Financial Modeling an important tool for MBA students?

Here's What We've Covered!

Rahul, an MBA graduate studying at a leading B-school in Mumbai, aspires for corporate roles after completing his course. His dream job, like most of his peers, is working in a top notch investment bank. He is specifically targeting the role of either a Merger and Acquisition specialist or an equity / credit research analyst. Rahul in this sense represents the typical profile of an aspirational MBA with a specialization in Finance.

An MBA graduate, irrespective of the role that he takes up after graduation, will find himself dealing with spreadsheets. MS – Excel is widely used for financial analysis across the industry. As an MBA graduate, he would be expected to have not just working knowledge but a fairly advanced knowledge of MS – Excel, including financial modeling.

As a part of the MBA curriculum, students are introduced to advanced concepts of corporate finance and other theoretical aspects of the financial services industry. Some curriculums do introduce MS – Excel but the concepts remain at beginner level. This leads to a distinctive mismatch between the advanced knowledge of financial theory and the practical experience of working with MS – Excel. Inevitably, corporate managers complain that fresh MBA graduates are not completely ready for corporate jobs. Clearly, spreadsheet modeling is a skill that MBA graduates are expected to possess when they apply for corporate jobs.

Why is excel modeling so important? As a manager, a substantial portion of any MBA graduate’s role is decision – making. Managers are expected to understand complex business processes and provide inputs to the senior management to aid in the process of decision making. While studying these business aspects, managers face numerous challenges on how the different aspects of business are interacting with each other. If these interactions are organized in a structured manner, process understanding is simplified, leading to faster decisions.

Spreadsheet modeling helps in transforming the business decision making process into an organized structure. There are multiple variables that impact any business. Each variable can be individually introduced into the model and the impact of the variable in the overall decision making can be studied.

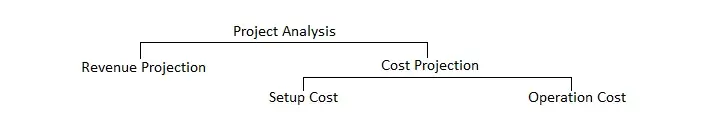

For example, Rahul may be entrusted with the task of analyzing if a new project needs to be taken up. The analysis of this project will involve building a financial model that will include forecasts of the revenues expected from the project. On the cost aspect, both the initial setup cost (Capital expenditure) and recurring operational cost will be included. Finally both the revenue and cost aspects are combined to calculate profitability.

Estimates of the revenue and cost will depend on factors that are both internal and external to the firm. Based on the profits generated and the money invested, the profitability of the project will be assessed. Using the model, the impact of each of the inputs (cost and revenue) on the profitability can also be studied. This analysis is extremely critical in figuring out the key inputs that will impact the project and these can then be prioritized appropriately. With important parameters identified, the senior management can focus their energies on these inputs.

MBA graduates will find that a strong base in spreadsheet (MS – Excel) modeling will complement their theoretical finance knowledge and help them achieve success throughout their corporate journey.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!