Financial Modelling Certification – A Door Opener for Analysts in India

Here's What We've Covered!

Let’s take one example to understand the importance of Financial Modelling:

When you are starting a new business or investing in any business, you must predict the profits precisely.

For example, if Reliance is planning to take the Metro Development project from Government, it must predict the return very accurately; otherwise, it will impact the company- financially to a large extent. This prediction job is done with the help of various tools and techniques. Financial Modelling is the base of all those techniques.

Now, you must have got an idea of how crucial Financial Modelling skills are. Now, let’s dive deep into it.

Let us begin by understanding what this course can do for you –

- Practical Skills – Financial modelling as a concept in an MBA program or while studying other courses is always taught as a theory. Modelling can be learned by individuals who are practicing for a long time. A certification program in core modelling from experts will help you in gaining practical skills that employers in India want. It is one thing to know in theory how depreciation affects the value of assets but completely different when you are required to show the calculations on an excel spreadsheet.

- Create Credibility – People always talk about their financial modelling skills in interviews but it is always easier said than done! By earning the certification you can establish credibility with your interviewer. Just by adding letters after the name does not impress interviewers but having the knowledge and confidence truly establishes credibility.

- Master of Excel – Most of the financial modelling methods are purely excel-based. This certification will teach you all the shortcuts and important excel tools like VLOOKUP, INDEX – MATCH, OFFSET, PIVOT, INDIRECT, Conditional formatting and many more.

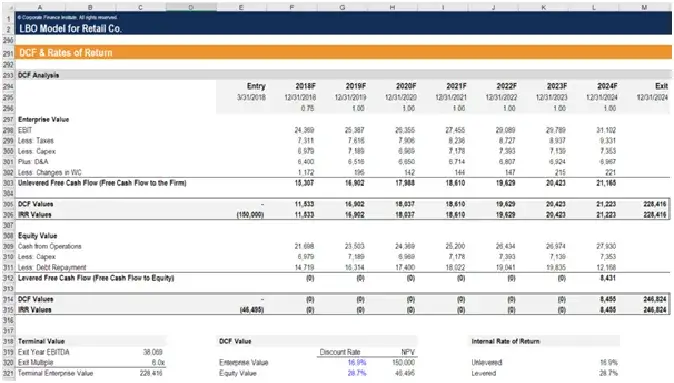

Sample of an Excel model –

Best Practices – Employees and industry veterans spend so much time in building the knowledge base and best practices for financial modelling, using excel and valuations. In the earlier days, it was only possible to learn this by working under them. But fortunately now that is not the case and you can learn all of this by enrolling for a financial modelling certification.

Valuation and other technical skills – Financial modelling is mainly conducted for the valuation of securities especially equities using different valuation methods. Valuation methods include discounted cash flow, leveraged buyout, accretion dilution, dividend discount model, comparable company analysis, capital structure analysis sensitivity analysis to name a few.

Building these models manually, by using excel would help you understand all the steps in detail. It will include forecasting each line item of the three financial statements, valuing securities, calculating the weighted average cost of capital, risk premiums. Models like accretion dilution also help in deciding if a merger will be successful or not based on the assumptions.

Now that we know the knowledge we are going to posses from this certification let us look at the sectors where this can be applied –

- Investment Banks

- KPO’s

- Equity Research

- Financial planning (Research)

- Mutual Funds

- Credit rating agencies

You must be wondering what kind of roles you can get into in the above sectors. Well, there is a wide range of opportunities that will be available after this course and with proper skills, experience, network, background and knowledge you should expect offers from good companies. Below is a generic list

- Financial Analyst

- Financial Associate

- Market Research Analyst

- Equity research analyst

- Business Analyst

- Financial manager

- Venture Analyst

- Project manager

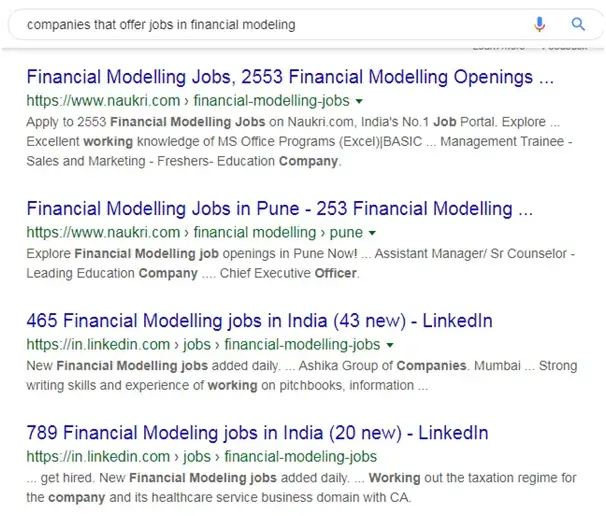

Companies in India offer jobs in financial modelling

The good news is that the market is scarce with employees having good financial modelling skills while the demand side is huge. Here is a list of companies (based on the sector) in India that employs candidates with excellent financial modelling skills

| Investment Banking | Credit Rating Agencies | Analytics Companies | KPO’s |

| Citi Bank | Moody’s | Wipro Analytics | Sutherland Global Services |

| Goldman Sachs | Standard & Poor’s | TCS Analytics | Transparent Value |

| J. P. Morgan | Real point | IBM Analytics | SG Analytics |

| HSBC | Crisil Rating Agency | HCL Analytics | TresVista |

| Barclays | Care Ratings | Absolut Data | Aranca |

| Credit Suisse | ICRA | Latent View | WNS |

| Bank of America Merrill Lynch | Equifax | Accenture Analytics | Reval Analytics |

| BNP Paribas | Cognizant Analytics | Eclerx | |

| Morgan Stanley | Credit Pointe | ||

| Nomura | Amba Research | ||

| Genpact | |||

| Evalueserve | |||

| DE Shaw |

When I searched to get an idea for the available roles in financial modelling this is the output I received from an Indian job portal – 2553 jobs!

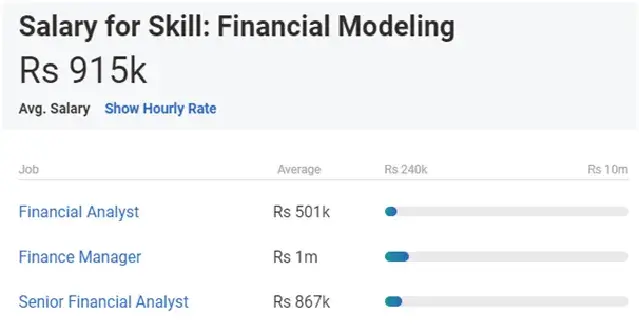

Approximate salary after completion of the Financial Modelling Certification

Salary appreciation for professionals or the beginning salary for fresher’s also depended on the background, experience, and education.

According to payscale, the average salary that a candidate can get after pursuing the financial modelling certification is around 5 lakh per annum to 12 lakh per annum depending on the position.

Suitable candidates for the financial modelling course

- Students who are interested in the world of finance and want to understand how money-related decisions are made.

- Students who are pursuing MBA or financial certifications like CFA, FRM, CA can also get this certification. Having it will be an added advantage.

- Candidates with other technical skillsets like B.Tech or candidates who have a degree or diploma in engineering can also pursue this certification. This will open up additional opportunities and increase knowledge in another sector as well.

- Financial professionals who want to upgrade their knowledge base or want to switch profiles into more research-oriented jobs can take this certification. Adding this certificate may also provide a salary hike.

Duration of the course

To cover all the valuation methods, excel shortcuts a period of four months is required.

Conclusion

Financial modelling is one of the most sought after skills in the world of finance and I would recommend that don’t leave this for too long and make most of the certification before the supply meets demand to have an added advantage.

Pursuing this course will not only increase your knowledge but also give you an added advantage over other candidates.

Read more: 9 Top Skills For Financial Analyst

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!