10 Trending ACCA Job Profiles In India

Here's What We've Covered!

Did you know that the world’s oldest accounting records are over 7,000 years old?

Did you also know that accounting became a proper profession in the 1800s?

It’s a time-test, traditional career that has survived endless recessions, multiple global changes and technological advancements.

That doesn’t mean accountancy hasn’t evolved because it has. There have been numerous updates and tremendous developments in the field, most notably the establishment of the ACCA or the Association of Chartered Certified Accountants. Since it was founded in 1904, the ACCA program has grown to become one of the most renowned accountancy certifications in the world. Today, there are over 2,41,000 members in over 180 countries, not counting the vast number of students studying for the course. With ACCA, there is scope in India to work in multiple job profiles such as:

- Management Accountant

- Treasurer

- Forensic Accountant

- Tax Accountant

- Financial Accountant

- Internal Audit Assistant

- Risk Manager

- Financial Controller

Top 5 advantages of the ACCA certificate

- This globally recognised course has created many successful and thriving accounting careers.

- Top companies in India, such as EY, Accenture, Morgan Stanley, Shell, Amazon and Barclays, offer exclusive ACCA job opportunities on the official careers website.

- The ACCA board has designed a well-structured and comprehensive syllabus that covers all accounting concepts and the latest developments in the industry.

- Students learn practical skills to take on contemporary challenges within the corporate world.

- All certified candidates are part of the ACCA network of professionals who support, update and offer various opportunities to each other.

Also Read – How Much Work Experience Do You Need to Complete Your ACCA Degree?

10 Trending ACCA Job Profiles

Once you are a certified accountant, you open yourself to a world of ACCA job opportunities. Many accounting profiles are perfectly suited for you. Here are ten that are most popular and lucrative.

-

Management accountant

The ACCA course has a strong focus on management accountancy. Students learn several responsibilities and accounting tools required in this role. The syllabus covers budgeting, financial planning and tracking expenses. It also delves deeper into investment planning, strategising and decision-making processes that could impact the company’s growth. Students also learn to develop their analytical skills and software proficiency to create financial reports for upper management.

ACCA job opportunities for management accountants (on the careers website):

- ICICI bank

- Deloitte

- EY

- HSBC

- JP Morgan

- State Street

Average salary expectations:

Source: Payscale

-

Treasurer

As an ACCA-qualified Treasurer, you can work in many companies in India and abroad. Treasurers are responsible for the fiscal health of an organisation. They manage company bank accounts, pay bills and make deposits. Treasurers ensure all records reflect updated financial information and budgets are maintained. They also offer valuable help during erratic economic conditions or mergers and acquisitions. For professionals who have done the ACCA, the scope in India for the position of Treasurer is tremendous.

ACCA job opportunities for treasurers (from the ACCA website):

- Citigroup

- Michael Page

- EY

- Wells Fargo & Company

- Whirlpool

- Valeo

Average salary expectations:

Source: Payscale

Did you know, Proschool has 100’s of accounting jobs waiting for you? Enroll with Proschool’s ACCA Course

-

Forensic accountant

The ACCA course trains students to be financial investigators who can detect fraud and criminal activities. There is huge scope in India for Forensic Accountants given the rise of cyber-based theft and attacks. Students are taught how to combine accounting expertise with legal tools to look for illegal transactions and practices. There is a lot of analysis required in this role. Forensic accountants can work with insurance firms and government agencies to provide evidence of suspicious financial activities.

ACCA job opportunities for forensic accountants (from the ACCA website):

- Expedia Group

- Morgan Stanley

- Capgemini

- HP

- PepsiCo

- Diageo

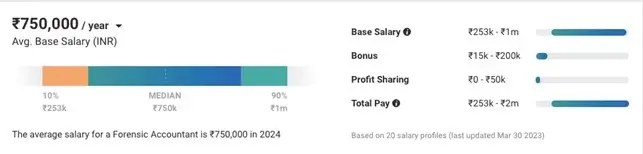

Average salary expectations:

Source: Payscale

Also Read – Countries where ACCA holders have the signing authority

-

Tax accountant

ACCA offers a lot of scope in India for tax ac

countants. Every company in the country needs taxation specialists to help them follow legal regulations and tax laws.

This profile is very important as an efficient tax accountant can help the company save money and avoid penalties. Tax accountants also work on merger and acquisition deals, setting up new offices and giving advice on potential investments.

ACCA job opportunities for tax accountants (from the ACCA website):

- Accenture

- EY

- Deloitte

- Baxter

- Citigroup

- Shell Business Operations

Average salary expectations:

Source: Payscale

-

Financial accountant

Commerce graduates who hope to become future financial accountants can gain knowledge and expertise from the ACCA course. Financial accounting helps companies record and report their financial information. They learn how to create income statements, cash flow statements and balance sheets for shareholders and investors.

If you join the course, you’ll learn about corporate laws, reporting standards and strategic planning tools to enhance profitability. As a financial accountant who has studied ACCA, there is scope in India to be successful.

ACCA job opportunities for financial accountants (from the ACCA website):

- Morgan Stanley

- Northern Trust

- Credit Suisse

- Amplifi Capital

Average salary expectations:

Source: Payscale

-

Internal Audit Associate

Another one of the many incredible ACCA job opportunities is the role of an Audit Associate. The accountant works with the company’s in-house team to ensure all practices and standards are in compliance with the law. The audit assistant carefully monitors how the company’s money is utilised and verifies the same through reports.

The job also requires intensive analysis of the company’s financial data to find ways to optimise productivity.

ACCA job opportunities for internal audit associates (from the ACCA website):

- BNY Mellon

- PwC

- Barclays

- EY

- Morgan Stanley

- State Street

Average salary expectations:

Source: Payscale

Also Read – How much should you be earning post-ACCA in Dubai

-

Risk manager

When it comes to the finance industry, there is always risk involved. To deal with this, companies pay high remuneration for competent and knowledgeable risk managers.

The ACCA course teaches students how to evaluate financial risks that affect an organisation’s revenue and economic security. Risk managers pay close attention to the current financial scenarios and predict possible outcomes that may cause a negative impact. They create failsafe solutions and options to reduce the risk factors and protect the company’s financial interests. Accountants who have done the ACCA, have scope in India to work in risk management.

ACCA job opportunities for risk managers (from the ACCA website):

- Accenture

- EY

- Expedia Group

- Northern Trust

- Shell Business Operations

- WPP

- Citigroup

- Syngenta Group

Average salary expectations:

Source: Payscale

You could easily save on ACCA Registration & exemption fees with Proschool. Enroll Today

-

Financial Controller

Financial controllers with an ACCA have a lot of scope in India to work with big companies. The job requires professionals to manage financial accounts and transactions that occur within the organisation. They oversee all financial operations and set up internal processes to keep company assets secure. The financial controller reports to the CFO or other upper management executives and informs that all financial operations are running efficiently.

ACCA job opportunities for financial controllers (from the ACCA website):

-

- State Street

- Baxter

- Access Healthcare

- OpenText

- Reliance

Average salary expectations:

Source: Payscale

Also Read – How to get an ACCA job in the UK?

Why you should study ACCA with Proschool

Over the years, IMS Proschool has earned the reputation of being one of the best coaching institutions in India. The institute has specially designed a course that elevates ACCA even further. The Program offers students a comprehensive study into cutting-edge accountancy. Proschool’s ACCA Prep Course includes special skills and tools such as financial modelling. The course is taught by experienced industry stalwarts who use innovative methods and training techniques. The course helps students get on the fast track towards becoming experts in the field.

Highlights of the GPA course:

- You can attend one of the many coaching centres in major cities in India.

- There are also online classes available for students.

- The course offers a holistic learning experience that transforms students into global accounting specialists.

- Proschool ensures students receive additional learning resources such as mock tests, practice papers and learning videos.

- Once you finish the program, you can start looking for ACCA job opportunities on the Proschool placement portal.

- To ensure you are recruitment-ready, you will also receive training for interview skills and resume writing.

FAQs

Can ACCA professionals get hired by the Big 4?

Absolutely. In fact, the Big 4 posts job openings directly on the ACCA careers website for their many offices worldwide. Also, leading MNCs like JP Morgan, HSBC, Accenture and many more actively recruit ACCA-certified candidates for various accounting roles.

Is the ACCA certification enough to get hired in the industry?

Yes. The ACCA is enough to get hired. However, some professionals have additional qualifications, such as a CFA or MBA, because it helps them climb the corporate ladder quicker. If you don’t want any other certification, that is fine. You can see a lot of success in your life as an ACCA holder.

How much demand is there for ACCA members?

When it comes to the ACCA, there is scope in India. The demand for ACCA members is very high, especially in companies that have a global presence. The Big 4 and other major corporations are known to hire directly from the ACCA careers website. They also look for ACCA members on other recruitment sites or through headhunters.

How do I find a job after completing ACCA?

Once you are certified, you can start looking for ACCA-related job opportunities. As mentioned earlier, the ACCA careers website is a great place to find lucrative jobs with some of the best-paying companies. You can also visit other recruitment websites like Naukri.com or LinkedIn. If you have a particular company you want to work with, visit their website to see if they have any job listings that suit you. If you have studied with an approved learning partner like IMS Proschool, they will help you find a job through their placement program.

Should I do ACCA after CA?

If you plan on migrating abroad or want to join an MNC that hires ACCA professionals, then you should join the ACCA after CA. Qualified chartered accountants get 9 ACCA exam exemptions, which means you can complete the course in a year. As a CA, the ACCA syllabus won’t be tough to crack, so you won’t have much to stress about.

Conclusion

When you study the ACCA, job opportunities open up in many accounting fields. The syllabus ensures you become a well-rounded accountant with updated skills and industry expertise. The ACCA enables you to adapt to new roles, move across fields within the industry and establish a bright future for yourself.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!