Top 8 Long-term courses in Finance in India

Here's What We've Covered!

So you want to carve a prestigious career in finance, but don’t know how to go about it? Well, as they say a journey of a thousand miles begins with a single step, a right degree/course is the first step to a rewarding career. Finance is one of the most coveted streams by students and young professionals and there are many sought after courses which can help you to make the right cut in the industry.

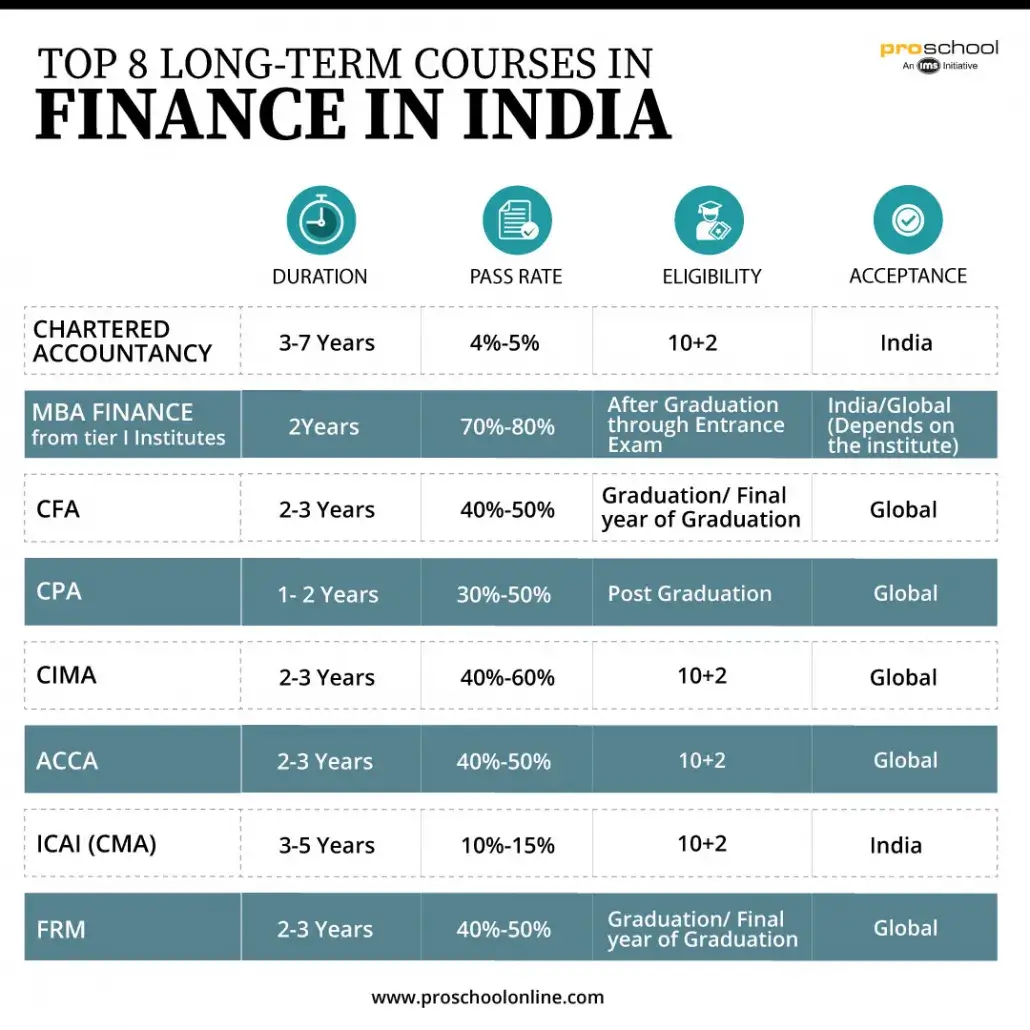

We have shortlisted few long term courses in finance which are highly preferred by students and employers alike. This is an indicative list which has been formed by analyzing Google Trends, availability of jobs on leading portals and overall popularity amongst aspirants.

(1) Chartered Accountancy

Chartered Accountancy offered by the ‘Institute of Chartered Accountants of India’ (ICAI), has always been a very sought after, as well as prestigious professional qualification. It is a rigorous course in the field of Accounting & Finance, which opens the doors to various career options in the financial domain. CAs are sought after by almost every business house for corporate finance, auditing, taxation, accounting, and legal counsel. Several banks and financial services firms look for CAs to fill their various financial analysis roles. CAs can also start their own practice soon after qualifying.

However, the pass rate of CA exams is a mere 4%-5%,

Expected Salary: Starting Rs 3.00 lacs to Rs 12.00 lacs (Source: LinkedIn)

For more details: https://www.icai.org

(2) MBA Finance from tier I institutes

If there is any career option that is most coveted after the Chartered Accountancy in India, it is the Masters in Finance or Masters in Business Administration (Finance) from tier I institutes. It is a career field which requires one to have skills in mathematics, economics, and financial theory, all of which are further polished for specialization in the field of finance.

The rigorous curriculum, internship with top MNCs and case study-based studies trains them to be astute managers in future. MBA Finance is basically an umbrella degree which has become almost mandatory for any specialised job in finance in India.

Expected Salary: Starting Rs 6 lacs

(3) Chartered Financial Analyst

While MBA Finance offers specialization on business and finance domain, there are certain areas which fall outside the purview of MBA Finance. This is an era of super specialization and industry demands degrees which are focussed. CFA is one such focussed certification for those interested in making a career in investment analysis, security analysis and financial management.

This is a highly sought after certification and is quite well known across the financial industry internationally. It is conducted by the CFA Institute, USA. A rigorous curriculum and gruesome study routine prepares candidates for challenging roles in the finance industry worldwide.

Expected Salary: Starting Rs 2.10 lacs to Rs 10.00 lacs (Source: LinkedIn)

To know in detail about the CFA Program

(4) Certified Public Accountant

Just like the CA qualification in India, the CPA (Certified Public Accountant) is the highest professional qualification related to accounting in the U.S. One can move towards becoming a practicing CPA by taking the Uniform CPA exam conducted by the American Institute of Certified Public Accountants (AICPA). Apart from the U.S., a CPA qualification is highly regarded and accepted globally, including India. With a CPA under your belt, not only can you practice Chartered Accountancy in the U.S., you can also be considered for roles involving international accounting policies in other countries.

Expected Salary: The average salary is 7,62,735.(Souce: PayScale)

(5) CIMA

The Chartered Institute of Management Accountants (CIMA) based in the UK is the largest professional body of management accountants. They along with the American Institute of Certified Public Accountants (AICPA – the body that conducts the CPA exam) conduct a highly respected global program called the CIMA Professional Qualification. The emphasis of this program is not just on management accounting, but also on marrying finance and accounting with strategy and decision-making. This is therefore a course more suitable for people interested in a corporate career as opposed to just public accounting practice. The CIMA professional exam consists of 12 exams in total, spread over 3 different levels.

Expected Salary: As CIMA qualified gets apponited on different job roles, salary varies drastically. An average salary around 9 lacs can be expected.

To know in detail about the CIMA Program

(6) ACCA

For those who have an inclination towards financial accountancy, taxation, audit, internal audit and pricing, “Chartered Certified Accountant” is one qualification worth considering. The Association of Chartered Certified Accountants (ACCA) is a UK-based body which offers this global certification in Accountancy. ACCA is recognized in over 78 markets and has more than 80 international accountancy body partnerships.

Owing to its highly professional standards, the ACCA exam is challenging. However, when compared with the US CPA, it is quite easier to handle. The pass rate for ACCA is around 50%, which is much higher than the Indian CA pass rates at 4%-5%.

Expected Salary: It depends on

- The Company

- The Profile.

ACCA qualified freshers are generally paid the same salary as that of CAs in companies such as the Big 4 and other MNCs (ranging between Rs. 7 to Rs. 9 lacs).

To know in detail about the ACCA Program

(7) ICAI (CMA)

The Institute of Cost Accountants of India (ICAI), formerly the ICWAI (Institute of Cost & Works Accountants of India) is the only institution of India which offers Cost Accountancy education in the country. ICWA course has now been renamed as CMA which now stands for Cost Management Accounting. This course is a blend of costing and management accounts, which is highly demanded in the finance sector today. This course comprises of three stages, i.e. CMA Foundation, CMA Intermediate and CMA Final.

Expected salary: Please check on institute report for detailed information.

(8) FRM

For a focussed career in risk management, FRM is the ultimate choice. Offered by the Global Association of Risk Professionals (GARP, USA), Financial Risk Managers is a globally recognized professional certification for banking and finance professionals. FRM holders can explore many rewarding career options in Risk Management, Trading, Structuring, Modelling, etc. Positions such as Chief Risk Officer, Head of Operational Risk, Senior Risk Analyst, and Investment Risk Management are few of the designations that FRM holders can be placed at. This is a relatively exclusive certification in the area of Finance and Risk Management, hence it’s perceived to be a little difficult.

Expected Salary: The national average is around INR 15,15,000. (Source: PayScale)

For more details: https://www.garp.org/#!/frm

Now that you have a clear picture of all the top courses in Finance in India, it is wise to weigh each of the options according to a particular set of criteria and take a pick. You may choose to have patience and tread the conventional path or take a lesser travelled path to carve an unconventional career.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!