What Are Options?

An option is a financial derivative that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

Now let’s Understand the definition of an option (a derivative) by breaking it down into simpler terms:

“Holder” – buyer

“Right, but not the Obligation” – this is important!

“Underlying Asset” – this can be anything – equity, commodity, currency, interest rate

There are two types of options: call options and put options.

You buy call options if you are bullish.

You buy put options if you are bearish.

You can also sell options!

Option sellers are also called Option writers. These writers are generally big players. It is said that – they eat like chicken but shit like elephants!

There are many trading strategies that come out of different combinations of buying and selling call-and-put options, which we will look at later. First, let us look at call options and put options definition.

What Is A Call Option?

A call option gives the holder the right to buy the underlying asset at a specified price, called the strike price, on or before a certain date, called the expiration date. For example, if you have a call option on a stock with a strike price of 50 and the stock is currently trading at 60, you have the right to buy the stock at 50 at any time before the expiration date.

What Is A Put Option?

A put option gives the holder the right to sell the underlying asset at a specified price, called the strike price, on or before a certain date, called the expiration date. For example, if you have a put option on a stock with a strike price of 50 and the stock is currently trading at 40, you have the right to sell the stock at 50 at any time before the expiration date.

If you are buying an option you are said to be a long option.

Long position in an option means to buy the option.

Similarly, a short position in an option is selling the option.

Options are traded on exchanges, and their value is derived from the underlying asset. The price of an option, known as the option premium, is determined by a number of factors, including the current price of the underlying asset, the strike price, the expiration date, and the volatility of the underlying asset.

Hold on! This was important! This is what you study in the subject. Option premium is option price – which is affected by 6 factors. You can Check out Zerodha BSM option price calculator.

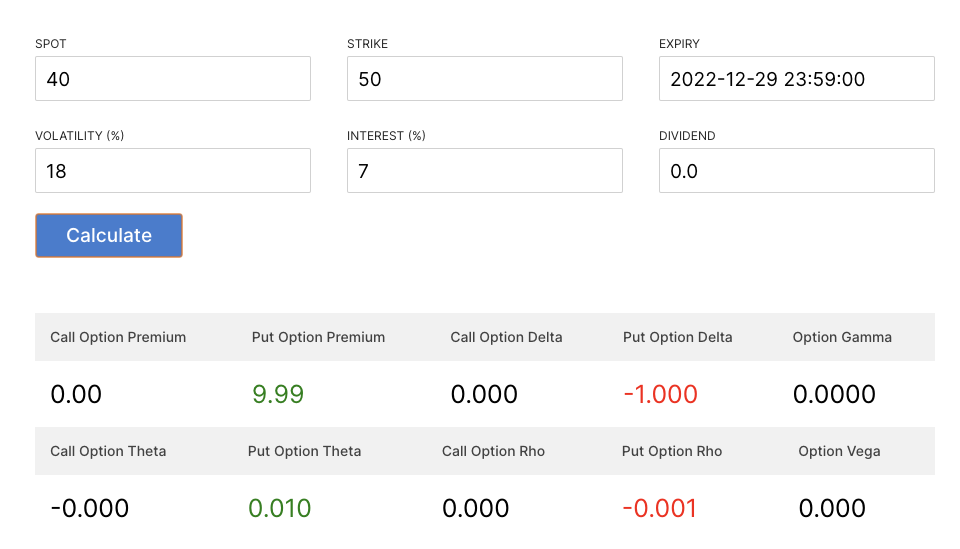

Here’s what each of the terms mean –

- SPOT – the current price of underlying

- STRIKE – exercise price of the option

- EXPIRY – the expiry date of the option

- VOLATILITY – volatility of the underlying

- INTEREST – risk free rate

- DIVIDEND – dividend/benefits of holding the underlying

Check the output after clicking the button calculate.

It includes the following

Premium, Delta, Gamma, Theta, Rho

Sounds daunting. Right?

Change the above 6 factors – one at a time. For e.g. increase the spot – click on calculate – see what happens to the call premium and put premium? The trick is to go slow and make fundamentals strong!!!

You can enroll for our Options Trading Course to learn from the fundamentals along with the practical aspects of the subject

Options can be used for a variety of purposes, including hedging, speculation, and generating income. They can be complex financial instruments, and it is essential to understand the risks and potential rewards before trading options.

What is Options Trading?

Options trading is the practice of buying and selling options.

In options trading, traders can buy or sell options contracts based on their views on the direction of the underlying asset, or they can use options to hedge their positions in other investments.

For example, a trader might buy a call option on a stock if they believe the stock will go up in price, or they might sell a put option if they believe the stock will remain stable or go up in price.

Options trading can be complex and involves a number of risks. It is crucial for traders to understand the mechanics of options and the various strategies that can be used before entering into any options trades.

Options trading is typically done through an options broker or a brokerage account. It is vital to choose a reputable broker with low fees and strong customer service e.g. Zerodha.

How Option Pricing Works:

The price of an option, also known as the option premium, is determined by a number of factors, including the current price of the underlying asset, the strike price, the expiration date, and the volatility of the underlying asset.

The option premium is made up of two components – intrinsic value and time value.

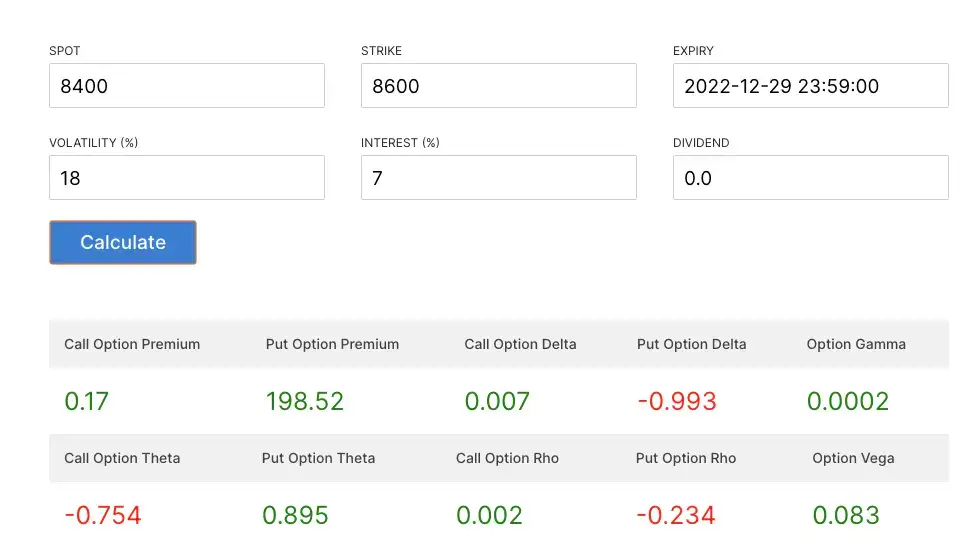

Intrinsic value is the amount by which the option is in-the-money, or the amount by which the market price of the underlying asset exceeds the strike price of the option. For example, if the strike price of a call option is 50 and the market price of the underlying asset is 60, the intrinsic value of the option is 10. If the option is a put option, the intrinsic value is the amount by which the strike price exceeds the market price of the underlying asset. See image below shows call option premium very close to 10 and put option premium close to 0. Today is 28 December, i.e. there is only one day to expiry in the EXPIRY below.

Time value is the amount by which the option premium exceeds the intrinsic value. It represents the expected value of the option based on the amount of time remaining until the expiration date, as well as the volatility of the underlying asset. As the expiration date approaches, the time value of the option decreases, as there is less time for the underlying asset to move in a direction that would make the option profitable.

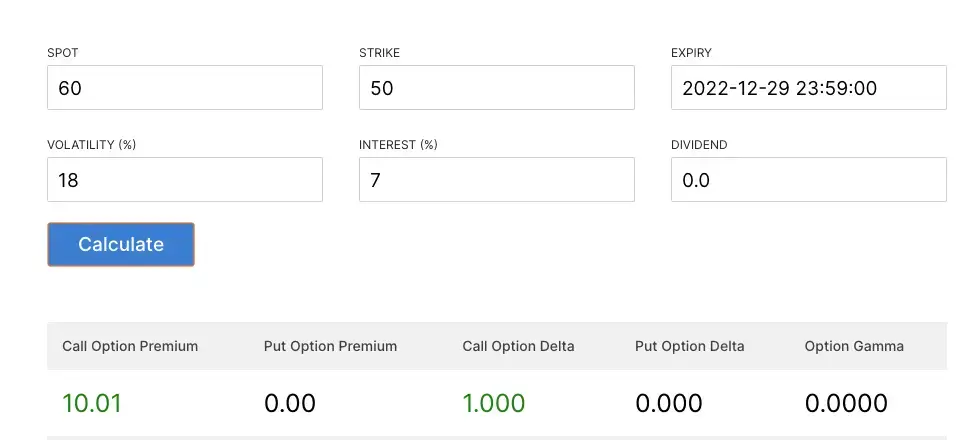

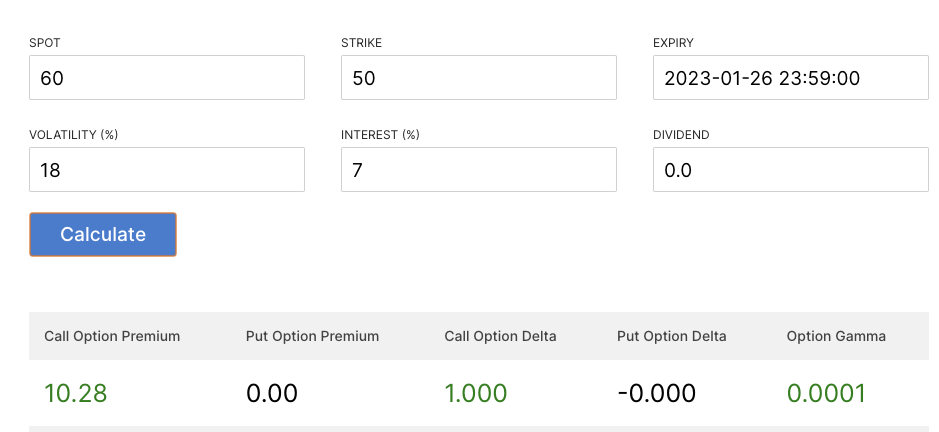

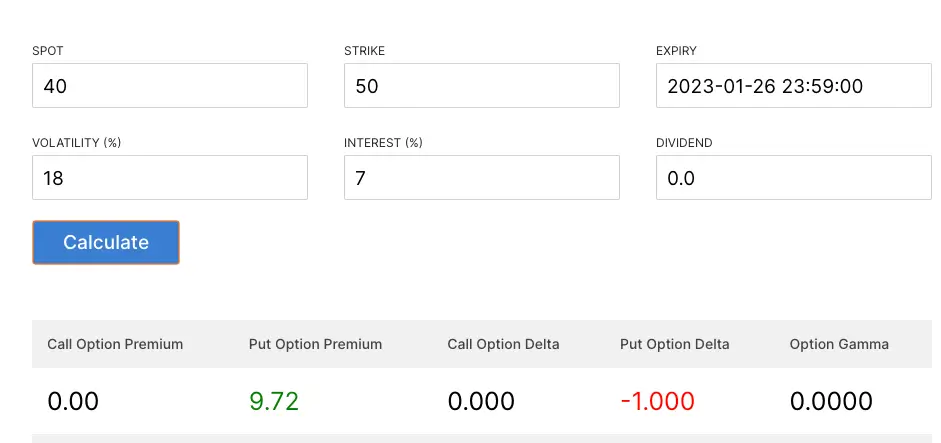

Now say we increase the EXPIRY to next month. See the image below showing that the call premium increased due to an increase in the expiry date. The increase in call premium denotes the time value of the option.

Now let’s understand the put premium in a similar way

Changing the Spot price to 40 – check the put premium – it comes close to 10 while the call premium is close to 0.

Now increasing the expiry to next month

Have a close look – Put premium reduced by increasing the Expiry.

This is how you can change one factor at a time and see its impact on Call and Put premium and make your fundamentals strong. Why don’t you try changing the Strike price and see the impact on call and put premium?

If you are looking for a course that teaches you the fundamentals of options trading in a practical manner, check out Proschool’s Options Trading Course.

The option premium is determined by the market through supply and demand. When there is a high demand for options, the option premium will increase, and when there is a low demand, the option premium will decrease.

It is essential to understand how options pricing works in order to make informed decisions when trading options.

So, let’s understand this using a practical example

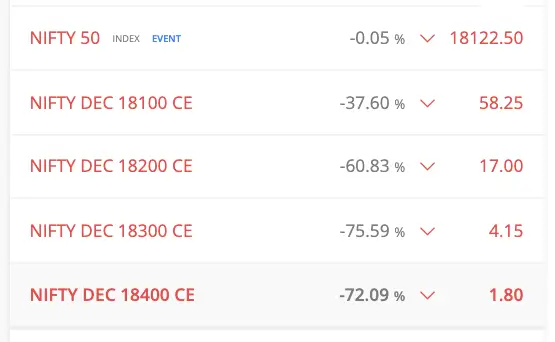

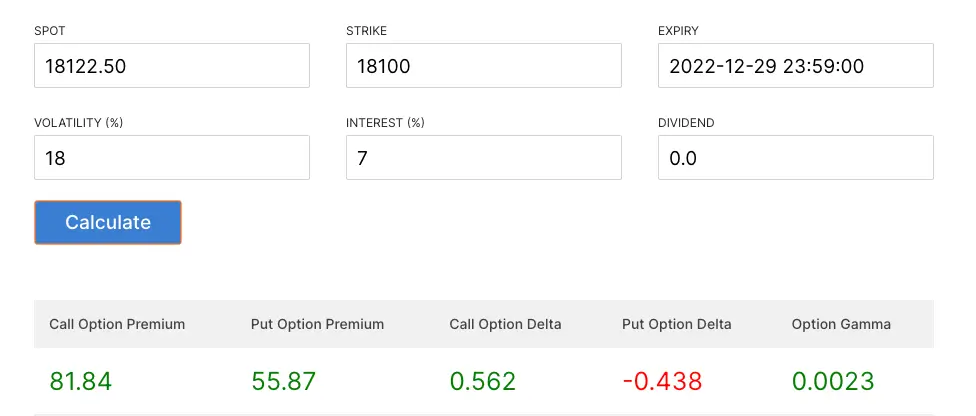

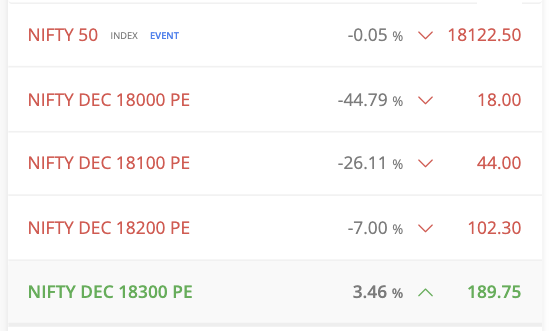

As on 28 December at the market close these are the numbers. Let’s drill them.

NIFTY is underlying. SPOT is 18122.50.

Strike prices taken are 18100, 18200, 18300, 18400.

Expiry is 29 December i.e. the next day.

Using these values in the BSM calculator, we see a call premium of close to 82 which is much higher than the current price (58.25) for 18100 strike. This tells you the market sentiment about the option. You can check for other strike prices in a similar manner.

Lets also check put options.

Drill the numbers below and try to make some sense out of it.

NIFTY is underlying. SPOT is 18122.50.

Strike prices taken are 18000, 18100, 18200, 18300.

Expiry is 29 December i.e. the next day.

If you compare the market put premium (44.00) for strike 18100 with the BSM calculator which gave 55.87 you can sense some market sentiment here as well.

Both the market call premium and put premium seem to be lower than the price suggested by the BSM model. What does this mean? Are both options undervalued? Or is the market prices suggesting that there is belief that the market will stay where it is? Well, the analysis requires more knowledge about the option chain. You can also extend your analysis by analysing the next month’s expiry options. Let us now dive into trading strategies and understand them.

Options Trading Strategies

There are many different option trading strategies that traders can use, depending on their investment goals and market conditions. Some common option trading strategies include –

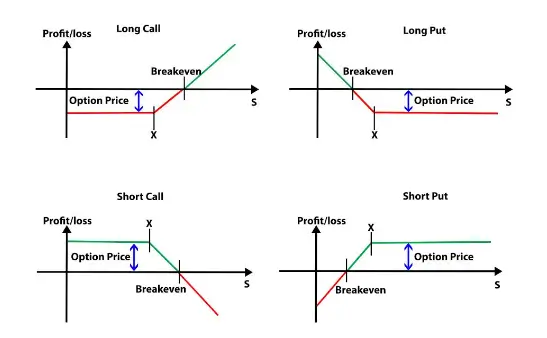

Buying calls (Long Call):

This strategy involves buying call options on an underlying asset that the trader believes will increase in price. If the price of the underlying asset does increase, the trader can exercise their option to buy the asset at the lower strike price and sell it at the higher market price, potentially realizing a profit.

Selling puts (Short Put):

This strategy involves selling put options on an underlying asset that the trader believes will remain stable or increase in price. If the price of the underlying asset does remain stable or increase, the trader will not be required to buy the asset at the higher strike price and can keep the option premium as profit.

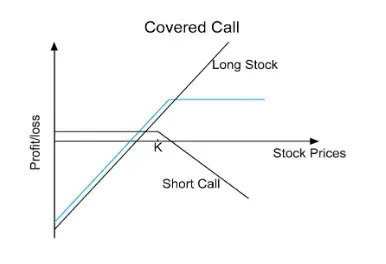

Covered calls:

This strategy involves holding a long position in an underlying asset and selling call options on that asset. If the price of the underlying asset increases, the trader can sell the asset at the higher market price and also keep the option premium as profit. If the price of the underlying asset decreases, the trader may still be able to realise a profit if the option premium exceeds the loss on the underlying asset.

Protective puts:

This strategy involves holding a long position in an underlying asset and buying put options on that asset as a form of insurance. If the price of the underlying asset decreases, the trader can exercise their option to sell the asset at the higher strike price and minimize their loss.

Bull call spread:

This strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price on the same underlying asset. The goal is to profit from a moderate increase in the price of the underlying asset.

Bear put spread:

This strategy involves buying a put option with a higher strike price and selling a put option with a lower strike price on the same underlying asset. The goal is to profit from a moderate decrease in the price of the underlying asset.

Straddle:

This strategy involves buying a call option and a put option with the same strike price and expiration date on the same underlying asset. The goal is to profit from a significant move in the price of the underlying asset in either direction.

Strangle:

This strategy involves buying a call option with a higher strike price and a put option with a lower strike price on the same underlying asset. The goal is to profit from a significant move in the price of the underlying asset in either direction.

Collar:

This strategy involves holding a long position in an underlying asset and simultaneously buying a put option to protect against potential losses and selling a call option to generate additional income.

Iron condor:

This strategy involves selling a put option and a call option with a lower strike price and buying a put option and a call option with a higher strike price on the same underlying asset. The goal is to profit from a narrow range of price movement in the underlying asset.

Butterfly spread:

This strategy involves buying a call option or put option at a lower strike price, selling two call options or put options at a higher strike price, and buying another call option or put option at an even higher strike price. The goal is to profit from a specific price range for the underlying asset.

Condor spread:

This strategy involves selling a call option and a put option at a lower strike price, buying a call option and a put option at a higher strike price, and selling another call option and put option at an even higher strike price. The goal is to profit from a specific price range for the underlying asset.

Reverse iron condor:

This strategy involves buying a put option and a call option with a lower strike price and selling a put option and a call option with a higher strike price on the same underlying asset. The goal is to profit from a wider range of price movement in the underlying asset.

Reverse butterfly spread:

This strategy involves selling a call option or put option at a lower strike price, buying two call options or put options at a higher strike price, and selling another call option or put option at an even higher strike price. The goal is to profit from a specific price range for the underlying asset.

Reverse condor spread:

This strategy involves buying a call option and a put option at a lower strike price, selling a call option and a put option at a higher strike price, and buying another call option and put option at an even higher strike price. The goal is to profit from a specific price range for the underlying asset.

Long straddle:

This strategy involves buying a call option and a put option with the same strike price and expiration date on the same underlying asset. The goal is to profit from a significant move in the price of the underlying asset in either direction.

Long strangle:

This strategy involves buying a call option with a higher strike price and a put option with a lower strike price on the same underlying asset. The goal is to profit from a significant move in the price of the underlying asset in either direction.

Short straddle:

This strategy involves selling a call option and a put option with the same strike price and expiration date on the same underlying asset. The goal is to profit from limited price movement in the underlying asset.

Short strangle:

This strategy involves selling a call option with a higher strike price and a put option with a lower strike price on the same underlying asset. The goal is to profit from limited price movement in the underlying asset.

Calendar spread:

This strategy involves buying an option with a longer expiration date and selling an option with a shorter expiration date on the same underlying asset. The goal is to profit from the difference in the time value of the options.

Diagonal spread:

This strategy involves buying an option with a long expiration date and selling an option with a shorter expiration date, but with a different strike price. The goal is to profit from the difference in the time value and the difference in the strike prices of the options.

Box spread:

This strategy involves buying a call option and a put option with the same expiration date and selling a call option and a put option with the same expiration date, but with different strike prices. The goal is to profit from the difference in the strike prices of the options.

Long put ladder:

This strategy involves buying a put option with a lower strike price and selling a put option with a higher strike price, and then repeating the process with a higher strike price and a higher strike price. The goal is to profit from a decrease in the price of the underlying asset.

Long call ladder:

This strategy involves buying a call option with a higher strike price and selling a call option with a lower strike price, and then repeating the process with a higher strike price and a higher strike price. The goal is to profit from an increase in the price of the underlying asset.

It is important for traders to carefully consider the risks and potential rewards of each option trading strategy before making any trades. Option trading can be complex, and it is important to have a solid understanding of the mechanics of options and the various strategies that can be used.