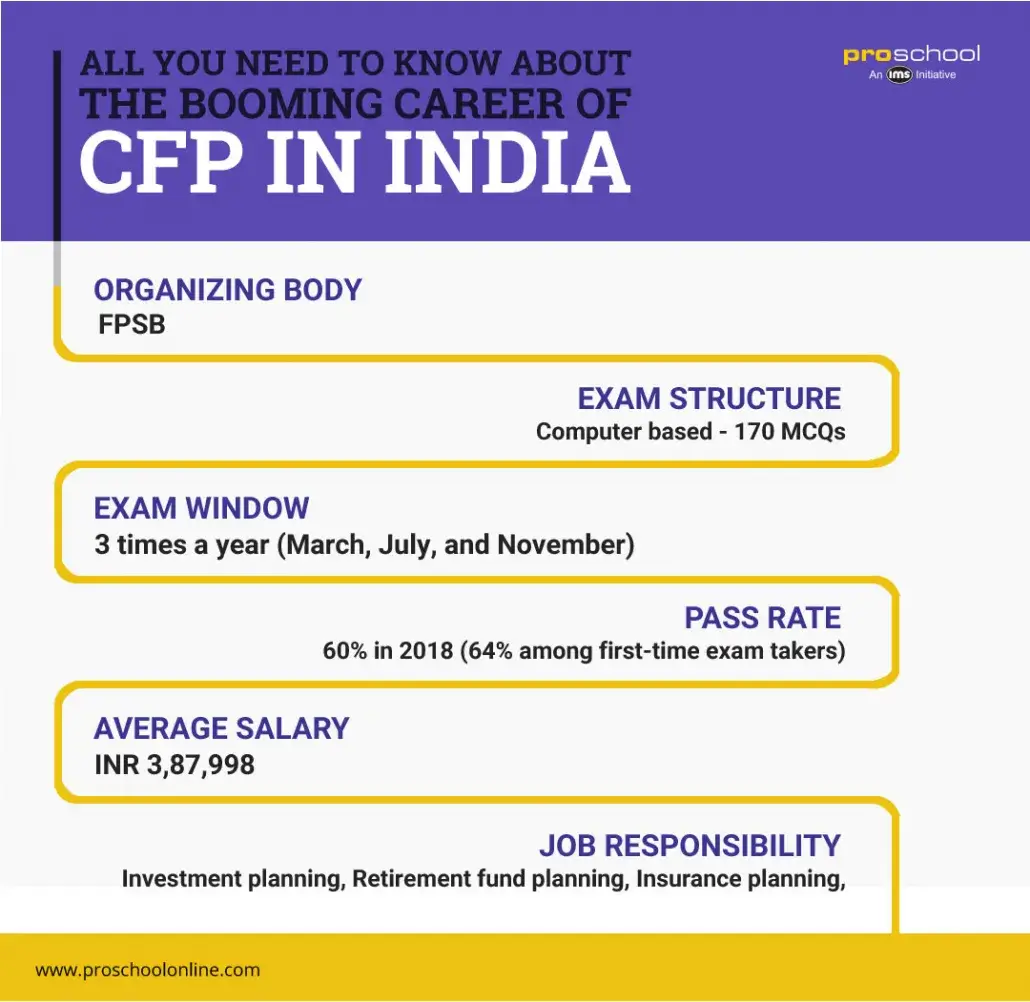

All you need to know about the booming career of CFP in India

Here's What We've Covered!

What is CFP?

CFP stands for Certified Financial Planner and it refers to the professionals who possess the expertise to help clients with their investment decisions and taxation, while they also advise on the selection of insurance policies and retirement plans. In India, the CFP certification is awarded by the Financial Planning Standards Board of India (FPSB). As a CFP, your typical day-to-day job responsibilities will include:

- Assessment of a client’s financial health

- Help clients with their financial and investment goals, such as retirement or child’s college education

- Monitor client’s financial and suggest requisite investment plans

- Research new investment opportunities

The growing need of CFPs

The surge in the demand for CFPs in India during the last couple of years is supported by many factors. Let us look have a look at some of the factors to understand the phenomenal growth:

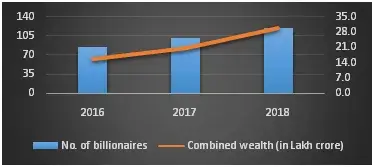

The era of wealth creation in India

Being one of the fastest-growing economies in the world, the Indian economy has witnessed significant growth. It is evident from a report published by Oxfam which states that India had another 18 new billionaires join the elite list in the year 2018, raising the total number of billionaires in the country to 119. The report also stated that the combined wealth of these billionaires touched ~Rs.30 lakh crore in the current year as compared to ~Rs 21 lakh crore in 2017. Although the reports draw attention to the inequality in wealth distribution existing in India, it also highlights the extent of wealth creation and the increase in the number of billionaires in the country which is nothing short of amazing.

Growing financial responsibility

With the accumulation of wealth comes the most difficult part – efficient management of the accumulated wealth. The Indians are not very efficient in managing their wealth as even today a large part of their savings are found to be invested in physical assets like real estate and gold. However, economic uncertainties coupled with inflationary pressure warrant a far more proficient investment policy to manage the corpus. Nevertheless, the financial awareness is slightly better among the youths of the country who are digitally connected which exposes them to information and reports of all kinds. According to a report by Kotak Wealth Management (KWM), around 60% of the country’s Ultra High Net worth Households (UHNH) are under the age of 40 years.

Shortage of talented professionals

A growing number of wealthy class people have resulted in the emergence of a large number of wealth management firms in the country. Consequently, the demand for talented wealth management professionals has also surged. The UHNH clients seek professionals who command expertise in advising customized investment plans. However, the India wealth management industry is still in its early days and as such it suffers from a lack of quality wealth managers. The industry faces huge talent gap and thus most of the wealth management firms are scouting for promising candidates to fill the gap. According to FPSB India, there were around 2,000 CFP’s in India in 2017 while experts believe that the Indian market requires around 1,00,000 CFP’s – so there is the gap.

Career Prospects

CFP is a globally recognized certification and as such it will open doors for you to the ample number of opportunities. Let us look at some of the career opportunities available to a qualified CFP.

Bank: Once you successfully complete CFP certification, you may opt for a career in the wealth management division of Banks. In this profile, your responsibility will include advising requisite investment plans to HNI and UHNH clients.

NBFC: Non-Banking Financial Companies (NBFC) is another set of financial institutions that recruit CFPs. In this profile, you will be pitching various products, such as shares, stocks, bonds, debentures, etc.

Insurance Companies: In Insurance Companies, you will be primarily responsible to assess the client’s requirement and then follow a goal-based approach to advising them on a suitable insurance policy.

Mutual Fund Companies: In today’s world one of the most popular channels for building wealth relatively safely but at a rate better than the savings accounts is through Mutual funds. This is one of the sought after roles for a CFP as it offers the opportunity to work in an Asset Management Company where you will be able to suggest best-suited funds to clients through a Financial Planning approach.

Financial Planning Companies: Another ideal place for an aspiring CFP would be Financial Planning Companies. In this profile you will be interacting with clients, suggesting financial plans, which will be followed by implementation and monitoring.

Eligibility

There are certain eligibility criteria for a candidate who wish to apply for CFP certification and they are:

- Must have a bachelor’s degree from an accredited university or college within five years of passing the CFP exam.

- Relevant professional experience of either three years of full-time personal financial planning or two years of apprenticeship.

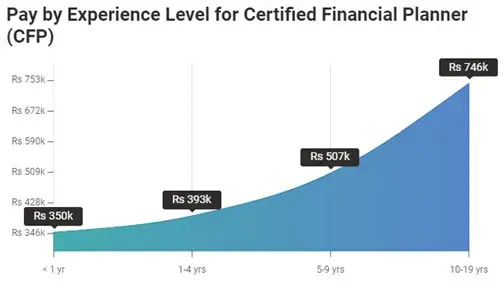

Potential Compensation

The CFPs in India can earn a salary between INR2,00,000 and INR8,00,000 per year with an average salary of more than INR3,87,998. However, as per a report released by Economic Times the best in the business who handle huge corpus of asset under management have earning potential in the range of Rs1 crore to Rs 2 crores. These wealth managers earn 28-30% of the revenue earned by the wealth management companies as commission. Examples of such high paying recruiters include Avendus Wealth Management, ASK Wealth, IIFL Wealth Management, etc

Conclusion

So, by now you what has been the driving factor for the booming demand of CFPs in the country. Also, you have seen what are the requirements of a CFP and what will be expected of you post CFP certification. So, now that you know about the available career options, what are you waiting for? Become a CFP professional by completing the required education, clearing the certification exam and meeting the professional experience requirement.

Read more: Fees Or Commission- Which One Is The Best Earning Option For Cfp

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!