Master Financial Accounting: Unlock Career Success with Essential Skills

Here's What We've Covered!

Can your company afford to add another office branch?

How much are you currently spending on research and development?

Are your budget allocations feasible in the long run?

It is the function of financial accounting to have the answers to all of the above questions. Financial accountants are the official guardians who look after the fiscal health of a company. Whether it’s transactions, investments valuations, mergers or growth rates… a competent financial accountant has all the information at the click of a button. The corporate world runs on numbers. Financial accountants ensure all those figures are recorded and maintained for posterity. They help to keep track of every monetary decision. They know the exact details of a firm’s income and expenses. And they help the company leaders make smarter, well-informed decisions.

Many businesses make poor choices when they are unable to accurately gauge their financial health. The function of financial accounting is to avoid such instances so that companies can evolve and develop in a sustainable manner.

The role of financial accounting

Companies carry out multiple tasks simultaneously. They are developing new products, expanding their national and global presence and looking for new investments, all while maintaining employee payroll. The function of financial accounting is to track and record the incoming and outgoing cash flow from various sources. How do accountants do this?

- They create summaries and reports of all financial transactions that take place within a stipulated period.

- They maintain historical financial records for audits and valuations.

- The accountants are also responsible for preparing budgets, cost-cutting measures, profit-boosting strategies and forecasting future financial requirements.

The importance of financial accounting

All companies, whether global corporations or small local businesses, understand the function of financial accounting. Certain defining factors make financial accounting vital to the success of a company. So here below are some of the tasks carried out by financial accountants.

1. Creates standard sets of rules

Financial statements are the lifeline of any business. It is imperative to maintain uniform standards to ensure consistency and accessibility. Financial accountants use industry-verified techniques and tools to ensure all reporting codes and regulations across companies follow the same protocol. In many cases, when it comes to cross-border transactions, accountants are also knowledgeable in international standards such as the IFRS so the company can expand the business globally without any hindrance.

Want to learn financial accounting? Try ACCA

Maintains financial records

If, at any given point in time, you required details of a business deal that occurred years ago, what do you do? Go to the company’s financial accountants. They maintain up-to-date and precise records of all transactions. Every receipt, invoice, purchase order and sales record is catalogued and saved. It is the function of financial accounting to help employees save valuable time and effort when trying to retrieve or access financial information.

3. Writes reports

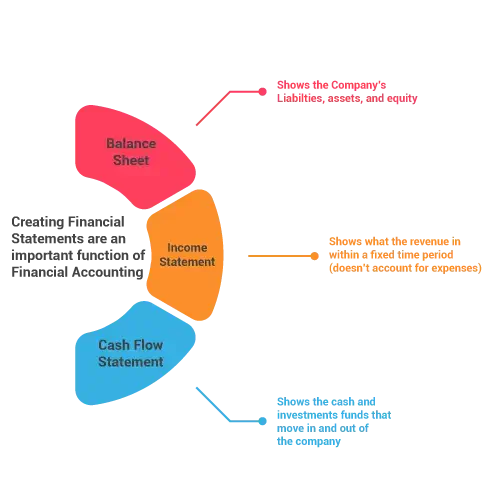

Companies are required to produce quarterly and annual financial reports about their various business activities, such as assets, expenses, profits and losses. One of the functions of financial accounting is to write these reports in a coherent and logical manner. It makes it easy for stakeholders, investors, employees and other individuals to understand.

Read – Why ACCA is the best Financial Accounting course?

4. Boosts company credibility

A business that has total control of its finances is a company many people would want to invest in. When seeking external growth opportunities, firms may need to showcase their financial assets and liabilities. The financial reports will shine a light on all transactions with total transparency and credibility.

5. Offers insights to management

Financial accountants have a clearer picture of the company’s finances. They are able to understand how the business operates and how funds are utilised. They are also able to spot unnecessary expenses or losses. Based on their findings, they can recommend changes and adjustments to the higher managers to optimise company performance. Improving productivity is also a function of financial accounting.

5 skills that help you understand the function of financial accounting

- Technical training in globally recognised accounting practices and regulatory standards.

- High proficiency in accounting software to create financial statements, reports and tax returns.

- High level of communication skills to write financial statements articulately and effectively.

- A sharp and analytical mind to help you process financial information along with any irregularities or anomalies.

- Time management skills to meet deadlines and deliver all statements and reports as per schedule.

Read – Financial Accounting vs. Managerial Accounting: A Comparison

The ACCA course enables you to become a financial accountant

The ACCA program is a powerhouse certification that helps you understand the function of financial accounting in business. The syllabus is packed with core subjects, techniques and industry-centric skills that make you a globally recognised financial accountant. Students who have done this course have gone on to join big financial firms and leading companies that include the Big 4, Wipro, Tata, Asian Paints, ICICI, and IBM, to name a few. So what makes the ACCA program special and revered? Here are some of the highlights of the syllabus.

- Financial reporting

- Double entry and accounting systems

- Creating and decoding financial statements

- Recording transactions

- Understanding qualitative features of financial data

- Standards and regulations compliance

- Subjects include:

- Business technology

- financial accounting

- audit and assurance

- strategic business reporting

- performance management

About Proschool’s GPA course for ACCA certification

To understand the function of financial accounting, you need a comprehensive coaching class that will simplify core subjects and concepts for you. As one of India’s finest coaching institutions, IMS Proschool is known for its efficient and innovative teaching methods. Students receive hands-on training and practical lessons to help them navigate the industry better. The faculty consists of some of the best accountants in the business who are only too willing to share their collective experience and knowledge with the students. As the field is highly competitive, and jobs in MNCs and leading companies are few, it is crucial to receive a well-rounded, world-class education that helps you ace your interviews. Proschool ensures every student learns the function of financial accounting and becomes an expert in their own right.

Course highlights:

- Proschool offers two variants of the GPA program — one for undergraduates and one for graduates.

- The practical active learning methods help students grasp the subjects.

- Classes are available in centres across India as well as online.

- There are additional resources for learning, such as mock tests, practice papers, online videos and prep books.

- There are 13 subjects and 3 levels to clear.

- The institute also offers 100 per cent placement assistance and interview grooming lessons.

- You receive an NSDC certification on completing the course.

- You can also pursue financial modelling along with your ACCA Course at Proschool.

In conclusion

It’s easy to see how relevant the function of financial accounting is in the corporate world. Companies depend on accountants to help them understand their finances better. The ACCA is one of the world’s most prestigious accounting qualifications and can ensure you are a shoo-in at the organisation of your choice.

Click here to learn more about the ACCA Course

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!