What is portfolio management?

Here's What We've Covered!

Let’s assume you have one crore rupees in your bank. There is no time to waste. You need to get that money working for you right away. So, you ask around, maybe speak to close friends or family members. They suggest you put your money in equity. Everyone is doing just that, they will tell you. Due to their limited understanding of investments, they can’t work out a customised plan for you nor understand the nuances of your financial needs. They don’t know what is portfolio management.

For that, you need investment advisors or portfolio managers. They know the right stocks and assets in which to invest. They understand economics and financial markets. They also are aware that no two clients are alike, and neither are their portfolios.

A professional will speak to you about your life first. What are your requirements? Future goals? Current expenses? Are you willing to take a few risks? Or would you prefer low-yield but safer options? They will evaluate your personality and finances meticulously.

This kind of counselling is very crucial. It is the mark of a good portfolio manager. You require a high level of thinking, analytical reasoning and numerical skill to create the perfect portfolio. If you have the talent and education, portfolio management can be a very satisfying and lucrative career. If this is where your interests lie, learn more about the meaning of portfolio management here.

What is portfolio management?

Simply put, it is the professional guidance given to individuals, families and organisations to choose and manage investments. A reputed portfolio manager offers personalised service to help clients meet their financial needs and goals. They manage mutual funds, bonds, stocks and other investment securities on behalf of their clients.

There is a delicate balance to portfolio management. You handle the risks, create strategies, engage in day-to-day trading and use your expertise to maximise returns. Many certifications and courses teach what is portfolio management. It is important to choose the right one as your entire career depends on it. The investment market is unpredictable and complex. You need the skills, knowledge and astute thinking to navigate this tricky terrain. Qualified professionals can give insightful recommendations to their clients. They understand the various types of portfolio management. It’s a complicated industry but very rewarding too.

Key elements of portfolio management

So how does one go about becoming a portfolio manager? There is a process involved. You must have the qualifications, skills and experience. Here is a step-by-step guide to help you on your journey to fully understand what is portfolio management.

-

Eligibility factors

You need one or more of the following degrees and certifications to learn the true meaning of portfolio management.

- Bachelor’s degree in Commerce, Finance or Economics

- MBA in Finance or Investment Banking

- Chartered Financial Analyst (CFA)

- Chartered Financial Planner (CFP)

- Chartered Accountant (CA)

- SEBI Portfolio Management certification

-

Skills needed in portfolio management

-

Strong analytical abilities

A competent portfolio manager is a very sharp-minded person and can scrutinise the financial markets for specific investments. You should be able to use your knowledge to extract insights about a company’s performance from the financial statements.

-

Calm under pressure

If you can keep a cool head during high-stress moments (and there will be quite a few of them in this industry), you have mastered one of the key elements of portfolio management.

-

Predictive strategies

None of us owns a crystal ball to see into the future. But, a portfolio manager can make reasonable predictions about an asset’s performance by using financial modelling and other predictive strategies.

-

In-depth knowledge of the markets

Without a strong foundation in portfolio theory, you will not make your mark as an efficient investment manager. A course such as CFA or SEBI portfolio management will help you learn the intricacies of the financial markets and global economies. You will also learn about the types of portfolio management and where your proficiency lies.

-

Decision-making skills

There are quite a few paths to pursue when planning a portfolio strategy. A skilled portfolio manager will know when to stop analysing and make sound decisions. This is vital, as in investments, timing is very important. Spend too much time musing over possibilities, and you may miss out on a viable opportunity.

-

Communication skills

One of the most important elements of portfolio management is communicating with your clients. You have to speak to them and understand their requirements. It takes several skilful questions to figure out their risk limits and future goals. If you have the gift of the gab and can communicate effectively, this is the perfect job for you.

-

Responsibilities of a portfolio manager

What is portfolio management on a day-to-day basis? That is a question most aspiring professionals want to know. A portfolio manager’s job involves a host of responsibilities to ensure optimal investment strategies for clients. They study economic conditions, create investment objectives and analyse risk factors. Here is a deeper look at the activities and functions of a portfolio manager.

- Communicate with clients to assess their risk tolerance and financial goals.

- Identify the client’s needs and constraints.

- Conduct market research and analyse economic factors.

- Create investment opportunities to discuss with clients.

- Build financial reports that focus on company performance and market opportunities.

- Design a portfolio that fulfils short-term and long-term goals.

- Buy and sell securities as per the investor’s demands.

- Evaluate the portfolio’s performance and tweak or adjust investment strategies according to existing or potential market conditions.

-

Job opportunities

Once you have a firm grasp on what is portfolio management, you are qualified to apply for jobs. Portfolio managers can work in many organisations such as banks, insurance companies, wealth management firms and other investment advisory firms.

ICICI, Tata Consultancy Services, HDFC Bank, Kotak Mahindra Bank and Deloitte are some of the top companies that offer different types of portfolio management services.

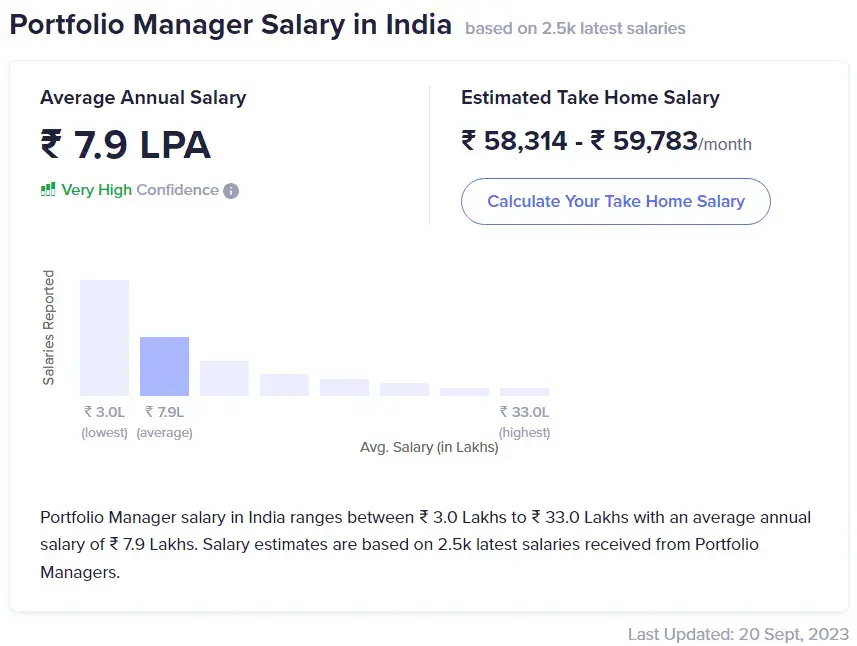

Starting salaries for portfolio managers are around Rs 3 lakhs and can go over Rs 30 lakhs for senior professionals.

Proschool’s CFA and CFP courses

Today, most successful investment advisors or portfolio managers have a CFA or CFP certification attached to their resumes. As one of India’s highly acclaimed coaching institutes, Proschool has innovative processes in place to help you clear either course successfully. The renowned faculty members are industry experts with considerable experience in the field. They offer students in-depth training and skill development using creative and advanced learning methods. Students are exposed to the latest industry standards and current trends, so they stay ahead of the learning curve.

The CFA and CFP courses are perfect for students who are learning portfolio management as both programs deal extensively with investment theory and applications.

Why Proschool?

- Highly experienced professors from the investment industry.

- Exceptional resources and facilities that help students study better.

- Classes are available online as well as in learning centres in major cities across India.

- Placement portals can help students land entry-level jobs after course completion.

- You receive certifications from Proschool and NDSC.

FAQs

Is financial modelling required in portfolio management?

Yes, financial modelling can be a big help in portfolio management. You can use it to make calculations, represent financial assets or forecast future stock performance.

What are the four types of portfolio management?

Active portfolio management: You buy low-priced stocks or assets and sell them at a higher value.

Passive portfolio management: You invest in diversified assets for long-term growth by tracking their performances and monitoring the markets.

Discretionary portfolio management: The manager has control over the portfolio and can make changes in the investment strategy as and when he sees fit.

Non-discretionary portfolio management: The client controls the portfolio and the portfolio manager carries out various investments as per instructions.

How can Proschool help me get entry-level jobs with portfolio management companies?

Proschool’s placement portals ensure that every student has the opportunity to apply for jobs in the portfolio management industry. You will also be groomed for interviews and resume writing techniques to ensure you make a lasting impact during your meeting.

In conclusion

In a nutshell, it is one of the most lucrative jobs in the finance industry today. You work hard at making money for your clients, and in turn, are handsomely rewarded as well. To be a top portfolio manager, you need the appropriate certifications and experience. A CFA or CFP qualification will go a long way in cementing your career as a highly successful investment professional.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!