Top 5 reasons for the growing importance of CIMA professionals in India

Here's What We've Covered!

The CIMA salary survey of 2016 shows the increasing demand for CIMA professionals in India. Earlier, the corporates operating in India were enamoured only by Chartered Accountants or Cost Accountants, but after awareness about the practical and holistic curriculum of CIMA, they perceive things in new light. Sectors such as legal services, KPOs, BPOs & shared services as well as manufacturing have warmed up to the management accounting roles and they are seeking talented professionals with expertise.

Apart from the curriculum and expertise that has helped CIMA to find its footing in India, there are other industry specific factors also that has led to the surge in preference for global CIMA professionals in the country. Let us explore few of the reasons why Corporate India is gradually becoming a flourishing ground of management accountants-

(1) Growth of KPOs in India:

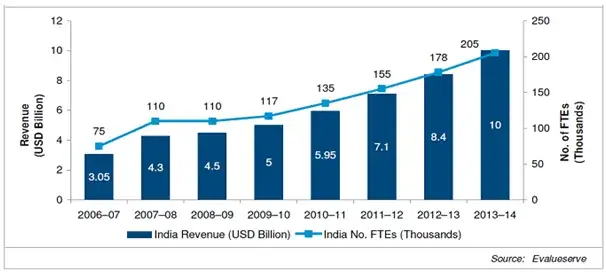

Owing to its large pool of specialized and talented professionals, India has emerged as a growing centre for Knowledge Process Outsourcing (KPOs). According to ASSOCHAM, the India accounts for 70% of the global KPO sector and a major chunk of the services is dominated by the financial sector. A study by Evalueserve, a leading KPO, shows the growth trend of KPOs since 2006. From a revenue of $3.05 billion and 75 full time employees (FTEs) in 2006, the sector has grown to one earning $10 billion in revenue with 205,000 FTEs in 2013-14. ASSOCHAM predicted the market to touch $30 billion by 2015-2016. With a growth at this pace, it is evident that KPOs will continue to be in need of expert professionals with theoretical as well as practical knowledge of global Finance & Accounting concepts.

(2) More Indian companies going abroad

By global economy we don’t just mean companies from western countries starting their operations in India. Not only IT companies, even Indian financial and manufacturing firms have made a foray overseas and most of them have also tasted success. SBI Capital has set up shop in Singapore, while Kotak Mahindra, Anand Rathi and JM Financial have entered into alliances to strike cross border deals. Smaller investment banks like Avendus, Religare and o3 Capital also have their offices in New York, London and Singapore. Overseas operations require professionals with a knowledge of global financial and management systems and CIMA members are truly cut out for it!

(3) Adoption of IFRS in India

In a move to enable uniform financial reporting, most countries are converging their standards towards IFRS or adopting IFRS as they are. India, has also got a step closer to convergence with IFRS, and adopted IND-AS. This would make it easier for companies to compete abroad, raise capital and to win global contracts by providing consistent and comparable financial details. With this, increasing number of firms are seeking professionals with a good knowledge of global reporting standards so as to undergo a smooth transition in financial reporting.

(4) Need for fast decision making skills

We live in a world of data overload. With so much of data available every minute, fast decision making becomes imperative, else the company may miss out on many profitable moves. The curriculum of CIMA, is not just focused on plain accounting knowledge but is skewed towards Strategic Planning and Decision making. This equips management accountants to think on feet, review each situation analytically and take quick decisions.

(5) Cost management: Need of the hour

Most of the businesses are growing profitable these days not by increasing revenues but by managing the cost. Automobile is one of the best example for this. Most of the automobile companies optimize costs by improving raw material sourcing, reducing manufacturing assets and investing in alternative renewable energy sources. Tata Motors is one of the leading employers of CIMA because management accountants are trained to take the best course of aon in critical situations like this.

CIMA professionals are the flag bearers of future in corporate India

Business today is much more complex than what it was a couple of years back. Dynamic management techniques and decision making skills are required to navigate these choppy waters. However, it’s a bitter truth that the existing professionals in India still have a long way to go as far as these techniques are concerned. Most of the methods followed are archaic and static. In other words, there is a serious lack of specialised managers. But the good news is, companies have realised the need of the hour and are making every attempts towards a matured planning and decision making process. Increased demand for CIMA professionals in the country is the biggest indication of this.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!