5 Jobs in Finance for MBA Freshers

Here's What We've Covered!

It is every finance student’s dream to receive an illustrious MBA degree.

The day you get your MBA certificate in your hands is the day you are ready to join the finance industry. The finance realm has seen many leaders, entrepreneurs, CEOs and visionaries who hail from an MBA background. These individuals have had a significant impact on the corporate world and earned themselves a stellar legacy.

If you’ve made it your goal to join this illustrious community, you must work hard and keep your eyes on the prize. The journey to the top is a long, winding road filled with obstacles. But before you can reach your career destination, start with the first step — get a good, entry-level job that will catapult you into bigger and better opportunities. There are jobs for MBA finance freshers that are highly sought after and can lead to good career growth. Just remember, finance is a fiercely competitive field. So you have to be committed to your goal. Your chances of getting hired increase even further if you have another reputed certification that complements your MBA. It will help your career in finance after your MBA.

Top 5 jobs in finance for MBA freshers

-

Assistant relationship manager

Banks prefer to hire MBA holders as relationship managers. They help customers to make decisions about their financial planning and investment opportunities. You need good salesmanship and interpersonal skills to work as a relationship manager. Freshers have to help senior executives with managing customers and creating investment strategies. This is an ideal job in finance for an MBA fresher as you learn a lot about the finance and banking industry.

Job Responsibilities

- Build a close, trustworthy relationship with the clients.

- Offer customised financial advice to help the customer make the right choices.

- Have a clear understanding of the bank’s financial products and how the finance markets operate.

- Follow the policies and guidelines set by the bank as well as government regulatory bodies.

Career path options: RM jobs for MBA freshers

Assistant relationship managers can move on to higher positions once they have accumulated experience, such as:

- Senior relationship manager

- Relationship director

- Branch manager

- Corporate banking relationship manager

- Treasurer

Additional certifications for relationship managers

- CFP

- CFA

- CMA

- CRM

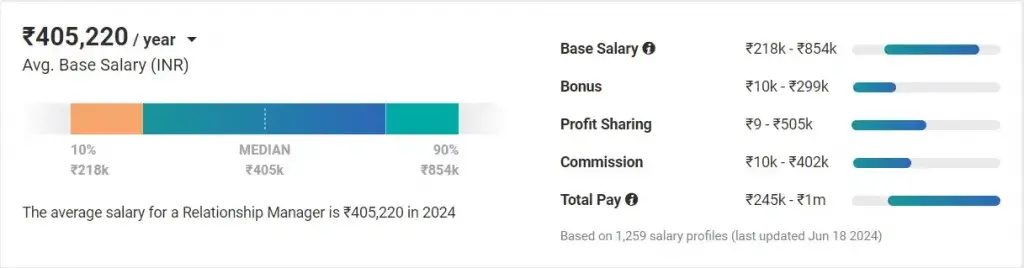

Salary expectations

- The salaries depend on which bank or financial institution you join and the location.

- Average annual salaries range from Rs 2 lakhs to Rs 4 lakhs.

- Senior professionals can earn over Rs 8 lakhs a year.

Source: Payscale

Also Read – 5 Exceptional Finance Courses For MBA Students

-

Junior financial analyst

One of the best jobs for MBA freshers is to become a junior financial analyst. In this role, you can help businesses and investors to make the right investments for bigger profits.

Job Responsibilities

- Financial analysts can work for banks, investment firms and financial institutions dealing in hedge funds, mutual funds, pension funds, securities, etc.

- The job requires a thorough evaluation and assessment of stocks, economic trends and investment prospects.

- You will be required to collect and analyse relevant financial data.

Career path options: Financial analyst jobs for MBA freshers

Junior financial analysts can move on to higher positions once they have accumulated experience, such as:

- Senior financial analyst

- Portfolio manager

- Fund managers

- CFO

- CIO

Additional certifications for financial analysts

- CFA

- Financial modelling certification

- Options trading certification

- Quantitative Finance

Salary expectations

- The salaries depend on which financial institution you work for. The location also matters.

- Average annual salaries range from Rs 3 lakhs to Rs 5 lakhs.

- Senior professionals can earn over Rs 10 lakhs a year.

Source: Payscale

Also Read – Career opportunities in microfinance industry

-

Junior credit analyst

As one of the top jobs in finance for MBAs, credit analysts enjoy a lucrative career. They are in charge of setting and enforcing credit policies and regulations within a company or financial institution.

Job Responsibilities

- You have to evaluate the company’s policies on credit and make modifications or changes where needed.

- Credit analysts have to determine and create interest rates for loans.

- They have to ensure that the loans granted follow the proper channels and procedures.

Career path options: Credit analyst jobs for MBA freshers

Credit analysts can move on to higher positions once they have accumulated experience, such as:

- Senior credit analyst

- Credit manager

- Portfolio manager

- VP

- CFO

Additional certifications for financial analysts:

- CFA

- CCRA

- CCP

- Financial modelling

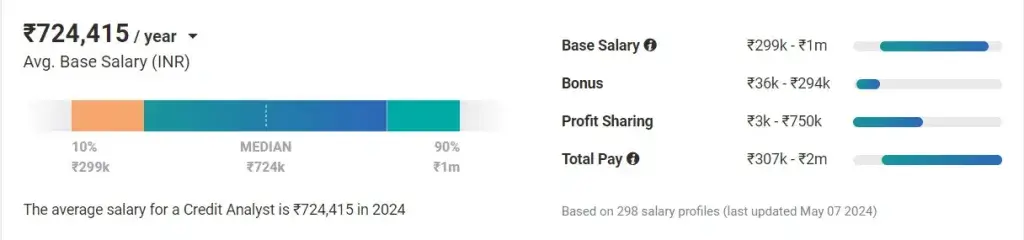

Salary expectations

- The calibre of the company or bank you work for, your qualifications, negotiation skills and office location all play a role in determining your salary structure.

- Average annual salaries are around Rs 7 lakhs a year.

- A professional with an experienced career in finance after an MBA can earn over Rs 10 lakhs a year.

Source: Payscale

Also Read – Top 7 Skills That Make You An Expert In Finance

-

Junior equity research analyst

One of the best careers in finance after an MBA is that of the equity research specialist. This professional studies and analyses financial markets and stock performances to help clients make profitable investment decisions.

Job Responsibilities

- You have to possess a deep understanding of how financial markets work.

- Professionals must analyse possible prospects for investments while examining all the risks involved.

- Make recommendations to clients, investors and companies based on your findings and research.

Career path options: Equity research analyst jobs for MBA freshers

Equity analysts can move on to higher positions once they have accumulated experience, such as:

- Senior equity analyst

- Sector Head

- Head of Research

- Asset manager

- Consultant

Additional certifications for equity research analysts

- CFA

- Options trading certificate

- Financial modelling

- Equity research certificate

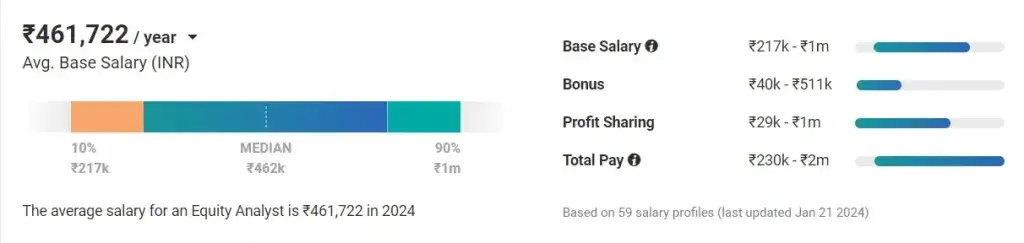

Salary expectations

- Salaries can be higher or lower, depending on the recruiting company and your qualifications.

- Average annual salaries are around Rs 4.5 lakhs a year.

- A professional with an experienced career in finance after an MBA can earn over Rs 10 lakhs a year.

Source: Payscale

Also Read – Top 5 Trending Finance Courses In 2025

-

Junior risk analyst

Risk management is one of the best careers in finance after an MBA. Risk analysts help companies to mitigate any financial disasters or losses by applying their knowledge and skills.

Job Responsibilities

- Reviewing market data, stocks, financial products and industries to determine various risk factors.

- Offering suggestions and recommendations that minimise risky investments.

- Implementing data software to help make accurate risk calculations.

Career path options: Risk analyst jobs for MBA freshers

- Senior risk analyst

- Risk manager

- Compliance Consultant

- Chief risk officer

Additional certifications for junior risk analysts

- CFA

- FRM

- ERM

- Financial modelling

Salary expectations

- Your salary will depend on several factors such as location, company name and qualifications. This is true for most careers in finance after an MBA.

- Average annual salaries are around Rs 10 lakhs a year.

- An experienced professional can earn over Rs 20 lakhs a year.

Source: Payscale

Also Read – Why Financial Modelling is the ultimate skill you need to kickstart your career in 2025

Proschool can help enhance your career in finance after MBA

Before you start looking for jobs in finance after your MBA, your resume must have enough substance to attract recruiters from the companies you apply to. Proschool, one of India’s top coaching institutes, offers a variety of exceptional finance courses that help to boost your MBA and make you a coveted hire. You can do a CFA, CFP, financial modelling or investment banking program and learn updated skills and industry knowledge. What makes Proschool unique? For starters, the faculty contains industry experts and experienced finance professionals who are also reputed teachers. They use active learning methodologies, real-world projects and case studies to help students gain insights and knowledge about the workings of the industry. Core concepts are simplified, doubts are cleared and students receive personalised support from the staff.

Highlights of learning with Proschool:

- The institution has an in-house placement program that helps all certified students find jobs in finance for MBA freshers.

- Additional study resources are available for all courses, such as practice papers, mock tests and study prep material.

- You can experience classroom-based learning or opt for online sessions.

- Proschool offers recruitment-based training as well, as students learn about interview and resume writing skills.

FAQs

Is there a lot of competition in the industry for jobs in finance after an MBA?

Yes. History has shown that an MBA in finance can lead to lucrative and exciting career opportunities. There has been a rise in the number of MBA graduates every year. India has the second-highest number of MBA holders. Nearly 3 lakh students clear the exams every year. Unfortunately, the number of jobs isn’t increasing as rapidly. MBA graduates who get noticed by top recruiters are either rankers from tier-one colleges or students with additional finance certifications.

What is the starting salary for most jobs for MBA freshers?

While salaries depend on many different parameters, on average, graduates from top colleges start at Rs 6 to Rs 7 lakhs a year, while the rest could start at Rs 3 to Rs 4 lakhs per annum.

Which job profile is best for MBA finance?

While there are many diverse roles in the finance industry, some of the best positions are financial analyst, relationship manager, credit analyst, risk analyst and equity researcher.

Is the MBA finance degree in high demand?

The MBA finance degree is one of the most coveted qualifications in the industry. It can lead to many opportunities that lead to high-paying jobs. However, it is a competitive field, so you really need to bring your A-game if you want a successful career in finance after your MBA.

Conclusion

We often hear about success stories in the finance industry and how a well-educated and hard-working professional rose to the top of the corporate hierarchy. That could be you in the future if you strategically plan your career in finance after your MBA. Receiving another prestigious finance certification like CFA or CFP can make a difference in how a recruiter perceives you and help you get one of the above jobs in finance for MBA freshers.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!