Using financial analysis ratios for determining company strength

Here's What We've Covered!

You aspire to be one of the top financial analysts and are unable to figure out which course to opt for. What would you do? You will surf the internet, discuss with your peers, ask your mentors, scan career guidance books etc. So now at least you have a list of 5-6 courses. But you can enrol for just one of them, what do you do? The next logical step would be to sit and compare those courses with each other against the backdrop of various parameters such as industry relevance, duration, fees, eligibility etc and reach a decision. Isn’t it?

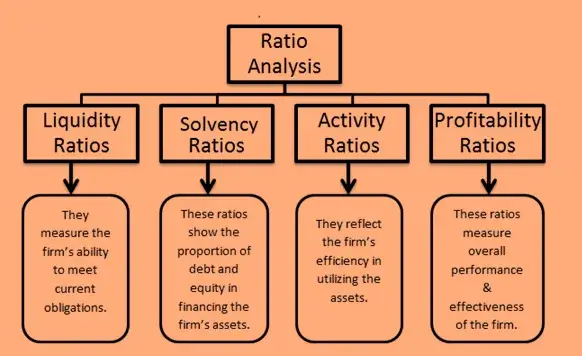

Well, analysing the health of a company and taking investment decisions is also quite similar. You need to compare various items of the financial statements against one another and derive a conclusion. This exercise is called Ratio Analysis. Though it might sound quite intimidating, actually it is quite a simple process.

Financial ratios can be divided into 6 main categories for better analysis. They are (1) Common Size (2) Activity (3) Profitability (4) Liquidity (5) Solvency (6) Valuation

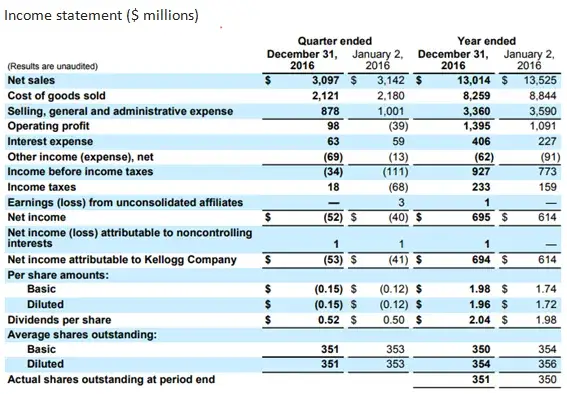

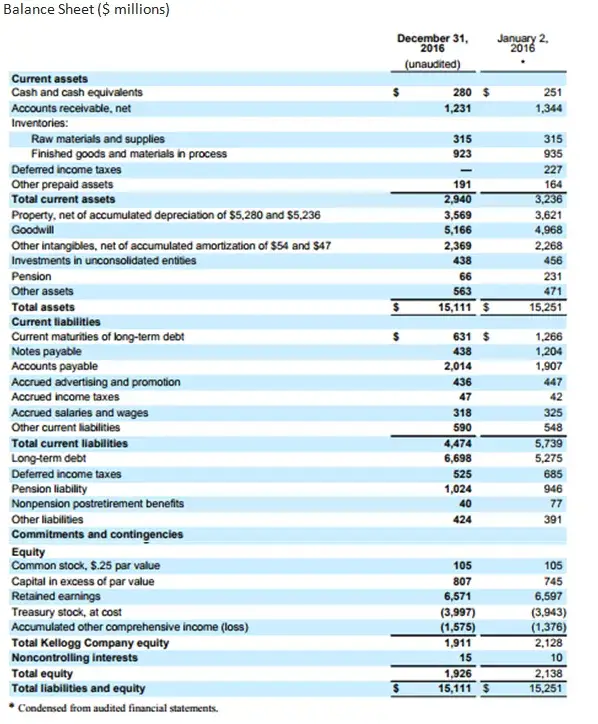

Let us take the Income statement and Balance sheet of Kelloggs Company and understand each of these parameters and the most simplistic method of analysis. Kelloggs is one of the leading brands in Consumer staples industry worldwide and its closest peers are General Mills and Kraft Heinz.

The common-size analysis is the presentation of financial statement information in a standardized form. Mostly in percentage form.

– The vertical common-size analysis uses the aggregate value in a financial statement for a given year as the base, and each account’s amount is restated as a percentage of the aggregate. For Balance sheet, the aggregate amount is total assets, while for Income statement it is total sales.

Vertical Analysis also helps you do the time series analysis, which means to study the trend as to how various items in proportion to the aggregate value increased or decreased over a period of time. It also helps in cross sectional analysis with other comparable companies in the industry.

Given below is a simple example of how to do a common size analysis in Balance Sheet and how to study the changes in asset composition over the years.

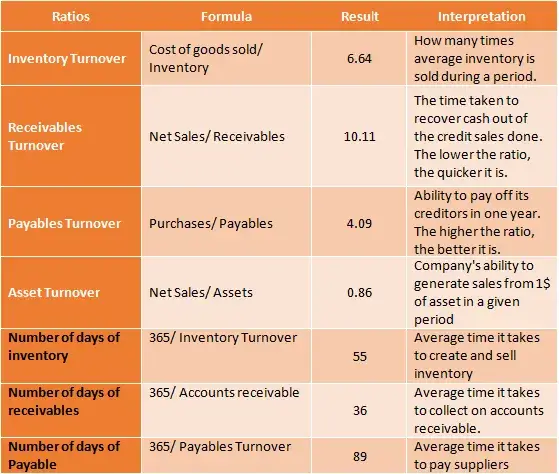

Activity Ratio:

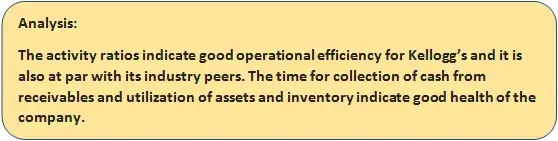

Activity ratios ascertain how efficiently a company utilizes its assets. Some of the activity ratios are also known as Turnover ratios as they show the utilization of asset per unit of the turnover. Some of the ratios are known as Operating Cycle ratio as it indicates the length of time from when a company makes an investment in goods and services to the time it collects cash from its accounts receivable, pays cash to accounts payable and so on.

Liquidity ratios

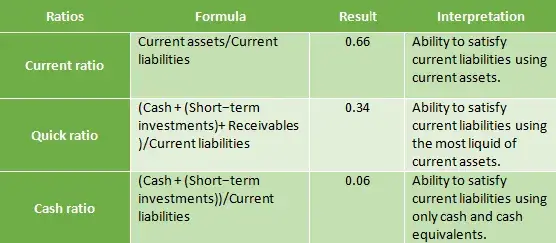

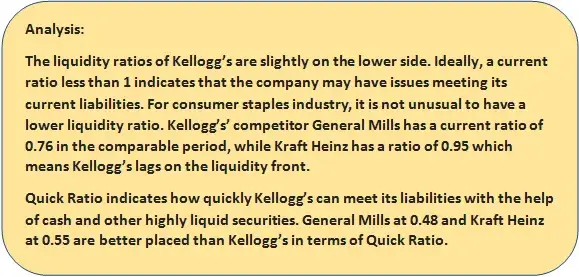

Liquidity is the ability to satisfy the company’s short-term obligations using assets that can be easily converted into cash. A high ratio indicates a high level of liquidity and less chance of a cash crunch. On the other hand, a too high current ratio may indicate that the company is loaded with too much inventory, accounts or unnecessarily holding too much in cash. Though these factors may not lead to insolvency, it surely pressurizes the profitability of the company. A direct implication of this is the effect on Working Capital. Liquidity squeezes the working capital, which in turn impacts the profitability of the firm.

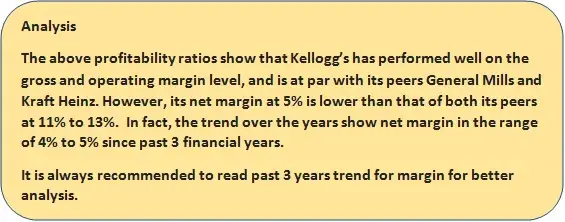

Profitability

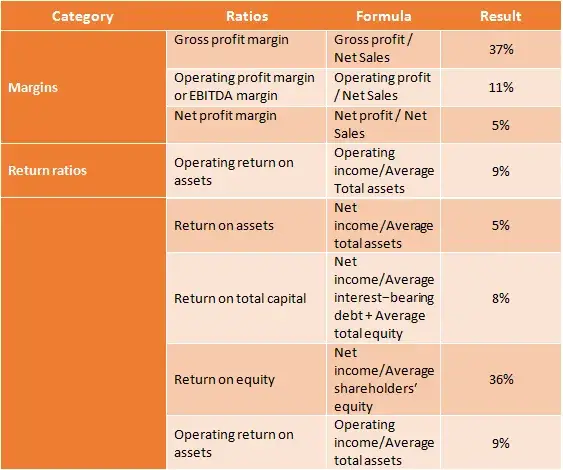

- Margins and return ratios provide information on the profitability of a company and the efficiency of the company.

- A margin is a portion of revenues that is a profit. There are various types of margins such as Gross margin, Net Profit margin and EBITDA margin. Gross Margin is the profit by which the sales exceed production costs. A higher Gross Margin means the company is controlling its overhead costs really well while earning good revenues.

- EBITDA Margin or the Operating margin is an indication of a company’s operating profitability as a % of its total revenue. It is the earnings before interest, tax, depreciation, and amortization (EBITDA) divided by total revenue.

- A return is a comparison of a profit with the investment necessary to generate the profit.

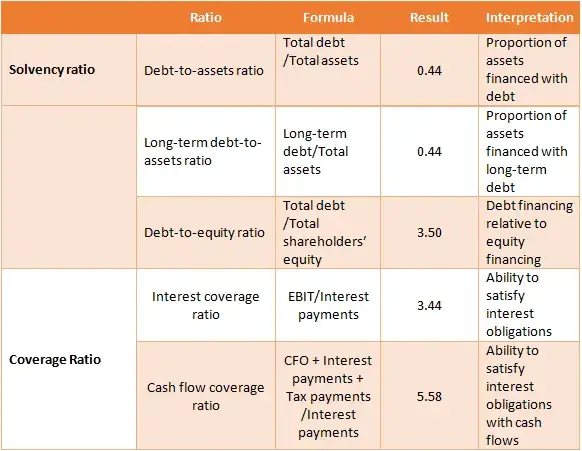

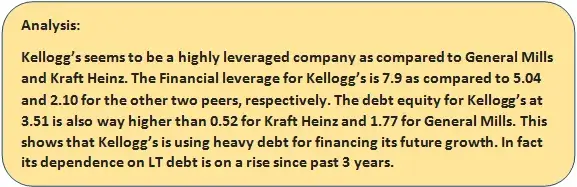

Solvency Ratios

- Solvency means company’s ability to take care of its long term obligations like debt and equity. We use solvency ratios to assess a company’s financial risk, which refers to the risk resulting from a company’s decision of how to finance the business using debt or equity.

- There are two types of solvency ratios: a Leverage ratio and coverage ratios.

- Leverage involves evaluating the capital structure mix.

- Coverage ratios measure the ability to meet interest and other fixed financing costs.

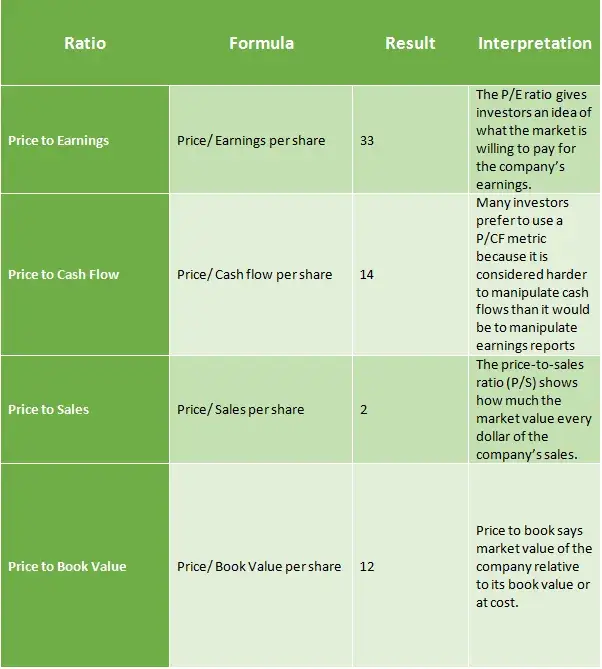

‘Valuation ratios

Valuation ratios put that insight into the context of a company’s share price, where they serve as useful tools for evaluating investment potential.

The above example showed the most basic method of ratio analysis for beginners, but as we work in the real world there are lot many other factors which go into it. Also, there can be many more ratios or combination of ratios that can be used according to the situation or goal of analysis.In depth Ratio analysis is not just numerical calculations, but it requires

In depth Ratio analysis is not just numerical calculations, but it requires thorough understanding of the operations and fundamentals of a company and sector.

Points to remember

Ratio analysis cannot be done in isolation. It has to be studied in a relative sense. Few Points to remember for conducting a Ratio Analysis are:

- You need to study the ratios in the light of other macro factors like the industry policies, macro scenario or other company specific happenings such as management decision, company’s product mix, accounting changes, mergers etc.

- Financial ratios vary across sectors and industries, which means that the ratio of a FMCG sector company cannot be compared to that of a manufacturing company. The comparable has to be from the same sector. Eg: The level of liquidity is different across industries. Certain industries are more cash-intensive. A retail chain like Wal Mart will require more cash to buy inventory constantly than IT firms like Accenture. Hence, it would make no sense to compare these two firms.

- Once the ratios are derived, you need to conduct a comparison with a set of peers from the same industry for arriving at proper insights and results.

- It is also important to analyse the ratios over a period to see a trend rather than only a single period exercise. Once the ratios are analysed over a period of 4-5 years, you can identify a trend and predict where the company is headed.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!