Why CFP is the smartest route to boost your banking career in 2022

Here's What We've Covered!

CFP – the smartest route to boost your banking career in 2022

If you are currently working as a bank employee, it is time to think about your future in the financial industry.

What are your plans?

Are you happy with your banking career?

Would you like to upgrade your credentials to boost your chances of moving up the corporate ladder?

Life in a bank can have its fair share of advantages. It is a prestigious profession with a certain level of security. An average bank employee earns between Rs 5 to 7 lakhs a year. However, without professional qualifications, there isn’t much room for growth. You may have already googled potential ways to attain new and lucrative prospects in the field. However, as a full-time working professional, you don’t have much time or space to take up long-term courses that demand all your energy.

In that case, consider becoming a certified financial planner. It is a qualification that can be easily obtained within two years and covers a wide range of comprehensive subjects that delve deep into personal investments and portfolio management. Financial planning is a rapidly growing field that offers so many worthwhile possibilities. As a personal advisor, it is your responsibility to help clients create an extensive financial plan that covers all areas of their lives. People need financial planners to help them create sustainable investment portfolios for their specific needs.

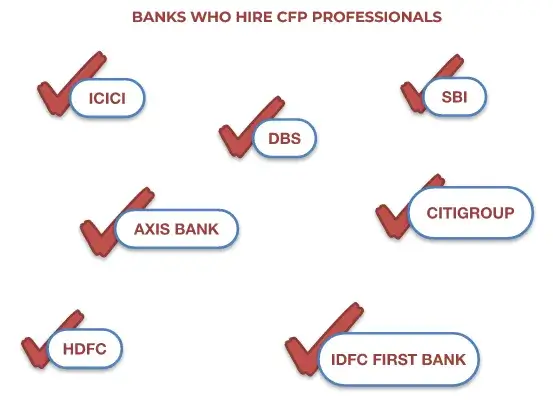

Financial planners are highly sought after by many financial institutions, especially banks. Banks are keen to retain their customers by offering investment services with certified financial planners. Once you are in, you’ll find that the work is satisfying, the earning potential is high, and the prospects for growth are very favorable. Sounds good? Then check out the CFP program. It is the ideal course to can help you further your career and fuel your ambition.

What you need to know about financial planning

Let’s say a client wants to save money for a child’s higher education.

Maybe an investor wants to build a large corpus to facilitate early retirement.

Or, a bank customer with a disposable income wants to start saving for the future.

They connect with a financial planner to discuss their current income, expenses and future financial goals. The advisor studies the client’s details and then comes up with a plan of action. The strategy includes figuring out which investments to make, how much money to put in and how much risk the client is willing to take.

It requires strong organisation skills, intimate knowledge of the financial markets and a knack for effective communication.

Most financial planners also possess:

- Good listening skills

- Sharp eye for details

- A keen mind for research

- Financial savvy and business acumen

- Strategic and analytical way of thinking

- A CFP certification

As a certified financial planner, you have the tools, skills and expertise to work as a personal advisor. The course offers an in-depth, detailed syllabus that gives you a strong understanding of the investment industry. There is also a strong emphasis on a code of ethics and professional responsibility. A financial planner must work in the best interests of the clients. People want knowledgeable and trustworthy advisors who perform their due diligence honestly. CFP holders enjoy a stellar reputation in the industry. They are known for the high standard of quality and excellence they bring to the table.

Want to read in detail about the CFP course, click here

Why are CFP professionals in such high demand?

Banks are not the only institutions that covet certified financial planners. Other organisations such as mutual fund houses, insurance agencies, NFBCs and wealth management companies actively seek out potential hires with this qualification. The reasons are:

- It is one of the most illustrious and acclaimed certifications in the world

- The CFP program is affiliated with the Financial Planning Standards Board (FPSB), a reputed organisation in the USA.

- Many banks have discovered that their clients prefer working with CFP-certified planners

- The above point also leads to an increase in customer loyalty

- Qualified planners help to sell the bank’s financial products and services as per the needs of the client

- They can explain complex financial concepts in simple terms to their customers

- They also have the training and education to deal with any sudden changes, challenges and risks

- CFP professionals are authorised to follow the regulations, standards and practices set by the authorities

CFP job responsibilities:

Your role as a financial planner is as follows:

- Understanding the clients’ needs by having a long discussion about their investment requirements while addressing any concerns about their financial future

- Analysing the client’s current finances to review the income, expenses, debts, assets and liabilities

- Creating a detailed financial strategy while minimizing risks

- Putting this plan into motion and reviewing it on a regular basis to ensure the client’s needs are still being met and haven’t changed.

Benefits of being a CFP-certified employee in a bank

Once you receive your qualification, things will start to look up. You can apply for a position within your current place of work or in another institution. Some banks are happy to promote employees from within once they have received their CFP certificate.

Here are some advantages of doing the course:

- You learn the effective methods of managing money

- You get paid more than your peers who don’t have a similar academic background

- The demand for financial planning is getting higher every day. The potential of earning increases as you get more clients

- You are an expert in various financial services such as insurance, mutual funds, estate planning and taxation

- This job cannot be automated. Even with banks shifting to digitalization, they need strong, intelligent planners who can connect with customers and offer a personal touch

- You are likely to have more satisfied customers while earning higher rewards for your organization and yourself

- Customers are more likely to ask for certified planners as the levels of success are well documented in the industry

- Working as a financial planner in a bank can open up more opportunities down the road, such as consulting or setting up your own practice

- The salary expectations for a CFP professional are quite lucrative

- A qualified planner starts by earning around 3.5 lakhs a year

- With experience, this figure can increase to over 12 lakhs per annum

- The planner also stands to make money as bonuses, commissions and profit sharing

According to the FPSB website, a survey conducted with over 3,500 CFP holders showed:

- 63% saw an increase in their earnings a year after completing the course

- 37% got a promotion, found another job or launched their own firm

- 72% were satisfied and happy with their careers

How to become a certified financial planner

The candidates eligible for CFP are:

- Students who have passed their 12th-year exams

- Undergraduates, graduates and postgraduates in relevant streams

- Professionals working in banks or investment services looking to upskill

The syllabus is divided into three modules:

- Investment planning

- Retirement and tax planning

- Risk management and estate planning

A few key details about the exams:

- You sit for an exam for each of the above modules

- Each paper is 2 hours long with 75 multiple choice questions

- The tests are computer-based

- After passing all three exams, you can take the exam for Certified Financial Planner Certification

- This computer-based test is 4 hours long and contains case studies

- You can register with a reputed, FPSB-approved coaching institute or study on your own

Advantages of doing the CFP course with IMS Proschool

IMS Proschool is one of the leading authorized educational centers in India, training students across India in some of the world’s finest professional courses. The institute has tied up with the FPSB organization to teach the CFP program to financial hopefuls in the country. Till date, IMS Proschool has trained over 3,500 students and 16,000 employees for CFP.

The benefits of doing CFP with IMS Proschool:

- Incredible study resources such as over 2,000 practice questions, mock interviews and video learning tools to help the students prepare

- Experienced industry professionals serve as mentors and faculty members

- 100 percent placement assistance once you clear your exams

- You can study through three mediums: live classroom, online or distance learning

In conclusion

When it comes to trusting money with a stranger, many Indians are wary. With so many scams hitting the newspapers every day individual investors will only hand their hard-earned income to a reliable and ethical professional. A CFP certification is like a badge of honour for planners, confirming that they are knowledgeable and reliable. Banks are aware of this. They know that customers will trust CFP holders. It is also more convenient for customers to have one banking organisation to handle all their monetary matters.

A CFP credential is renowned the world over. It is the benchmark in personal financial planning. Once you clear the course, you earn your title as a certified financial planner. So, don’t settle for one of the ordinary bank jobs. Start your CFP journey today.

Ready to boost your banking career? Register for the CFP course here.

Resent Post

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

>

Financial Modelling Classes in Hyderabad: Your Guide to the Best Institutes

Follow Us For All Updates!