IFRS, US GAAP and Indian GAAP – A comparative study

Here's What We've Covered!

As the name suggests US – GAAP is the accounting standard used by the US registered companies in Security Exchange Commission (SEC) and Indian GAAP is for Indian companies in India.

IFRS (International Financial Reporting Standard) is the standard issued by the IFRS foundation and International Accounting Standard Board to achieve common global accounting standards.

As the title says a comparative study of these accounting standards are very vast in nature. We have chosen few accounting standards to explain you about the basic differences.

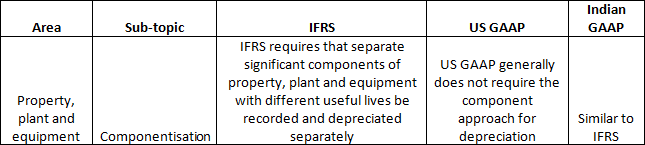

Property, plant and equipment

As mentioned above, Componentisation is the requirement under IFRS whereas it not generally followed in US GAAP.

Componentisation in simple terms is to depreciate the components of the assets based on its significance, the benefit derived and the useful lives of those. This may seem to be easy to read but the practical difficulty is to get the component level details. If the details are not available we have to use the replacement cost/value of the components.

Interested in IFRS?

If the details are available the journals would remain same as the normal depreciation of any assets. Anyway let’s look at a simpler example to understand:

Mr. X bought a building valued RS 10,000,000. The building has an estimated life of 40 yrs with no salvage value.

Since componentisation is not a mandatory requirement under US GAAP, we will just follow the normal depreciation recognition as Rs 10,000,000/40yrs = Rs 250,000/year. This is the value of depreciation recognised each year.

Under IFRS, we need to identify the significant components with useful lives of the building. You may identify the values as below:

Yes. You got it right. We need to depreciate each components of the building w.r.t its useful lives.

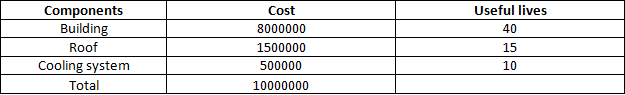

From the above table the difference in terms of review of useful lives of assets can be easily followed. Indian GAAP has given special emphasis to this area.

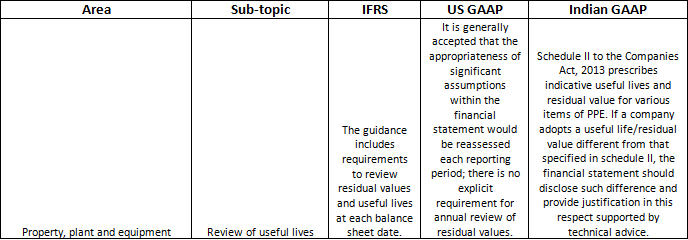

Recognition of provisions:

From the above table the definitions are almost similar between all the three accounting standards. But note that the chances of recognition of contingent liability is more likely in IFRS/Indian GAAP than US GAAP based on the probability guidance described above.

Under Indian GAAP there is an introduction of constructive an obligation term for which provisions is not to be recognised as opposed to IFRS. Constructive obligation in simple terms is an obligation which arises based on set of circumstances in a particular situation as opposed to contractually based obligation. Ex: Company has decided to give some social benefits to a party which is not yet communicated. There is no contractual obligation yet.

Contingent liability recognition would be similar to provision. Ex: If I have a contingent liability of Rs 10000, can be recognised as below:

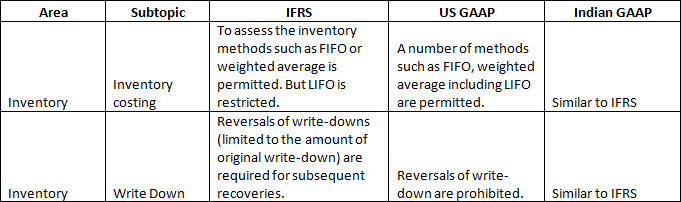

Inventory:

Ex:

Historical cost: Rs 5,000

Market cost: Rs 2,000

Estimated selling price: Rs 4,000

Estimated cost to complete sale: Rs 1,000

Net Realisable Value (NRV): Rs 4,000 – RS 1,000 =Rs 3,000

Inventory valuation under IFRS: Rs 3,000 (lower of historical and NRV values)

Inventory valuation under US GAAP: Rs 2,000 (lower historical and market value)

Assume NRV increases from Rs 3,000 to Rs 4,000 and market value increases from Rs 2,000 to Rs 3,000

Reversal of inventory write-down is permitted to the extent earlier written-down value under IFRS. If the earlier written value of Rs 1000 is revalue back to Rs 1000 as below:

Journal entries for inventory write down by Rs 1000:

Journal entries for inventory revaluation permitted only to the extent of Rs 1000:

These were few of the examples depicting the major differences between US GAAP, IFRS and Indian GAAP. IFRS is becoming global standards for preparation of financial statements. Most countries are converging their standards towards IFRS or adopting IFRS as they are, to enable uniform reporting. India, as a step closer to convergence with IFRS, has adopted IND-AS. Watch out this space for more features that distinguishes IFRS from the existing accounting standards.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!