Who is a Relationship Manager & What do they do?

Here's What We've Covered!

Very often in movies, we see banks as cold, impersonal and emotionless. The focus is always on the money and never on the individual. In real life, the perception is similar. Most commercial banks are so large that they seem unapproachable. It is hard to connect to the organisation on a personal level.

You see machines, not people. You hear automated messages, but not a real voice. This can get disconcerting for many customers. Human interaction is very essential when it comes to handing over your hard-earned money.

Enter the relationship manager. While the title doesn’t sound like it belongs in the finance industry, it is actually a very significant profession in the banking business. This job profile is in high demand and can lead to a prestigious and lucrative finance career.

Here is why the role of a relationship manager is vital within a commercial bank. These professionals are highly knowledgeable and aware of the latest financial developments. They support and guide clients, advising them on the right financial products and investment opportunities that suit their specific needs.

To do this job right, you need the skills, acumen, interpersonal skills and good communication abilities. Want to know more? Scroll down.

The role of a relationship manager

Let’s say you apply for a job at ICICI Bank, and congratulations! You are hired. But now what? What comes next? As a relationship manager, you take on many responsibilities in this line of work.

You start by building a close relationship with your clients and helping them on their banking journey. Most customers don’t understand financial jargon and struggle to comprehend different products. They rely on your advice and recommendations. Here are some of the most relevant job responsibilities of a relationship manager.

- Establish a trustworthy relationship with customers so they are open to your advice.

- Help clients understand and identify business and financial opportunities.

- Stay updated on the financial markets and economic developments within the industry.

- Introduce new products to clients, generate interest and work towards closing deals.

- Addressing customer issues or complaints.

- Drum up enough business to achieve your sales target.

Skills of a relationship manager

- Expertise in banking products, industry knowledge and financial markets.

- Excellent communication and presentation skills

- Proficiency in problem-solving and analytical thinking

- Good mathematical skills to calculate and comprehend financial data

- Strong negotiation techniques and salesmanship

Also Read – 9 Must-Have Next-Level Skills for Relationship Managers

Qualifications needed for the role of relationship manager

You need to have one or more of the following certifications:

- An MBA or BBA in finance/economics/business management

- CFA

- CFP

- Financial modelling

- Investment banking course with PG certificate

Career scope for relationship managers

Relationship managers can work in

- Investment banks

- Commercial banks

- Retail Banks

- Non-Banking Financial Institutions

Top banks to work in:

- ICICI bank

- HDFC bank

- Axis Bank

- Standard Chartered

- Deutsche Bank

Also Read – Decoding the Myths – Is Relationship Management right for You?

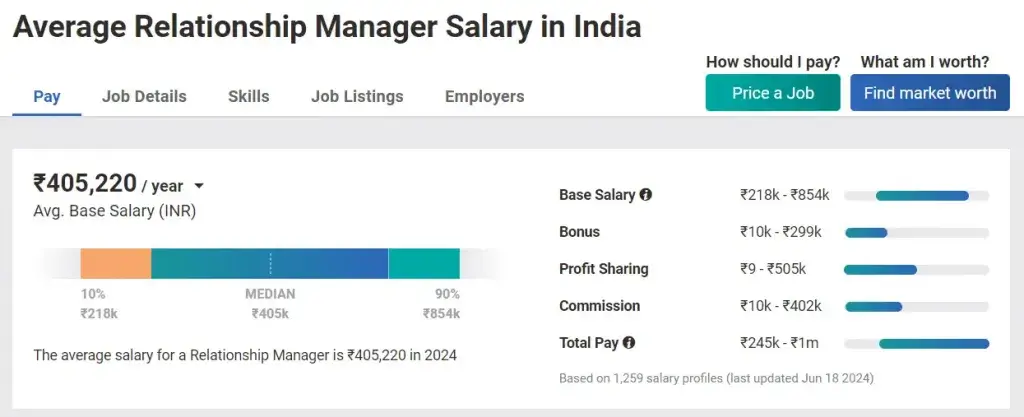

Annual salary packages for relationship managers:

The salaries depend on the bank, location and your level of expertise. International banks may pay more than Indian banks.

- The starting income is around Rs 2 lakhs.

- The average salary for less than eight years of experience is around Rs 4 to Rs 6 lakhs.

- Experienced senior professionals make over Rs 8 lakhs.

Source: Payscale

Also Read – A Day in the Life of a Relationship Manager

Future roles for relationships managers

The role of a relationship manager eventually evolves into higher positions within the organisation.

- You can become a senior relationship manager and eventually a relationship director.

- Relationship managers can also move on to areas of specialisation such as asset management, corporate banking or wealth management.

- They can also get promoted to head of customer service departments within the bank or financial organisation.

Also Read – 6 Roles That Make Relationship Managers Indispensable

How Proschool helps you take on the role of a relationship manager

The finance field is highly competitive. Banks receive hundreds of resumes for job positions, yet only a few from that number get hired. So how can you join the prestigious community of relationship managers? You need the skills, expertise and most importantly, qualifications. One of India’s leading coaching institutions, IMS Proschool offers the best finance courses such as CFA, CFP, PG Investment Banking and Financial Modelling. These programs are taught by experienced finance experts, using active learning methods and real-world training techniques. Students are taught to take on leadership roles in the field of finance. They learn more than the relevant finance concepts listed in the syllabus, such as practical applications and industry-relevant skills.

Highlights of learning with Proschool:

- You can study at Proschool’s many coaching centres in major cities across India, or you can register for online classes.

- To ensure you ace your exam, Proschool offers access to mock tests, practice papers, learning videos and other study material.

- The professors help clear doubts, retain core concepts and offer personalised attention.

- The courses are taught to prepare you for the real world, not just the examination.

- Proschool’s highly effective placement program will help you find a job in the role of a relationship manager.

Proschool’s finance courses for relationship manager

- CFA – Chartered Financial Analyst program

- Deep Financial Expertise: The CFA program covers extensive financial topics like investment management and financial analysis, giving you a solid foundation to understand complex financial scenarios.

- Analytical Skills: Through the CFA curriculum, you develop strong analytical skills, enabling you to evaluate investment opportunities and risks effectively, which is crucial for advising clients accurately.

- Professional Credibility: Earning a CFA charter boosts your credibility in the financial sector, making you a trusted advisor for clients and paving the way for career advancement into roles like relationship management.

- CFP – Certified Financial Planner

- All About Money Management: A CFP is like the go-to expert for personal finance. They learn everything from creating smart investment strategies to planning taxes and retirement. It’s all about getting the best out of your money.

- Sharper Decision-Making Skills: The CFP course arms you with the skills to analyze financial situations deeply, helping you guide clients through their financial journeys with better, personalized advice. It’s like being the captain of a ship in stormy seas — you know how to navigate.

- Trust and Growth: Having a CFP certification adds a lot of weight to your resume. It shows clients and employers that you’re serious about financial planning and ethical practices. This not only builds trust with your clients but also opens doors for advancing to roles like a relationship manager, where you oversee and grow client relationships

-

Financial modelling

- Financial Forecasting: Financial modeling involves creating detailed mathematical representations of a company’s financial performance, which helps predict future outcomes based on past and current data.

- Enhanced Client Advice: By mastering financial modeling, a relationship manager can provide precise financial forecasts and strategies, helping clients make informed investment decisions.

- Building Trust: Effective use of financial modeling can boost a relationship manager’s credibility by demonstrating analytical prowess and commitment to data-driven decision-making, thus deepening trust with clients.

-

Investment Banking course with PG certificate

- Master of Deals: Investment banking is all about helping companies and governments manage big money moves—like issuing stocks, handling mergers, or securing funding. It’s the behind-the-scenes magic that fuels major financial growth and stability.

- Master of Negotiations: Working in investment banking sharpens your negotiation and deal-making skills. You’re always in the thick of negotiations, figuring out the best terms for complex financial deals. This makes you adept at understanding what each party needs and how to bridge gaps—a killer skill for any relationship manager.

- Building Networks: As an investment banker, you’ll rub shoulders with top-tier business execs and decision-makers. This not only gives you insights into different industries but also helps you build a vast network. When you switch to being a relationship manager, this network can be a goldmine for building and maintaining strong client relationships.

FAQs

-

Is the role of a relationship manager a good position?

Yes. A relationship manager is a bridge between the bank and the customer. All types of banks need professionals in this capacity to manage and retain their clientele. Relationship managers form valuable connections with customers and help them achieve their financial needs. Most people are intimidated by the different products in a bank and need a relationship manager to explain the jargon and give sound advice.

-

How can I become a relationship manager in a commercial bank?

You need one or more of the following qualifications:

- MBA in finance/economics/investment banking

- CFA

- CFP

- Financial modelling

- PG Investment banking certificate

-

Do I have to be good at sales to be a relationship manager?

It helps to be an effective salesperson when you are a relationship manager. If you have the ‘gift of the gab’, it can help you build an easy and trusting relationship with your clients. You also have to persuade them to follow your recommendations. A good relationship manager knows how to bring in new customers and close deals.

However, this job is more than just sales. You also require a deep proficiency in financial products, a clear understanding of the industry and above-average analytical skills.

-

How do I prepare for a relationship manager interview?

Before you meet with the recruiter, you need to prepare yourself.

- Research the bank thoroughly, especially facts about its client base, history and market performance.

- Understand what is required of you in this role, and connect your skills and abilities with the job.

- Practice your communication and presentation skills, so that you come across as articulate and confident.

- Prepare for questions in advance, as you may be asked about their actual clients and any real-life situations.

- Speak to other relationship managers who can share their interview experiences with you.

- If you have enrolled with a coaching institute like Proschool, you’ll receive training for your interview and even special resume writing tips.

-

Can a fresher become a Relationship Manager?

Yes. You can apply for this position after you finish your finance course. This is an entry-level role for most finance graduates, although some banks prefer to recruit candidates with an MBA in finance or CFA certifications.

Conclusion

The role of the relationship manager is one of the best positions in the banking industry. It is a complex profession where you use your financial acumen, industry knowledge and interpersonal skills. As a relationship manager, you take initiative, understand market trends and offer personalised service to your clients. Your brain is always ticking. Whether it’s about new business opportunities, collaborations or potential customers, you have to be on the top of your game. A top financial course can help you learn the tricks of your trade and make you a competent professional. Once you are certified, you can begin your journey as a relationship manager.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!