Credit Analysts — Who are they? What do they do? How much do they earn?

Here's What We've Covered!

- The role of the credit analyst

- Qualifications for credit analysts

- Career opportunities for credit analysts

- About Proschool’s CFA course

- Conclusion

- FAQs

- What is the scope for a credit analyst in India?

- Is being a credit analyst a stressful job?

- What is the career progression for a credit analyst?

- Does having a CFA certification get you a job as a credit analyst?

- What is the average salary of a credit analyst in India?

- What is the difference between a financial and a credit analyst?

In today’s fast-paced financial world, credit is the new currency. It keeps people’s jobs secure, helps companies maintain their bottom line and ensures the economy doesn’t collapse. The credit analyst is at the helm of all this activity.

Employed by banks, credit card agencies and investment companies, he is a financial detective with a keen eye for detail and a head for crunching numbers. There are many responsibilities to consider when you take on the role of a credit analyst. You have to assess the borrower’s creditworthiness using the 5Cs of credit.

You keep the current market scenario in mind and evaluate all potential risks. It’s no surprise that credit experts are in high demand in the finance industry. This position is highly coveted among finance students and can lead to many exciting career developments in the future.

But let’s stay in the present for now and learn what a credit analyst does. If you want to join this illustrious community of finance professionals, first understand the various roles and responsibilities required.

The role of the credit analyst

Credit analysts serve as gatekeepers to credit. They are the deciding party with the expertise and knowledge to approve or reject loan applications. To do this, they evaluate, assess and analyse the borrower’s history and financial circumstances. This job requires the credit analyst to be proficient, carry out intensive research and have a good understanding of the financial markets.

Job Responsibilities of a credit analyst

-

Evaluating risk

One of the key responsibilities of a credit analyst is to look for and identify risk factors when reviewing a loan application. The professional will dig deep and scrutinise all financial information such as previous credit history, income, debt, savings account and other vital data. If a company is seeking a loan, their financial statements and background will be analysed. Customers who apply for a credit card or want to increase their credit limit will also have their financial history reviewed to ensure they are not likely to default on payments. Any red flags during this evaluation can prevent the loan request from being granted.

-

Ensure compliance with credit policies

Credit analysts must ensure that they file all paperwork and perform due diligence per the rules and regulations.

-

Conduct ratio analysis

Credit analysts are required to use ratio analysis to evaluate potential customers’ finances. This process involves comparing two figures as percentages of each other. Depending on the scenario, professionals may assess the debt-to-income ratio on a company’s financial statements to understand their creditworthiness.

-

Make reports and presentations

After completing the research, credit analysts present their findings and recommendations to their managers to grant or deny the loan application. These reports are in great detail and include the due diligence done.

Also Read – The 5 Cs Of Credit Simplified! And Here’s Why They matter!

Skills needed to be a credit analyst

-

Knowledge of the finance industry and credit regulations

A competent credit analyst has the knowledge, skills and expertise to carry out the various responsibilities. Courses like the CFA can help professionals master important credit-based concepts such as the 5Cs of credit, risk strategies and financial ratios.

-

Number crunching skills

Credit analysts are often required to be proficient in maths. When pouring over financial data, they need to make accurate calculations. Without this skill set, a minor error can cause a huge setback. Your proficiency in number crunching will ensure the correct assessment of the borrower’s financial data and help the credit agency arrive at the correct loan terms.

-

Due diligence

When applicants present their financial information for loan approvals, a credit analyst must double-check that data for accuracy. Intensive research can verify the authenticity of all the information in the borrower’s file. The professional must have good observational skills, giving attention to every little detail. They should also be able to analyse and decode complex financial data.

- Know how to use MS Excel

Most credit analysts know how to use MS Excel software to carry out most finance-based calculations and even create financial models.

-

Good organisational skills

Credit analysis is a busy, time-consuming job, juggling several clients simultaneously. Good organisational skills and multi-tasking abilities will help you prioritise projects and work in a demanding environment.

Also Read – Credit Analysis Essentials: Fundamentals, Importance & Techniques

Qualifications for credit analysts

To become a credit analyst, you need one or more of the following certifications:

- Bachelor’s degree in commerce or finance

- Chartered Accountant (CA)

- Chartered Financial Analyst (CFA)

- MBA in finance

- Financial Risk Manager (FRM)

Also Read – Credit Analyst | Process, Skills, Decisions, Scope, Courses

Career opportunities for credit analysts

- Qualified professionals can apply for entry-level jobs as junior credit analysts.

- After a few years of experience, you can rise to senior credit analyst or credit manager.

- Senior professionals can take on leadership roles such as Director, Vice President or CFO.

- You can move laterally into sales positions such as relationship manager, portfolio manager or lender.

- Most credit analysts can work in banks, credit rating agencies, insurance firms, government loan agencies or finance departments of non-financial companies.

- Top companies that hire credit analysts include Citigroup, Barclays, ICICI Bank, HDFC Bank, EY, HSBC, Axis Bank and Goldman Sachs.

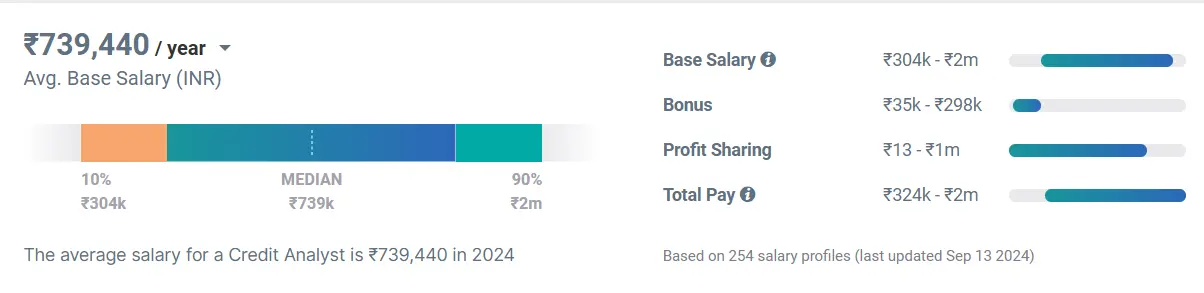

Salary packages for credit analysts

- The salaries vary depending on the company you work for and your experience level.

- The starting salaries are from Rs 2 lakhs a year.

- The average annual salary for a credit analyst is Rs 7.4 lakhs to Rs 8.5 lakhs.

- Senior professionals can earn over Rs 10 lakhs per annum.

Source: payscale.com [Updated September 2024]

About Proschool’s CFA course

The CFA program is perfect for budding credit analysts as the syllabus offers a strong foundation in finance and a focus on credit-centric concepts and knowledge. The course is widely respected in the industry and can make you eligible for many lucrative opportunities from top companies.

At one of India’s leading CFA coaching institutes, IMS Proschool, you receive a high-quality education, excellent learning resources and experienced teaching faculty. Proschool has a solid track record of helping students achieve their CFA dreams.

The professors are industry experts who use active learning methods and innovative training techniques to help students master the curriculum. Once certified, you are on your way to becoming a credit analyst.

Highlights of learning with Proschool

- You can attend coaching centres across India or register for interactive online classes.

- The professors are trained professionals who offer customised study plans and personalised mentorship.

- Proschool offers additional learning resources such as over 2,000 practice papers, mock tests and learning videos.

- There is a one-month online foundation module available for students who don’t have a finance background.

- Students also get access to Proschool’s placement program, which has hundreds of job openings in the finance and credit industry.

Conclusion

To be a successful credit analyst, you need the skills, expertise and a deep understanding of the finance industry. A CFA course will give you a comprehensive learning experience in finance and credit, enabling you to apply for jobs in this field. With time and experience, you can move to upper management roles and have a credit team working under you. If you stay focused and dedicated and work hard, there is a lot of scope for growth as a credit analyst.

FAQs

What is the scope for a credit analyst in India?

Credit analysts can work in big commercial banks, insurance companies, investment banks, credit rating agencies and even non-financial companies. There is tremendous scope to move up the corporate ladder. You can rise to upper management positions such as director, VP and CFO. Some credit analysts can also work in other fields, such as portfolio management or sales.

Is being a credit analyst a stressful job?

There is a lot of responsibility when you work in the credit department. You have to analyse risk factors, research the financial history of every applicant and ensure all the numbers are accurate. It can be stressful for some people. However, if you have received proper training in this field or are a CFA holder, you are more than prepared to take on the challenges of this job.

What is the career progression for a credit analyst?

Here’s what credit analyst career progression looks like:

- Junior credit analyst

- Senior credit analyst

- Credit manager

- VP

- Director

- CFO

Does having a CFA certification get you a job as a credit analyst?

The CFA program gives students the perfect education in various finance fields, including credit analysis. Professionals learn about the fundamentals of credit analysis, the 5Cs of credit, risk evaluation, financial ratios and other relevant concepts. You receive the knowledge and skills to work in several job positions within the credit industry.

What is the average salary of a credit analyst in India?

On average, a qualified credit analyst earns Rs 7.45 to Rs 8.5 lakhs a year.

What is the difference between a financial and a credit analyst?

The job responsibilities of a financial analyst include financial planning, portfolio/wealth management and investment analysis.

A credit analyst has a narrower role in which he works on risk management and verifying loan applications.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!