CFA Jobs & Salaries In USA | What Could You Earn In Each Profile Throughout Your Career?

Here's What We've Covered!

The CFA’s growing global presence is a dream for any finance professional hoping to migrate. You can clear your CFA course in India and use that certification to find employment anywhere in the world, noticeably in countries like the United States of America. If you are considering doing a CFA and hoping to move to the US, then you’re in luck. This qualification is held in high esteem within the American finance industry and opens up several lucrative and exciting CFA jobs in the USA.

The CFA professionals there are highly paid, and there is scope to increase their salaries with experience. Some top recruiting companies such as Morgan Stanley, PwC, BlackRock, Citibank and Bank of America often prefer hiring CFA-certified candidates due to the intensive and rigorous finance training they undergo. These organisations recognise the high calibre of a CFA professional irrespective of nationality. As an Indian charter holder, you are a quality hire in any company in America. So, what are your job options if you choose to migrate? Do you want a better understanding of the CFA salaries in the USA? Keep reading to find out.

Top 5 CFA jobs & their salaries you can expect in the USA

The American economy is booming. Financial services such as investment banking, wealth management and portfolio management are in high demand. The CFA course ensures every certified professional undergoes intensive training and is ready for any challenge or complexity that may arise. Your qualification is the key to applying for several CFA jobs in the USA. Here are the top profiles for which you are eligible.

-

Equity research analyst

Job profile:

Equity research analysts do in-depth research and due diligence on various public companies. They analyse their findings to create investment-based opportunities and decisions for their clients, investors or companies.

Job responsibilities:

- Make recommendations to clients about which stocks to sell, buy or hold.

- Create reports and projections to help their clients and investors make better investment decisions.

- Review market data, economic trends and the latest industry developments.

CFA Jobs & Salaries for Equity Research Analysts in the USA:

- CFA-certified equity research analysts are recruited by top American financial companies such as Merrill Lynch Wealth Management, PwC, BlackRock, Credit Suisse, UBS and JP Morgan Chase.

- Cities that hire the most equity research analysts are Boston, San Fransisco, Houston, Miami and Cleveland.

The salaries vary depending on the location (for instance, jobs in New York pay more), the company and your negotiation skills. However, here are the approximate CFA salaries in the USA.

- Entry-level analysts earn an annual salary between $50,000 and $60,000.

- Mid-level analysts earn around $60,000 to $80,000 a year.

- Senior-level analysts have an annual income of over $90,000.

Source:salary.com

Looking for offline CFA Coaching In Your City? Proschool has 15+ centers in India.

-

Portfolio manager

Job profile:

Many CFA jobs in the USA are for portfolio managers. As a professional in this field, you play a critical role in helping companies and investors make lucrative investment decisions.

The CFA course offers intensive training that enables you to understand how the markets work. You also learn about emerging economic trends and make informed and intelligent projections.

Job responsibilities:

- Create and execute financial strategies and business plans to meet the required goals.

- Manage and modify client portfolios as needed.

- Measure and analyse the performance levels of investments along with their potential risks.

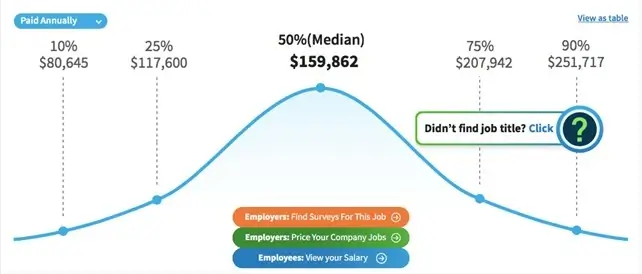

CFA Jobs & Salaries for Portfolio Managers in the USA:

- There is a high demand for portfolio managers in several top companies such as Morgan Stanley, Franklin Templeton Investments, Capital One, Metropolitan Commercial Bank and New York Life Insurance.

- Cities such as New York, Boston, Chicago and San Fransisco offer many lucrative opportunities for portfolio managers.

Your income will depend on which part of the USA you reside in, the calibre of the company you work for and your level of experience. However, here are the approximate CFA salaries in the USA.

- Entry-level portfolio managers earn an annual salary between $80,000 and $100,000.

- Mid-level managers earn over $100,000 a year.

- Senior-level managers have a yearly income of more than $250,000.

Source: salary.com

Also Read – CFA Scholarships – Types, Eligibility & Application Process

-

Investment consultant

Job profile:

Investment consultants are highly proficient professionals who offer valuable investment advice to clients and investors. This coveted position is among the top CFA jobs in the USA.

Job responsibilities:

- Build long-lasting relationships with clients.

- Offer advice on which stocks, asset classes, funds, companies and even countries to invest in.

- Create investment strategies and financial plans to help clients achieve their financial goals.

CFA Jobs & Salaries for Investment Consultants in the USA:

- Some of the top companies that need investment consultants in the USA are Bank of America, Citigroup, Morgan Stanley, Goldman Sachs and McKinsey and Company.

- You can find lucrative opportunities in cities such as Philadelphia, Chicago, New York and Los Angeles.

Different cities in the USA will offer different salary packages. Your earnings depend on the job profile, company and many other factors. However, here are the approximate CFA salaries in the USA.

- Entry-level portfolio managers earn an annual salary between $80,000 and $100,000.

- Mid-level managers earn over $100,000 a year.

- Senior-level managers have an annual income that could cross $150,000.

Source: salary.com

Also Read – Breaking Down CFA Pass Rates by Levels and Years

-

Investment Strategist

Job profile:

One of the top CFA jobs in the USA is that of the investment strategist. This professional is responsible for helping portfolio managers and other investors understand market insights and economic indicators.

Job responsibilities:

- Analyse and decipher market trends and emerging finance developments.

- Make recommendations on buying and selling assets.

- Create effective strategic plans based on the market research done.

- Contribute to major decision-making processes.

CFA Jobs & Salaries for Investment Strategies in the USA:

- Investment strategists are in great demand in US-based companies such as Wells Fargo, Credit Suisse, HSBC, Jeffries, Rothschild & Co, PwC and many more.

- There are several exciting job opportunities for investment strategists in cities such as New York, St Louis, Dallas, Seattle and Houston.

While the investment strategist position is very lucrative, the exact salary will depend on your location and level of expertise. However, here are the approximate CFA salaries in the USA.

- Entry-level investment strategists earn an annual salary between $80,000 and $90,000.

- Mid-level professionals earn between $90,000 to $100,000 a year.

- Senior-level experts have an annual income of over $120,000.

source: payscale.com

84% of our students recommend that you join Proschool for your CFA Prep

-

Research analyst

Job profile:

One of the top CFA jobs in the USA, Research analysts are known for their meticulous investigative skills and sharp analytical thinking. These experts are valued in US-based finance firms for their insightful and detailed financial information gathered from deep market research.

Job responsibilities:

- Do quantitative and qualitative research on various financial markets, emerging economic trends and company performances.

- Stay updated on relevant industry knowledge.

- Create reports and recommendations for companies looking for investment opportunities.

- Work with people within the finance industry to obtain financial data.

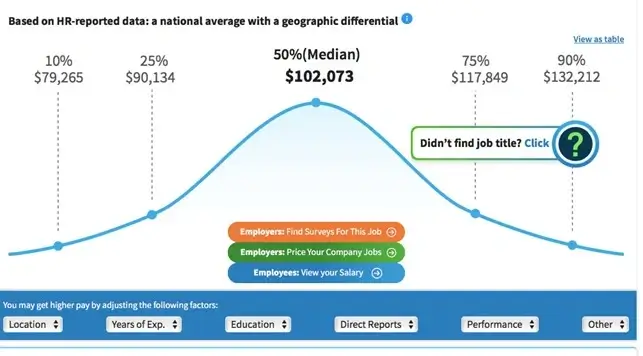

CFA Jobs & Salaries for Research Analysts in the USA:

- Research analysts work in some of the top companies in the USA, such as Bank of America, Barclays, ScotiaBank, Schroders, Morgan Stanley and Fidelity International.

- Research analysts can find top CFA jobs in US cities such as Minneapolis, New York, Chicago, Columbus and Kansas City.

Research analysts are sought after in the US, but the salaries vary depending on the company and office location. However, here are the approximate CFA salaries in the USA.

- Entry-level investment strategists earn an annual salary between $40,000 and $50,000.

- Mid-level professionals earn between $60,000 to $70,000 a year.

- Senior-level experts have an annual income of over $80,000.

source: payscale.com

Also Read – Duration of CFA Course: How Long Would It Take To Complete Each CFA Level?

Here’s How Proschool Helps CFA Aspirants LAunch Their Career

If you want to land one of the top CFA jobs in the USA, you have to certify as a CFA charter holder first. Proschool can help you accomplish your goal as one of India’s top coaching institutes in the CFA course.

The professors are experienced professionals with the expertise and foresight to understand how the finance industry works. They teach the CFA syllabus using innovative learning methods, real-world applications and hands-on training. They act as mentors and guides to students, offering personalised attention and customised study plans. Proschool also provides various other facilities and benefits. Here are some of them:

- Updated Curriculum: Get the latest CFA curriculum, including March 2023 CFA Institute updates, & learn Financial Modeling and Python.

- Extensive Training: Receive over 200 hours of dedicated preparation for CFA Level 1.

- Comprehensive Practice: Prepare with 5 mock exams and 2,000 practice questions to solidify your understanding.

- Career Opportunities: Secure employment opportunities immediately after completing Level 1.

- Expert Faculty: Learn from CFA charter holders who bring valuable industry insights into the classroom.

- Customized Study Plans: Benefit from a personalized 6-month study plan that covers all 10 subjects, plus an extra 3 months for revision.

- Exam Pass Assurance: We offer unlimited classroom and doubt-solving sessions if you need to retake the exams.

- Introductory Module: The M0 module helps you understand the fundamentals of finance and assess if the CFA program aligns with your career goal

FAQs

-

Can an Indian CFA holder work in the USA?

Yes. CFA professionals can work in the USA using the same certification they received in India. There are ample CFA jobs in the USA in different finance fields across the major cities.

-

How can I clear the CFA course on the first attempt?

You should prepare for the exams in advance. The CFA board recommends 300 hours of study before you give the papers. It helps to have an efficient study schedule, a clear understanding of all the complex concepts and repeated practice in solving previous years’ exam papers and mock tests. It helps to study with an established coaching centre like Proschool as they use innovative learning methods to help students clear the CFA course on the first attempt.

-

Which companies in the USA hire CFA professionals?

Most of the big giants in finance hire CFA professionals in the USA. Here are some of the companies:

- JPMorgan Chase

- BofA Securities

- UBS Group

- PwC

- Citigroup

- HSBC

- BlackRock

- Merrill Lynch

- EY

-

Can I return to India after working as a CFA professional in the USA?

Yes, you can. Your CFA certification is acknowledged in both nations. You can find a job in finance and investment across 160 countries without having to retake the CFA exams or revise your existing certification.

-

Who earns more in the USA — CFA or MBA?

While the MBA and CFA salaries in the USA vary on several factors, both qualifications have enabled professionals to earn between $90,000 and $135,000. However, the calibre of your MBA university matters and plays a role in determining your salary. A CFA is universally recognised as a top finance qualification irrespective of where you take the exams.

Conclusion

The CFA certification carries a high level of prestige in the finance industry. You can work in over 160 countries, including the United States of America. All you need to do is enrol in the course today, and soon, you can apply to several CFA jobs in the USA

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!