CFA Jobs & Salaries In Canada | What Could You Earn In Each Profile Throughout Your Career?

Here's What We've Covered!

Did you know that the demand for CFA professionals has significantly increased in Canada in recent years? Opportunities are opening up in major cities such as Ontario and Toronto as investment firms and financial companies actively seek out CFA charter holders to join their businesses. When it comes to professionals with CFA, Canada is one of the best countries to work in. There is a high standard of living, immense earning potential and great career prospects for those professionals who are willing to work hard and deliver the goods.

The CFA course is coveted by many Canadian financial organisations because it is a mark of excellence in the industry. Students receive the financial training and skill development to navigate this complex and unpredictable field. There are over 160 countries that recognise the CFA course as the benchmark certification in finance and investment, Canada included. According to the JobBank website, Canada will likely see an increase of 23,700 job openings for financial and investment analysts between 2022 and 2031.

So if you are hoping to be one of the lucky professionals hoping to migrate to this great country, stay on the page to learn more about the exciting CFA Canada job profiles and salaries.

Top 5 CFA jobs & their salaries you can expect in Canada

-

Equity analyst

Job profile:

CFA professionals can apply to be equity analysts for various financial companies in Canada. Their job is to conduct research and analyse the stock markets, so they can help their clients make sound investment decisions.

Key job responsibilities:

- Do a thorough research of financial data and analyse the stock market.

- Advise clients and organisations on appropriate investments that support their economic background and financial requirements.

- Create reports and projections about the stock performances of different companies.

CFA Jobs & Salaries for Equity Analysts in Canada:

- Professionals can work with companies such as Fidelity Canada, Bank of Montreal, Scotiabank, Royal Bank of Canada, Barclays and Deloitte in Canada.

While salaries differ depending on location and company brand, here are approximate salaries for equity analysts.

- Entry-level equity analysts earn between $45,000 to $50,000 per annum.

- Mid-level analysts earn an annual income of around $67,000 a year.

- Senior-level experts make over $150,000 every year.

Source: Payscale.com

Looking for offline CFA Coaching In Your City? Proschool has 15+ centers in India.

-

Portfolio manager

Job profile:

Investors and companies need portfolio managers to help them organise their finances and investments. These professionals are proficient in structuring, monitoring and modifying portfolios and ensuring their clients’ financial stability and well-being.

Key job responsibilities:

- To understand how financial markets work and keep track of economic trends.

- Make projections about investments and companies.

- Create strategies and financial plans that help make investment decisions.

- Manage the client’s portfolio regularly.

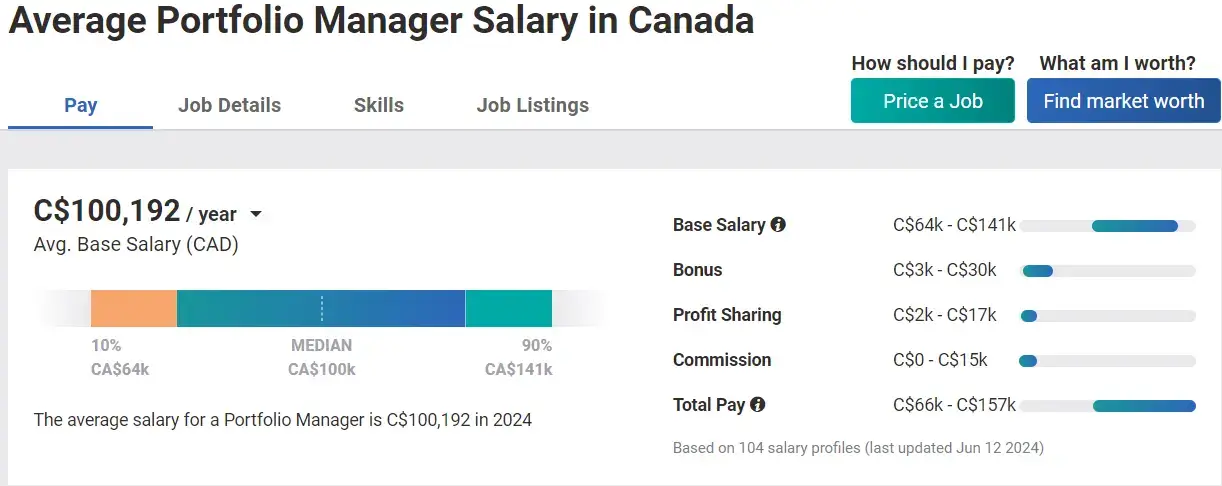

CFA Jobs & Salaries for Portfolio Managers in Canada:

- Portfolio managers are hired by reputed finance companies such as the National Bank of Canada, Banque Laurentienne, Franklin Templeton Investments, and Richter LLP.

Portfolio management is a lucrative profession, but salaries can vary. If you work for a multinational company in a major city, you can earn one of the higher salaries on the income spectrum.

- Entry-level managers earn between $55,000 to $65,000 per annum.

- Mid-level portfolio managers earn an annual income of around $100,000 a year.

- Senior-level portfolio managers make over $140,000 every year.

Source: Payscale.com

Also Read – CFA Scholarships – Types, Eligibility & Application Process

-

Financial analyst

Job profile:

The CFA course helps professionals become competent financial analysts. They are experts on finance matters, guiding companies and investors on a wide range of investment-based decisions.

Key job responsibilities:

- To collect and organise financial data.

- Analyse historical information and current financial scenarios to make accurate projections.

- Using financial models to generate reports and forecasts.

- Recommending a well-thought-out and strategic plan for investments.

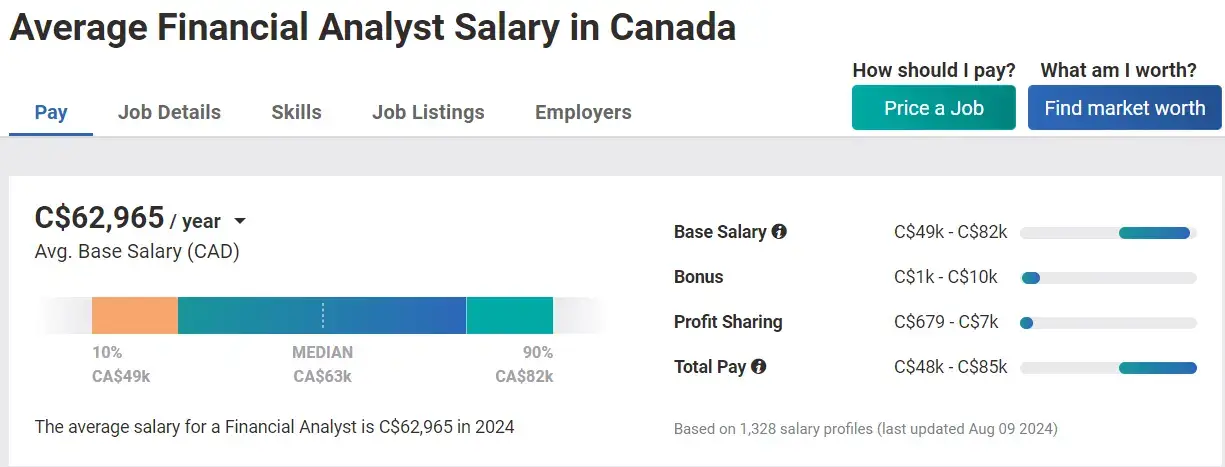

CFA Jobs & Salaries for Financial Analysts in Canada:

- As a financial analyst, you can build your career with top companies such as Miller Thompson LLP, Brookfield Asset Management, Deloitte, Scotiabank and BMO Financial Group.

A financial analyst’s salary is determined by which part of Canada you work in and the company size. However, the approximate incomes are listed below.

- Entry-level analysts earn between $45,000 to $50,000 per annum.

- Mid-level financial analysts earn an annual income of around $65,000 a year.

- Senior-level professionals make over $80,000 every year.

Source: Payscale.com

Also Read – Breaking Down CFA Pass Rates by Levels and Years

-

Investment banker

Job profile:

Investment bankers work on several investment-based activities to help their clients or companies. They raise capital, work on M&A deals and recommend well-researched investments.

Key job responsibilities:

- Raise money for companies by selling equity or issuing debt.

- Perform due diligence, research and financial analysis for various investment options.

- Create financial models for raising capital, company valuation and mergers and acquisitions.

- Staying updated on the latest industry news and economic developments.

CFA Jobs & Salaries for Investment Bankers in Canada:

- CFA professionals can apply for investment banking jobs with renowned financial companies such as Morgan Stanley, BMO Capital Markets, PWC, Cormack Securities, JP Morgan, Scotiabank and many more.

Investment bankers in Canada work in four major cities – Toronto, Vancouver, Montreal and Calgary. Here are the approximate salaries for professionals working in these places.

- Entry-level professionals earn between $45,000 to $55,000 per annum.

- Mid-level investment bankers earn an annual income of around $80,000 a year.

- Senior-level specialists make over $110,000 every year.

Source: Payscale.com

84% of our students recommend that you join Proschool for your CFA Prep

-

Credit Analyst

Job profile:

CFA holders are qualified to take on the role of credit analyst. In this capacity, they have to evaluate the creditworthiness of companies or people to ensure they are financially capable of paying off their loans and debts.

Key job responsibilities:

- Assess the individual or company’s financial history and background

- Use financial ratios when examining relevant financial data.

- Evaluate credit risk before approving a loan.

- Create a credit limit for borrowing based on the research conducted.

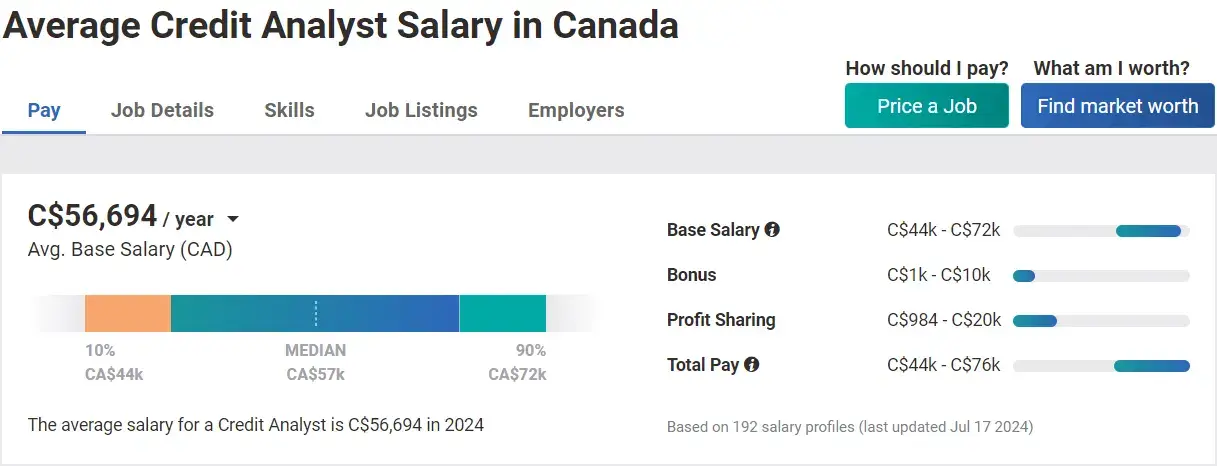

CFA Jobs & Salaries for Credit Analysts in Canada

- As a CFA-certified credit analyst, you can apply for job openings in top companies such as HSBC, Wells Fargo, BNP Paribas, Moneris and Scotiabank.

Credit analysts can work for financial institutions such as banks, investment firms and credit rating agencies. While salaries will depend on where you work, here are the approximate ranges for analysts working in Canada.

- Entry-level professionals earn between $40,000 to $45,000 per annum.

- Mid-level credit analysts earn an annual income of around $60,000 a year.

- Senior-level analysts make over $70,000 every year.

source: Payscale.com

Also Read – Duration of CFA Course: How Long Would It Take To Complete Each CFA Level?

Why you should study the CFA course with Proschool

Your future financial career begins when you enrol with Proschool, one of India’s most trusted coaching institutes and prep providers for the CFA course. Proschool offers a world-class learning experience for all students. The professors are industry professionals who skilfully teach key concepts, exam strategies and the most recently updated syllabus. They use active learning methods and innovative training techniques that enable students to achieve exam success. Students are proficient in the practical application of theoretical knowledge and are ready to face real-world scenarios.

Benefits of learning with Proschool

- Proschool has 15+ coaching centers set up in all the major cities including Mumbai, Pune, Chennai, Delhi and Bangalore.

- If you can’t attend classroom-based sessions, you can opt for online classes, instead.

- At Proschool, you receive multiple resources for exam prep including 5 mock tests and over 2,000 practice papers.

- Students get customised 6-month study plans, and 3 months of revision to ensure the entire curriculum is covered.

- Professors offer hands-on training, personalised attention and doubt-clearing sessions.

- As a certified student, you can access Proschool’s placement portal which contains hundreds of job openings.

- Your education at Proschool will prepare you to work anywhere in the world, even as a professional CFA in Canada.

- The institute also ensures all student receive recruitment-based training and enhance their resume writing skills.

FAQs

-

Can an Indian CFA holder work in Canada?

Yes. An Indian CFA-certified professional can work anywhere in the world, including Canada.

-

Can I self-study for the CFA exam?

While it is possible to prepare for your CFA exams on your own, it can be a challenge. You won’t have a teacher or mentor you can rely on to help you if you are stuck on certain concepts or have doubts. It is better to register with a coaching institute like Proschool as they have the knowledge, facilities and resources to help you successfully clear your exams.

-

Which companies in Canada hire CFA professionals?

Most financial institutions, banks, investment firms and multi-national corporations hire CFAs in Canada. These include the Big 4, JP Morgan, National Bank of Canada, Scotiabank, BNP Paribas and many more.

-

How much do CFA holders earn in Canada?

The salaries depend on your designation, level of experience, company brand and location. However, entry-level job positions offer roughly $40,000 to $50,000 while established professionals can earn over $100,000.

-

Who earns more MBA or CFA in Canada?

In some cases, MBAs earn more than CFA professionals. This depends on the type of MBA and company. However, CFA professionals also earn well and are preferred hires in most investment companies. An MBA and CFA joint qualification is probably the most lucrative.

Conclusion

If your heart is set on being a CFA professional in Canada, you can achieve your dream with hard work and dedication. Apply for the course with a respected coaching institute, pass your exams with flying colours and you’ll be well on your way to applying for CFA Canada jobs.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!