8 Benefits Of Becoming A CFA Charter Holder

Here's What We've Covered!

The road to your dream job in the investment industry may contain a few potholes along the way. You could face stiff competition, pressure-filled job interviews, and a limited time frame to impress hard-to-please recruiters.

Even if you pass muster and get the job, you still have to prove your mettle. Do you have what it takes to climb the corporate ladder ahead of your peers? Can you overcome challenges and meet intense deadlines? Do you have a finger that is always on the pulse of the financial market?

Sounds overwhelming? Not if you have an ace up your sleeve. The CFA course is tailor-made to educate and prepare students to take on the unpredictable world of investment advisory services. The program offers an in-depth and comprehensive syllabus designed for future financial specialists. It equips them with the training and skills they need to forge a clear path toward their career goals. When you are a CFA charter holder, the chaotic and frenzy-filled investment industry begins to make sense. You develop a keen eye for the essential details, become proficient in deciphering the stock market, and your resume gets placed on the top of the shortlist pile. These are just a few of the benefits of doing CFA. There are more, so keep reading.

Everything you need to know about the CFA charter

Back in 1963, nearly 300 candidates appeared for the first CFA exam. Today, there are over 160,000 charter holders in more than 160 countries. Every year, thousands of students apply for the coveted program around the globe. The CFA institute offers one of the most prestigious certifications in investment management. They have set the standards for professional excellence in the global financial services industry. The curriculum covers core knowledge and skills, ensuring that every student is fluent in the language of investment planning and portfolio management. While the program contains three levels, there are even a few benefits of doing CFA level 1 before finding a job. Many companies recognize each CFA level as a standalone certificate and hire candidates even if they are still to finish the whole program.

To apply for the course, here is what you need to know:

Eligibility criteria

- You should hold a bachelor’s degree received from an acknowledged university

- You can apply as an undergraduate student if you plan on getting your degree before the CFA level 2 exam

- Alternatively, you can also register if you have four years of relevant experience

- You should own a valid passport

You could be eligible for CFA Scholarships. To know more

CFA syllabus

The program is split into three levels, each one containing the following ten subjects:

- Economics

- Quantitative Methods

- Portfolio Management

- Alternative Investments

- Ethics and Professional Standards

- Corporate Issuers

- Fixed Income

- Derivatives

- Equity Investments

- Financial Reporting and Analysis

Work requirements

To become a CFA chart holder, you must pass all three levels. You are also required to gain mandatory work experience.

- You need to show proof of working for 36 months or 4,000 hours with an industry-affiliated organization

- The job can be full-time or part-time

- The CFA acknowledges the work experience you have cultivated before or during the course as long as the number of hours adds up

Why you should become a CFA charter holder

Here are some of the many benefits of doing CFA.

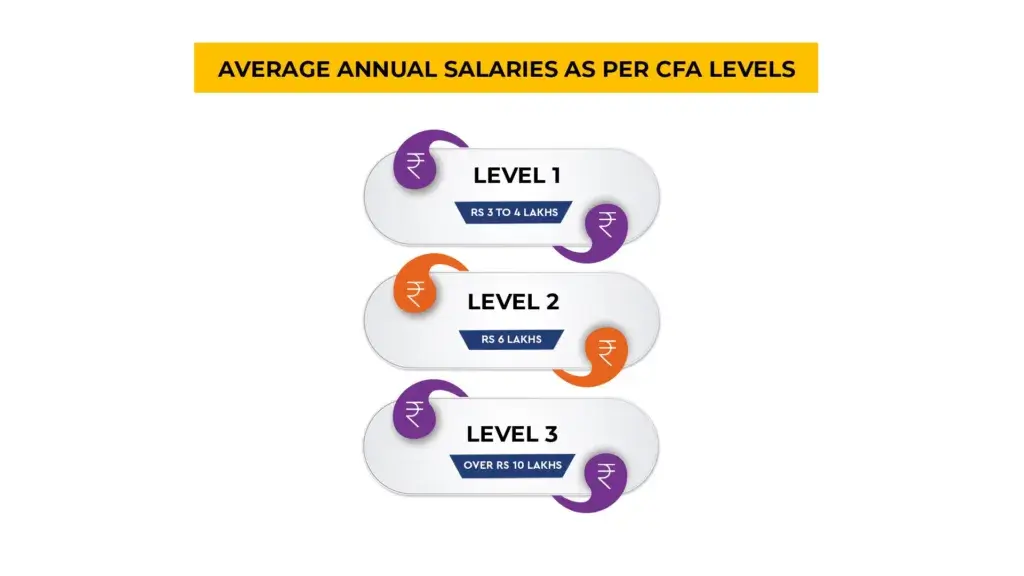

- Better job opportunities and salaries

As a CFA charter holder, you are in a position to negotiate a higher salary for yourself. You have much to offer the prospective company. Your industry knowledge and technical and practical skillset make you a standout. The intensive training and well-rounded development have transformed you into a formidable investment specialist. You will be able to handle the tough interview questions and impress the recruiter with your mastery of core finance subjects. Companies know the level of quality a CFA charter holder brings. They are willing to pay you what you are worth.

- The CFA has global recognition

The program is revered by international investment firms, major MNCs and even the big 4. Your certificate can open doors to organizations around the world. If you plan on migrating, over 160 countries are hiring CFA charter holders. Companies coming to India also prefer qualified professionals who carry the CFA stamp.

- Receive regular updates from the CFA Institute

When you are a part of the CFA global community, you get instant insider access to the many advantages they provide. Over 160 CFA societies worldwide offer charter holders incredibly rewarding experiences. They have the resources to connect members to each other along with the external investment services industry. From job positions to new financial developments, as a CFA member, you hear about it first.

- You can start your own portfolio management service

The CFA program creates future-ready investment specialists. You receive the tools and technical training that guide you towards eventually launching your firm. Many experienced CFA charter holders, after a few years in the industry, become consultants or offer independent portfolio management services. One of the best CFA benefits is the holistic training that teaches you how to work independently and efficiently. It works in your favor when the time comes to be your own boss.

- Helps in advancing your career

CFA charter holders have the distinct advantage of applying their skills in several professional roles. They can work in areas like wealth management, hedge funds, fixed income, insurance and equity research. Since the CFA syllabus covers significant topics like financial modeling, portfolio management and financial analysis, it opens up more prospects for your career. You can also use your education to climb up the corporate hierarchy more quicker.

- Get tons of unique networking opportunities

One of the perks of having a CFA qualification is the respect you receive from your peers and industry leaders. It opens up many avenues to further your career. Recruiters need qualified and capable candidates to take on the unpredictable and complex investment industry. They recognize the strenuous and rigorous process every CFA holder undergoes to acquire the certification. They have respect and value attached to the credential, making it easier for you to go through rounds of interviews and shortlists. There is no denying that the CFA holds a place of pride on your resume.

- Waive licensing requirements as a CFA professional

Here is another CFA benefit. As a CFA holder, you are eligible for several exemptions when applying for other professional courses and exams. Some universities allow you to skip the GRE/GMAT entrance tests for the masters in finance degree. It does not just apply to India. There is a whole list of nations where you can waive exam papers with your certificate. In some cases, you are also exempt from the regulatory requirements to practice in that country. You don’t need to take additional tests to qualify.

- It is more cost-effective and time-efficient than an MBA

The MBA degree may seem like a hard-to-reach target due to time constraints or a lack of financing. The CFA course is a worthy substitute. You receive the full spectrum of investment-related education without cutting any corners. There is so much struggle and competition when trying to get into a top-tier B-school. It can be quite a nerve-wracking and heartbreaking process. However, rest assured, a CFA course can also do wonders for your career, as they offer a complete education in subjects like investment banking, portfolio management and professional standards.

Read – Top 5 trending CFA jobs in India

CFA Course At IMS Proschool

As a nationally renowned institute with over ten years of coaching experience, Proschool enjoys a high reputation among its students. The faculty consists of industry experts who are CFA Charter holders and devote their time and effort to instructing and preparing young eager minds to become investment-centric specialists. The syllabus is taught in a clear and engaging manner so that students develop their skills better. Proschool is also well known for using cutting-edge teaching methods to enhance the learning experience.

Here are some more benefits of doing CFA with Proschool:

- The faculty helps you with a customized study plan which ensures that you finish your syllabus and have sufficient time left for your revision

- You can approach your mentors 24*7 in your chatrooms to clear your doubts

- You can take up to 5 mock tests to help you study better

- There are many handy resources at your fingertips, such as over 2,000 practice papers and prep books

- While Proschool has coaching centers in major cities, you can also avail of their exceptional online learning sessions

In conclusion

Before you step foot into the investment banking industry, you need a solid foundation to stand on. In this fast-paced, high-pressure environment, your supervisor will not have the time to train you. The CFA curriculum teaches core investment and finance concepts, real-world application and practical skill development. The course covers all the integral topics, so you can step into your role as an investment banker without missing a beat.

Start working on your CFA certification today. Click here.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!