CFP – the best professional course after 12th commerce

Here's What We've Covered!

Life after the 12th commerce exams is bittersweet in many ways.

It is time to celebrate. There is a great sense of relief. Heart rates go back to normal, and Netflix accounts are restored. But as every parent knows, this joy is temporary. The tension will soon return, bringing the age-old question: “Now what?”

It is time for your child to plan the future. To make the right choices that can reap many benefits later. There are many options ahead for commerce students or those inclined towards a financial career. One of them, the certified financial planner course, is a good bet for many reasons.

The CFP program is a globally respected qualification, opening many viable opportunities for any professional looking to make a mark in financial advisory services. Developed by the Certified Financial Planner Board of Standards, Inc, the CFP designation is recognised by over 26 countries, including the UK, USA, Australia, Germany and Hong Kong. The syllabus is structured to reflect the demands of investment and financial planning services. The areas of expertise are personal financial management, taxes, estate and retirement planning and risk management. It is a very rewarding career in an industry that is booming with prospects.

If you are a parent concerned about your child’s future, this post is for you. Keep reading to find out how the CFP course is one of the best career options after 12th commerce.

What does a CFP do?

There has been an increasing demand for financial planners in India, especially in the past few years. The CFP is the gold standard in the advisory services industry. International companies, banks and financial firms are keen to hire certified planners to work with their customers. CFP professionals apply their knowledge and expertise to create personal portfolios for their clients. They offer investment and financial advice that helps meet the individual’s personal essentials and future requirements. They also manage the finances, investments, taxes and insurance details as part of their services.

The Proschool CFP course details

To pursue a financial planning career after 12th commerce, here are the significant points you need to know.

- To apply for the course, you must have scored a minimum of 50 per cent in your 12th-year exams (preferably commerce)

- The course duration is for one year

- There are 3 modules in the CFP curriculum

- Investment planning

- Retirement and Tax planning

- Risk management and Estate planning

- Subjects include

- Personal financial management

- Tax planning and optimisation

- Estate planning

- Financial planning principles, process and skills

- The certification exam for each module is computer-based, last for 2 hours and has 75 multiple choice questions

- The certified financial planner exam is for four hours and contains case studies

- The course includes intensive training, skill development, mock interviews and practice tests

- The experienced faculty consists of qualified certified financial planners

- There are classroom-based, online or distance learning methods

- 100 per cent placement assistance is provided after the program

Why CFP is one of the best career options after 12th commerce

With India’s economic prospects on the rise, the field of financial planning has seen substantial growth in recent times. Economic institutions recognise the need for CFP-qualified professionals to add value to their business.

The jobs available after completing the course are:

- Portfolio manager

- Financial manager

- Risk analyst

- Financial planner

- Investment advisor

- Financial advisor

- Wealth manager

- Cost analyst

- Insurance advisor

- Stockbroker

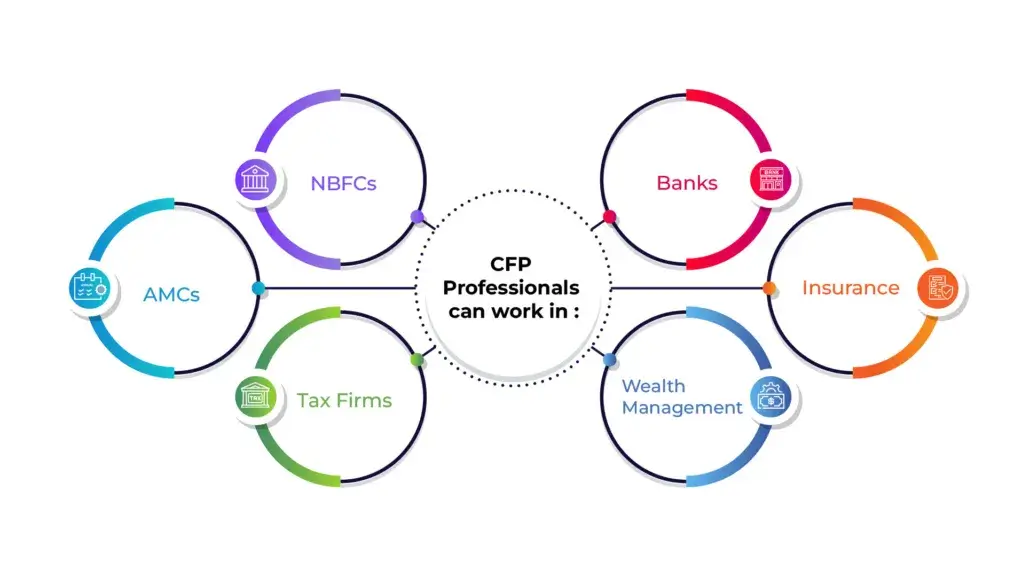

CFP professionals have detailed knowledge about many financial services and products such as insurance, mutual funds and taxation. They are often hired by:

- Non-Banking Financial Companies (NBFCs)

NBFCs need planners to work with clients on managing their investments such as stocks, bonds and shares. CFP-qualified employees can advise the customer personally to make decisions that suit their requirements.

- Insurance companies

The insurance industry depends on CFP-trained employees to work with their clients. The financial planner talks to the customers to understand their needs and helps them choose from the policies available in the firm. The planner also assists the company with analysing market research and uncovering insights that will appeal to the client.

- Asset management firms

AMCs hire CFP professionals as investment advisors. The job involves advising clients about different products and fund opportunities within the firm. Planners also use their expertise to analyse the market and make sound decisions that reflect their findings.

- Wealth management services

The financial planner is trained to assist high-net-worth individuals in managing their finances and investments. CFP executives will direct the clients toward products and services that will enhance the value of their portfolio. They will also help with estate, will and retirement planning.

- Banks

The banking industry is a highly competitive sector where banks compete with each other to build a valuable customer base. They need financial planners to help them sell their new products and services to clients. CFP professionals also help the customers with financial planning, portfolio management and risk analysis.

- Tax firms

A certified financial planner is well educated in tax regulations and structures. They are qualified to advise clients on how to make investments and other financial decisions to optimise savings on tax.

Salaries packages for certified financial planners

CFP specialists are an esteemed community within the industry. The salaries earned vary according to the company, location and job profile. However, it is safe to say, most professionals earn well and enjoy many perks.

- Fresher salaries start at around 3.5 lakhs a year

- Experienced planners move up to 6-7 lakhs per annum

- Senior position holders can command an annual salary of over 12 lakhs

- The earnings continue to go up higher once you establish your firm or become a high-ranking consultant

The CFP course can be combined with other qualifications

This is one of the best courses after 12th commerce. As a standalone certification, the CFP offers an abundance of opportunities. However, combining the CFP qualification with another professional certificate can lead to better prospects.

- CPF and MBA

A CFP credential can boost an MBA degree. The combination will help candidates attain leadership roles and upper management positions. It is also helpful to have both qualifications when starting a financial planning business.

- CFP and CFA

Holding both of the above certificates can be quite beneficial for a career in wealth management or opening an advisory firm. If a student already has a CFA qualification, the CFP board waives many educational requirements.

- CFP and CA

This combination can be helpful as some companies in India choose candidates who are qualified in both certifications. It is also mandatory to do both if planning to become an accountant in the USA. CA students will be exempt from some of the CFP levels.

Famous CFP holders

Meet the brilliant financial minds who have risen to great heights of success in their careers.

Suze Orman

CFP-qualified Suze Orman has advised a generation of people for over 13 years on her highly rated ‘The Suze Orman show’ in America. She is recognised as the face of financial planning, building a powerhouse empire in the industry. She has also written many books that help people manage their finances and expenses. Her net worth today is over $75 million.

Suhas Harshe

A highly experienced certified financial planner, Suhas Harshe has helped several businesses, start-up firms, and individuals enhance their fiscal value. He has worked in leadership positions in major companies such as Kotak Group and Godrej. Today he is India’s first ‘money coach’, helping others with financial planning through his seminars and workshops.

Nisreen Mamaji

The founder and CEO of MoneyWorks, Nisreen Mamaji has had an illustrious career spanning over two decades. She has worked with businesses, individuals and investors to create sustainable financial plans that have reaped many rewards. She also writes money-centric blogs and holds workshops to reach a wider audience and help more people consciously make good quality decisions.

Soubhagya Kumar Patra

Soubhagya Kumar Patra is an expert in the field of financial planning and tax advisory services. As the co-founder and director of Succinct Financial Planners, he has actively helped many individuals achieve their monetary goals through comprehensive investment plans.

The bottom line

The CFP program is of the best courses for commerce students after the 12th. After completion, the CFP certification will ensure bright career opportunities in a wide range of investment services and financial companies. If your child naturally inclines toward the financial industry, a CFP course is a worthy investment for a secure future.

Visit us to learn how the CFP certification can create a prosperous future for your child

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!