How to get ACCA jobs in the Big 4?

Here's What We've Covered!

How awesome would it be to say that “I work in one of the Big4 Organisations”?

Imagine standing in a group chit-chatting with everyone, and suddenly someone asks you, “So, where do you work”?

If you dream about saying that “I work for Ernst & Young,” then this article is for you. Working in the Big4 means you will be recognised for your stature and that you are an employee of one of the biggest and best accounting firms in the world.

Although all four companies in the Big4 are non-Indian, they have a strong hold in Indian auditing practices and strategies.

Do you know why?

That is because these four companies take care of the auditing and accounting needs of 10% of the listed companies. And these are not small companies; instead, we are talking about pan-India banks and automotive companies that have a global presence.

Let’s find out more about the Big4 companies and what it takes to get ACCA jobs in Big 4.

What is Big4, and What do They Do?

The Big4 accounting firms include;

- Deloitte Touche Tohmatsu

- KPMG

- PricewaterhouseCoopers

- Ernst & Young

These account firms provide services like;

- Auditing

- Transaction advisory

- Taxation

- Financial consultation

- Risk advisory

- Actuarial services

Let’s know about these companies separately.

- KPMG: After the merger of Klynveld Main Goerdeler (KMG) and Peat Marwick in 1987, KPMG or Klynveld Peat Marwick Goerdeler was formed. Today the company has operations in over 154 countries and employs more than 219,000 employees. KPMG mainly works in technical and analytical accounting work while providing services like audits, taxation, advisory and a few industry-specific services.

- Ernst & Young: Ernst and Whinney merged with Arthur Young to build Ernst & Young as a single entity in 1989. Today it is a global company spread in over 150 countries providing advisory services and taxation services. While hiring new people, Ernst & Young looks at the employee’s sincerity, cooperation, and enthusiasm. With over 284,000 employees working for the company globally, Ernst & Young earned $37.2 billion in 2020.

- Deloitte: Also known as Deloitte Touche Tohmatsu, William Deloitte founded the company in 1845. As a consulting firm, Deloitte practices in Human Capital, Strategy & Operations, and Technology while focusing on a few industries. These are finance, Infrastructure operations, Merger and acquisition, supply chain, and manufacturing operations.

- PricewaterhouseCoopers (PwC): The formation of PwC also came after the merger of Price Waterhouse and Coopers & Lybrand in 1998. Initially, the company was established to deliver valuable services and sustain customer relations. The services provided by the company include asset management, banking, and capital markets.

Collectively, these companies take up projects like managing the finances of organisations. They also audit the company accounts and provide advisory services, including risk management and actuarial services.

Why Do These Companies Need ACCA Professionals?

The Association of Chartered Certified Accountants (ACCA) trains individuals in a wide range of accounting methods and helps them learn the ways and means of adaptive accounting.

The professional-grade certification helps train people to create a sustainable understanding of the concepts associated with accounting. The training provided relates to real-life scenarios to build the right cognitive skills to tackle the situations while working for an accounting firm.

Moreover, the trainees under ACCA are always abreast with the latest developments and changes in the accounting standards. This helps implement the required changes in the standards and always stay relevant in the workplace.

The knowledge and learnings a trainee gather from here help build a solid foundation of the basic concepts. Moreover, they can implement the learning in any industry and any type of business across the globe.

Lastly, they mould the trainees to work like a professional in any company setting via different types of activities and skill-training sessions curated for the specific purpose.

After considering the training provided here, it must be clear that the Big4 companies crave for individuals with the right skills, training, and professionalism. As these four companies serve clients globally, they require employees who can effectively understand the accounting and tax standards of a specific industry and country only to implement adaptive solutions.

Besides the technical and foundational understanding of the concepts required to work, individuals wanting to get ACCA jobs in Big 4 must also possess attributes like;

- Competency

- Reliability and accountability

- Integrity

- Honesty

- Self-control

- Flexibility

- Respect for others

- Professional image

With these qualities and traits, you can get ACCA jobs in Big 4 companies. You will find the hiring process at the Big4 is relatively easier against people who don’t have this level of training.

Skills Big4 Companies Look for in Potential Employees

If you are thinking that getting the top position in the university is enough to land a job in Big 4, you need to have these skills.

- Technical Acumen: Well, this goes without saying that for an accounting job at the Big4, you need to be an expert in your field. It can be accounting, taxation, financial analysis, economic consulting, corporate finance, restructuring, mergers and acquisitions, actuarial, business modelling, financial modelling, and so on.

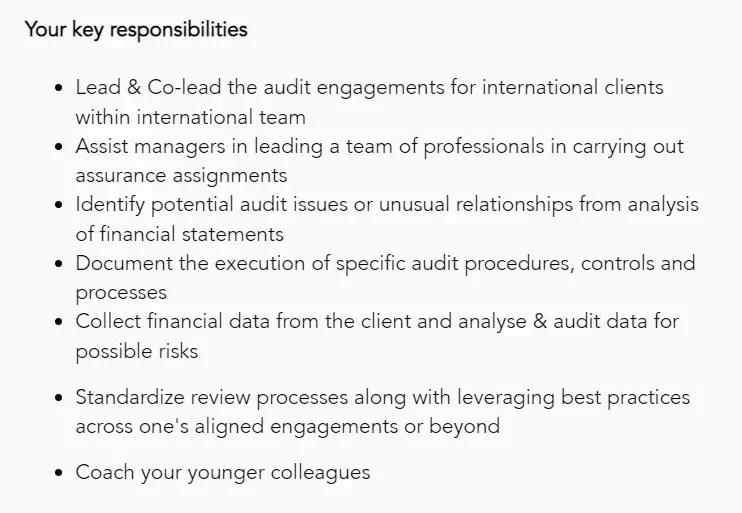

For instance, an Audit Executive at Ernst and Young is expected to carry out operational and financial processes. They work on system audits specifically designed to find accounting and auditing issues. They identify the required improvements in control systems and present audit reports.

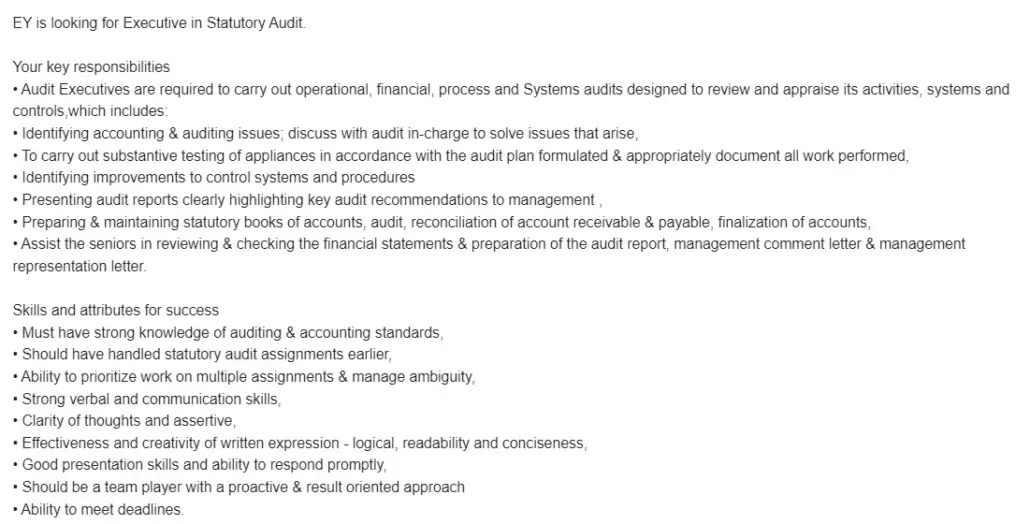

Look at the image below for more information;

Carefully look at the technical and additional skills Ernst & Young expects from a potential employee.

- Work Ethics: This is a skill that won’t be listed on the job descriptions posted by Big4 companies. As we are talking about highly competitive and global companies, they need people who are smart, adaptive and are ready to put in the effort.

The recruiters look at your CGPA score and the extracurricular activities you might have participated in at the school or college level to judge your work ethic.

The companies desire individuals who know how to prioritise tasks and manage operations effectively. Also, the potential employees must know how to be a team player and follow a result-oriented approach.

- Communication: Another essential skill people need to secure ACCA jobs in Big 4 includes communication. Working in the accounting team means you need to communicate frequently with employees, clients, and stakeholders.

The employees also need to deliver presentations, give speeches, and work on reports. So, their communication skills have to be adept and impressive.

- Company and Cultural Fitness: Recently, Ernst & Young and PwC have reduced their educational requirements to attract a larger cohort of eligible individuals. Substituting the screening requirements, these companies are looking for skills like leadership potential, courage, enthusiasm, and a global mindset.

According to our understanding, companies like the Big4 give less importance to the individual’s education. They will get access to more than enough in-house training and skill enhancement programs.

The companies need people who are the right fit for the company and possess the right characteristics and qualities. This is why the recruitment and application selection process is so rigorous and detailed.

How to Develop the Skills to Secure Jobs in Big 4?

There is no doubt about the fact that working at the Big4 requires the person to possess some amazing skills. They do need technical acumen, but they also need to have additional job-related skills and knowledge.

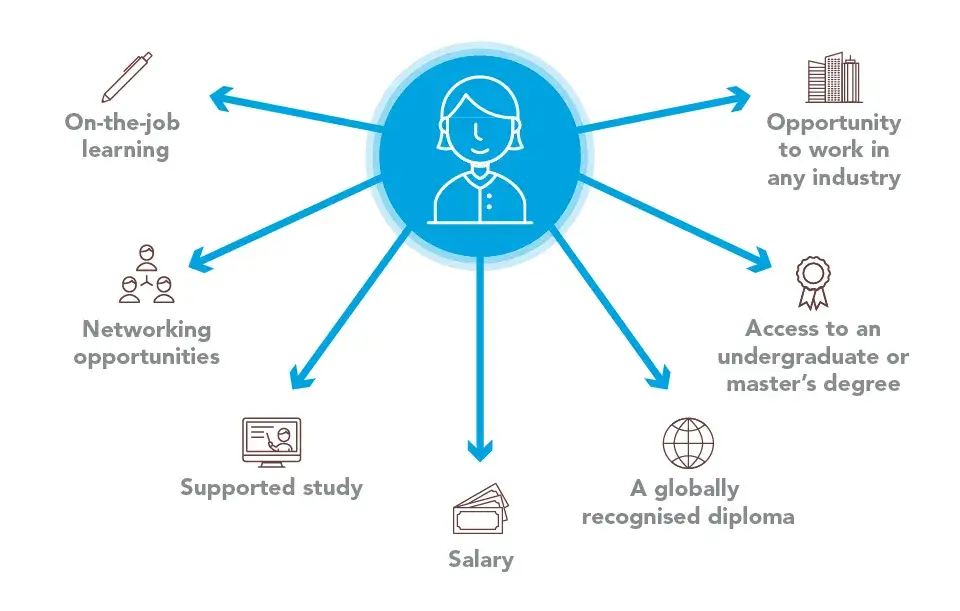

An ACCA course prepares the trainees to ensure that they can work anywhere in the world, including the Big4 companies. The training provided here helps the individuals with;

- Strategic thinking

- Technical understanding

- Professional values

These are the qualities an organisation desires in its employees as they are critical to move the company forward. These qualities are combined with quality tuition provisioning on a flexible pattern to help support the educational requirements.

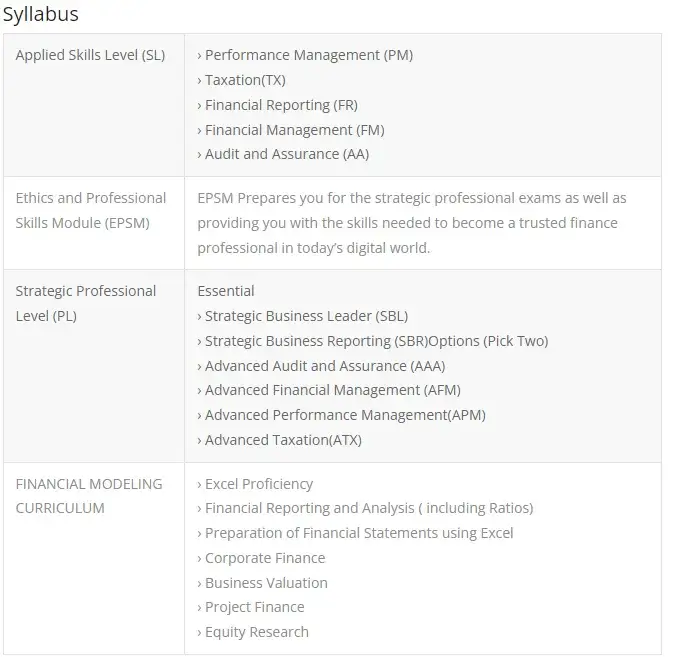

To build the right skill set, you need to approach the preparation in components. For instance, there is applied knowledge, applied skills, ethics, strategic professional training, and financial modelling.

These are the elements taken from IMS Proschool’s course on Global Professional Accountant associated with the ACCA.

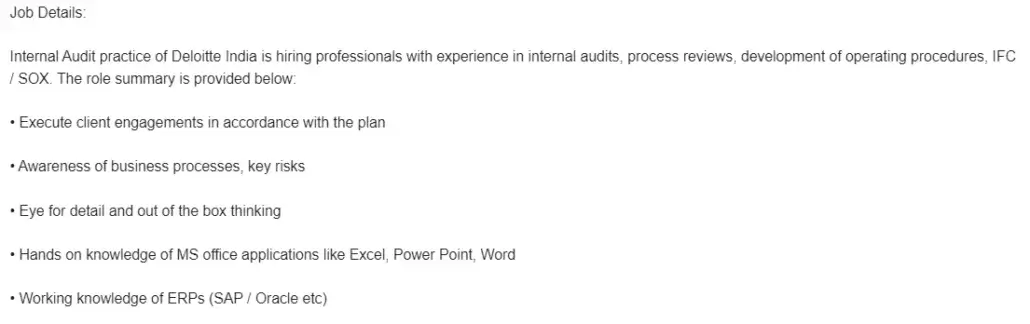

If you compare the course components with the job requirements, it will match. For instance, below is a job description posted by Ernst and Young on the ACCA website.

The course at IMS Proschool trains the individual in taxation, financial reporting, financial management, audit and assurance. Besides this, the strategic professional skills module is about schooling the person in strategic business leadership, advanced financial management, and advanced audit and assurance, among other components.

In the job requirements above, you will notice that EY is looking for candidates to lead and co-lead audit engagements and identify audit issues (audit and assurance) for international clients. The job requires you to assist management in leading a team (strategic business leader). Also, it requires you to create effective documentation on the specific audit procedures, controls, and processes (Financial reporting and analysis).

Likewise, other ACCA jobs in Big 4 have similar requirements, adding/removing one or two requirements and responsibilities.

ACCA courses at IMS Proschool also help the students learn and use Microsoft Excel to arrange data to create financial reports and statements. So, one course covers a major chunk of the requirements for ACCA jobs in Big 4 and get you on the right track to building a promising career.

Besides the technical training, IMS Proschool courses also help build the right communication skills. These courses are specially designed to train and nurture the students so that they can have expert interactions with clients and teammates while working at one of the Big 4 companies easily.

Conclusion

Working at the Big4 companies means you will live and breathe in an environment that trains people to drive change and things in terms of the future. Organisations like EY, Deloitte, KPMG, and PwC set in new trends and directions in the industry.

It’s the people working in these organisations who have become drivers of change in the industry and have created a culture of efficiency and expertise in auditing, accounting, financial analysis, and reporting, among other components.

So, while you are training to secure ACCA jobs in Big 4, get onboard the IMS Proschool courses on ACCA and get assured results. These courses will help you build the required skills and technical acumen to not only secure a job but also play a critical role in shaping the future of accountancy.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!