The Cost of Becoming a Certified Financial Planner (CFP) in India

Here's What We've Covered!

Think about the person you would go to for financial advice. It could be your parents, relatives, or a trusted friend. Although they may have good intentions, their advice would only be expert advice if they come from a financial background. On the other hand, a certified financial planner (CFP) is a financial expert who specialises in analysing finances, creating plans, putting strategies in place to help you achieve your financial goals, and reviewing, monitoring and redirecting the strategy as the need arises. CFPs could be the jack of all trades or the master of one. For instance, they may help you with taxes, insurance, investment, retirement planning, or estate planning or they may be a specialist in either one of these fields.

The CFP is a globally recognised and well-reputed certification. If you’re committed to stepping into ethical financial planning, CFP certification can open job opportunities for you in 27+ countries.

What Is the Eligibility for CFP?

If you have the dedication and conscience to work in the financial planning space with integrity, CFP is for you. The minimum qualification you need for undertaking the CFP exams is 50% scored in 12th standard from any recognised board.

Pathways For Becoming a CFP

The CFP certification offers distinct pathways for candidates willing to step into this field and gain the certification. They are:

Regular Pathway

- The most basic academic requirement for being a CFP is scoring 50% in 12th Standard from any recognised board.

- Next, under the regular pathway, candidates are required to pass three exams as follows; CFP Level 1 – FPSB Investment Planning Specialist, CFP Level 2 – FPSB Retirement and Tax Planning Specialist, and CFP Level 3 – FPSB Risk Management and Estate Planning Specialist. After clearing all three aforementioned exams, candidates can undertake the FPSB Integrated Financial Planning examination. Post the evaluation of their submitted financial plan, candidates become eligible for undertaking the final CFP Exams.

Also Read – Can I do the CFP Course After B.Com? Check out the pros & cons.

Fast Track Pathway

Candidates who have academic qualifications like Chartered Accountant (Inter level), from ICAI with 3-year Articleship + Bcom, Chartered Financial Analyst, from CFA Institute (USA), Certified Public Accountant from AICPA (USA), Fellow Member of Insurance Institute of India (Life/General), CA Intermediate level, CAIIB + Graduation in any discipline

Postgraduate degree in Economics, Commerce, Finance/Financial Planning from a UGC approved University, MBA (all streams) and PGDM (all streams) from an AICTE approved institution/Ministry of Education approved institution/such other Indian or Foreign institution or business school with a work experience in the financial industry can take this pathway.

Also, it is important to note that CFP Certification demands work experience from the candidates. So, no matter which pathway you’re choosing, adequate work experience in the field of finance will help you in gaining the certification.

Also Read – An In-depth Overview of The CFP Syllabus in 2025

Breakdown of Costs for Becoming a CFP

As per the CFP Board (2024), the passing rate of CFP Exams is 65%. That means, if you aspire to be a part of this statistic, disciplined preparation is a must. IMS Proschool being the official learning partner of FPSB India offers both online and offline courses that equip the students with adequate knowledge and skills to clear all the levels of CFP Examinations.

Our comprehensive syllabus, expert faculty, and prompt placement support sets us apart from the rest. Our online courses cost Rs 40,000 while the offline counterpart may cost Rs 50,000.

Next, the registration to FPSB may cost you around Rs 18,000. Remember, there are discounts available for early birds whereas a penalty is levied for the late comers. Next, the specialist exam module costs INR 6750 per module and final module costs INR 13,000 per module. The project fees for the same would be around Rs 10,500 and an annual CFP Certification fee needs to be paid of INR 10,500 for gaining the certification.Please note that the fee structure can fluctuate at the discretion of the Financial Planning Standard Board (FPSB) India.

Overall, you can safely expect to spend around 1.5 to 2 lakhs to gain the CFP Certification.

FAQs

-

How much does CFP certification cost?

The total cost for becoming a Certified Financial Planner (CFP) in India is estimated to be around INR 1.5 to 2 lakhs. This includes the fees of CFP training program (Rs 40,000 to Rs 50,000), CFP registration fees (around Rs 18,000), specialist exam module fees (INR 6750 per module), final exam fees (INR 13,000), project fees (Rs 10,500), and an annual CFP certification fee of INR 10,500. Costs may vary based on the institute and potential discounts or penalties applied by FPSB India.

-

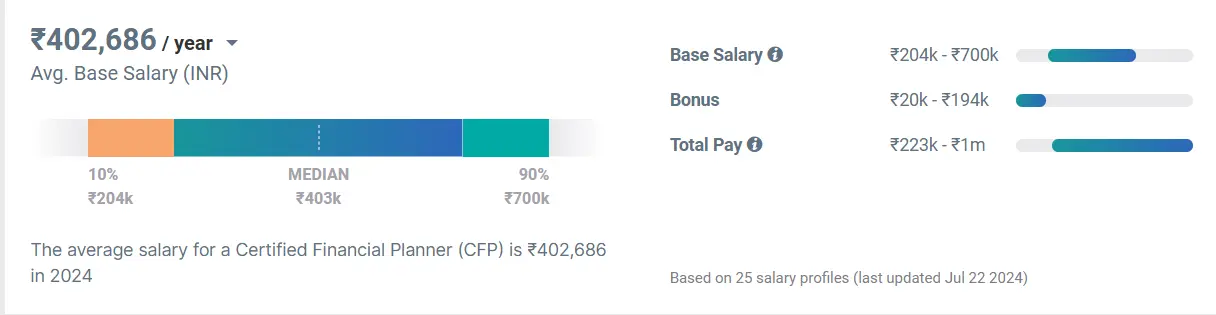

What is the average salary of a CFP In India?

A CFP in India can earn between INR 2 lakhs to INR 7 lakhs per annum, depending on factors like experience, location, and the type of employer. With more experience and specialization in fields like investment planning, retirement planning, or estate management, CFPs can command higher salaries. The salary range can also increase for those who work independently or run their own financial advisory firms.

Source – Paysacale

-

Is CFP worth it in India?

Yes, CFP certification is worth pursuing in India, especially for those looking to establish themselves in the financial planning industry. The certification is globally recognized and can open up job opportunities not only in India but also in 27+ countries.

CFPs are in demand as more individuals and businesses seek expert advice for financial planning, investments, retirement, and estate management. It also allows professionals to build trust and credibility with clients due to its ethical and comprehensive approach to financial planning.

-

Which is the best institute for CFP in India?

IMS Proschool is considered one of the top institutes for CFP training in India. It is the official learning partner of FPSB India and offers both online and offline courses that cover all levels of CFP exams.

Proschool is known for its expert faculty, comprehensive syllabus, and prompt placement support.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!