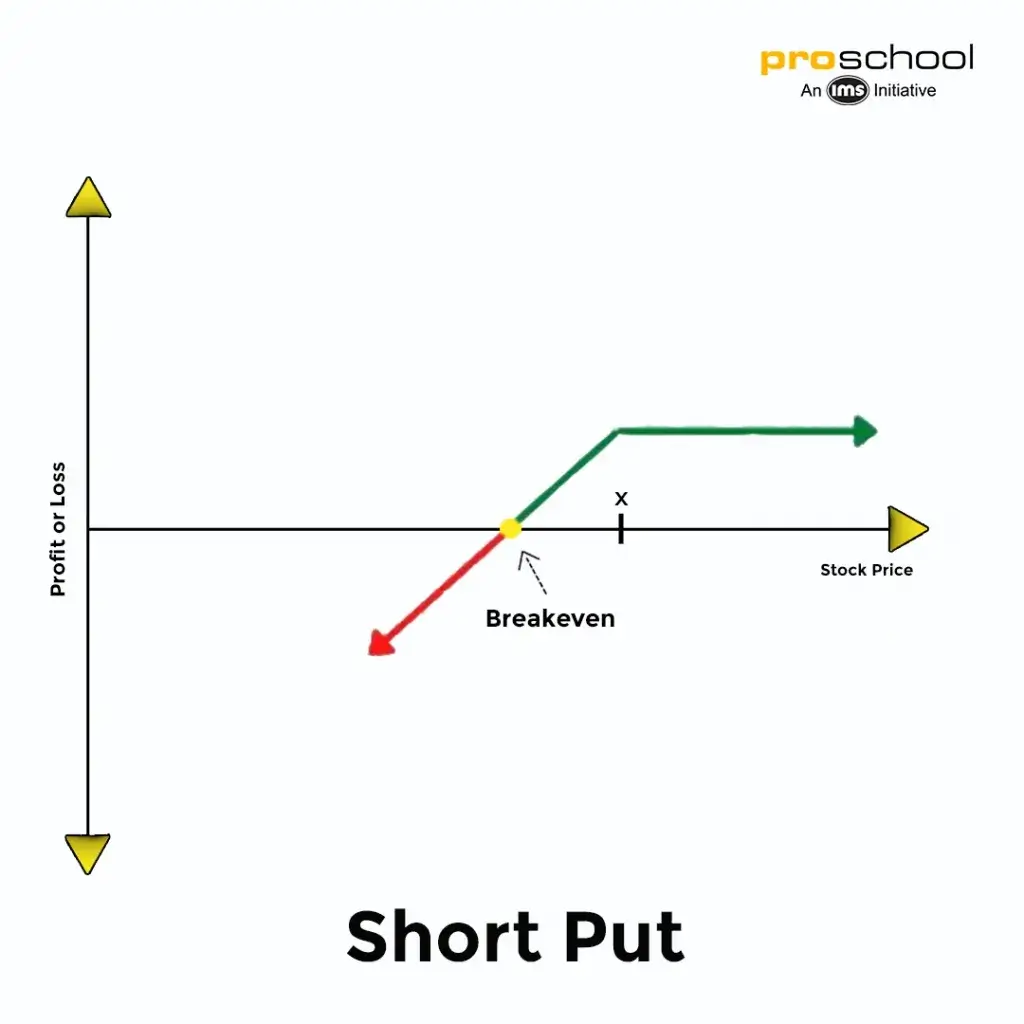

4. Short Put: This strategy involves selling a put option that you don’t own. This is a bullish strategy, and you profit if the stock’s price doesn’t fall below the strike price. For example, if you believe that HDFC Bank’s stock price will remain steady or increase, you can sell a put option and potentially earn a profit.

Now that we’ve covered the basic strategies, it’s time to move on to more intermediate

Intermediate Option Strategies – Desi Style!

Alright, my friends, it’s time to graduate from our basic strategies and add some desi tadka to our options trading game! So, put on your thinking caps, and let’s dive into some intermediate option strategies with a hint of Indian context:

1. Vertical Spreads: Picture this as a plate of steaming hot samosas and chutney. You can’t have one without the other, right? Similarly, in vertical spreads, you buy and sell options of the same type (call or put) with the same expiration date, but different strike prices. There are four types of vertical spreads:

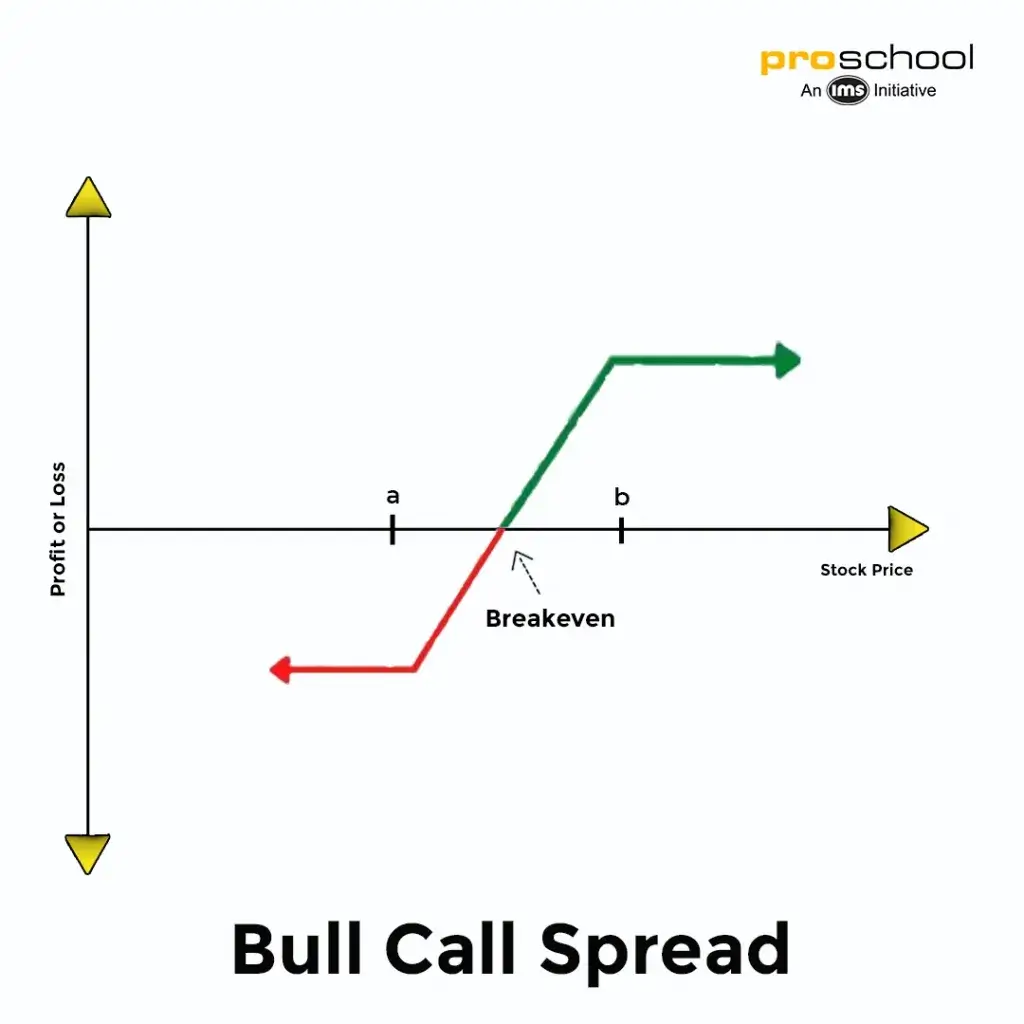

- Bull Call Spread: Like a cricket fan betting on Team India’s victory, you buy a call option with a lower strike price and sell a call option with a higher strike price, expecting a moderate price increase in the stock.

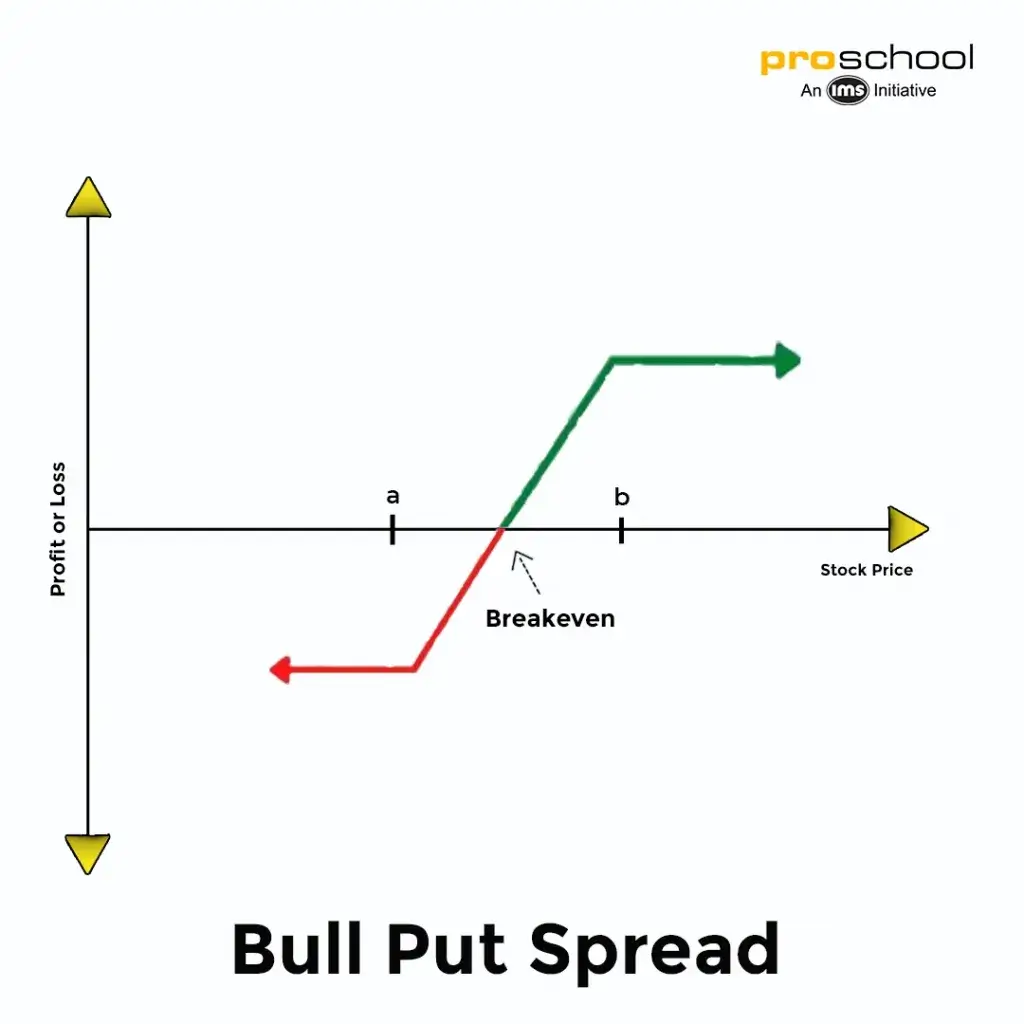

- Bull Put Spread: This strategy is like exchanging your old currency notes for new ones. You sell a put option with a higher strike price and buy a put option with a lower strike price, anticipating a moderate price increase in the stock.

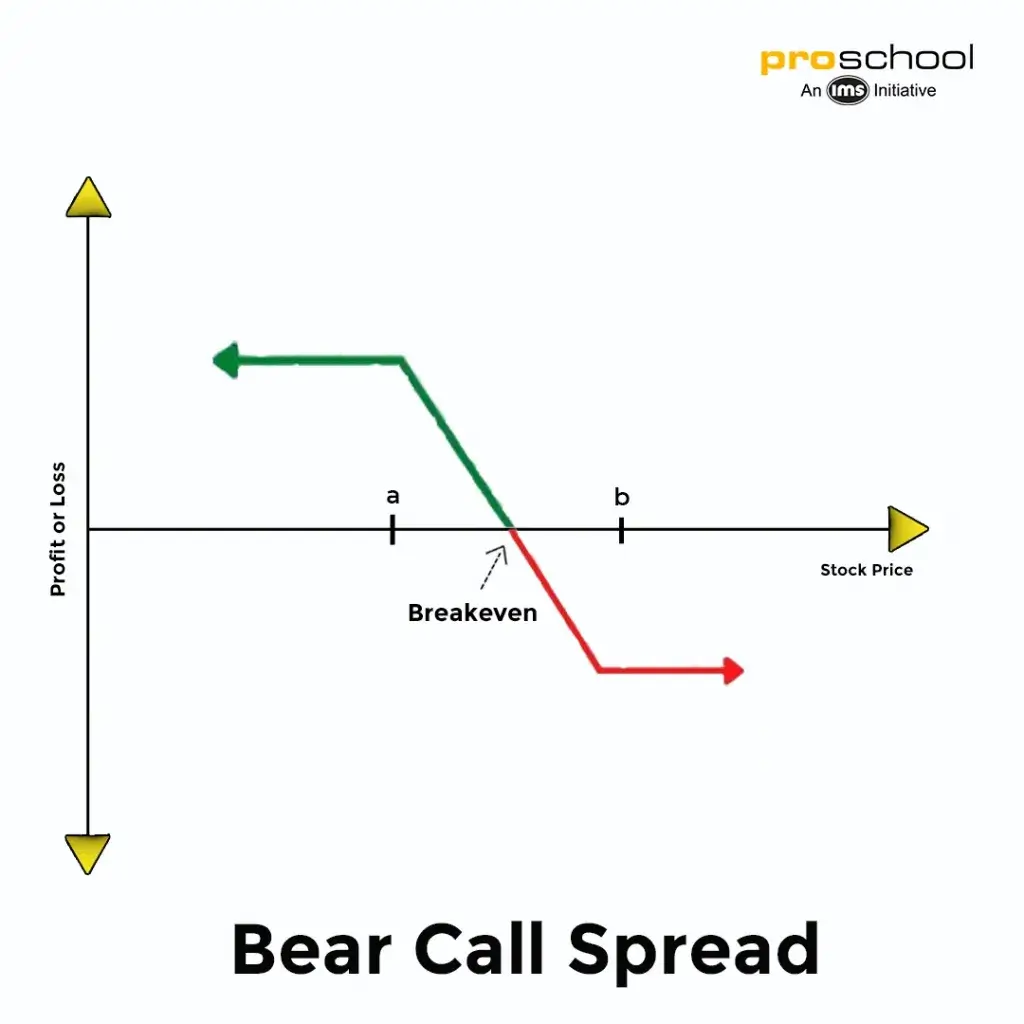

- Bear Call Spread: Just as you would hold an umbrella during the monsoon season, you sell a call option with a lower strike price and buy a call option with a higher strike price, expecting a moderate price decrease in the stock.

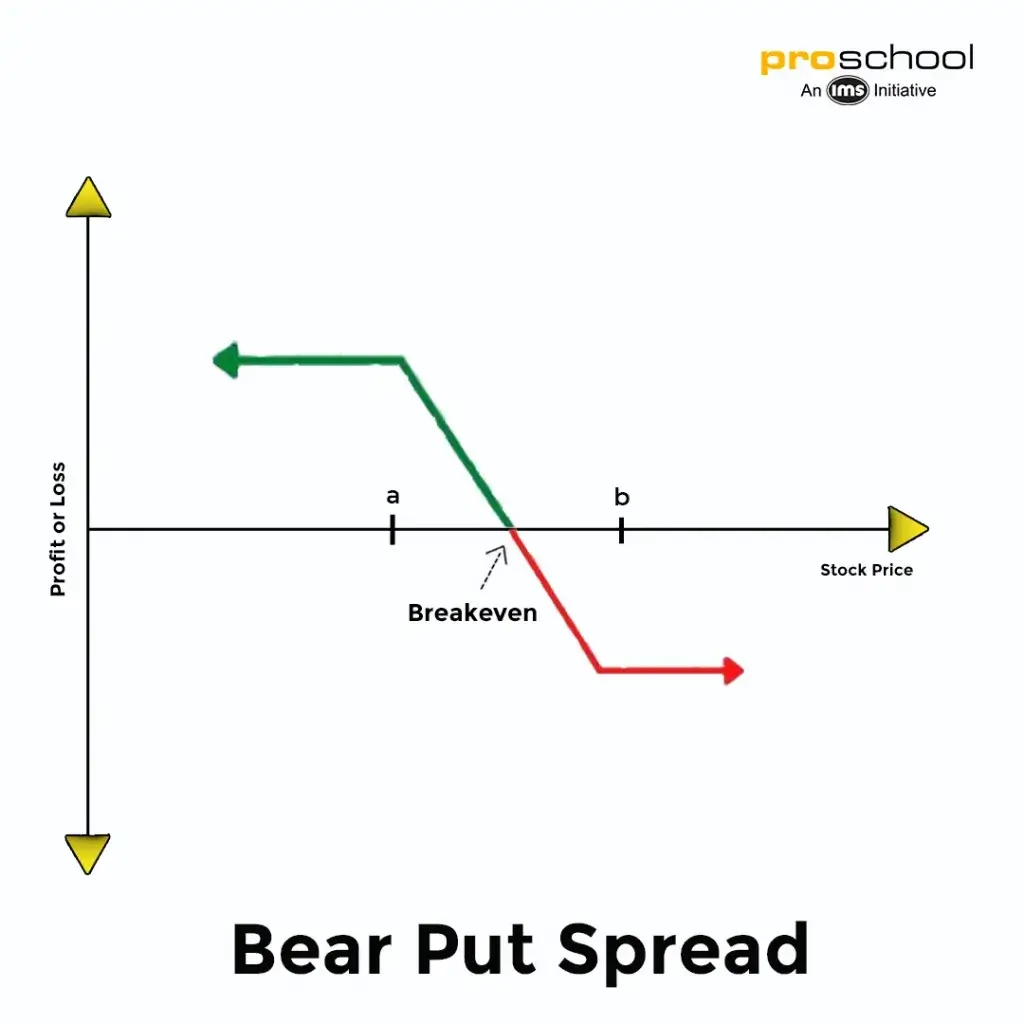

- Bear Put Spread: Much like trading in your old scooter for a newer model, you buy a put option with a higher strike price and sell a put option with a lower strike price, anticipating a moderate price decrease in the stock.

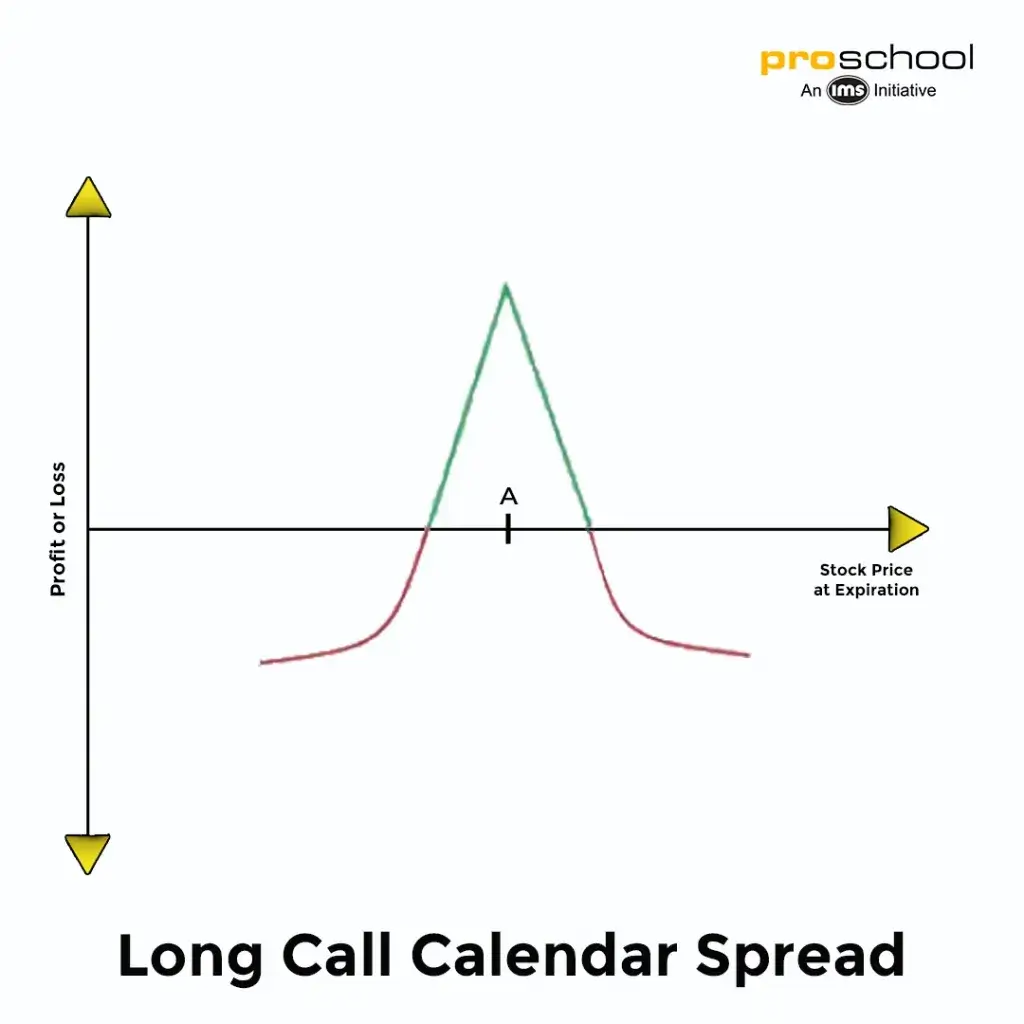

2. Calendar Spreads: This strategy is like attending two different weddings on the same day—one in the morning and one in the evening. You buy and sell options of the same type and strike price, but with different expiration dates. There are two types of calendar spreads:

- Horizontal Call Spread: Like waiting for the release of your favorite Bollywood movie, you sell a call option with a near-term expiration date and buy a call option with a later expiration date, expecting the stock price to remain stable in the short term and rise in the long term.

- Horizontal Put Spread: Imagine holding onto a box of ladoos to enjoy later. You sell a put option with a near-term expiration date and buy a put option with a later expiration date, anticipating the stock price to remain stable in the short term and fall in the long term.

Did you know, you get to practically trade in our course

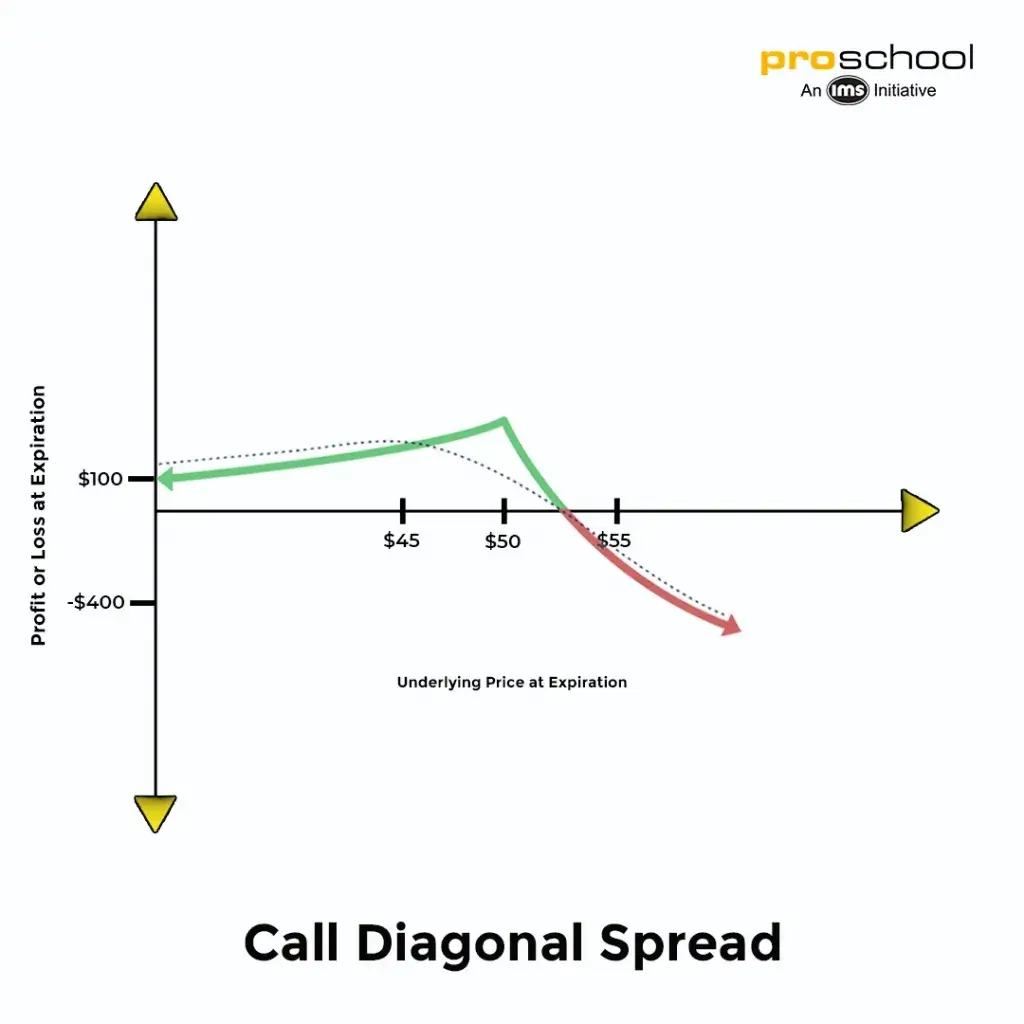

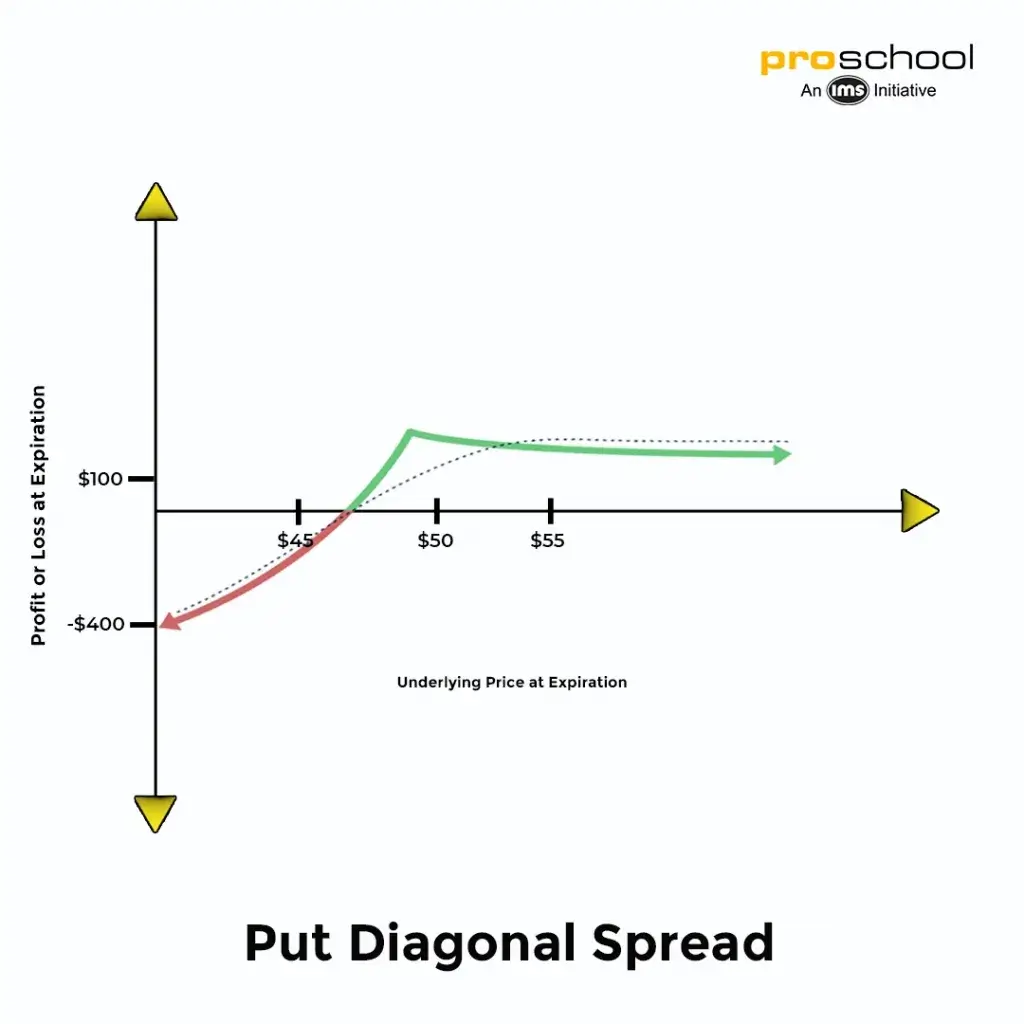

3. Diagonal Spreads: In this strategy, you juggle different options like a pro, just as you would balance work and family time during Diwali. You buy and sell options of the same type but with different strike prices and expiration dates. There are two types of diagonal spreads:

- Diagonal Call Spread: Much like celebrating your job promotion now and a bigger one in the future, you sell a call option with a near-term expiration date and a lower strike price, and buy a call option with a later expiration date and a higher strike price, expecting the stock price to rise moderately in the short term and even more in the long term.

- Diagonal Put Spread: Like enjoying a small discount now and a bigger one later, you sell a put option with a near-term expiration date and a higher strike price, and buy a put option with a later expiration date and a lower strike price, anticipating the stock price to fall moderately in the short term and even more in the long term.

Advanced Option Strategies – The Indian Masala Mix!

Congratulations, dost! You’ve made it to the advanced level. Now, let’s add some masala to your options trading by exploring advanced option strategies with a dash of Indian flavor:

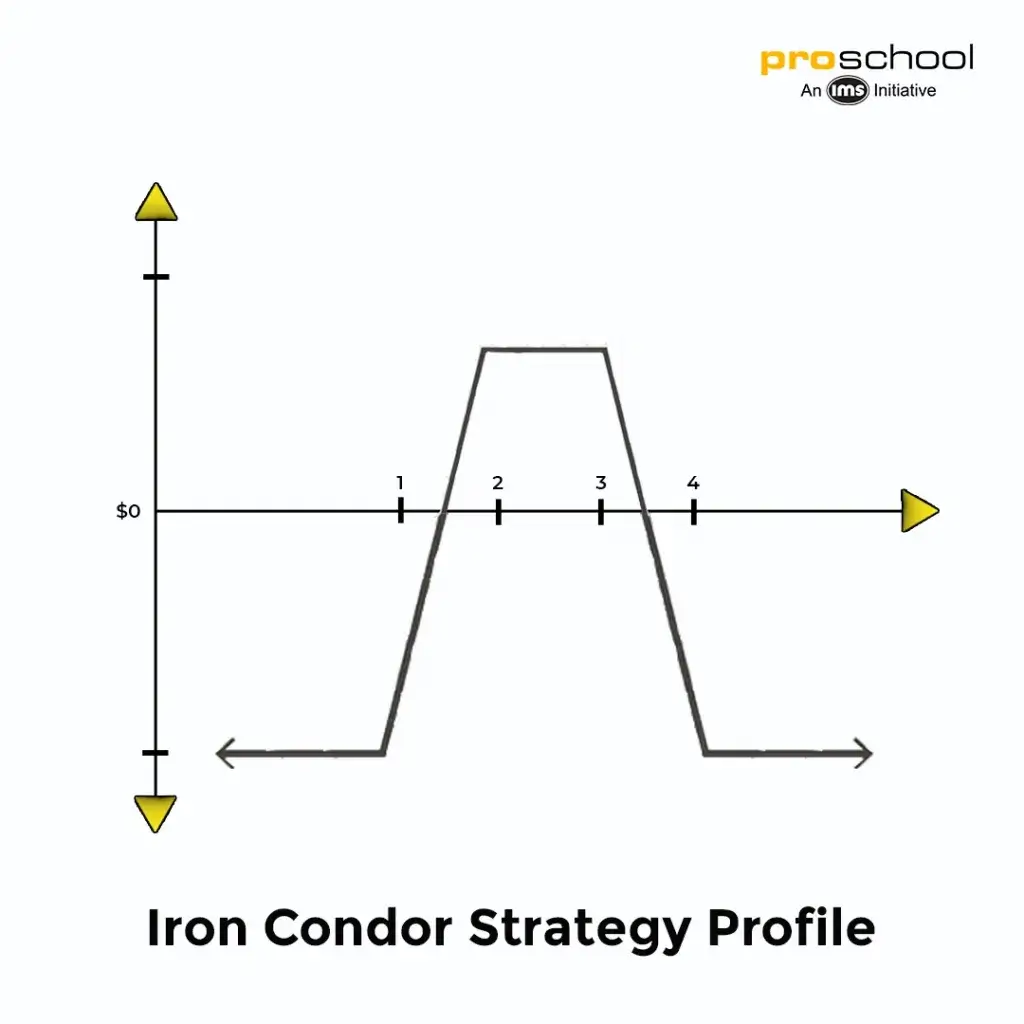

1. Iron Condor: Picture this as the ultimate combo of butter chicken and paneer tikka, satisfying both non-vegetarians and vegetarians alike. This strategy involves selling a call and a put at two different strike prices, and then buying a call and a put at two other strike prices (usually further out-of-the-money). Use this strategy when you expect the stock price to remain stable within a specific range.

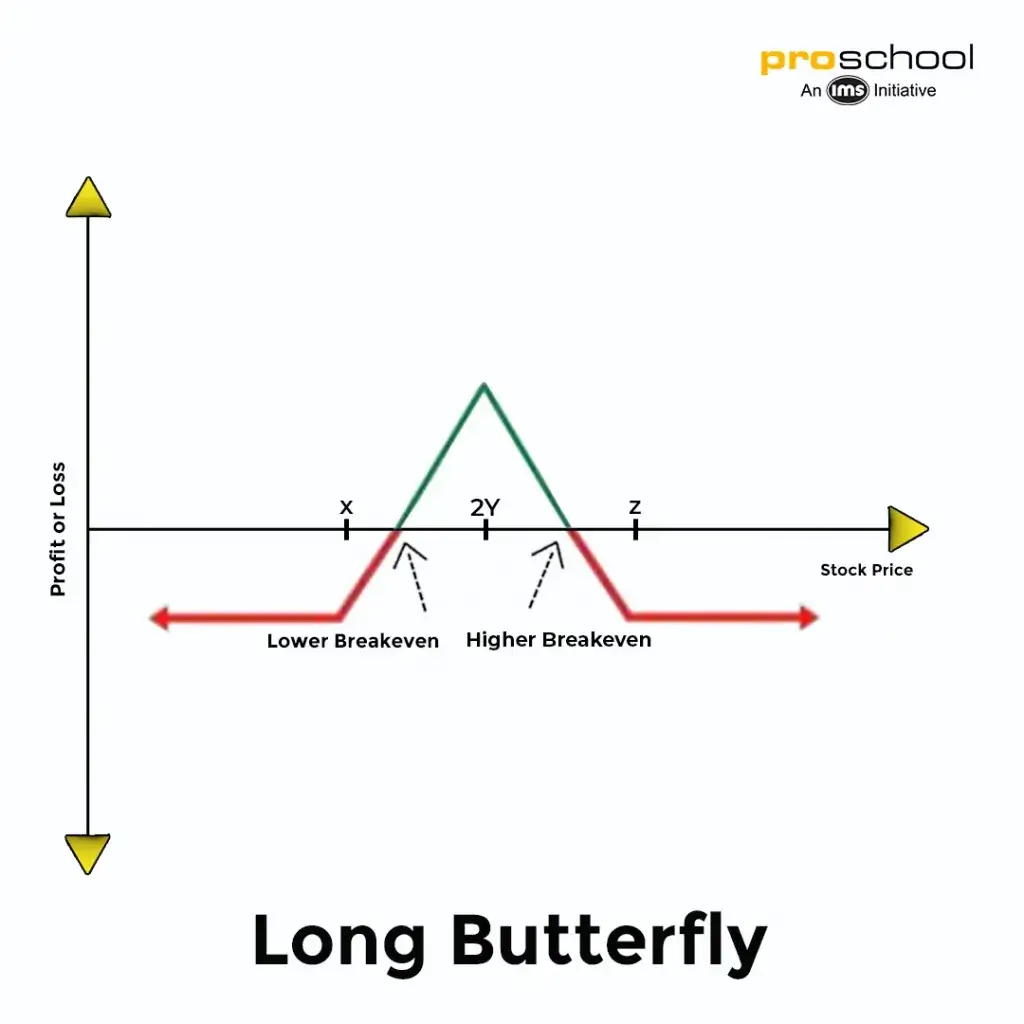

2. Butterfly Spread: This strategy is like preparing the perfect Indian thali, where you need to balance the flavors just right. It consists of buying and selling options with three different strike prices. There are four types of butterfly spreads:

- Long Call Butterfly: As if you’re planning a trip to three different Indian destinations, you buy a call with a lower strike price, sell two calls with a middle strike price, and buy a call with a higher strike price, expecting the stock price to remain stable.

- Long Put Butterfly: Like trying to win three different games of carrom, you buy a put with a lower strike price, sell two puts with a middle strike price, and buy a put with a higher strike price, anticipating the stock price to remain stable.

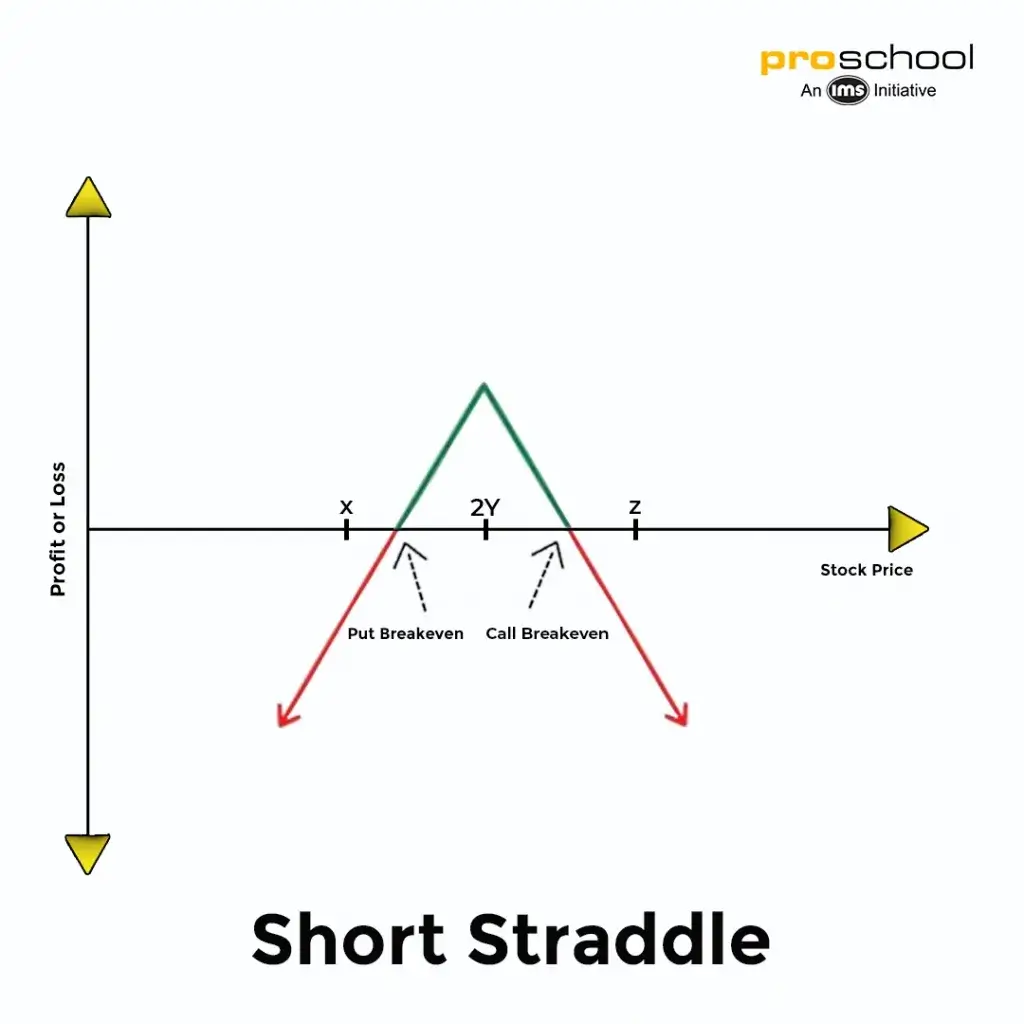

3. Straddle: Imagine this strategy as being stuck in Indian traffic – you don’t know which direction to take. You buy a call and a put option with the same strike price and expiration date, expecting the stock price to make a big move in either direction.

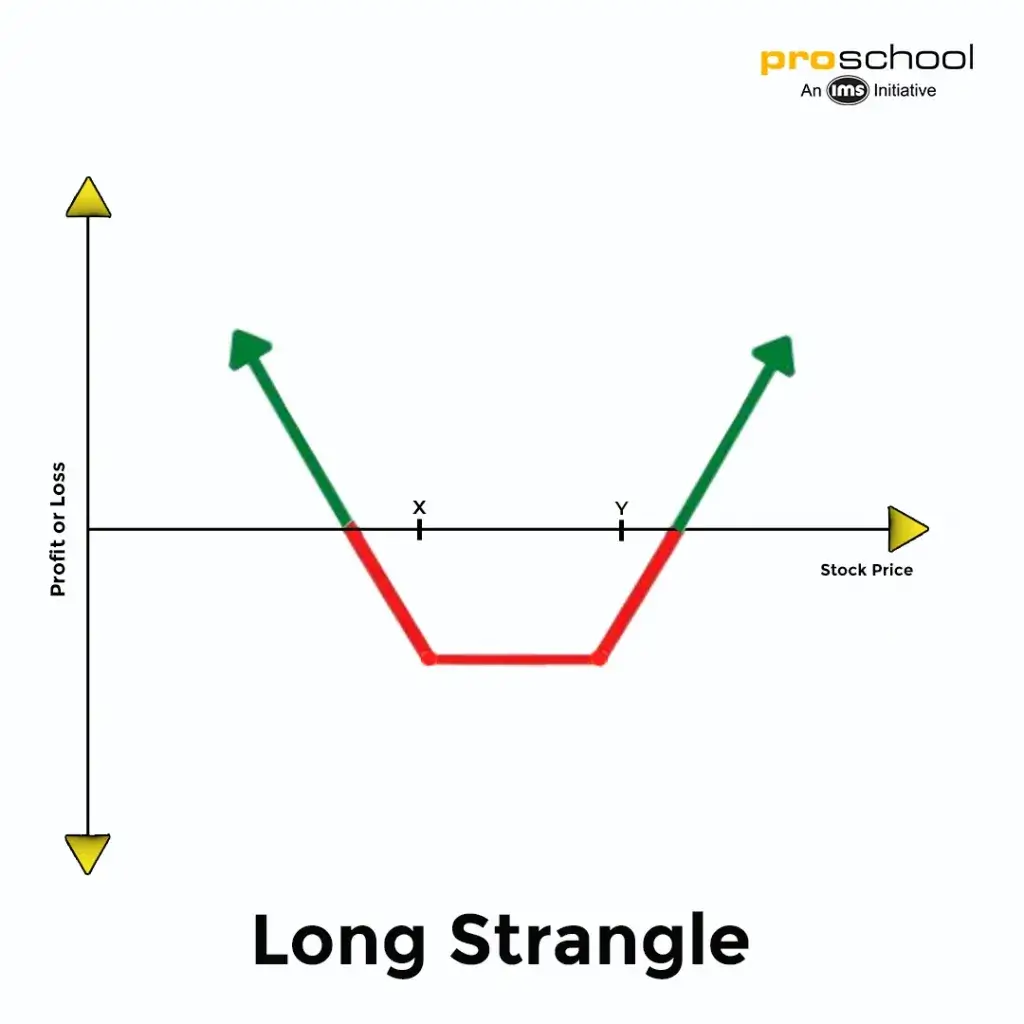

4. Strangle: This strategy is like playing a game of snakes and ladders, where you’re unsure of your next move. You buy an out-of-the-money call and an out-of-the-money put option with the same expiration date, expecting a significant price movement in the stock, but uncertain about the direction.

By now, you must be feeling like a true options trading maestro! Remember, practice makes perfect. So, keep honing your skills and exploring new strategies. And if you’re looking for a place to learn more and enhance your trading expertise, our course is just the ticket. Join us today and give your options trading journey the boost it deserves!

How To Read Option Chain – The Options Trading Cookbook!

Ever cooked a dish using a recipe? Well, an option chain is like your recipe book for options trading, and we’re here to help you become the MasterChef of the options world! Let’s learn how to read an option chain with a pinch of humor and a generous helping of Indian context.

1. Calls and Puts: Think of call options as the main course and put options as the dessert. An option chain is divided into two halves: the left side lists call options, and the right side lists put options.

2. Strike Price: This is the fixed price at which the option contract can be exercised. Consider it as the price of your favorite dish on the menu – you know what it costs before you order.

3. Expiration Date: Just like the ‘best before’ date on your food items, options have an expiration date too. The date specifies when the contract expires, and you can no longer exercise it.

4. Bid and Ask Prices: Bid price is like the price a customer is willing to pay for a dish, while the ask price is what the restaurant is willing to sell it for. The bid price is the highest price someone is willing to buy an option, and the ask price is the lowest price someone is willing to sell it for.

5. Open Interest and Volume: Open interest is like the number of customers waiting to be served at a restaurant, and volume is the number of dishes being served. Open interest shows the number of contracts that have been created but not yet closed, while volume represents the number of contracts traded in a day.

6. Implied Volatility: It’s like the spiciness of your dish – you know it’s there, but you can’t measure it precisely. Implied volatility represents the market’s expectation of how much the stock price will move over time. Higher implied volatility means that the market expects more significant price movements.

Now that you’re equipped with the knowledge of reading an option chain, you’re one step closer to becoming a pro in options trading. And if you’re hungry for more, why not join our course to satiate your appetite for learning? We’re the ultimate destination for options trading enthusiasts like you. So, enroll now and become a master of the trade!

Read – Options Trading For Beginners: How To Generate Consistent Profits

Understanding Put-Call Ratio – The Seesaw of Options Trading

Do you remember playing on a seesaw as a kid? The put-call ratio in options trading is just like that – it helps maintain the balance between optimism and pessimism in the market. Let’s dive into the world of put-call ratio and understand its importance with a dash of humor and desi flavor!

1. Define Put-Call Ratio: The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options. Think of it as the ratio of samosas to jalebis at a party – it gives you an idea of people’s preferences.

2. Importance of Put-Call Ratio: The put-call ratio is a critical indicator for gauging market sentiment. A high put-call ratio suggests that investors are bearish and expect the market to fall, while a low ratio indicates bullishness and expectations of a rising market. It’s like measuring the enthusiasm of cricket fans during an India-Pakistan match!

3. Good Put-Call Ratio: A “good” put-call ratio is subjective and depends on your trading strategy. However, remember that the put-call ratio is a contrarian indicator – extreme values can signal a market reversal. So, when everyone is cheering for Team India, it might be time to put your money on the opposition.

Options Trading Tips – The Gyaan You Need for Your Trading Journey

Here are some tips to make your options trading journey smoother than a butter chicken gravy:

- Start with a paper trading account: Before putting your hard-earned money at risk, practice with a paper trading account, like the riskless mock trading on Sensibull offered by IMS Proschool.

- Develop a trading plan: A well-thought-out trading plan is crucial – it’s like having a GPS for your trading journey.

- Use stop-loss orders: Set stop-loss orders to minimize losses – because no one likes to see their money disappear faster than biryani at a family gathering.

- Stay updated with market news: Keep yourself updated on market happenings, like how you’d follow the latest Bollywood gossip.

Enroll in IMS Proschool’s Options Trading Course – Your Ticket to Options Trading Mastery

Feeling inspired to conquer the world of options trading? IMS Proschool has got your back! Our options trading course offers you:

- Riskless mock trading on Sensibull

- Eligibility to appear for NISM Series 8 Certification

- No prior knowledge required – start from the beginning

- Access to 100’s of curated jobs

- Starting salaries around 4-5 LPA

- Faculty with 15+ years of combined experience

- 4-month course duration

So, why wait? Enroll in IMS Proschool’s options trading course and embark on your journey to becoming an options trading expert

Conclusion: The End of the Trail, but the Start of Your Options Trading Adventure!

We’ve covered everything from the basics to advanced strategies and essential tips for options trading in India. We hope you’re now motivated to join our course and get started on your options trading journey.

Remember, practice makes perfect, so keep honing your skills and stay persistent. And with IMS Proschool by your side, you’ll become an options trading expert in no time. Good luck and happy trading!

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!