Can I do the CFP Course After B.Com? Check out the pros & cons.

Here's What We've Covered!

As a commerce student, the end of your undergrad journey opens up many pathways in finance. You can work in banking, investment firms, insurance agencies, relationship management and many more. The proper certifications can help you achieve your career goals.

Certified Financial Planner course is one of the best qualifications in the world. It can help you build financial expertise in several finance sectors. The program is popular in over 27 countries for its comprehensive syllabus and in-depth coverage of financial planning concepts.

CFP professionals are at an advantage over their peers in financial advisory services. Top companies, banks and financial institutions recognise the CFP certificate as the benchmark in financial planning. CFP professionals are trained to work with clients and investors in various fields, such as retirement planning, insurance, risk management and tax planning.

They can create customised financial plans by studying the client’s background, history and future objectives. The level of expertise of a CFP holder is unmatched. This qualification is a perfect fit for commerce graduates as the CFP can be done after B.Com.

Eligibility requirements for the CFP course

There are two pathways in the CFP program.

-

Normal Pathway

- You can join the course after scoring 50 per cent or more in the 12th-year exams from a recognised board.

- You will take three exams — Investment Planning Specialist, Retirement and Tax Planning and Risk and Estate Planning.

- After clearing the above papers, you can sit for the Integrated Financial Planning exam to receive your CFP certification.

-

Fast Track Pathway

Individuals can skip the first three exams and sit directly for the final exams if they have:

- Relevant educational background such as MBA, CA Inter with B.Com Articleship, CA, CFA, CPA, etc.

- 1 year or more of job experience under a CFP’s supervision or 3 years in another relevant field such as banking, insurance etc.

Did you know, 70%+ CFP candidates enrolling with Proschool ace the CFP exams easily?

Can I do the CFP course after BCom?

Yes, of course. Many students prefer to complete their graduation before signing up for the CFP course, even though undergrads can apply after the 12th. There are many reasons for this. Some people may be unsure of their financial career path when they are in the 12th.

Or they may prefer to complete their graduation before enrolling in a professional course. Either way, it is not unusual for commerce graduates to become CFP professionals. Here are the leading pros and cons of getting a CFP certification after BCom.

Can the CFP be done after Bcom? — Pros

-

The course is easier for commerce students

Please note that the CFP program is not an easy one. However, students who have taken the final commerce exams can benefit from their experience. If you have finished your graduation, you are in a stronger position to deal with the CFP syllabus and exams. At 20, students are more mature and mentally capable than when they take their 12th-year exams at 18 years.

-

Compliments well with the commerce curriculum

B.Com graduates are on the right path when they take the CFP course. Commerce subjects can lay the foundation for your career in financial planning. The two courses together give the perfect education in finance, and if there are any gaps in your industry knowledge, the CFP course will help you overcome them. This is one of the best answers to the popular query: Can CFP be done after BCom?

-

Salaries are enhanced with CFP certification

If you start your career directly after graduation, it might take you longer to reach a higher salary. A CFP stamp on your resume is indicative of your expertise and knowledge. It will help you negotiate a better salary package and open doors for interviews with bigger companies

-

CFP can lead to better job opportunities

You can find a job straight after B.Com in the finance industry, however there will be a learning curve. If you want to join investment advisory or financial planning services, you’ll need to learn the ropes. A CFP professional is trained and ready to start work and will be first in line to get bigger job responsibilities and promotions than a B.Com graduate.

Also Read – What Jobs Can You Get In The UK as a Certified Financial Planner

Can the CFP be done after Bcom? — Cons

-

You start your career later

It can be hard to be a student when your peers around you are finding jobs. It may seem like you are delaying your career by one to two years, but when you do the CFP certification you reap the benefits in the long run.

-

CFP is tougher than Bcom

When your final college paper is over, it’s nice to think it is the end of your exam-taking days. So getting back into student mode with the CFP course can be a tough pill to swallow. Also, the CFP is a harder nut to crack than the BCom exams, so you have to work that much harder. But is it worth the extra effort? 100% yes!

-

There is no success guarantee

If you choose to self-study, you might struggle with a few tough concepts and topics. That could cost you important points in your exam. The CFP papers need proper preparation. This is one of the world’s top finance qualifications, and they only certify students who master the syllabus. The global success rate is 68 per cent. And if you join a respected coaching centre like Proschool, your chances are even greater as they help you grasp the course material efficiently.

Also Read – How a CFP certification can help mutual fund distributors

4 Benefits of pursuing the CFP certification

- The qualification is globally recognised and leads to better job opportunities in over 27 countries, including India.

- Finance experts have declared the CFP course the ‘gold standard in financial planning’.

- There is a 68% global pass rate, higher than other professional courses such as the CA.

- CFP professionals are the preferred choice for job positions in personal finance services, insurance agencies, mutual fund houses, investment firms, wealth management companies and banks.

Also Read – 10 reasons why you should become a certified financial planner

How Proschool can help you ace the CFP course

Imagine if you could learn the CFP curriculum with some of the finance industry’s best professionals. Sounds like a dream, right? If you enroll with Proschool, one of the country’s best CFP coaching institutes, it is a reality.

The subjects are taught by experienced professors who understand the intricate workings of financial planning. They use active learning methods and innovative training techniques that help students engage with the syllabus through real-world applications.

It is not difficult to see why Proschool students enjoy such a high success rate. Many graduates who were unsure of their careers have realized that with Proschool, CFP can be done after Bcom.

Why students choose Proschool:

- You can register at any of the 15+ coaching centers across India or enroll in online classes instead.

- You learn from practicing CFPs who know the industry very well.

- The teachers offer personalised interactions and doubt-clearing sessions.

- You can sharpen your exam prep with over 2,000 practice papers, mock tests, learning videos and an online library.

- If you are new to the finance genre, Proschool’s one-month online foundation module will help you catch up on the important concepts.

- Proschool also offers a placement program that connects students with hundreds of job openings in the industry.

- Students also go through soft skill training, where they are taught professional etiquette for interviews and resume writing techniques.

FAQs

-

Is CFP easier than CA?

Both courses are challenging, and the difficulty level is directly impacted by where your interest lies. The exam structure for CFP is more straightforward than the CA.

-

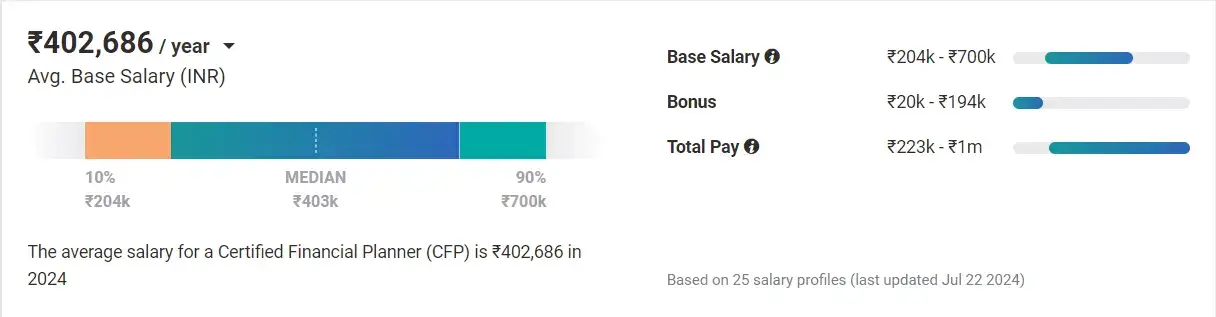

How much does a CFP professional earn?

On average, a CFP holder earns an annual salary of over Rs 4 lakhs. As the professional gains more experience, this figure increases.

source: payscale.com

-

What is the toughest paper in the CFP exam?

Most students and experts would agree that the final exam — integrated financial planning — is the toughest due to the case study presented in the paper. Your future as a CFP professional rests on how well you answer this section.

-

What is the pass mark for the CFP exams?

You need a score of 50% or more to clear the CFP exams.

-

What are the career options for CFP professionals?

If you have a CFP certification, you can apply for any of the following job profiles:

- Personal financial planner

- Wealth management advisor

- Portfolio manager

- Mutual funds advisor

- Broker

- Risk analyst

- Cost analyst

- Finance manager

-

Can I do the CFP course after BCom?

Yes. Anyone who has completed their 12th year with 50 per cent or more can apply. Graduates as well.

-

Can I complete CFP in one year?

You can complete the course in a year if you plan accordingly. Although some experts recommend taking two years so you have enough time to understand the material and prepare for the exams, one year is also possible.

Conclusion

If you’ve reached the end of this post, hopefully you have the answer to your question, “Can I do the CFP course after Bcom?” The CFP program is perfect for graduates hoping to make their mark in financial planning and wealth management.

It is not an easy journey, but the destination is worth it. Start planning your financial career today with Proschool, and soon you will be ready to reap the rewards.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!