Investment Banking vs. Commercial Banking: Understanding the Differences

Here's What We've Covered!

- What is investment banking?

- What is commercial banking?

- Investment Banking Vs Commercial Banking – Differences

- How Proschool helps students learn investment banking and commercial banking

- FAQs

- How does risk affect investment banking and commercial banking?

- Can a commercial bank also offer investment banking services?

- Can a CFA work in commercial and investment banking jobs?

- What are the similarities between investment banking and commercial banking?

- Can I switch from a career in commercial banking to investment banking?

- What degree is best for a career in investment banking?

- Conclusion

Good financial management is the key to a quality life, but a robust banking system is the key to a thriving economy. A community depends on different types of banks to carry out various monetary services. People trust banks with their hard-earned money, while companies depend on banks for funding. Without banks, we’ll probably still hide our money inside our mattresses.

Now that we’ve established the importance of banks, let’s move on to two of the most popular banking systems — investment banking and commercial banking. While both play a prominent role in financial and commercial development, they also have very distinct personalities. Commercial banking is a system that runs on borrowing and lending money. Investment banking helps people multiply wealth through various avenues and opportunities.

As a future banker, where do you see yourself? Are you a finance guru who analyses markets to find viable investment prospects?

Or are you a relationship manager selling different services and products to banking customers?

If you are confused between investment banking and commercial banking, keep reading. Below is a detailed post on the differences between the two to help you decide which career is best for you.

What is investment banking?

When you take a portion of an individual’s income or a part of a company’s revenue and put it to work in the stock market, you are a professional in the investment banking industry.

It is a very specialised and niche sector in finance that offers various investment services to people, companies and government institutions.

Investment professionals can help their clients multiply their wealth, or they help raise capital to fund various ventures. They connect the buyers with the sellers and help both sides make well-informed investment decisions.

The main difference between investment banking and commercial banking is that the former takes the client’s money to invest in stocks, assets, bonds, securities, etc, while the former takes deposits and gives out loans.

Also Read – Benefits of Pursuing a Career in Investment Banking

Investment banking job responsibilities:

- To scan the markets for viable investment opportunities through careful analysis.

- Identify potential risk factors that might affect the investment plan.

- Create projections, company valuations, M&A financial models and other calculations.

- Help companies set up their IPO by creating valuations, ensuring all regulations are met and underwriting the shares for the IPO.

- Assist companies with raising capital by issuing or selling bonds, debt and equity offerings, etc.

- Carry out due diligence, company analysis and industry research during merger & acquisition deals.

Also Read – A 5-step plan to starting your investment banking career

How to get into investment banking:

- You need an MBA in finance or a financial certification such as CFA, PG investment banking, etc.

- Professionals should know financial modelling, quantitative methods and MS Excel.

- Strong communication, problem-solving and analytical skills are necessary.

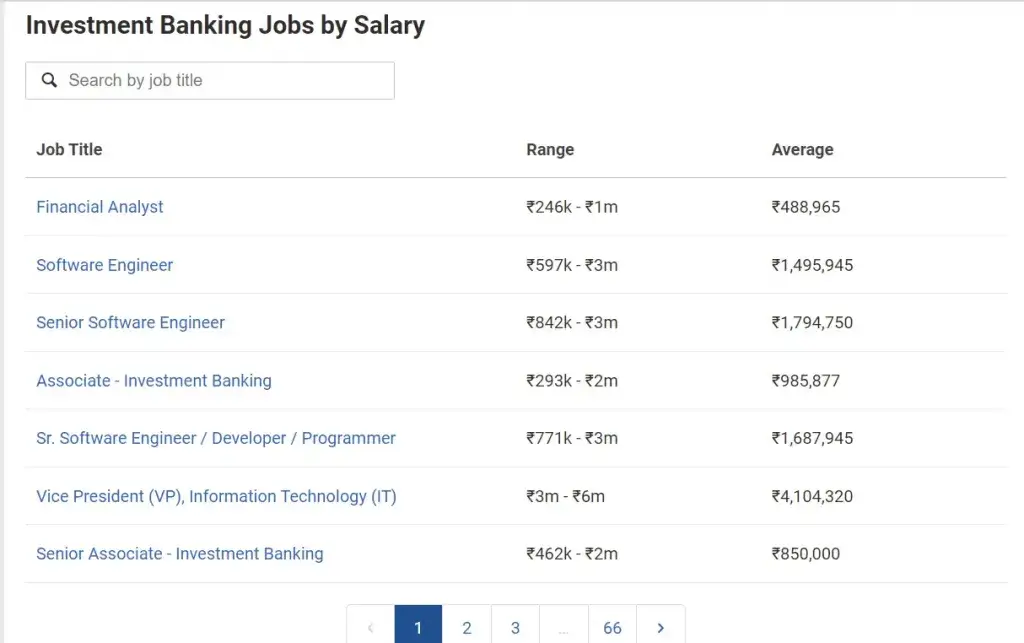

Source:Payscale

How top investment banks help the Indian economy

-

Massive M&A deals

2023 saw a 72 per cent rise in mergers and acquisitions in India. Due to deals such as Tata and Air India, PVR and Inox, and Reliance Retail and Ed-a-mamma, the total value of all M&A projects was over 150 billion dollars.

-

Hyundai Motors IPO

Hyundai Motors is working with two of India’s top investment banks, Citibank and JPMorgan, for their initial public offering (IPO) in India, valued at over 3 billion dollars.

Also Read – How Does a Financial Modelling Course Help Investment Bankers?

What is commercial banking?

The difference between commercial banking and investment banking is that commercial banks focus on lending money to businesses rather than using the money for investments. These banks build a corpus by taking deposits from people and using some of that money to grant loans to companies and entrepreneurs. Commercial banks are known to mobilise wealth, create credit and support the economy through various financial services.

The banks operate on the grassroots level, providing funding for agricultural and rural development. They also play a massive role on an international level, through foreign exchange, financing trade and various cross-country transactions. Both services have a direct impact on India’s economic growth.

Commercial banking job responsibilities:

- To provide financial services to people, small businesses, big companies and government organisations.

- Services include savings and current accounts, fixed and term deposits, loans, credit cards, foreign exchange, locker facilities, etc.

- Commercial banks offer personal loans, home loans, business loans, MSME and SME loans, women entrepreneurship loans, commercial vehicle loans, etc.

- The banks also ensure that various government schemes and policies are implemented.

- Customers are given several platforms as payment options, such as credit cards, debit cards, EFTs and banking apps.

Also Read – The Critical Importance of Commercial Banking in India

How to get into commercial banking:

- Candidates need an MBA in finance or professional certifications such as CFA, CFP, FRM, CPA, etc.

- Expertise in financial modelling, core banking products and business development is important.

- Professionals must have interpersonal skills as well as analytical and critical thinking abilities.

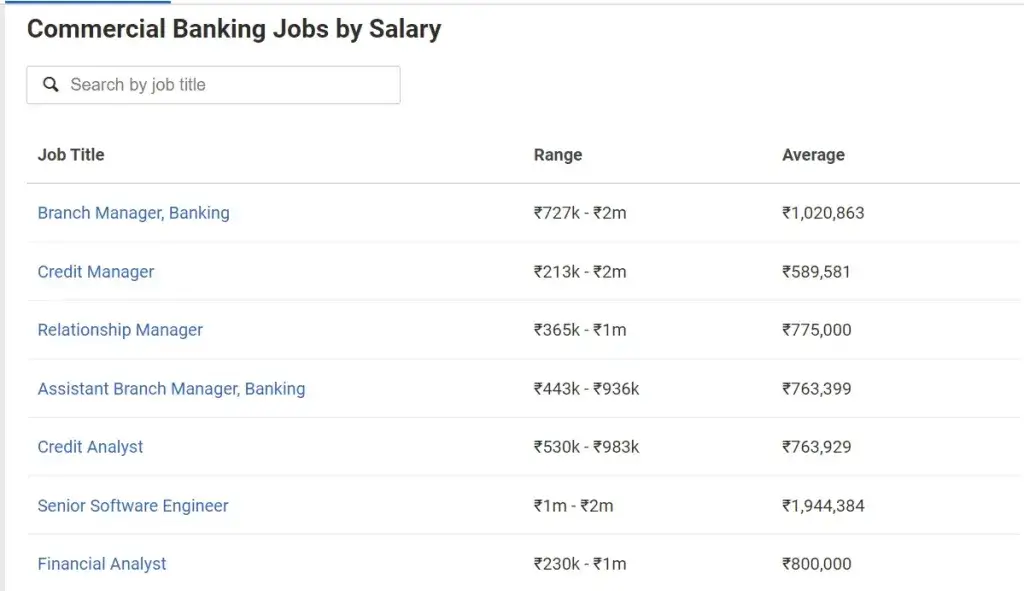

Source: Payscale

Also Read – Breaking Down the Functions of Commercial Banking: An Essential Guide

How top commercial banks help the Indian economy

Here are some of the contributions made by commercial banks towards economic development in India.

-

HDFC Bank

HDFC arranged a loan mela in a town in Andhra Pradesh for small farmers, agricultural startups and entrepreneurs. Over 3,500 people attended this event and learnt about the various financial products that can help them with their business needs. Through this mela, HDFC planned to reach out to thousands of rural dwellers to improve the quality of their lives and ease their financial burdens.

-

ICICI Bank

Another top bank in India, ICICI, launched ‘Mera iMobile’. This is a mobile app for people living in rural and semi-rural areas. The app is the first of its kind and connects customers to online financial services such as farm equipment loans, Kisan credit cards and SHG loans.

-

Bank of Baroda

Bank of Baroda and REC Limited are working together to fund projects that lead to better power supply and infrastructure in rural parts of India during the next three years.

Also Read – 4 Different Types of Commercial Banks and Their Roles in the Economy

Investment Banking Vs Commercial Banking – Differences

| Investment Banking | Commercial Banking | |

| Main purpose | To provide investment-related services that help clients and companies achieve their financial targets. | To offer banking services for customers along with wide range of loans for small, medium and big businesses. |

| Services offered |

|

|

| Clients |

|

|

| Job profiles |

|

|

| Professional qualifications |

|

|

| Most popular banks |

|

|

How Proschool helps students learn investment banking and commercial banking

IMS Proschool is one of India’s most popular coaching institutes and offers the best finance courses, such as CFA, CFP, PG investment banking and financial modelling. These certifications can help you get a good job in investment banking and commercial banking. However, these courses are not easy to master. It helps to have a support team and study resources to guide you through the syllabus. Proschool’s faculty are renowned finance professionals, offering students a comprehensive learning experience. They use active learning methods, real-life case studies and practical training to help students gain valuable perspective into the finance industry.

Why Proschool?

- You can study in a classroom set-up or register for online sessions.

- The CFA course comes with a customised study plan, with time marked out for revision.

- The professors are approachable and accessible. They help to clear doubts and offer personalised support.

- Additional resources such as mock tests, practice papers, learning library and prep books are also available.

- Proschool’s placement program can help you get a job in investment banking and commercial banking.

- Certified students receive training on the recruitment process, such as interview etiquette and resume writing skills.

FAQs

-

How does risk affect investment banking and commercial banking?

As they both deal with large amounts of money, risk management is an essential feature in investment banking and commercial banking.

Both types of banks are affected by market risks, credit risks and solvency risks.

Banks hire risk managers or analysts to protect themselves and secure their finances. These experts can predict or mitigate any financial threats, thereby preventing heavy losses.

-

Can a commercial bank also offer investment banking services?

Yes. Some of the largest commercial banks in India offer financial planning services such as asset and portfolio management. Commercial banks such as ICICI, HDFC, Axis and Citigroup also have investment banking divisions that provide various financial services.

-

Can a CFA work in commercial and investment banking jobs?

Absolutely. The CFA program is designed to teach students concepts and functions within investment banking and commercial banking. The CFA course opens up several job profiles in finance. You are eligible to work as a relationship manager, equity research analyst and portfolio manager, among many other roles.

-

What are the similarities between investment banking and commercial banking?

- Both banks provide financial services that can help an individual or company build wealth or raise more capital.

- Investment banking and commercial banking offer lucrative career opportunities for finance-oriented professionals.

-

Can I switch from a career in commercial banking to investment banking?

Yes, it is highly possible to switch. To make a smooth transition, you will need the right certifications. Most professionals in the commercial banking space may already have the degrees or qualifications to make this career change. An MBA, CFA, financial modelling and similar credentials are required in investment banking and commercial banking. A CFA will add value to your resume, so if you don’t have one and want to get into investment banking, it will help to do the course.

You can also contact former commercial bankers now working in investment banking. They can help you with advice and suggestions from their own experience.

-

What degree is best for a career in investment banking?

While most banks prefer an MBA in finance or investment banking, they are also willing to hire candidates who are CFA charter holders or have done the PG investment banking course. Also, a financial modelling certification adds extra weight to your CV.

Conclusion

While the post has mostly talked about the differences between investment banking and commercial banking, it is also crucial to understand the similarities. Both types of banks offer services that help people and businesses to prosper. They have a substantial impact on India’s economic growth as they mobilise multiple wealth within the country in different ways. Finally, both investment banking and commercial banking can lead to lucrative and exciting career prospects for you.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!