How to complete CFA in 1.5 years

Here's What We've Covered!

The number one mantra of any finance professional is — Time is money.

Every minute wasted is considered a monetary loss. It is especially true when you delay your prime earning years because you can’t get the qualification you want. More so, if the certification you are after is the CFA program. As one of the most respected courses in the investment banking industry, this coveted credential is the benchmark in financial education. It is a demanding and intensive curriculum that offers select students the tools and training to become investment experts. Who doesn’t want the prestige of carrying the CFA designation next to their name? The program is in high demand. The students go on to accomplish great things. The career starting point is much ahead of their peers, and they have advanced skills.

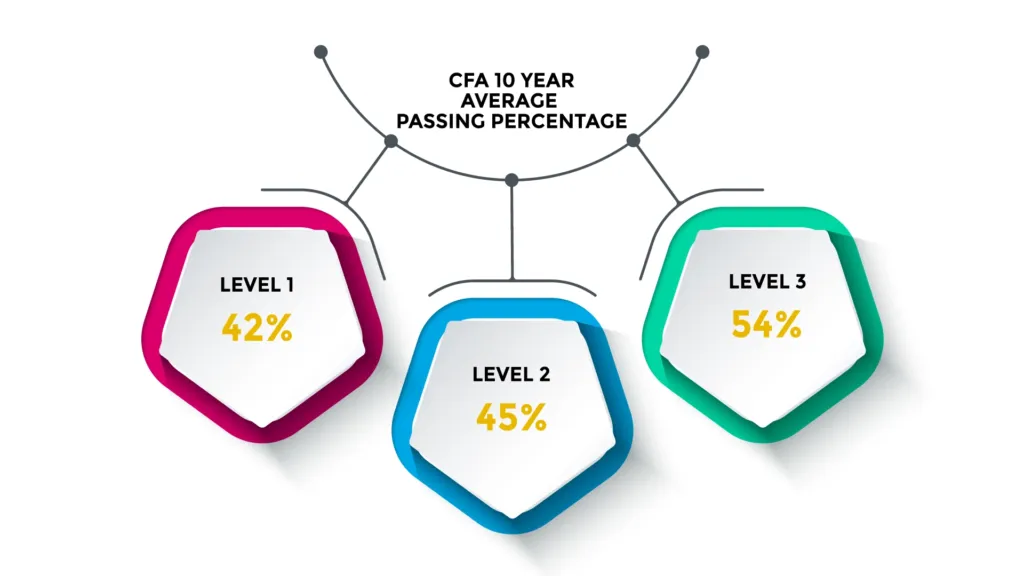

The CFA course duration can be anywhere from 2 to 5 years. You have to study an intensive syllabus, sit for three competitive exams and pass all of them before you can call yourself a chartered financial analyst. Not everyone passes on the first attempt. Not everyone has a study plan to prepare effectively. Most importantly, not everyone knows the secret tips to own the CFA title.

However, that is not going to be you. If you stay on this page, you will learn everything you need to know to pass the CFA exams in 1.5 years.

About the CFA course

The CFA institute has enjoyed a long and illustrious standing in the finance industry since its inception in 1947. Today, over 150,000 charter members work in more than 165 nations. They are leaders and specialists in their fields, as they extend their expertise as portfolio managers, risk consultants, fund managers and CFOs.

The CFA curriculum is structured and designed to offer precise knowledge and skill development. It gives students an edge, as they are fully prepared to take on any challenges in the workspace.

Advantages of becoming a CFA:

- Globally recognised and acclaimed certification

- Preferred by major investment firms, asset management companies and hedge fund houses during the recruitment process

- Offers a complete education in ethics, global standards and practices

- Get access to incredible opportunities through CFA societies set up worldwide

- Sharpen your analytical and practical skills

- Become an expert in industry-relevant knowledge

The CFA course

Sounds good so far? Find out more about how to become CFA-certified professionals. Here are the course details:

The subjects

There are three levels across the CFA course, with the same set of ten subjects.

- Ethics and Professional Standards

- Portfolio Management

- Quantitative Methods

- Alternative Investments

- Economics

- Corporate Issuers

- Financial Reporting and Analysis

- Equity Investments

- Derivatives

- Fixed Income

The CFA exam schedule

The first step on how to become CFA in a year and a half? Figure out the exam schedule. This is critical because planning your exam dates is as crucial as the actual study schedule. Here is what you need to know:

Level 1:

- The exam for Level I takes place in June and December, twice a year

- There are 180 multiple choice questions

- Level 1 paper is divided into two halves (135 minutes each) with an optional break in between

- The first session contains 90 multiple choice questions and lasts for 2 hours and 15 minutes

- Subjects include: ethics and quantitative methods, professional standards, financial statement analysis and economics

- The second session of the exam has the same number of questions and duration as the first.

- Subjects include: portfolio management, equity, corporate issuers, fixed income, alternative investments and derivatives

- Results are declared within 2 months of taking the exam

Level 2:

- The exams happen once a year in June

- The paper has 88 multiple choice questions, but they are sorted into 22 item sets

- Each item set will revolve around a specific subject

- Level 2 exam will also be divided into two sessions, both lasting for 2 hours and 12 minutes

- You can choose to take a break between the two papers

- Results will be available within 60 days

Level 3:

- As of February 2023, there will be a change in how the exam is structured

- The item sets and essay-style questions will be spread across both the sessions

- So in either session, you might receive 5 items sets and 6 essays or vice versa

- Portfolio management is a very important subject, as it carries 35 – 40 per cent of the total score

- The duration of the paper will be similar to that of level 2

- Results will be out within 3 months

Strategy for giving the exams

Since you now have an understanding of the CFA course duration, you need to work out how to sit for the exams so that you can complete them within the target duration.

- Take the Level I exam in December. You’ll receive the results by mid-January/early February

- Sit for the level 2 paper in June. You’ll get your marks by August

- Finally, appear for the final Level 3 test in June of the following year. You’ll get your results by August.

This plan rounds out your CFA duration to 1.5 years. You need to work hard and efficiently prepare for the exams so that you can clear each level on the first try. While this is known to be notoriously difficult, it is possible to do that with some commitment and determination.

More details about the CFA levels

Level 1

- The level 1 exam is the foundational level for the level 2 and 3 papers

- A good study plan can help you pass with flying colours

- The topics are not too difficult. You may have already studied them at the graduate or post-graduate stage

- Ethics is a very important subject at this level and needs proper attention

Level 2

- Many CFA students find this exam to be the toughest of all three

- The most focused topic is financial statement analysis, which includes currency effects

- You may need to put in extra hours of study time as compared to level 1

- A recommended study plan of 10 to 12 hours a week can help you stay on track

- If you can finish the syllabus two weeks before the exams, it leaves you with plenty of time to revise the topics

Level 3

- Some students feel that level 3 is a touch easier to manage than level 2

- The main topic is portfolio management, as the exam focuses on fund management within capital markets

- Of the two sessions, the first paper has multiple choice questions and the second one is an essay-type exam based on case studies

- The evening session of the exam is MCQ based. However, the morning session is based on small case studies that require essay-style answers

- While you may write a lot of theory, it helps to highlight the relevant points or use bullet points so that the examiner can find the significant aspects of your answer quicker

The study material for the CFA exams

A few CFA prep books are available to study for all three exams. Below are the three best study guides to help you clear the CFA course within 1.5 years.

- CFA Institute CFA program curriculum

Once you register with the CFA board, you can buy the entire CFA syllabus in print or digital format. The books are sold in a set of six volumes, and you can buy each one separately. The online curriculum is available on the Learning Ecosystem platform.

The study guide has been authorised by the CFA course so you’ll find the entire syllabus in a clear, concise structure. It is an easy-to-use guide, as they offer colour-coded features and an efficient layout.

2. Kaplan Schweser notes CFA prep book

The Kaplan series is considered one of the most user-friendly study guides for the CFA exams. While they cover the entirety of the curriculum, they use unique methods to make the subjects easier to understand. The books break down complex concepts and use compact study notes to help students learn better. They also offer practice questions and quizzes to help you revise for the exam.

- Wiley’s Level 1/2/3 CFA program study guide

Wiley’s CFA prep books are available as ebooks or in the form of hard copies. They offer five large textbooks for each CFA level. The syllabus is simplified, while the subjects are explained clearly. The books also have figures and illustrations on topics, such as economics and portfolio management.

How to become a CFA in 18 months

- Create a smart study calendar

This point may seem obvious. Everyone understands prepping for an exam. But how you go about it will make a difference to your final performance. Work hard, but also work smart. A detailed daily schedule can help you break down this intense syllabus into smaller portions. The CFA board recommended students study for 300 hours before they give each exam. Break this time down realistically. If you plan to finish the course in a year and a half, your timing must be perfect. Set aside six months per exam. Then, plan to study for 2-3 hours a day. You need to ensure you have enough time to finish the portion and then revise.

- Register with a qualified coaching class

It is possible to pass the exams on your own. However, if you are under a time constraint and want to clear the course within 18 months, you need all the support you can muster. A reputed coaching institute has the tools and tips for students to grasp the entire CFA program. They offer you insights and deepen your ability to retain knowledge. If you want your CFA certificates in 18 months, you need professionally trained teachers to reach your goal.

- Practice questions

While level 1 and 2 exams have multiple choices, level 3 contains more essay-style questions. Practise regularly by physically writing down the answers. Check the contents, make your corrections, and then write them down once again. The more you write, the more familiar you will be with the syllabus. Remember, practice makes perfect.

- Work on as many mock tests as possible

When you solve the previous years’ papers, you understand how these exams are structured. Time yourself and work on several mock exams. Your mind will become disciplined and easily slip into exam mode on the actual test day.

How IMS Proschool can make you a CFA holder

An efficient academic support system is key to passing the CFA exams on the first attempt. IMS Proschool has created an educational environment that helps students learn to the best of their abilities. It helps when you use ingenious teaching methods and techniques. The CFA subjects are technical and complex. They need to be broken down and simplified while using real-world examples. Under the tutelage of the institute’s esteemed faculty, students can widen their minds and efficiently incorporate the lessons.

Here’s how Proschool can be of service to students:

- They offer updated study material, prep books and online resources to help you study

- There are over 2,000 practice questions available for revision

- 5 mock tests that will make you proficient in answering the CFA exams

- If you can obtain at least 70 per cent in the mock exams, you are sure to pass when sitting for the finals

- All subjects are revised one more time before the exams

- There are recorded video sessions to help you learn as well

- You can visit a coaching class near you or opt for online virtual classes

- Faculty members are CFA holders with considerable industry experience

In conclusion

It is good to have a clear goal in mind, but you need an effective strategy to achieve it. If you are wondering how to become a CFA in 1.5 years, make sure you do everything in your power to make it happen. Do the mock tests, register with a coaching institute and discipline yourself to learn the study material thoroughly. It will be 18 months of gruelling, intense work. But the payoff will be spectacular. Imagine how impressed recruiters will be when they see your resume.

Get all the details of the CFA course here

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!