How to Grow & Shine in Your Accountancy Career with Case Studies

Here's What We've Covered!

Do you think that your accounting career needs a change? Are you stuck in the same position? The answer is simple: Your resume needs to boast of an additional skill set.

If you’ve an appetite for learning, sky’s the limit. We take examples of three profiles who have grown in their accountancy career with additional skill sets. Here’s how you can grow and shine in your accountancy career.

Case Study 1

| Ms.Varsha, works as: Senior Consultant – IFRSQualification: M.Com + IFRS

Responsibilities: Technical & process assistance for conversion from Indian GAAP to US GAAP/IFRS and vice-versa. Handle complex data such as leases, revenue recognition, stock compensation, consolidation, business combinations, and taxation, etc. |

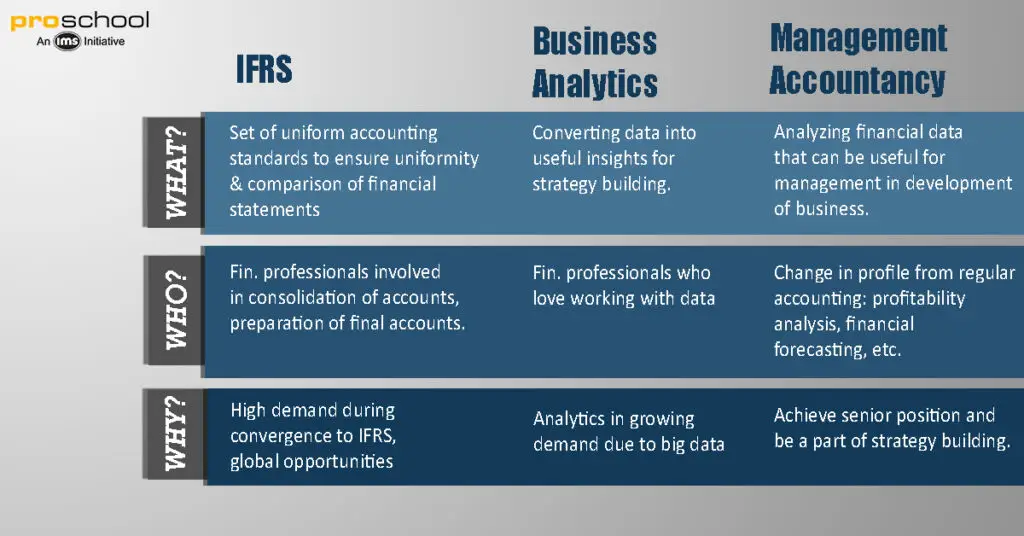

IFRS (International Financial Reporting Standards)

Accounts professionals must have already heard about the buzz of IFRS – a set of standards developed by International Accounting Standards Board. The objective is simple: to provide framework and guidelines for preparation of financial statements of public companies. The intention behind this is to reduce the differences owing to different set of accounting rules and make comparable financial statements. Currently, IFRS has been accepted by over 100 countries and countries such as India have already started implementing it.

No accountant who is involved in consolidation of financial statements can remain oblivious of IFRS. There is increasing demand of professionals who are adept in IFRS and can guide in initial phase of IFRS convergence.

Case Study 2

| Mr. Shah, works as Finance Analytics ManagerQualification & Skills: MBA (Fin), knowledge of analytical tools: SAS, SPSS, R and experienced in Data modeling and analysis.

Responsibilities: Supporting business and finance team with analytical solutions, analyzing revenue trends, financial metrics, set financial priorities. |

BA (Business Analytics)

With a tsunami of information available, it is quite difficult to deal with pounding data and how to use it. Most accountants use accounting softwares for their accounting, however, scanning this information and developing insights is impossible without learning analytical tools.

With growing ease in availability of data, it has huge potential to give you insights that will be useful in finance. It can open various avenues for you, right from financial forecasting, detecting errors to setting up financial goals. Your work might encompass accounting, maintaining vouchers & supportings, financial management, or even building strategies, BA can help you in all realms.

Case Study 3

| Mr. Pankaj, works as a Financial Control ManagerQualification: B.Com, CIMA

Responsibilities: Costing analysis, Client budget analysis, due diligence, prepare financial schedules, Price testing, etc. |

Management Accountancy

Management Accountancy differs from regular financial accounting. If you’re looking for an additional zing to add to your job profile, management accountancy is the safest bet. A perfect way to grow up in the corporate ladder is to choose management accountancy, you can shift your profile or handle additional responsibilities such as performing profitability analysis, implementing financial controls, analyzing competitiveness in the market, etc.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!