Which is better – ACCA Or CIMA?

Here's What We've Covered!

ACCA and CIMA certifications help you in building an impressive career in the finance industry. However, I would suggest you evaluate both options thoroughly before making a decision. Therefore, let us understand what are the prospects and scopes offered by the two in more details below.

WHAT IS ACCA?

The first question that should come in your mind is – what is ACCA? So, ACCA is a globally accredited multi-level certification program that is primarily focused on educating students who have a special interest in the fields of accountancy, taxation, and auditing. The ACCA certification is offered by a reputed global professional accounting body, the Association of Chartered Certified Accountants (ACCA). Over the decades, students who have successfully completed the program have landed good accounting jobs in respectable multinational organizations. Headquartered in Glasgow (UK), ACCA was founded in 1904 with the objective to help aspiring accounting professionals to refine their accounting skills, capabilities, and knowledge.

WHY SHOULD ONE PURSUE ACCA?

Now, let us move to the benefits of pursuing ACCA certification. Well, as an ACCA professional you will become part of a large global community of skilled accounting professionals which counts more than 208,000 members and 503,000 students spread across 179 countries. The ACCA certification will open door to a plethora of global opportunities as the community can hook you up with more than 7,400 approved employers and 80 accountancy partners globally. So, in case you are seeking a bright career path in accounting, then you should definitively consider ACCA as a good option for you. Besides the core areas of accounting, taxation, and auditing, the course also lets you explore other concepts pertaining to business studies, financial management, financial reporting, law, and ethical & professional standards. In fact, the course offers you the flexibility to select your specialization only when you are comfortable to pick your field of interest during the course curriculum.

WHAT IS CIMA?

Now, let me walk you through the CIMA certification offered by the Chartered Institute of Management Accountants (CIMA). The program offers a master’s degree in the field of management accountancy and other subject areas relevant for accountants working in the industry. Founded in 1919, the body was formed with the objective to promote education with new techniques and spread the new practices among the community of management accountants. The CIMA professionals are guided by ensuring regulations that ensure that the members follow its disciplinary code and maintain the decorum that sets them apart in the industry.

WHY SHOULD ONE PURSUE CIMA?

Now, let us discuss the scope of CIMA certification. If you are interested in management accounting, then CIMA is the perfect course for you as it is custom made for candidates who share a keen interest in the fields of business and management. As a CIMA professional you will have one of the best launch pad for your career because the program offers a wide range of career options, not only in the finance industry but even outside it. Today CIMA connects you to a network of more than 677,000 spread across 100 countries. The CIMA certification lays great emphasis on the development of your overall strategic business skills that helps you in exploring career options beyond the finance profiles. CIMA can boast of the feat that it is one of the very few accountancy bodies that primarily focuses on business needs in its entirety.

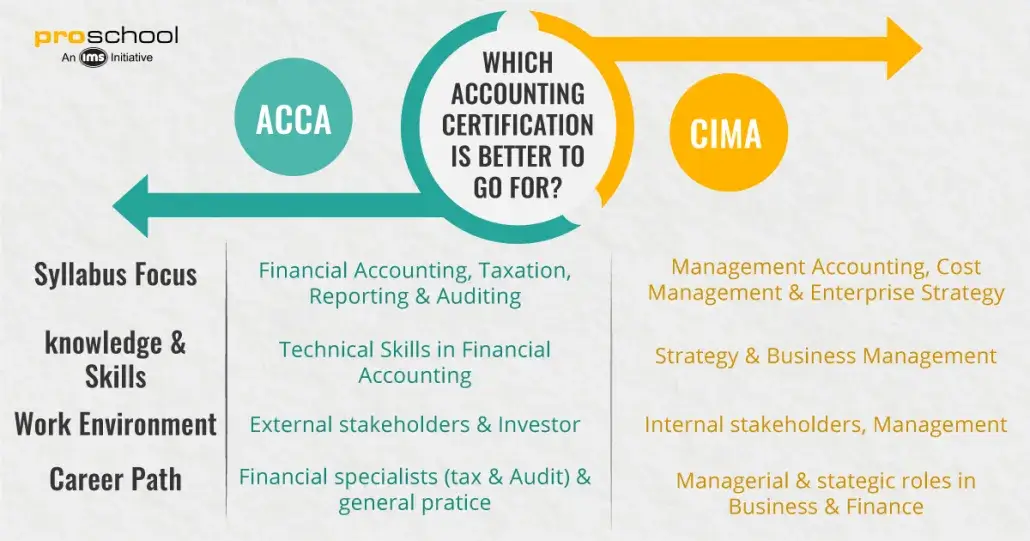

HEAD TO HEAD COMPARISON BETWEEN ACCA AND CIMA

Now, let us look at the head to head comparison between an ACCA certification and a CIMA certification:

Organizing body: Although both the organizing bodies are from the UK, the ACCA certification is issued by the Association of Chartered Certified Accountant, while the CIMA certification is offered by the Chartered Institute of Management Accountants.

Duration of course: Now, when it comes to the duration of course, both the courses take more or less the same amount of time. For ACCA certification you will need to clear 14 professional examinations along with 3 years of supervised accountancy experience, which eventually comes to be around 3 years if you are able to manage your work and studies simultaneously. On the other hand, CIMA certification also requires you to have 3 years of relevant work experience to go with the successful completion of the 16 papers. So, even in this case, you will be able to complete the program in 3 years if you are good at balancing both work and studies.

Modus operandi: As an ACCA you are expected to be an expert in the field of accounting and finance, while a CIMA acquires expertise not only in the field of accountancy but also in decision making because the course is a mix of MBA and accounting.

Cost: Both the certification courses again go hand in hand in case of course fee too. To become an ACCA personal you will need to spend around $2,500 – $3,000 which is basically the same for CIMA certification. So, you can probably say that either they are equally expensive or equally inexpensive.

Job opportunities: As an ACCA you will be able to land various job profiles that include Accountant, Tax Management, Internal Auditor, Financial Consultant, and Finance Manager. On the other hand, after your CIMA certification, you will be fit for the roles of Management Accountant, Forensic Analyst, Business Analyst, Finance Controller, and Project Manager.

CONCLUSION

So, it can be said that both the above-mentioned finance certifications will help you secure some of the sought after job profiles in the finance and accounting industry. However, each of the certification programs caters to some specific job profiles and it is you who has to decide which course fits into your scheme of things. I hope this article has given you some perspective about the career scopes offered by ACCA and CIMA.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!