Top 5 Accounting Careers in India

Here's What We've Covered!

Accountants are a rare breed of finance professionals. They can organize, record and analyze a company’s fiscal data in many impressive ways. No wonder they are in such high demand. A company with a strong accounting team is an organization that will always be in the red. Accountants contribute so much to the economic growth of a company. Yet, people who don’t have a commerce or finance background seem to think accountancy is a one-dimensional, boring job. This couldn’t be further from the truth. There is so much scope and potential to have a flourishing, rewarding career in accounting. The salary of an accountant in India is nothing to scoff at. These professionals are known to draw very competitive packages from some of the top companies in the world.

All you need is a qualification in one of the top courses such as ACCA, CPA, CMA, CIMA and CA. Once you are certified, you can apply for one of the many lucrative careers in accounting.

Top 5 careers in accounting

-

ACCA-certified accountant

The ACCA certification is fast setting the course for the future of accounting. The course is universally recognised to produce the next generation of experts in the accounting industry, with over 240,000 members across 180 countries. The ACCA sets the benchmark when it comes to shaping careers in accounting. The syllabus contains the latest industry knowledge, important concepts, financial theory and relevant skills. It is divided into three levels – Applied Knowledge, Applied Skills and Strategic Professional.

The beauty of this program is it opens up several job opportunities for you. You qualify to apply for positions such as financial accountant, management accountant, financial advisor and business analyst.

Skills needed:

- Good communication abilities

- Quantitative and analytical skills

- Knowledge of accounting principles and standards

- Global awareness and business acumen

- Critical and strategic thinking

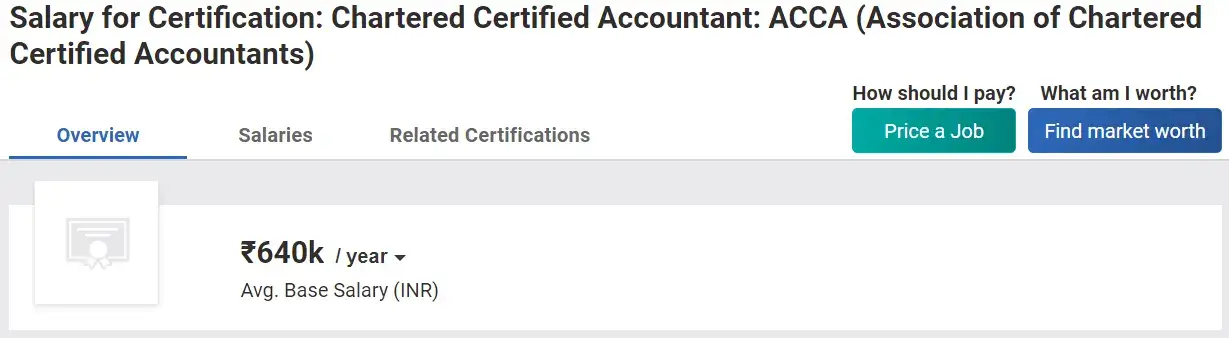

Salary expectations:

- ACCA-certified accountants earn an average yearly salary of Rs 6 lakhs.

- Senior professionals can make over Rs 20 lakhs annually.

(source: Payscale)

Also Read – 3 Types of Accounting – Understand each one in detail

-

Financial Analyst

As the designation suggests, a financial analyst is one of the careers in accounting that requires logical and investigative thinking. Interestingly, the term, ‘financial analyst’ falls under a broad umbrella that offers several roles in the finance industry. From an accounting standpoint, you will be required to prepare budget reports, financial statement analysis and projections for the future. You can also write reports using various data methods, such as descriptive analysis.

Skills needed:

- Critical thinking

- Proficiency in mathematics

- Interpersonal skills

- Knowledge of accounting and economics

- Attention to detail

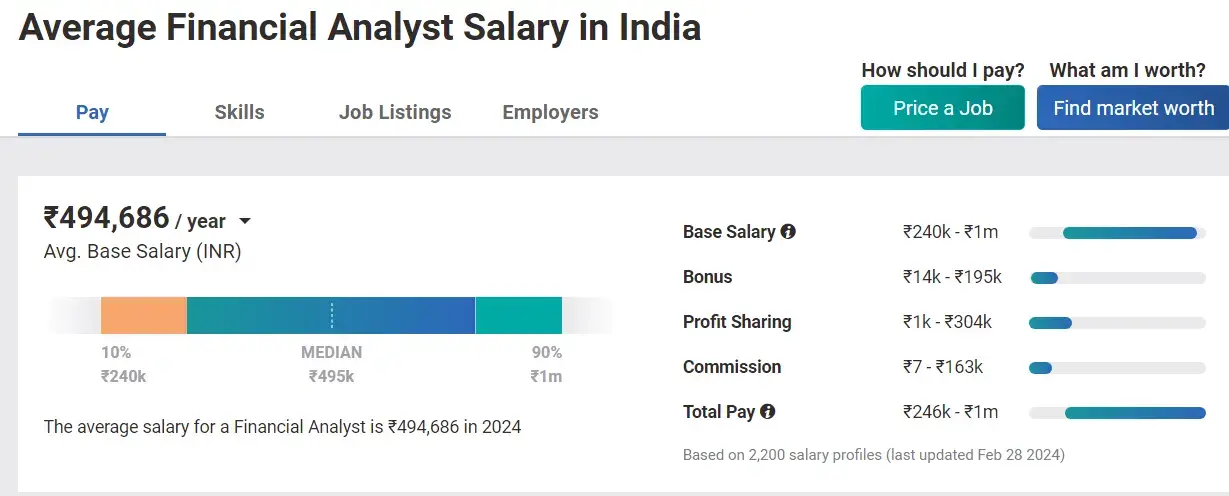

Salary expectations:

The average salary of a financial analyst in India is around Rs 5 lakhs a year.

Expert professionals will earn around Rs 12 to Rs 15 lakhs per annum.

(source: Payscale)

Also Read – 15 questions asked in every Accounts Interview

-

Chartered Accountant

Set up by the Institute of Chartered Accountants of India (ICAI), the CA program is one of the most sought-after careers in accounting for commerce students. The course takes around 4.5 to 5 years to finish and contains three levels — Foundation, Intermediate, and Final. While the CA certification can be a challenge to acquire, this highly lucrative career presents many growth opportunities. As India’s economy continues to develop, there is a strong need for qualified CAs. A Chartered Accountant can work as a taxation specialist, forensic accountant, executor, dispute arbitration and auditor. In India, only a certified CA can act as an auditor within a company.

Skills needed:

- Technical expertise

- Knowledge of accounting principles

- Problem-solving skills

- Organizational skills

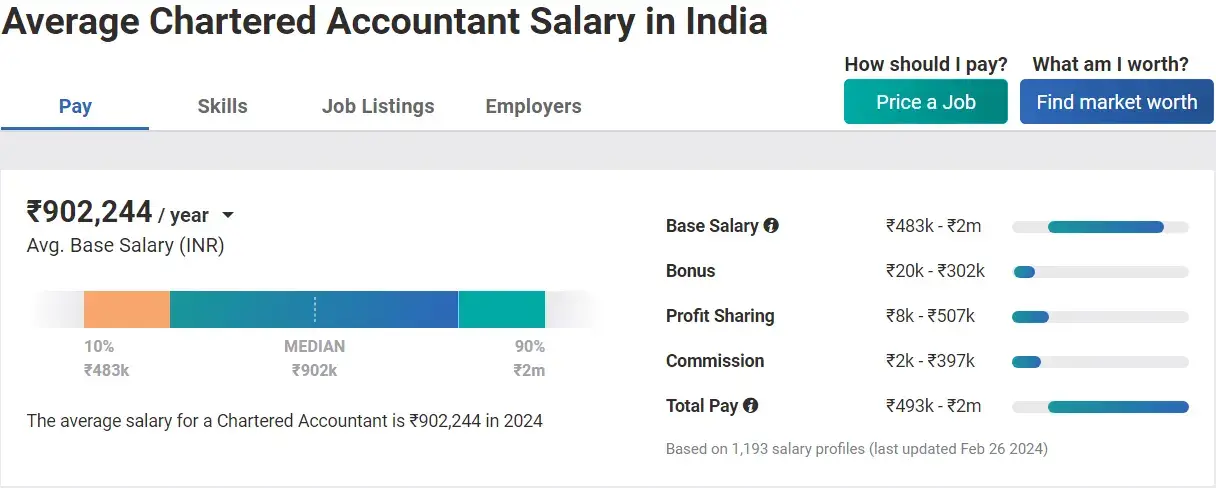

Salary expectations:

- Chartered Accountants in India receive approximately Rs 8 to Rs 9 lakhs a year.

- Senior CAs can earn an annual income of over Rs 25 lakhs.

(source: Payscale)

Also Read – It’s not all numbers! 9 Must-Have Skills To Become a Successful Accountant

-

Company Secretary

To be appointed as a company secretary, you need to be proficient in corporate law and government regulations. Accounting courses ensure the curriculum includes crucial subjects on corporate governance and is supported by the Institute Of Company Secretaries of India (ICSI). Professionals in this line of work are responsible for various tasks. They ensure the administration runs efficiently, the company practices are in compliance and all legal matters are in order. Those with a knack for legalities and regulations can consider taking a closer look at company secretary as a potential career in accounting.

Skills needed:

- Detail oriented

- Good communication skills

- Knowledge about corporate law

- Organizational skills

- Administrative abilities

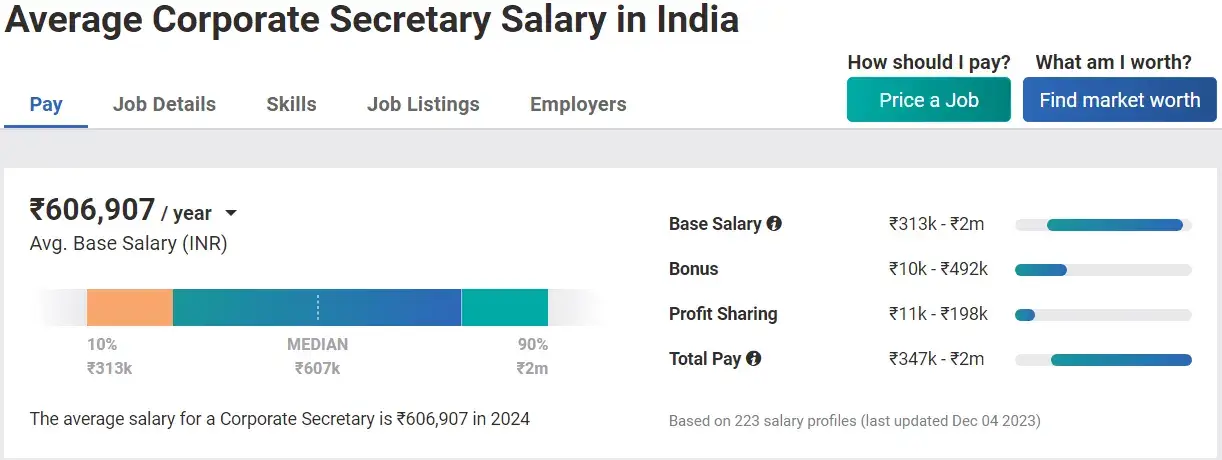

Salary expectations:

- The average annual salary of a company or corporate secretary in India is roughly Rs 6 lakhs.

- Experienced accountants can earn over Rs 40 lakhs a year.

(source: Payscale)

Also Read – 8 Accounting Principles that every Graduate should know

-

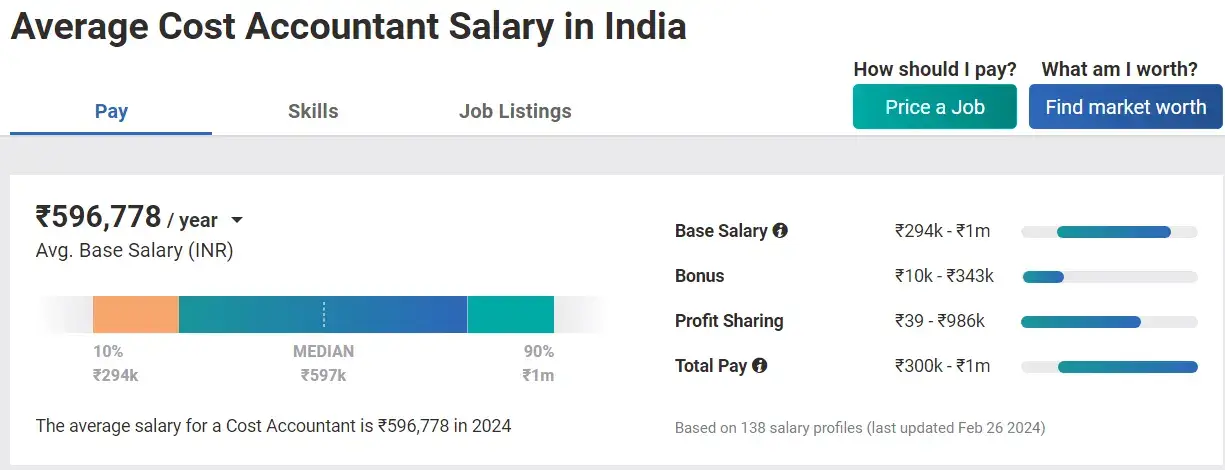

Cost Accountant

Also known as management accountants, cost accountants are an integral part of any company. Many organisations have learnt that cost accountancy can help preserve profits and succeed in a fiercely competitive environment. Cost accountants record, manage and analyse the costs that occur within a company. They take stock of a firm’s goods and services, paying close attention to expenses and revenue. They also collect and decipher financial data, helping companies optimise their management processes. In today’s world, cost accountants play a vital part in corporate strategy. So, if you love a challenging job, then you can build your career in accounting as a cost accountant.

Skills needed:

- Attention to detail

- Knowledge of accounting codes and practices

- Financial modelling

- Data analysis skills

- Good communication skills

Salary expectations:

- A cost accountant in India earns an average annual salary of Rs 6 lakhs.

- Senior cost accountants can make Rs 20 to Rs 30 lakhs a year.

(source: Payscale)

Also Read – Entry-Level Accounting Jobs – 5 Steps to finding the most suitable one!

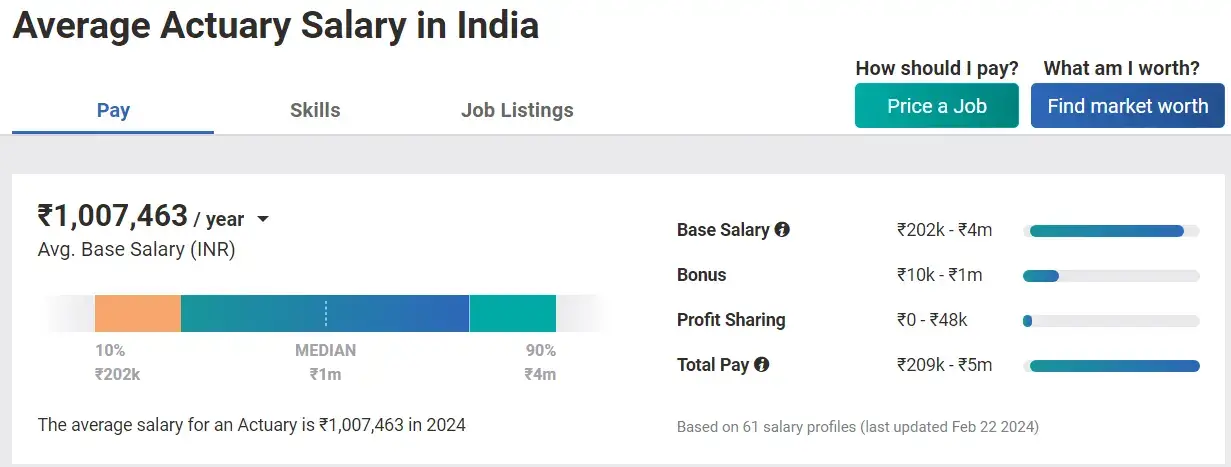

Bonus Accounting Career – Actuary

An accounting qualification can help you land a job as an actuary. These are skilled specialists who work in risk assessment for insurance companies. They have a number of job responsibilities, such as reviewing company policies, creating techniques for risk analysis and examining statistics. Actuaries need to have a math or statistics background before they apply for the course, so it is a very good fit for commerce students. You can opt for a BSc, PG or MSc in Actuarial Science. Since 2002, the Institute of Actuaries of India (IAI) governs the training of actuary professionals in India. You have to clear the Actuarial Common Entrance Test (ACET) to join the IAI. The actuary certification is considered to be one of the best careers in accounting. It is worth pursuing if you have the skills that fit the job profile.

Skills needed:

- Business acumen

- Math and statistics proficiency

- Good communication skills

- Financial modeling

- Industry knowledge

Salary expectations:

- An Actuary in India earns an average salary of around Rs 10 lakhs a year.

- Established professionals can earn over Rs 50 lakhs per annum.

(source: Payscale)

Also Read – Financial Accounting vs. Managerial Accounting: A Comparison

About Proschool’s Accounting Courses

Before you embark on a career in accounting, make a pit stop at IMS Proschool. As one of India’s top coaching institutes, Proschool offers a comprehensive learning experience in several accounting courses, such as ACCA, CPA, CIMA and IFRS. Whichever program you opt for, you get to study with some of the brightest accounting minds in the industry. The faculty comprises top experts who are able to enhance classroom learning with out-of-the-box thinking and practical, hands-on training. The institution has a high pass rate among students and also offers placement services to help them get jobs in their chosen fields. Many careers in accounting have been launched at Proschool. Maybe yours will be next.

Highlights of studying at Proschool:

- Coaching centres are set up across various cities in India.

- You can also enrol online for virtual learning sessions.

- Proschool offers superior learning resources such as mock exams, practice papers, study prep books and lots more.

- Students receive additional training in interview skills and resume-writing techniques.

- The professors are known to mentor and guide students to the best of their abilities.

- You can also receive an NSDC certification on the completion of your course.

FAQs

What will I learn in an accounting course?

It depends on which course you choose — whether it is ACCA, CIMA or CA. However, most courses will cover accounting principles, taxation, auditing, and various other accounting processes. You will also learn about budgeting, projections and financial reporting. These skills and abilities will help you land a job at a good company.

How is ACCA different from the CA course?

Both are highly reputed programs, yet there are a few differences. ACCA is a universally recognised certification which is valid in more than 180 countries. It is also the accounting qualification that many global corporations look for in a candidate.

The CA is an esteemed course that is widely revered in India. However, it is a tough exam to clear and may require repeated attempts.

What are the top courses for accounting?

You can apply for any of the following programs:

- ACCA – Association of Chartered Certified Accountants

- CIMA – Chartered Institute of Management Accountants

- CA – Chartered Accountant

- CPA – Certified Public Accounting

- CMA – Cost Management Accounting

Additionally, it also helps to learn financial modelling and IFRS as both qualifications may be required when you work as an accountant.

In conclusion

A career in accounting can be very lucrative and rewarding while offering immense job satisfaction. But before you can reap the rewards, you need to learn the technical knowledge, accounting standards and financial theory. You should also sharpen your soft skills, such as good communication and analytical thinking. Once you have received your certification from a renowned board, you will be ready to join the accounting field and make an impact in the financial industry.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!