Top 5 Reasons Why CFA After MBA Is Your Best Bet

Here's What We've Covered!

Raise your hands if you think an MBA finance degree is enough to get a high-flying career in the investment banking industry.

If your hand is up, you may want to reconsider. While it is true that once the MBA was a powerhouse degree that landed you most of the coveted finance jobs, there have been too many changes in the corporate landscape in recent years. Today, your degree is no longer a sure-fire guarantee to get hired by the world’s leading corporations.

The finance and investment industry is a very fickle place to work. Companies are expanding and merging on a regular basis. Regulations and standards are constantly updated. And you need the skills and knowledge to take on the unpredictable and volatile world of investment banking.

This is why you should apply for the CFA after MBA. The CFA program came into existence to fill in the gaps in the knowledge that many MBA and other finance professionals had. The CFA syllabus is the perfect combination of finance-related subjects, key industry concepts and essential skills that make you successfully manage an investment advisory career.

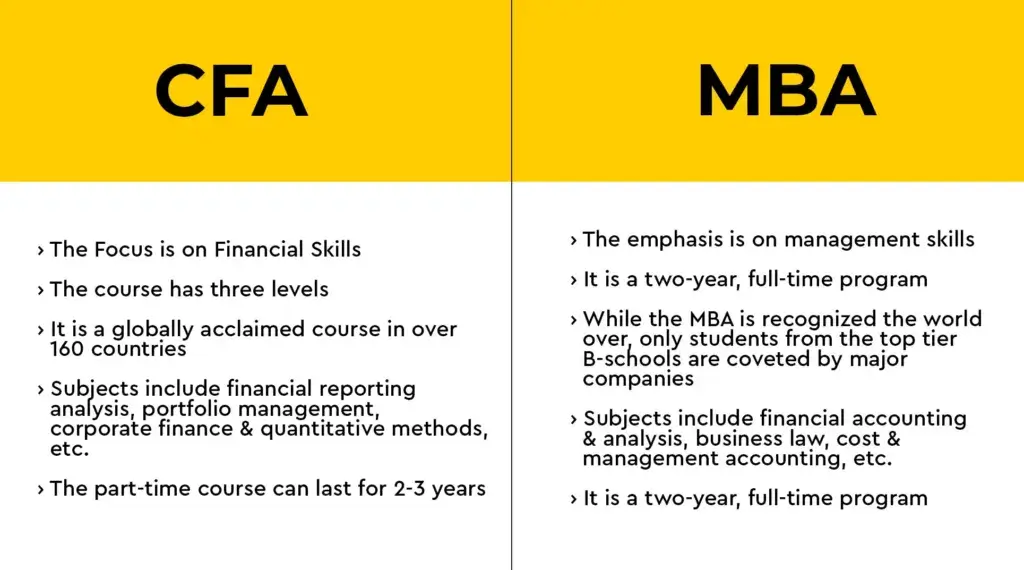

So which is better? CFA or MBA? Both have merits and help students become finance specialists. However, if you can find the time to clear both courses, you’ll be a force to reckon with during your job interviews.

The CFA Course — A Brief Overview

The CFA institute created the chartered financial analyst program to fulfill the increasing demand for high-quality professionals in investment advisory services. The post-graduate course is globally recognized for its standard of excellence and is considered a benchmark certification in the industry by all leading finance experts. So what makes the CFA after MBA the right choice for you?

- There are over 130,000 CFA members in 160 countries

- The CFA curriculum has relevant subjects such as portfolio management, financial analysis, wealth planning and economics

- There are a total of ten subjects and three levels in the CFA program

- There is a strong emphasis on ethics and professional standards

- As a charter member, you have access to many networking opportunities and new industry developments through CFA societies present worldwide

- CFAs are preferred by leading investment banks, wealth management firms, brokerage houses and other financial agencies

- The course is open to graduates, industry professionals and MBAs

Have questions related to CFA?

Benefits of CFA after MBA

- The course enhances your financial expertise

The CFA syllabus has a steady focus on financial analysis, portfolio management and other essential investment topics. The subjects are detailed and comprehensive, as they are curated by some of the top investment specialists in the world. Level 1 helps students build a solid foundation in finance. Level 2 is tougher as it focuses on asset class and valuations. Here, students learn advanced theory and skills. The last level deals extensively with portfolio management and capital markets, ensuring that every charter holder is fully qualified to work in this complex, nuanced industry. The curriculum also fills in any gaps in your financial education. It is one of the main reasons why you should do your CFA after MBA.

- CFA has instant recognition among global banks and companies

The CFA makes you eligible to work in a number of job profiles. Today, most financial analysts working in some of the top global companies are CFA holders. Other profiles are portfolio managers, credit analysts, auditors, equity analysts, and chief investment officers. The certification also helps you land these coveted positions with major financial firms. Some organisations that hire charter holders in India are JP Morgan, Crisil, HSBC and Credit Suisse. The offer letter by these firms comes with a cushy Rs 10 to Rs 40 lakhs, depending on your experience level. If you have a CFA after MBA course listed on your resume, it will boost your chances of working with some of the world’s largest financial companies. Your dual credential also increases career opportunities further down the line when you decide to become a consultant or open your own firm.

- Easier to clear CFA after MBA finance degree

Many students have found the CFA course to be quite tough to clear. However, when you apply for the CFA after MBA, the program won’t seem as difficult to pass as you are already knowledgeable in many of the finance theories and topics. If you compared the syllabus of the CFA vs MBA finance, you will discover a significant overlap of concepts in both courses. The training you receive as an MBA student will help you to take on the CFA course with ease. In fact, many MBA graduates cleared level 1 without breaking a sweat.

- Get double the skill set from both courses

The MBA ensures better organisational skills, time management and sharper decision-making abilities. The CFA equips you with a firm understanding of capital markets and industry-centric knowledge. When they come together, they make you a proficient and competent finance professional. You become more than capable of handling the challenging and inconsistent nature of the investment industry. In the battle of CFA vs MBA, the real winners are those who have done both courses.

- Outshines your competition with your CFA after MBA certifications

The HR manager or company recruiter is a very busy job profile. On average, they take 20 seconds to scan through a resume. After that, they either toss it in the reject pile or upgrade it to the shortlist. Where your documents end up will depend on what your credentials are. Are you an average finance hopeful? Does your resume resemble all the others? Or do you have an ace up your sleeve in the form of a CFA after MBA listed on the CV? This is a sure-fire way to get a recruiter to contact you for an interview.

Read – CFA Scholarships – Are You Eligible For It

CFA vs MBA Finance

Job profiles for CFA after MBA

- Financial analyst

- Credit analyst or manager

- Auditor

- Equity researcher

- Corporate controller

- Corporate financial analyst

- Management consultant

- Cash managers

Read – Top 5 Trending Jobs In India

IMS Proschool’s CFA Prep Program

As an MBA graduate, you are keen to get started on your career. Which means you need to get your CFA certification as soon as possible. Proschool can help you clear your exams and achieve your qualification quickly. The coaching institute is known for efficient teaching methods and active learning techniques that help all students become proficient financial analysts.

Here are a few more reasons why you should join Proschool to get started on your CFA after MBA.

- The faculty is made up of experienced industry experts who are also qualified, effective teachers

- Students receive personalised guidance and mentorship

- There is an abundance of additional learning resources, such as practice papers, mock tests, study prep books and recorded videos.

- If you choose to attend classroom sessions, you will receive over 170 hours of in-house training

- Working professionals who are doing their CFA after MBA can also apply to learn online

Checkout IMS Proschool’s CFA Prep Course

In conclusion

CFA or MBA? You don’t have to decide between the two. You can do both if you have the time and inclination. The combination of these two illustrious certifications is quite potent. It can help you join some of the world’s biggest corporations, earn a higher salary and take your career to a higher level. So if you were undecided before, hopefully, you have seen the merits of doing a CFA after MBA.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!