7 myths about ACCA making it the best career option after 12th commerce

Here's What We've Covered!

Not convinced that the ACCA course is best after 12th commerce? Here are the most popular misconceptions about ACCA which might be stopping you to take the course after your 12th commerce.

The corporate world is rapidly changing due to the advent of digitization. Many traditional careers are struggling for relevancy.

But Accountancy is not one of them.

In fact, this industry is growing stronger. The demand for globally qualified accountants is increasing. In the finance sector, technology may be the future, but the importance of accountancy is timeless. It is a constant necessity, no matter how much the corporate landscape changes.

Every conglomerate, multinational corporation, small business or emerging start-up needs a competent, skilled team to handle finance-related tasks such as bookkeeping.

It doesn’t matter if the company is online or offline. Whether it’s a financial firm, a retail group or even a tech company like Google, they all hire certified accountants.

While the profession has been around for a long time, the field has seen significant upgrades. Most notably, the prestigious ACCA qualification has emerged as the new benchmark in accounting across the globe.

So if you are a parent of a student trying to figure out the best career options after 12th commerce, stay with us. The ACCA course is a perfect choice for a thriving financial career. You may be skeptical or uncertain about this credential. You may have even heard it is unsuitable for a variety of reasons. To set the record straight, we debunk 7 ACCA myths below. We also shed light on how this credential can lead to many booming opportunities for your child.

What is ACCA?

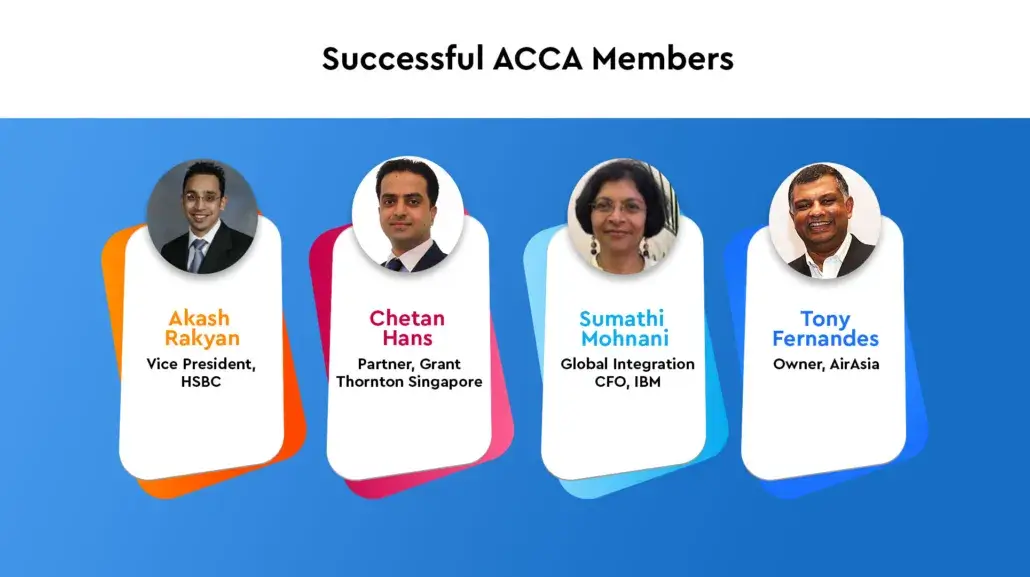

Formed in 1904, the association of chartered certified accountants offers a globally acclaimed professional certification. The ACCA enjoys a stellar reputation in the accounting community. The students who complete the course can have thriving careers in various industries worldwide. Some move up the corporate hierarchy to become CFOs, while others launch their own consultancy firms.

Students go through intensive training in the ACCA course, learning theoretical knowledge and practical skills. They study professional techniques and tools that help them navigate their careers in the right direction. At the end of the program, the students emerge as accomplished accountants.

Here are the 7 most popular myths about the ACCA

MYTH 1: ACCA certification is only for professionals looking to migrate to foreign countries

Paradoxically, this myth is true as well as false. The ACCA certificate is the international standard for excellence in accounting. It opens up the possibility of working in over 180 countries. Yes, an ACCA accountant in India could find work anywhere in the world, without having to reapply for certification. Countries like the US, UK, Australia and Singapore prefer ACCA certified accountants.

However, you are equally hireable in India. We have many multinational corporations and global companies who have opened offices on our shores. Even the big four firms — E&Y, PWC, Deloitte and KPMG — have branches all over the country. These corporations prefer to hire ACCA professionals as they follow a consistent standard of accounting skills and practices. Indian-owned companies such as Godrej and Tata are also eager to be hired from the ACCA talent pool. The value of the certificate is well known and much appreciated.

MYTH 2: There is no support system when it comes to placements

This statement isn’t true at all. First of all, the ACCA official website has a strong network of certified accountants. Recruiters from all over the world (and in India) put up job postings for entry-level positions and higher designations. The website offers other resources to ACCA members to upskill and develop their abilities.

IMS Proschool also offers placement assistance to every student. From mock interviews to drafting resumes to setting up meetings, the candidates receive personal attention to achieve their career goals.

MYTH 3: ACCA professionals do not earn as well as other accountants

This belief is another fallacy. The big 4 firms and many corporations hire ACCA-certified employees and pay them as per industry standards. A fresher with zero or minimal experience can earn between INR 3 lakhs to INR 6 lakhs a year, depending on the company and location. While the starting salary may not be on par with chartered accountant salaries, with some experience, both qualifications earn around the same.

Seasoned ACCA employees take home annual salaries between INR 8 to 15 lakhs, but this figure depends on your skills and negotiation abilities. As you rise higher in your career, the numbers on the pay cheque will increase.

MYTH 4: It is difficult to clear the ACCA exams

A few stories are circulating on the internet about how tough it is to pass the ACCA exams. The course papers are designed to establish a professional standard. While they are more challenging than the 12th commerce exams, they are not impossible to clear. The first four papers consist of multiple-choice questions and can be taken on demand. Students can prepare accordingly before taking the tests. The rest of the exams occur four times a year. The board allows up to four papers in one sitting so candidates can plan their study strategy accordingly.

Also, unlike the CA exams, there are no group papers in ACCA.

With advanced studying, a proper schedule and a firm grasp of the concepts, there is no reason why students can’t pass on the first attempt.

MYTH 5: The ACCA course is only for graduate students

False. Students who have finished their 10th or 12th-year exams can do the ACCA program. As long as they have scored 65 per cent in English and Maths along with a 50 per cent average in the other subjects.

Students who don’t meet the criteria can join the entry-level foundation course to qualify for the main program.

If you play your cards right and plan accordingly, there is a high chance of receiving the ACCA certification with graduation. Think of all the time saved.

MYTH 6: The career options are limited

Does ACCA have any scope for career growth? The answer is an overwhelming yes. The course offers a well-rounded, comprehensive curriculum to cover a wide range of roles within the accounting and finance industry. The program also trains students to fit into the corporate culture of multinational organisations and the big 4. As an ACCA member, most students are well suited to work in job profiles such as:

- Management accountant

- Business advisor

- Tax accountant

- Risk manager

- Funds manager

- Financial analyst

- Credit control manager

- Forensic accountant

- Treasurer

- Internal auditor

- Chief financial officer

MYTH 7: The ACCA course is expensive

Many people fear the ACCA course fees are priced high without confirming the amount. The truth is it is reasonably priced when compared to an MBA degree or a CA license. Also, the cost is in line with the kind of earnings the student can expect when they start their careers.

The Proschool ACCA course details

- The well-designed and in-depth curriculum contains 13 subjects across 3 levels.

- The three levels are:

- Applied Knowledge

- Applied Skills

- Strategic Professional

- The ethics and professional skills module teach students about real-world skills to help them adjust to a corporate environment

- Graduate and relevant certificate holders receive certain ACCA exemptions

- Graduates can skip the first four papers

- CA holders are exempt from the first five papers

- CMA-certified students can waive seven papers

- BMS degree holders can drop the first four papers

- Undergraduates can avail of Proschool’s GPA program which is a unique course that combines the ACCA certification with relevant skills such as financial modeling

- This is one of the best courses after 12th commerce as it prepares students to become complete professionals by the time they graduate

The Proschool GPA program offers you real value for your money. Besides your ACCA qualification, you also receive added benefits such as financial modeling and other skills.

| COURSE | FEES | DURATION | EXAMS | ADDITIONAL TRAINING |

| GPA | INR 180,000 | 3 years | 3 Knowledge level and 6 Skills level papers | Financial modelingPlacement assistance3 mock examsFaculty support LMS access Hard copies of the Kaplan study text |

| GPA comprehensive | INR 250,000 | 3 years | All 13 papers across 3 levels | Same as above |

In conclusion

The ACCA is one of the best professional courses after 12th commerce, designed for students with an aptitude for accountancy and finance.

The course helps them take on the competitive job market with intensive training and skill development. On completion, the student becomes a qualified and proficient global accountant and is ready to carve a niche in the industry.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!