Detailed Guide on CFA vs CFP & How to Choose the Best Course?

Here's What We've Covered!

Are you a finance enthusiast looking for good career options? Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) are two of the most prestigious common certifications if you aspire to become a financial advisor.

While CFP helps in developing financial planning skills, CFA focuses on investment analysis and corporate finance skills. In this blog, we will focus on the differences between CFA and CFP, and how you can select the best course based on your career goals and interests. Let’s start with the basics first!

What is a Certified Financial Analyst (CFA)?

The CFA Institute, which is the regulating body of the CFA charter, gives the designation. CFA has globally earned the badge of “gold standard” for financial analysis, with the community growing as strong as 170,000+ active charter holders as of 2023.

Financial professionals with this charter designation hold tested skills and expertise in portfolio management, financial reporting, investment analysis and specific business concentrations. CFAs also hold specialization in relationship and wealth management, trading, credit analysis, accounting, auditing and financial planning.

To acquire the CFA certification, it is mandatory for the candidates to pass three levels of exams that cover topics ranging from accounting, and security analysis to money management and others. The institute noted that candidates dedicate up to 300 hours of study to pass each of these three exams. Only 36% who took the first and 44% of those who took the second exam passed in November 2022, with 48% passing the third exam in August 2022. It is mandatory for the candidates to pay a one-time enrollment fee.

The designation is given by the CFA Institute, which is the regulating body of the CFA charter. CFAs help clients in making data-driven decisions on estate planning, investments, insurance product, and other short-term and long-term financial goals.

Want to read more, click here

What is a Certified Financial Planner (CFP)?

The CFP board in the US and the Financial Planning Standard Board (FPSB) outside the US offer Certified Financial Planning (CFP) certification.

Want to create a financial blueprint for your entire life? You should work with a CFP! CFPs hold expertise in various aspects of Financial Planning such as Tax Planning, Estate Planning, Retirement and Insurance. They also adhere to the highest standard of ethics, the fiduciary standard in which they keep their client’s interests first.

To acquire the CFP certification, it is mandatory for candidates to pass the CFP Board exam and dedicatedly indulge in ongoing education programs that test and maintain their skills and course of certification. Want to read more, click here

Key Differences Between CFA and CFP

While we have already established the basic ways in which both courses differ, a deeper understanding of their functional distinctions will give you a clearer view.

-

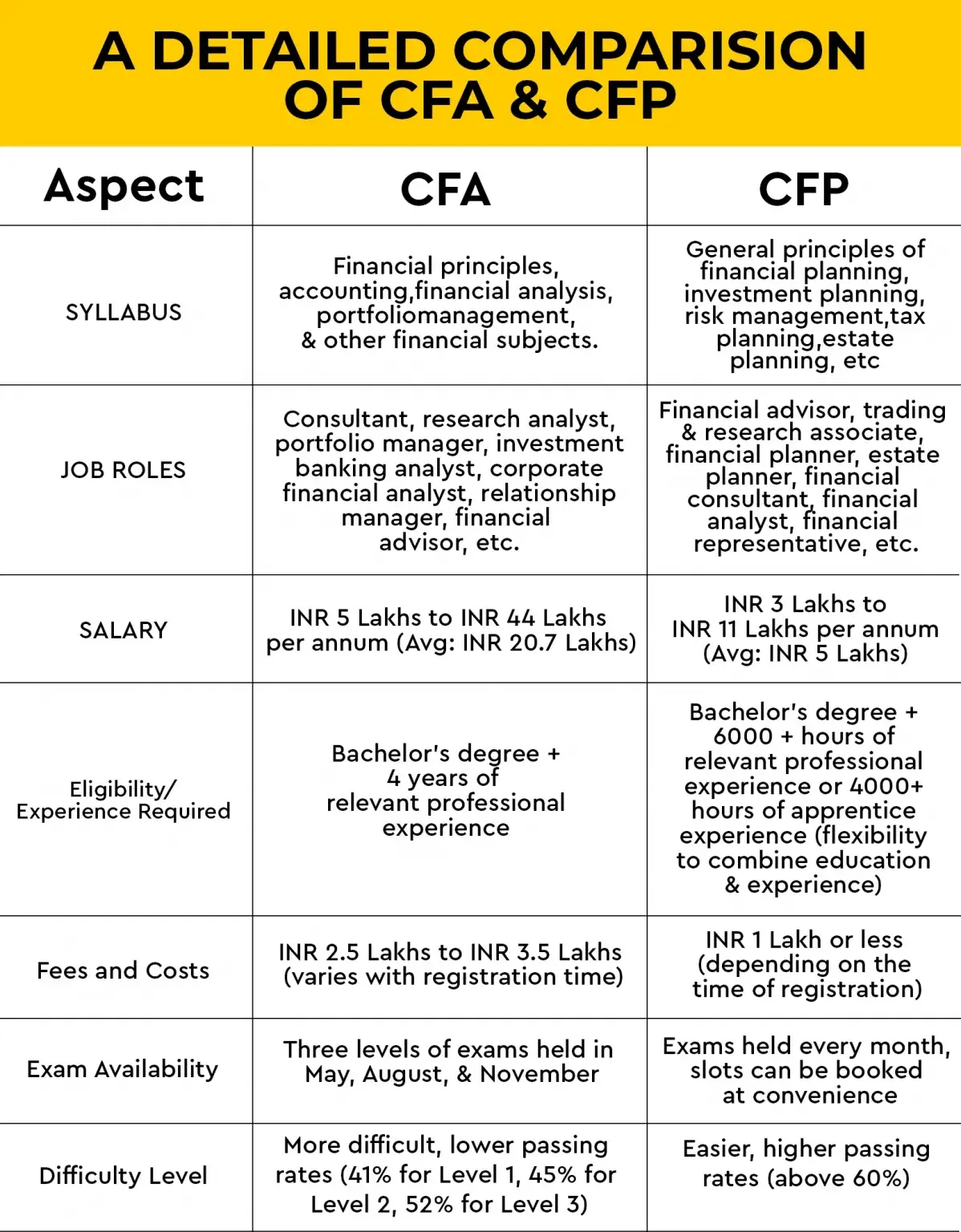

Syllabus

The CFA program includes three levels. Level I revolves around financial principles, Level II focuses on accounting and financial analysis, and Level III helps build decision-making and portfolio management skills. The other important subjects covered as a part of the CFA program include financial reporting and analysis, economics, derivatives, quantitative methods, equity valuation, fixed income, corporate finance, alternative investments, portfolio management. Etc.

The FPSB India has set a course curriculum that includes general principles of financial planning, professional conduct and regulation, education planning, investment planning, income planning and retirement savings, insurance planning and risk management, tax planning, estate planning, etc.

-

Job Roles

A CFA charter opens doors to exciting opportunities in the field of finance and investment as a consultant, research analyst, portfolio manager, investment banking analyst, corporate financial analyst, relationship manager, financial advisor, etc.

Job profiles in the CFP domain are exciting as well. With a CFP certification, you can take up roles like financial advisor, trading and research associate, financial planner, estate planner, financial consultant, financial analyst, financial representative, etc.

-

Salary

As mentioned by Livemint, CFA charter holders receive a salary in the range of INR 5 Lakhs to INR 44 Lakhs per annum, with an average of INR 20.7 Lakhs.

According to Glassdoor, CFP holders receive a salary in the range of INR 3 Lakhs to INR 11 Lakhs per annum, with an average of INR 5 Lakhs.

-

Eligibility or Experience Required

To be designated as a CFA, the candidate must complete their bachelor’s degree and have a minimum of four years of relevant professional experience. You can start your preparation for CFA from your first year in graduation. Want to know how?

To be designated as a CFP, the candidate must complete their bachelor’s degree and have a minimum of 6000+ hours of relevant professional experience or 4000+ hours of apprentice experience. However, to meet the 4-year requirement, there is flexibility to combine education and professional experience if sequential and not overlapping. You can start your preparation for CFA from your first year in graduation. Want to know how?

-

Fees and Costs

Depending on the time of registration, the official CFA exam fees fall between INR 73,000 to INR 99,000 per attempt. There is a onetime registration fee of around INR 29,000, which brings the CFA program’s total fees to range between INR 2.5 Lakhs to INR 3.5 Lakhs.

As of 2023, the standard registration period for CFA is $1200 and applies from 2nd February 2023 to 9th May 2023 and is available for Level 1, Level 2 and Level 3. The early registration fee is $900 and it applies from 14th November 2022 to 1st February 2023 applicable to Level 1, Level 2 and Level 3.

CFP is much more affordable. The entire CFP certification costs 1 lakh or even less depending on the time of registration. 0.

-

Exam Availability

Exams for the three levels of CFA take place several times throughout the year. The CFA exams in 2023 are scheduled as follows:

| May 2023 | August 2023 | November 2023 | |

| Level I | 16-22 May 23 | 22-28 August 23 | 11-17 November 2023 |

| Level II | 23-27 May 23 | 29 August – 2 September 2023 | 18-22 November 2023 |

| Level III | 29 August – 5 September 2023 |

On the other hand, exams for CFP are held every month. You can book the slot at your convenience and quickly clear the exams.

-

Difficulty Level

Hands down, CFA is a lot more difficult compared to CFP. To receive the CFA Charter, you have to clear all the 3 levels of examination. From 2013 to 2022, the average passing rate of CFA has been on the lower side.

In the last 10 years, the average passing rate of CFA has been approximately 41%, 45% and 52% for Level 1, Level 2 and Level 3 respectively. Passing CFP is much easier and the historical passing rate has been above 60%. The lesser success rate of CFA itself reflects its level of difficulty and makes it a coveted achievement for any commerce aspirant.

If you’re an undergraduate looking to kickstart your career, a CFP certification can put you on the right track. By understanding the basics of taxation, retirement planning, and investments, you can get a decent beginner-level job in the field of finance and investments.

CFA VS CFP – Enrollment Process

To enrol for CFA, follow the steps given below:

- Create an account on the official CFA website before the exam registration. To apply for a scholarship, however, one must register much earlier.

- Make the fee payment for the relevant exam applied for.

- Schedule the testing appointment.

Did you know, 84% of our students, recommend that you join Proschool for your CFA Prep

To enroll for CFP, follow the steps given below:

- Create an account on the official FPSB Board website. Fill out and complete the registration form.

- Make the payment for the registration fee.

- Schedule the testing appointment.

Did you know, Proschool’s CFP passing % is more than that of the national average?

How Do You Select Between CFA Vs CFP

Choosing between the CFA and CFP designations can be tricky. But don’t worry, some objective factors such as your career goals, personal interests, educational background and work experience together will guide you on the right path.

- Without a doubt, consider the job opportunities and salary potential for either designation along with the time and cost spent on completing the courses.

- Keep your personal references and career goals in mind, as these will majorly influence your passion towards either of the courses.

- If you are inclined towards investment management and analysis, the CFA designation would be a great fit for you.

- If you are someone more inclined towards personal financial planning and helping individuals and families achieve their financial goals, CFP might be the one for you.

- The CFA designation is held in high regard in the finance industry and can lead to a variety of job opportunities and career paths.

- CFP is focused on personal financial planning and may be a good fit for those who enjoy working with clients.

- If you’re an undergraduate aspiring to build a career in Finance, a CFP can be the right choice because the course will help you understand the basics of taxation, investment, retirement planning, insurance and much more.

- If you have good work experience and looking for a master-like course to upskill yourself, CFA fits the bill!

And yes, it is possible to achieve both – the CFA and CFP certifications which can take your expertise and qualifications in investment management and personal financial planning to a whole another level! However, a designation like CFA will demand a significant amount of time and energy while CFP will require lesser effort.

How Does IMS Proschool Equip You for Both?

With rigorous training from CFA and CFP experts at IMS Proschool, aspirants will be under the guidance of the best in the industry. The teaching methods are quite progressive, with a focus on speed, depth and accuracy. The curriculum is covered in its entirety and well in advance, allowing the students to take up revision or doubt sessions, too. Regular teacher-student interaction creates a positive, approachable environment, making the classes even easier.

Our unique course design is available online too, which makes it a lot more accessible. And finally, the all-round teaching at IMS Proschool gives you an edge over the other candidates, increasing your chances of landing a rewarding job opportunity! It is never too late to apply. Our batches start every 3 days! What are you waiting for? Apply today. We are here to guide you every step of the way!

FAQs

-

If I plan to do both CFA and CFP, which course should I do first?

In that case, you can complete the CFP designation first. This is because the CFP designation covers a broader range of financial planning topics, including retirement planning, tax planning, estate planning, and risk management. This knowledge can provide a foundation for the more specialized investment analysis and portfolio management covered in the CFA program.

The CFP designation has fewer educational requirements than the CFA, which may make it more manageable to complete while working towards the CFA designation. However, ultimately, the decision of which designation to pursue first will depend on your personal career goals and interests.

-

CFA vs CFP – How much time does it take to complete these courses?

The CFA designation typically takes an average of 4 years to complete, while the CFP designation can be completed in as little as 12 months to 18 months.

-

Do I need to have a finance background to pursue CFA and CFP courses?

No. While a finance background can be helpful, it is not a must-have. The curriculum of both these courses is designed to provide a comprehensive knowledge of all the subjects covered, regardless of your previous educational or professional background.

-

CFA vs CFP – Which is more difficult?

Yes. CFA is any day more difficult than CFP and also completing a CFA takes longer duration. Historically, only 11% of candidates are able to clear all levels of CFA. You have to sit for 5 hours at a stretch and answer all the 10 modules of CFA in one go. This requires immense concentration and mental strength.

-

CFA vs CFP – Which is more expensive?

A typical CFA attempt can cost you approximately $850. If you’re unable to clear the attempt, you have to pay the same amount again for the next attempt. On the contrary, a CFP attempt costs you as little as $72.

So, to conclude, it is advised one takes one step at a time. CFP helps in clearing your base and provides you an entry into the investment world. With a strong foundation, it is always easier to crack tougher exams such as CFA.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!