Decoding the Myths – Is Relationship Management right for You?

Here's What We've Covered!

True or false?

- Relationship managers are failed finance professionals.

- Relationship managers don’t earn as well as their finance peers.

- Relationship managers don’t have much career scope.

- They are easily replaceable by technology.

If you have answered true to any of the above questions, then you are wrong!

Many finance students are confused about this profession. They often wonder — is relationship manager a good job to pursue?

The banking sector is one of the biggest industries in India. Relationship managers are specialised finance professionals who serve as the face of the bank. They manage clients, achieve sales targets and research market trends. It is a highly respected profession that comes with career growth, lucrative packages and a lot of demand. Every bank has a relationship management team that they depend on. These managers help to bring in new business, retain older customers and sell the bank’s financial products.

Don’t just take our word for it. A simple Google check will show many job openings from leading banks and financial institutions.

Still not convinced? Then stick around, as we take a popular myth about the work of a relationship manager.

Debunking myths about relationship managers’ work and job profile

-

This profession lacks career progression

It is a common misconception that relationship managers don’t see much growth in their careers. The reality is that this profile is a launch pad to many higher positions of responsibility and leadership. A relationship manager’s work continuously evolves.

You start in the position of a relationship manager. You work one-on-one with clients, meeting their current and future financial needs.

After some years of experience, you get elevated to the position of senior relationship manager.

If you show great promise and leadership skills, you can get promoted to relationship director or head of the sales department. From there, you can rise to vice president of sales.

Experienced relationship managers can also work in specialised areas such as asset management, wealth management or business development.

-

This is not a challenging job

If someone told you that relationship management is an easy, dull job, they couldn’t be more wrong! A relationship manager’s work is quite unique. You are a professional who can merge salesmanship, people skills and financial expertise. The job can be quite thrilling as you work with different types of people, create customised financial plans, keep track of the competition and look for emerging market trends. The position also offers immense growth opportunities and increments.

-

It is only a sales job

On one level, a relationship manager’s work requires a lot of salesmanship. But on other levels, you also have to be a qualified finance expert, an analytical thinker and possess excellent communication skills. When you work as a relationship manager, you open up possibilities in many different job profiles as you learn many new skills and build your expertise.

Also Read – A Day in the Life of a Relationship Manager

-

It is a low-paying job

If this were true, why would the job attract MBA graduates and CFA charter holders? Wouldn’t they also wonder if relationship manager is a good job?

Now, keep in mind that the relationship manager is also an entry-level position. So the salary will increase as you rise to higher designations.

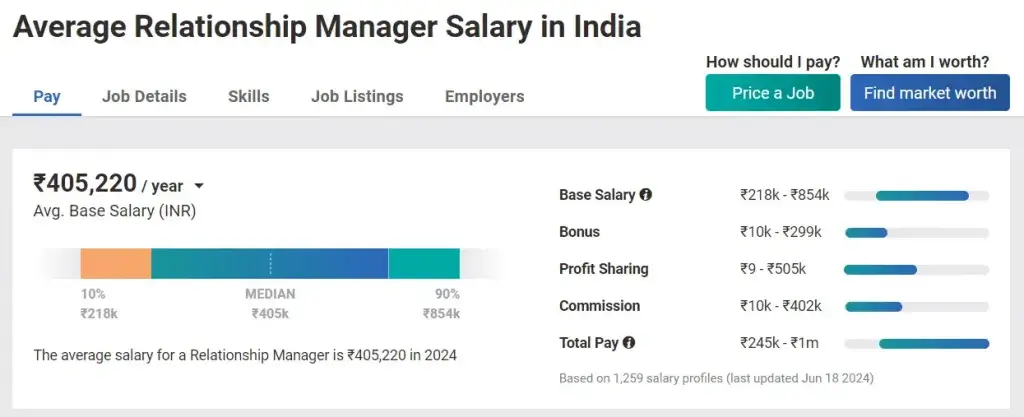

While the average annual salary is around Rs 4 lakhs, this number can change depending on the company you work for, the location of the office and the number of years of experience.

Source: Payscale

-

It is a job for failed finance professionals

The only people who would agree with the above statement are those unable to work as relationship managers! As mentioned earlier, many MBA finance graduates and CFA holders enter the banking industry through the role of a relationship manager. They then move on to more lucrative prospects and higher leadership positions. You have a lot of opportunities ahead of you when you do a relationship manager’s work.

-

The job can easily be automated in the future.

That is a genuine fear, isn’t it? With so many traditional roles in banking going down the automation route, it is easy to imagine the same thing happening here.

However, rest assured, the relationship management department won’t get replaced by automated service. Why? Because a robot can’t be the face of a banking institution. Customers need a human connection with their banks. They don’t want to deal with AI bots. When you need a personalised experience, you need a relationship manager. However, the boost in AI-centric services has led to improved CRM tools for relationship managers. So while you’ll be working alongside technology, you won’t get replaced by it.

Why you should be a relationship manager:

- You want to work in the finance or banking field, but you have great interpersonal skills

- You have a high aptitude for numbers and calculations

- Your extroverted and persuasive personality needs a challenging and stimulating profession

- You are good problem-solving and analytical thinking

Skills and qualifications for a relationship manager’s work profile

This brings us to another question: who is qualified to do a relationship manager’s work? You need finance certifications and specific skills that will help you find a job in this field.

Qualifications

You will need one or more of the following certifications:

- BBA or MBA in finance

- CFA

- CFP

- Financial modelling

Skills

- Deep knowledge of finance concepts and theory

- Awareness of industry regulations, market trends and government policies

- Good communication and presentation skills

- Salesmanship

- People skills

- Good negotiation skills

- Analytical thinking

- Problem-solving abilities

Also Read – 9 Must-Have Next-Level Skills for Relationship Managers

How Proschool can help you become a relationship manager

To become a relationship manager, you need the right qualifications. As a renowned coaching institute, IMS Proschool offers some of the best finance courses, such as CFA, CFP, Investment banking PG certificate and financial modelling.

These courses help students learn the core subjects and relevant skills needed in the finance industry. The faculty members are experienced professionals from the industry. These teachers share valuable insights, break down complex concepts and offer students a helping hand when in doubt or stuck on a topic.

The CFA and CFP courses are famous the world over and are held in high esteem by most financial companies in India. Proschool uses innovative learning methods and hands-on training to help students master these courses and ace the exams. The Investment Banking program is also very informative and engaging, giving students an intensive study in the finance field. Financial modelling is an essential finance tool used by professionals across the industry and gives you an edge over your peers during recruitment. These courses are perfect if you want to learn how to do the work of a relationship manager.

Benefits of studying with Proschool:

- You can enrol in any of the coaching centres located across India or opt for online classes instead.

- Proschool ensures all students are fully prepared for the course exams by providing additional resources such as mock tests, practice papers, prep books and customised study plans.

- Teachers are highly approachable and offer personalised attention to students.

- Proschool’s placement program helps all certified students seek entry-level jobs in the industry.

- You also receive recruitment-based training, such as interviewing techniques and writing effective resumes.

FAQs

-

What are the responsibilities of a relationship manager?

A relationship manager’s work is very complex and multi-faceted. Some of the responsibilities include:

- Building and retaining strong customer relationships.

- Seeking new clients to add to the current clientele.

- Using CRM tools to enhance the customer’s banking experience.

- Staying updated with all the latest information about the bank’s financial products and services.

- Offering advice and recommendations that are customised to the client’s needs.

- Working with the sales and marketing departments within the bank.

- Addressing any concerns or issues that may arise from the client’s side.

-

What is CRM?

Customer relationship management tools are specialised digital systems that support a relationship manager’s work. They are used to organise and analyse customer-related data received from various sources. Today, CRM is evolving to incorporate AI and machine learning and offer customers an enhanced and streamlined experience.

-

How do relationship managers build close relationships with customers?

A good relationship manager will regularly check in with his client. He will be approachable and friendly yet professional. There is constant communication from both sides, and the manager will solve any problems as soon as they arise.

It is a process and takes some time, but in the end, a competent manager will earn his customer’s loyalty.

-

Is there any growth in relationship managers?

Yes. The role of a relationship manager can lead to better opportunities. You can become a director of customer management, sales head or even a vice president. Some relationship managers branch out into other areas and take on a speciality in which they excel.

-

Is relationship manager a high position?

It is an entry-level position that can lead to several higher designations as stated in the previous paragraph. However, it is a coveted role and recruiters receive applications from many financial aspirants.

-

What is the future of relationship management?

Expect a lot of technological innovation in this sector. Already, AI is transforming a relationship manager’s work. Data analytics and machine learning will optimise the customer experience and lead to better banking relationships.

Conclusion

Hopefully, by now, we have disproved all the myths surrounding the role of a relationship manager. Relationship manager is a good job for MBAs, CFA, CFPs and other finance students to pursue. This is a very engaging and lucrative career that can also be a great launchpad into other fields of financial specialisation. So, if you are looking for a challenging and compelling profession, you may have just found it.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!

One Comment

Great read on relationship management! This blog offers valuable insights into whether it’s the right career path for you.