Here’s What CFP’s Earn In India In Different Job Roles

Here's What We've Covered!

Do you remember why Rich Dad was rich in Robert Kiyoski’s famous work ‘Rich Dad Poor Dad?’

Because instead of just working for money, he made his money work for him.

But, here’s the thing, not everyone who earns a lot knows how to manage their finances or to make their money grow.

That’s why the demand for skilled, trained, and qualified individuals in investment, insurance, wealth management, etc is always high.

Certified Financial Planners are experts in the field of financial management. They are experts because they are well-educated, evaluated, experienced and abide by ethical standards. Only after fulfilling all the 4Es mentioned before, are they awarded a CFP Certificate. In fact, the CFP certificate has national and international recognition. Thus, the scope for working abroad is at an all-time high after earning a Certificate in CFP.

If you’re keen to know more about who can pursue CFP, how to start the preparation, the examination structure for CFP, expected expenditure, and other nitty-gritty of the same, read our comprehensive guide on CFP certification.

The next logical question would be,

What Does a Certified Financial Planner Do?

Simply put, a Certified Financial Planner works towards achieving their client’s financial goals such as diversifying their portfolio, providing adequate emergency funds, retirement plans, or something as simple as ensuring their children have access to the best higher education in future. To do this, they may curate customised investment plans for their clients, and manage their taxes, insurance, etc.

There are two ways through which CFPs can render their services to clients. They can either work independently or get associated with firms that offer financial planning, wealth management, consultancy services, and more. In the case of the latter, apart from fulfilling the client’s financial goals, the CFP must also meet the organisational goals.

If you’re intrigued by this career pathway, continue reading to learn about the plethora of job opportunities in CFP along with the expected salaries!

Let’s go!

Job Roles/Opportunities In CFP Along With The Salaries

-

Financial Advisors

As per Ambitionbox, the average salary of a financial advisor in India is ₹4.7 lakhs per annum.

Financial advisors are generalists who can work in a range of fields from banking and insurance to investment and estate planning. Typically their role involves guiding their clients through where, when and how to invest their money to reap maximum benefits.

Today, almost all high-net-worth clients require financial advisors who can guide them through managing and multiplying their income. Thus, the demand for financial advisors is at an all-time high. Moreover, based on your qualifications, skill set and experience, you can find jobs from junior positions to senior positions with better pay and advantages.

As such, financial advisors can find a lot of employment opportunities in banks and firms. They can even practice independently.

Source: Ambitionbox [Updated Oct 4, 2024]

Also Read – The Cost of Becoming a Certified Financial Planner (CFP) in India

-

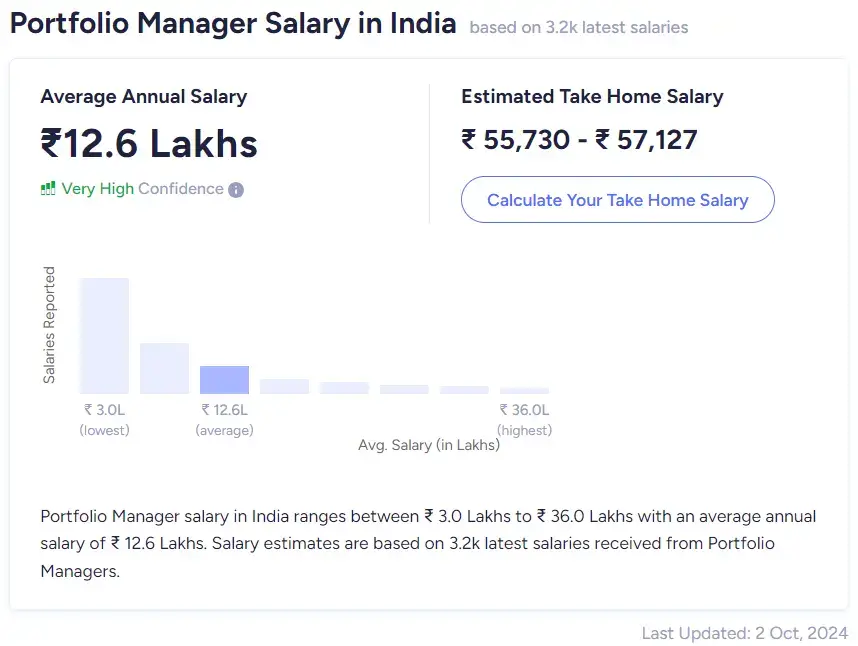

Portfolio Manager

As per Ambitionbox, the average salary of a portfolio manager in India is ₹12.6 lakhs per annum.

Portfolio management is another field that is gaining a lot of traction these days. Due to widespread demand and shortage of qualified and skilled portfolio managers, it has emerged as a well-paying field.

The role of portfolio managers involves managing the basket (portfolio) of investments of their clients. This may require finding the best investment option based on the client’s needs, investing, monitoring performance, reducing risks through diversification and so on.

Efficient portfolio managers can find a lot of success in the corporate sector as well as through their independent practice.

Source: Ambitionbox [Updated Oct 2, 2024]

Get Offline CFP Classes In Your City, plus save thousands on FPSB Study Material with Proschool’s CFP Prep Course

-

Mutual Fund Manager

As per Ambitionbox, the average salary of a mutual fund manager in India is ₹24.1 lakhs per annum.

Being a mutual fund manager, you would need to direct your clients’ money into investments that yield positive results and at the same time minimise risks. Since the job is challenging, the demand for qualified and seasoned professionals is high. As a result, the package offered is also handsome.

Source: Ambitionbox [Updated Oct 1, 2024]

-

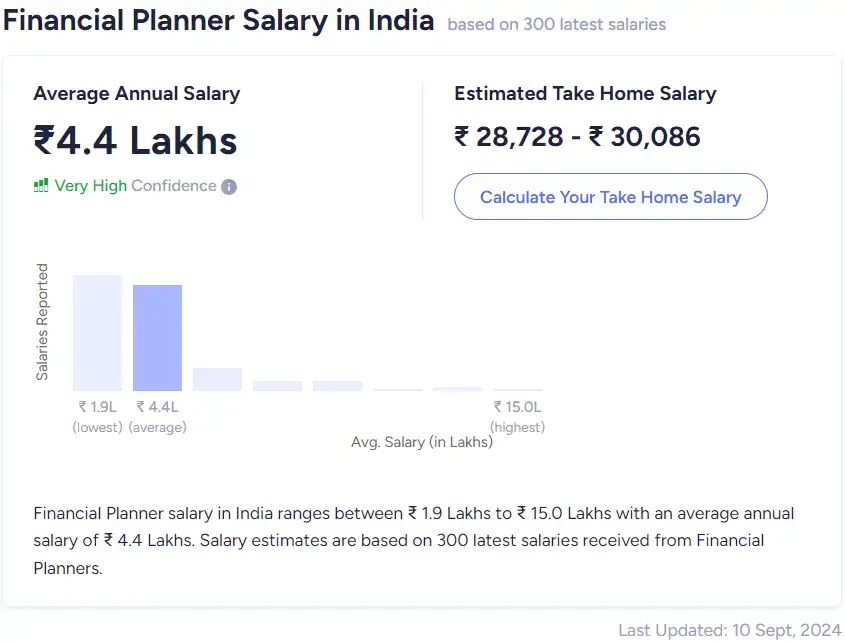

Financial Planner

As per Ambitionbox, the average salary of a financial planner in India is ₹4.4 lakhs per annum.

We all have one financial planner in our house. It could be our Mom, Dad, Grandparents or anyone with a knack for managing finances. However, a financial planner is different from this.

A financial planner is a qualified professional who specialises in managing the finances of individuals and families. They can help them with investments, insurance, creating retirement plans, arranging finances for medical emergencies, fulfilling the family’s goals of buying a house, a car, and so on.

The demand for qualified, skilled and dedicated financial planners is all-time high and thus, it offers a lucrative career opportunity.

Source: Ambitionbox [Updated Sept 10, 2024]

Also Read – Course Duration of Certified Financial Planning (CFP)

-

Financial Manager

As per Ambitionbox, the average salary of a financial manager in India is ₹17 lakhs per annum.

The financial manager holds a key position in a company’s financial framework. S/he is responsible for overlooking the inflow and outflow of money in an organisation, creating investment plans, overseeing taxes, crunching financial reports, presenting them to various stakeholders, and so on.

Since the post holds a lot of importance, qualified and skilled financial managers are well-desired by corporates and well-paid.

Source: Ambitionbox [Updated Oct 4, 2024]

-

Insurance Advisor

As per Ambitionbox, the average salary of an Insurance Advisor in India is ₹2.8 lakhs per annum.

The role of insurance advisors in the management of an individual or company’s assets is paramount. Based on an individual’s requirement, they suggest appropriate insurance plans, explain them to their clients, and help them with buying plans as well as while making claims.

Moreover, you can find employment opportunities in private companies, PSUs, or even work independently.

Source: Ambitionbox [Updated Sept 26, 2024]

Did you know, 70% of Proschool’s CFP students pass the exams on the first attempt?

-

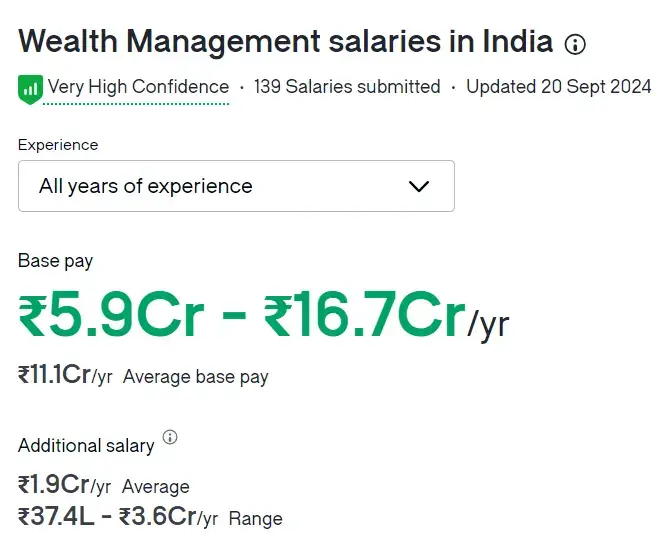

Wealth Manager

As per Glassdoor, the average starting salary of a wealth management professional in India is ₹8 lakhs per annum. As per our analysis, a seasoned wealth manager’s salary could go up to ₹10Cr – ₹15 Cr per annum.

High-net-worth and ultra-high-net-worth clients require wealth managers who can offer customised solutions for their wealth preservation and enhancement. Thus, the demand for qualified, experienced and skilled wealth managers is at an all-time high. They can find well-paying job opportunities in wealth management firms, private banks, and even financial advisory teams of huge private firms.

As a wealth manager, you would be required to comprehend the complex financial position of such individuals and offer tailor-made solutions for investment, tax management, estate planning, and more. Moreover, you may need to closely collaborate with attorneys, tax advisors and other professionals to carry out your responsibilities.

Source: Glassdoor [Updated Sept 20, 2024]

Also Read – An In-depth Overview of The CFP Syllabus in 2024

-

Investment Advisor

As per Ambitionbox, the average salary of an investment advisor in India is ₹7.4 lakhs per annum.

An Investment Advisor is someone with a knack for researching the ups and downs in financial markets and accordingly, makes investment suggestions to their clients. Moreover, s/he monitors their investment, diversifies their portfolio, minimises risk, and helps the clients achieve their financial goals.

Source: Ambitionbox [Updated Sept 20, 2024]

-

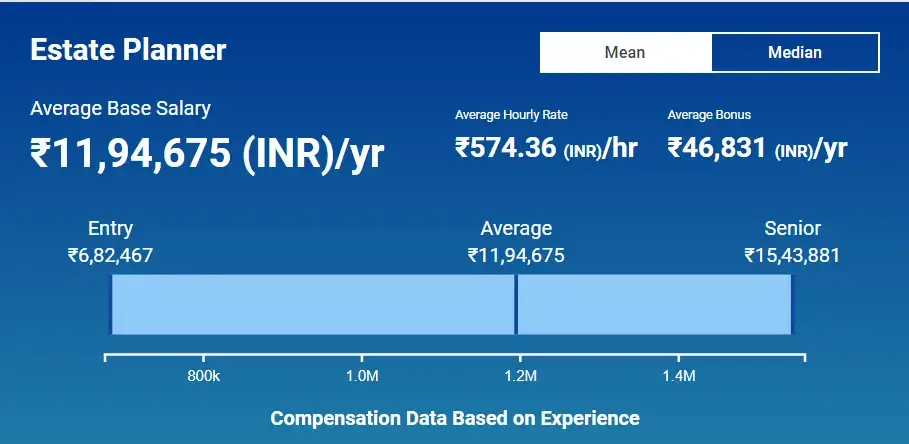

Estate Planner

As per Salary Expert, the average salary of an Estate Planner in India is ₹11.94 lakhs per year

Estate planners are both financial and legal experts. When the property needs to be distributed among children, spouses, relatives or even offered to trusts upon the death or incapacity of the property holder, estate planners step in and ensure a smooth transfer of the same.

They can prepare and enforce wills, create trusts, power of attorney and other legal instruments to help a family navigate through a smooth and hassle-free transfer of properties.

Source: Salary Expert [Updated Oct 5, 2024]

-

Retirement Planner

As per Ambitionbox, the average salary of a retirement planner in India is ₹4 lakhs per year.

As the name suggests, a retirement planner is responsible for creating investment plans and strategies for their clients’ retirement so that they can enjoy their life post-retirement fret-free. With the trend of early retirement settling in, the need to start planning for retirement as soon as one can is felt by people. Thus, the demand for professionals in this field is also high.

Source: Ambitionbox [Updated Sept 19, 2024]

If you’re keen on having a thriving career in any of these fields, you must start preparing to clear the CFP Certification exams. IMS Proschool offers both online and offline CFP Prep courses with a comprehensive syllabus and one-on-one classes with trainers who are CFP Certified. Check out our course on CFP preparation TODAY!

FAQs

Is CFP a demanding career in India?

As you had seen earlier, a CFP Certification opens up job opportunities in multiple fields. Certified financial planners can thrive in several fields ranging from financial planners, advisors and managers to estate planners, wealth managers, portfolio managers, and so on. All these career opportunities are in demand and are likely to be in demand in the coming future.

How much does CFP cost?

The cost for FPSB registration is ₹18,000, the cost of ebooks per module is ₹3250 and ₹6500 for integrated module after 50% discount. Exam fees per module are ₹6750 and ₹13000 for integrated modules.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!