How does a CFA® designation help in entrepreneurship

Here's What We've Covered!

After CFA® Program, the usual career profiles that you would like to foray into are Investment Banking, Equity Research, and Risk Management, Stock Trading, M&A analysis or Corporate Financial Analysis. In fact, if you are already a charter holder, you may be working in one of these profiles currently. These are highly coveted career options, globally accepted and financially rewarding. Given the amount of labour and perseverance that goes into getting the charter, it is highly justified that the aspirants aim at these ultimate job roles.

However, there are few of you who want to take the roads less travelled. You are bitten by the entrepreneurial bug and wish to make a difference in this world. The first impression that comes into our mind when we talk of entrepreneurs are youngsters spending sleepless nights, making business plans, managing things on a shoestring budget and attending endless funding events. This involves a lot of struggle and rarely do charterholders want to undergo this hardship after years of preparation. But there are few who dare to do this.

First, let us understand who is an entrepreneur?

“An entrepreneur is someone who has a unique vision, a rare idea, which he wants to transform into reality. The aim of his venture is to add value to lives”.

The charter holder who wants to be entrepreneurs face a lot of reactions; some are encouraging while some are downright de-motivating. Being an entrepreneur doesn’t require any qualification, it requires a far-sighted vision, ability to plan, perseverance to execute and the courage to learn from failures. So does it help when a charter holder who is believed to be a different class of professional, aspire to be an entrepreneur? Let us find out how.

Proficiency in making corporate investment decisions:

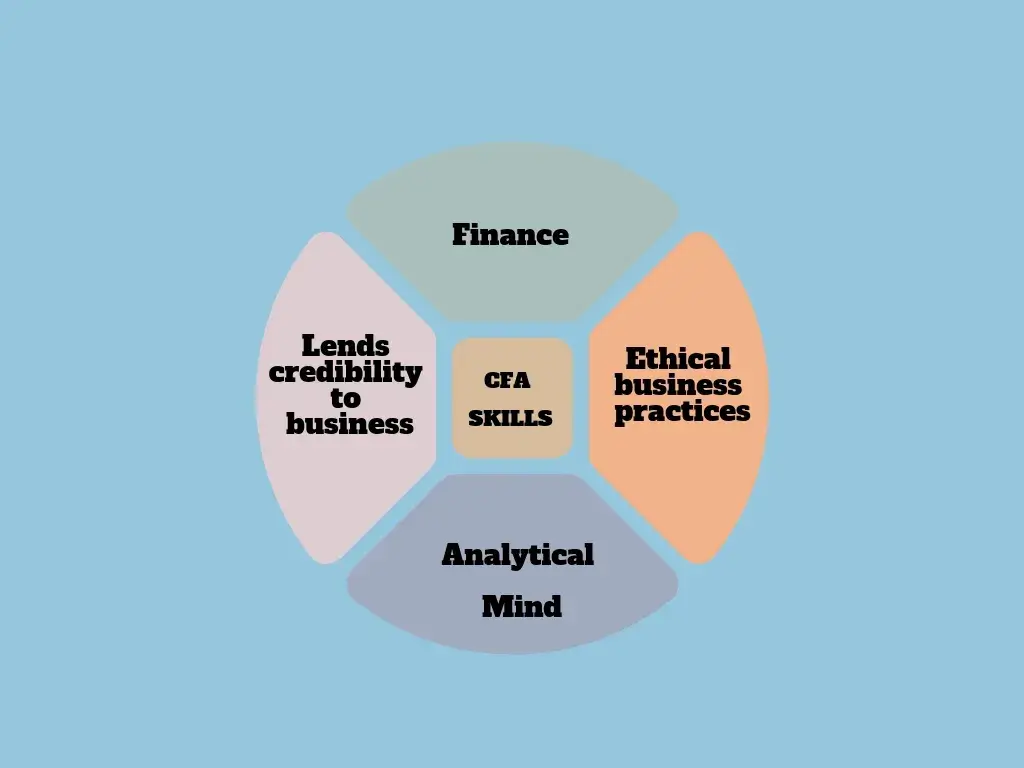

The charterholders are skilled in the field of corporate finance and investment management. Finance is the lifeblood of business and every business, whether small or medium requires efficient financial management. Cash balance, working capital, capital structure analysis, financial models for funding, are few of the areas which will benefit a lot from the expertise of a financial analyst.

A charter can manage finances well right from the beginning, and leave no scope for wastage of capital. Hence, there will be maximum utilisation of resources.

Business Ethics:

As a subject, Ethics & Integrity is given immense importance in the CFA® Program curriculum. Not just that, even your behaviour as an ethical charter holder is monitored. Ethics imply that the interests of the customers and clients must be given importance over the interest of the business. Adherence to fair practises is also equally crucial.

CFA® charterholders know well how to practise these mandates. If a start-up follows ethical business practises, it will enhance the goodwill and brand of the business.

Analytical thought process:

An entrepreneur has to wear many hats. He has to do all the activities right from the idea generation stage to arranging the resources, convincing numerous investors, product marketing, customer management and much more. All these activities require proper planning and analysis.

A charterholder is adept in analytical skills, critical thinking, problem-solving and decision making. This leads to informed decision making with increased efficiency in operations.

Lends credibility to your business:

It makes a lot of difference when a charterholder starts a venture. Everyone around the world is aware of how prestigious the designation is and the kind of respect a charter holder commands. Hence, it is easier to leave an impression in the minds of prospective investors and clients.

Being a charter it lends credibility to your company and makes it more distinguished.

The Charter accentuates your authority as an entrepreneur:

India has close to 40,000 odd startups as of today. There may be even smaller ones that can add to this number. Needless to say, all the entrepreneurs are talented and courageous enough to pursue their dreams. Being a charterholder may not be a prerequisite for entrepreneurship but it definitely helps the venture.

There is a lot that a charter brings to the table. If you have a charter, you will be adept at various areas of business management which would otherwise be difficult to grasp. Knowing the fundamentals of business and finance helps the charterholder turned entrepreneur to save time on operations and focus more on the core work.

Start-ups are fraught with failures at the initial level. After repeated failures to make a cut, it is easy for a new entrepreneur to give up. However, as a charter holder, you know the value of perseverance. You may have achieved this charter after repeated attempts and years of hard work. Being a charter, you very well know how to pick yourself up from the ashes and aim for the starts every time you fall down.

CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by

IMS Proschool. ‘CFA® Program, CFA® charterholders’ are trademarks owned by CFA Institute.

The CFA® program is truly an asset and you will be surprised to know how many doors of opportunity it can unlock for you in life.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!