A Brief on Actuary Jobs – Roles & Responsibilities & Career Opportunities

Here's What We've Covered!

Are you interested in pursuing actuary jobs in India? Actuaries play a crucial role in the insurance industry, as well as in finance, healthcare, and other sectors. Their work involves analyzing data and using statistical models to assess and manage risk.

In this blog post, we will provide you with a brief overview of actuary jobs, including their roles and responsibilities and career opportunities available in India. If you are considering a career in actuary jobs in India, this post will provide you with valuable insights into this dynamic and rewarding field.

So, let’s dive in and learn more about the exciting world of actuary jobs in India! Whether you are a student or a professional looking for a career change, this post will give you a clear idea of what to expect in the field of actuary jobs.

Importance of actuary jobs in the financial industry

Actuary jobs play a crucial role in the financial industry. These professionals are responsible for assessing and managing financial risks, which is becoming increasingly important in today’s complex and volatile economic environment. As a result, there is a growing demand for actuary jobs in India and worldwide.

Actuary jobs in India are highly valued, and those who pursue this career path can expect to be well-compensated. Actuaries are highly sought after by insurance companies, banks, and other financial institutions. This is because their expertise in risk management can help these organizations make more informed decisions about their operations.

As the demand for actuary jobs continues to grow, so does the supply of qualified professionals. Many universities in India now offer actuarial science programs, which provide students with the necessary knowledge and skills to pursue a career in this field. Additionally, there are several professional organizations that offer certification and training programs for aspiring actuaries.

Overall, actuary jobs in India offer a great deal of potential for those who are interested in the financial industry. Whether you are just starting out or looking for a career change, this field offers a wide range of opportunities for growth and advancement. So if you have a knack for numbers and a passion for risk management, consider exploring the exciting world of actuary jobs in India.

Actuaries play a critical role in the financial industry. They are responsible for assessing and managing financial risks in various sectors, such as insurance, banking, and investments. In recent years, the demand for actuary jobs in India has been on the rise, with an increasing number of companies seeking to hire skilled professionals in this field.

The importance of actuary jobs lies in their ability to provide companies with valuable insights into potential risks and their impact on financial performance. Actuaries use complex mathematical models and statistical analysis to analyze data, identify trends, and make predictions about future outcomes. As a result, they help companies make informed decisions about investments, pricing, and risk management strategies, which can significantly impact the business’s success.

Regarding demand and supply, there has been a shortage of skilled actuary professionals in India in recent years. This shortage is primarily due to the need for more awareness about the profession and the complex and technical nature of the work. However, with the increasing demand for actuary jobs in the financial industry, there is a growing need for professionals with the right skill set to meet the market’s requirements.

According to industry reports, the demand for actuary jobs is expected to grow in the coming years. As businesses focus more on managing financial risks, the need for skilled actuary professionals will only increase. In addition, with the growing trend of digitization and automation, actuary jobs are also likely to evolve, creating new opportunities for professionals in this field.

Now let us understand more about Actuary? What is it and what purpose does it solve in the industry?

What is an Actuary?

Actuaries are professionals who analyze financial risk and uncertainty using mathematical and statistical models. They are experts in risk management and are employed in various industries, including insurance, finance, healthcare, and more. Here, we will explore the purpose of an actuary and their importance in the financial industry.

The Purpose of an Actuary

Actuaries use their analytical and problem-solving skills to assess the likelihood of future events and their financial impact. They apply their expertise to create models that help organizations manage financial risk and uncertainty. Actuaries are responsible for evaluating the financial implications of various scenarios and developing strategies to minimize risk.

Actuaries use various techniques to analyze data and create models. For example, they may use statistical methods, such as regression analysis, to identify patterns and trends in data. They may also use probabilistic models to predict future events. In addition, actuaries work closely with other professionals, including economists, accountants, and underwriters, to develop comprehensive risk management strategies.

Roles and Responsibilities of Actuaries

Actuaries are professionals who specialize in analyzing and managing financial risks. They work with complex mathematical models to help businesses make informed decisions about investments, insurance, and other financial matters. Today, we will discuss the roles and responsibilities of actuaries, the skills required to become an actuary, and the job duties and responsibilities of an actuary.

Actuaries play a critical role in the financial industry. Some of the key responsibilities of actuaries include:

- Risk Analysis: Actuaries use their knowledge of mathematics, statistics, and finance to analyze and evaluate financial risks. They use complex models to analyze future events’ probability and impact on a company’s financial position.

- Financial Planning: Actuaries work with businesses to develop financial plans that minimize risk and maximize profits. They help companies develop investment strategies, plan for retirement, and manage insurance portfolios.

- Pricing and Product Development: Actuaries work with insurance companies to determine the pricing of insurance products. They use data analysis and mathematical models to calculate the risks associated with different policies and choose the premiums customers should pay.

Skills Required to Become an Actuary:

Becoming an actuary requires a strong foundation in mathematics and statistics. Here are some of the key skills required to become an actuary:

- Analytical Skills: Actuaries must be able to analyze and interpret complex data. They need to be able to identify patterns, draw conclusions, and make informed recommendations.

- Mathematical Skills: Actuaries must have a strong understanding of mathematical concepts and be able to apply them to real-world problems.

- Communication Skills: Actuaries must be able to communicate complex information to non-technical stakeholders. They need to be able to explain their findings and recommendations in clear and concise language.

Job Duties and Responsibilities of Actuaries:

The day-to-day responsibilities of actuaries can vary depending on their specific role and industry. However, some of the common job duties and responsibilities of actuaries include:

- Collecting and Analyzing Data: Actuaries collect and analyze data to identify trends and patterns. They use this information to make predictions and develop recommendations.

- Developing Models: Actuaries develop complex mathematical models to analyze risks and make financial predictions. They use these models to develop investment strategies, determine insurance premiums, and plan for retirement.

- Presenting Findings: Actuaries need to be able to communicate their findings to non-technical stakeholders. They prepare reports, presentations, and other materials to explain their analysis and recommendations.

Career Opportunities for Actuaries in India

Are you good at math, statistics, and problem-solving? Do you want to pursue a challenging and rewarding career that offers high salaries, job security, and growth opportunities? If yes, then you may consider becoming an actuary.

Actuaries are professionals who use mathematical and statistical methods to assess and manage financial risks and uncertainties. They work in various industries and sectors involving insurance, finance, investments, healthcare, government, etc. Actuaries help businesses and organizations to make informed decisions based on data and analysis.

If you are interested in actuary jobs in India, you may wonder about the job market for actuaries and the various industries and sectors that employ them. Here is some information that may help you.

Job market for actuaries in India:

According to the Institute of Actuaries of India (IAI), the demand for actuaries in India is growing rapidly, and the supply is limited. As per the latest data, there are around 2,000 qualified actuaries and 5,000 actuarial students in India. However, the requirement for actuaries is much higher, and the gap is expected to widen in the future.

The reasons for the increasing demand for actuaries in India are:

- The expansion of the insurance industry and the introduction of new insurance products and services that require actuarial expertise.

- The rise of financial planning and investment management services that need actuarial analysis for risk assessment and portfolio optimization.

- The emergence of healthcare financing and social security schemes that require actuarial modeling for cost projections and benefit design.

- The regulatory requirements for actuarial valuation and reporting of insurance and pension liabilities, as mandated by the Insurance Regulatory and Development Authority of India (IRDAI) and the Pension Fund Regulatory and Development Authority of India (PFRDA).

The job market for actuaries in India is relatively small but growing, and the opportunities are diverse and rewarding. Actuaries can work in various roles and domains, such as:

- Life insurance

- General insurance

- Health insurance

- Reinsurance

- Investment management

- Risk management

- Employee benefits

- Pension funds

- Government agencies

- Consulting firms

Industries and sectors that employ actuaries in India:

Here are some examples of industries and sectors that employ actuaries in India and the types of jobs available:

- Life insurance: Actuaries in life insurance companies use mortality tables and other actuarial methods to calculate the premiums, reserves, and benefits of life insurance policies. They also design new products, analyze the portfolio’s profitability and risk, and monitor policyholders’ experience.

- General insurance: Actuaries in general insurance companies apply statistical and mathematical models to estimate the frequency and severity of claims and the reserves and premiums needed to cover them. They also evaluate the risk exposure of various lines of business and design pricing and underwriting strategies.

- Health insurance: Actuaries in health insurance companies use actuarial techniques to predict the utilization and cost of healthcare services and the premiums and reserves needed to support them. They also analyze policyholders’ health status and behavior and design wellness and disease management programs.

- Reinsurance: Actuaries in reinsurance companies assess the risk exposure and pricing of large and complex insurance policies, such as catastrophe bonds, aviation insurance, or marine insurance. They also help manage the reinsurer’s and its clients’ capital and solvency.

- Investment management: Actuaries in investment management firms use quantitative methods to evaluate the risk and return of investment portfolios, such as equities, bonds, derivatives, or alternative assets. They also develop asset-liability management (ALM) models to match the cash flows and risk profiles of the investments with the clients’ liabilities, such as pension funds, endowments, or sovereign wealth funds.

- Risk management: Actuaries in risk management departments of corporations or banks use risk assessment tools and methodologies to identify, measure, and monitor the risks of the business, such as credit risk, market risk, operational risk, or strategic risk. They also advise senior management on risk appetite, tolerance, and mitigation strategies.

- Employee benefits: Actuaries in employee benefits consulting firms or departments of corporations design and manage various employee benefit plans, such as retirement plans, health plans, disability plans, or leave policies. They use actuarial techniques to ensure the plans’ adequacy and sustainability and comply with the regulatory and accounting standards.

- Pension funds: Actuaries in pension funds analyze and manage the financial risks and obligations of the pension plans, such as defined benefit plans, defined contribution plans, or hybrid plans. They use actuarial assumptions and models to estimate the plans’ liabilities, assets, contributions, and expenses and provide funding and investment strategies.

- Government agencies: Actuaries in government agencies, such as the IRDAI, the PFRDA, the Reserve Bank of India (RBI), or the Ministry of Finance, use actuarial analysis to regulate and supervise the insurance, pension, and banking sectors. They also provide technical support to policymakers and legislators on social security, public finance, and macroeconomic stability.

- Consulting firms: Actuaries in consulting firms provide actuarial services to various clients, such as insurers, banks, corporations, governments, or non-profit organizations. They use their expertise to solve complex problems, such as mergers and acquisitions, capital management, litigation support, or enterprise risk management.

How to Become an Actuary

Are you interested in pursuing a career as an actuary in India? But still figuring out the way to become one? Then, we are here to help you out!

Educational Requirements:

To become an actuary in India, one must have a strong foundation in mathematics, statistics, and finance. Most employers prefer candidates who have completed a bachelor’s or master’s degree in these fields from a recognized university. Some popular degree courses for aspiring actuaries are B.Sc. (Actuarial Science), B.Com. (Actuarial Science), M.Sc. (Actuarial Science), and MBA (Actuarial Science). You can also pursue courses like financial modeling or financial analytics by premium institutions like IMS Proschool, which provides NSE Certification to validate your skills. They also provide you with additional Certification In Equity Research, which can also be upgraded to AICTE Approved PG in Equity Research to broaden your career scope in finance.

Besides the academic qualifications, candidates must pass a series of actuarial exams conducted by the Institute of Actuaries of India (IAI). The IAI is the professional body of actuaries in India, and it offers a comprehensive syllabus and study material for the actuarial exams. The exams cover various topics, such as probability theory, financial mathematics, statistics, economics, risk management, and insurance. To become a fellow of the IAI, one needs to pass all the exams and gain practical experience in the field.

Certification Process:

The certification process for actuaries in India is rigorous and challenging. It involves passing a series of exams and gaining practical experience in the field. The IAI conducts a total of 15 exams divided into three stages: Core Technical, Core Application, and Specialist Technical.

The Core Technical stage includes eight exams that cover the basic principles and techniques of actuarial science.

The Core Application stage includes three exams that focus on the application of actuarial science in real-life scenarios.

Finally, the Specialist Technical stage includes four exams that allow candidates to specialize in a particular area of actuarial science, such as life insurance, general insurance, health insurance, or enterprise risk management.

In addition to passing the exams, candidates need to complete a certain amount of practical experience in the field. Therefore, the IAI requires candidates to complete at least three years of work experience in an actuarial role under the supervision of a fellow of the IAI. The work experience should involve the application of actuarial principles and techniques in solving business problems and making strategic decisions.

Salary and Compensation for Actuaries

Are you curious about the salary and compensation packages for actuaries in India? As an actuary, your expertise in risk management and financial planning is highly valued, and you can expect to receive a competitive salary and compensation package. Now, we will discuss the average salaries and compensation packages for actuaries in India and the factors that affect their salaries.

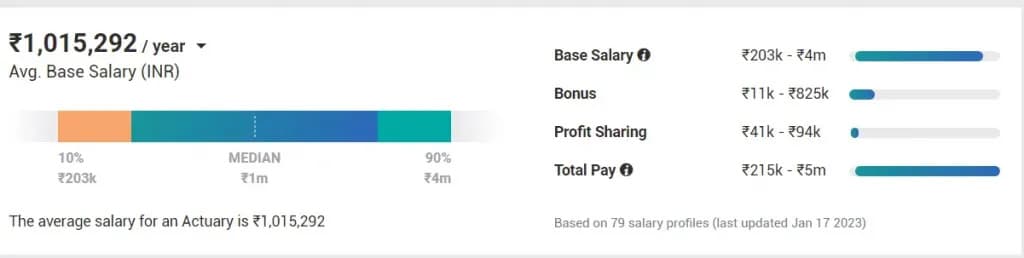

Average Salaries and Compensation Packages:

According to payscale.com, the average salary for an actuary in India is around INR 8,93,000 per year. However, the salary range varies from INR 4,25,000 to INR 26,00,000 per year, depending on factors such as experience, qualifications, and industry. Apart from the base salary, actuaries in India can expect additional benefits such as health insurance, retirement plans, bonuses, and paid time off.

Factors that Affect Salary and Compensation:

Various factors, such as experience, qualifications, industry, and location, influence the salary and compensation of an actuary in India. Let’s explore some of these factors in more detail:

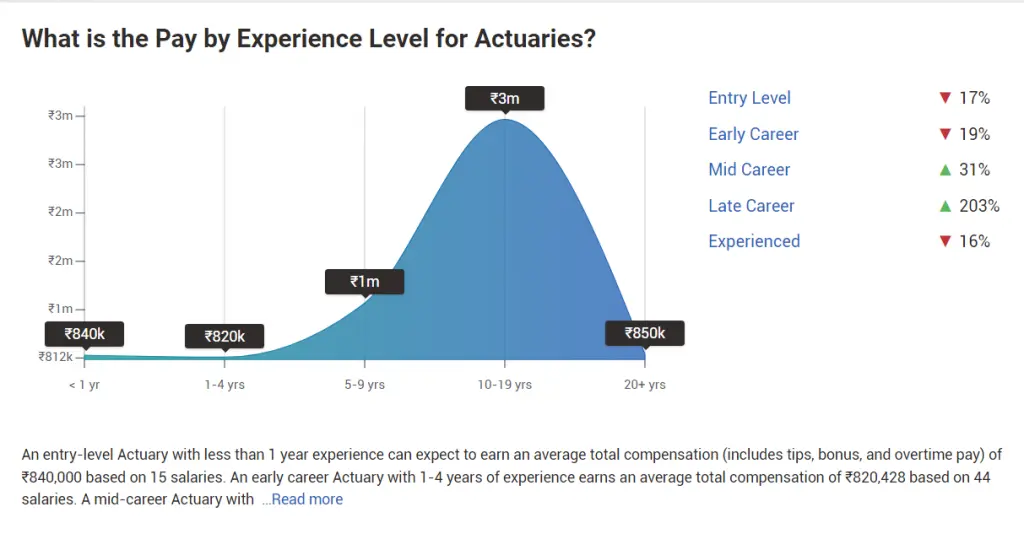

- Experience: As with any profession, the more experience you have as an actuary, the higher your salary is likely to be. According to a report by the Society of Actuaries (SOA), actuaries with five or more years of experience in India can earn up to INR 2,500,000 per year.

- Qualifications: The educational qualifications of an actuary also play a significant role in determining their salary. Actuaries with advanced degrees, such as a master’s or a PhD, can expect to earn more than those with just a bachelor’s degree.

- Industry: The industry in which an actuary works can also affect their salary. For example, actuaries working in the insurance industry tend to earn more than those in other sectors, such as finance or healthcare.

- Location: The location of an actuary’s job can also impact their salary. Actuaries working in metropolitan cities like Mumbai, Delhi, or Bangalore earn more than those in smaller cities or towns.

Conclusion

Actuary jobs are highly valued in the financial industry, and the demand for skilled actuaries is expected to grow in the coming years. In addition, as businesses face increasing economic uncertainties, actuaries are crucial in helping them navigate these challenges and make informed decisions.

For readers who want to learn more about actuary jobs in India, we recommend exploring the financial modeling course offered by Proschool. They teach you how to build 6 financial models using the practical based approach of teaching by top industry experts. Not just that, they also offer NSE certification and make you job ready. In addition, other professional organizations and associations, such as the Society of Actuaries, also provide resources and support for aspiring and practising actuaries.

In conclusion, actuary jobs in India offer a promising career path with many opportunities for growth and advancement. By developing the necessary skills and qualifications and staying up-to-date with industry trends, you can carve out a successful career in this exciting field.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!