200Hrs+ US CMA Training

Classroom Training In 15+ Centres

Course Duration – 6 Months

Solve 4000+ MCQs and 90+ Essays

Achieve Excellence with Proschool’s US CMA Coaching Classes!

If you’re looking for US CMA Classes In India, you’ve got to check out Proschool! We’re all about giving you the tools and support to nail those US CMA exams.

Here’s why our course is a game changer:

- Global Standard Material: Use international training materials approved by the IMA, ensuring you study with the best resources.

- Fee Waiver Available: Benefit from our fee waiver options to help manage your education costs.

- Rich Question Bank: Tackle over 4000 MCQs and 90+ essay questions to thoroughly prepare for your exams.

- Complimentary Foundation Course: Strengthen your basics with our free foundation course, setting you up for success from the start.

CMA USA Course Overview

What Do You Get By Enrolling @ Proschool’s US CMA Classes?

We focus on personal career goals.

Classroom Teaching Available

You can opt for US CMA classroom coaching in any of our 15+ centers or go for live online classes. Both of them are equally lucrative.

Personalized Study Plans

Receive a study plan specifically tailored to meet your individual learning needs.

Top Notch Placements

The placement team at IMS Proschool helps students with resume building, aptitude, interview tips along with access to 1000’s of jobs on our portal

Exam Pass Commitment

Proschool offers unlimited classroom and doubt-solving sessions in case you fail US CMA Exams

Focused Revision Classes

Attend dedicated revision classes to polish your knowledge before exams.

Extensive Pool Of Questions

Students solve 4000 MCQs and 90+ essay questions to thoroughly prepare for your exams.

Where Our Alumni Work

GPA qualified professionals are trained to handle different strategic roles like a Chief Financial Officer (CFO) and Chief Executive Officer (CEO) in a multinational firm.

What Students Have To Say About Our Institute?

What Do You Get In Proschool’s Placement Support

Expert-Led Interview Prep

Undergo 3 rigorous mock interviews with top industry professionals, complete with personalized, face-to-face feedback to sharpen your performance..

Guaranteed Interviews

Secure your future with 5 guaranteed interview opportunities, tailored to your preferred companies, ensuring your foot is in the door of your dream job.

Soft Skills Mastery

Elevate your professional appeal with targeted soft skill development sessions, designed to enhance your communication, teamwork, and leadership qualities.

LinkedIn Profile Makeover

Boost your digital presence with our profile enhancement service, aimed at maximizing your visibility and attractiveness to recruiters on LinkedIn.

Are You Eligible For Pursuing US CMA?

CMA – Education Requirement

- Successful completion of 10+2 in India.

- A Bachelor’s Degree or equivalent from a recognized institution in a relevant field.

- Students currently enrolled in a degree program are also eligible for the US CMA certification.

CMA – Experience Requirement

- Candidates must have a minimum of 2 years of work experience in management accounting or financial management. Part-time work of at least 20 hours per week also satisfies this requirement.

- Experience must be verified within 7 years after passing the CMA examination.

- Relevant experience can vary and may include:

- Preparing financial statements.

- Conducting internal or external audits.

- Developing and reporting budgets.

- Managing general ledgers or balance sheets.

- Forecasting financial outcomes.

Our US CMA Faculty Members

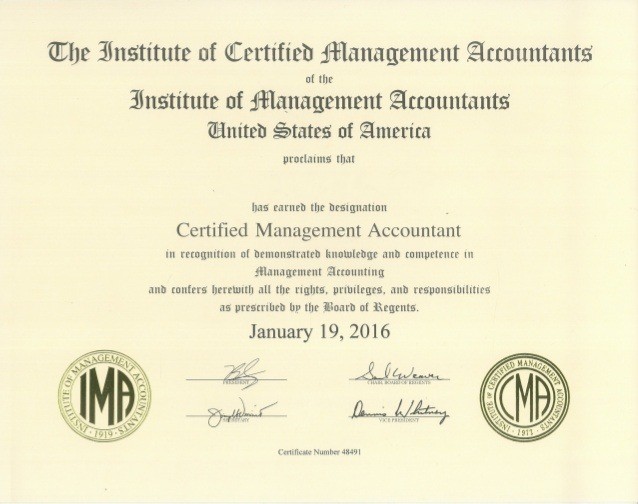

CMA USA Certifications

Certificate in Management Accounting from IMA

Upon passing Part 1 of the US CMA exam.

Advanced Certificate in Management Accounting from IMA

Upon passing Part 2 of the US CMA exam.

Strategic Management Professional Certificate from IMA

Awarded after fulfilling the two-year work experience requirement post passing both parts of the US CMA exam.

FAQ’s

CMA USA Blogs – Everything You Need To Know

Get an insight into the creativity of our team.